Crypto Trading Apps

Crypto trading apps let everyday investors speculate on leading digital currencies, such as Bitcoin and Ethereum. There is a range of easy to navigate mobile applications on the market. To help you find the best solution, we’ve listed the top cryptocurrency trading apps for beginners and experienced investors. Our reviews of the top crypto trading apps cover the coins offered, fees charged, download options, and more.

Top 6 Crypto Trading Apps

These 6 apps stood out as the best for trading cryptos following our tests:

-

1

Interactive BrokersApps for iOS & Android

Interactive BrokersApps for iOS & Android -

2

OANDA USApps for iOS & AndroidCFDs are not available to residents in the United States.

OANDA USApps for iOS & AndroidCFDs are not available to residents in the United States. -

3

Optimus FuturesApps for iOS & Android

Optimus FuturesApps for iOS & Android -

4

Focus MarketsApps for iOS & Android

Focus MarketsApps for iOS & Android -

5

InstaTradeApps for iOS & Android

InstaTradeApps for iOS & Android -

6

CoinbaseApps for iOS & Android

CoinbaseApps for iOS & Android

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - The IBKR Mobile app, available on both iOS and Android devices, makes your phone a powerful gateway to your IBKR accounts, offering you the freedom to keep an eye on portfolios, initiate trades, and dive into real-time quotes and charts, all while managing your account activities on the fly. This app stands out for its intuitive design, making it especially welcoming for those just starting their trading journey, providing a smoother and more accessible experience than the more complex TWS platform.

- OANDA US - OANDA's app stands out for its deeply customizable interface, ensuring you can tailor every aspect of the trading experience to your strategy, from setting custom notifications to adjusting chart sizes and overlays. This level of personalization, combined with the ability to quickly react to market changes, manage risk, and stay informed with alerts on significant market events, makes it a category leader.

- Optimus Futures - Optimus Futures Mobile gives futures traders fast, direct exchange access with low-latency execution and full depth-of-market (DOM) views. Order entry is quick and reliable, with support for advanced strategies such as brackets, OCO, and trailing stops alongside 150+ indicators for charting. It’s best suited for active day traders who need professional futures tools on the go.

- Focus Markets - Focus Markets does not provide its own trading app, which is a downside for beginners. However, Apple and Android users can trade the broker's growing list of 1000+ CFDs on the MT5 mobile app with competitive trading conditions. This includes powerful charting with 21 timeframes, 4 execution types, and tight spreads from 0.0 pips in the Raw account.

- InstaTrade - InstaTrade offers its own app that’s been downloaded more than 2 million times and facilitates trading on its 300+ instruments from your palm. Fast, responsive and sporting a modern interface, it supports real-time quotes, an array of orders, and analytical tools. However, what stood out during testing was the ‘hot’ ideas and trading signals, helping investors find opportunities.

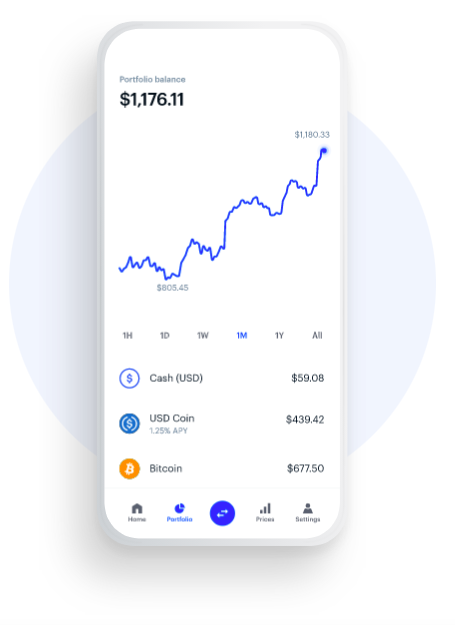

- Coinbase - Coinbase offers an intuitive and regularly updated app that’s generally fast, reliable and matches the desktop experience. It provides powerful tools for crypto investors with advanced trading features, real-time market analysis, staking rewards, secure portfolio management, and educational incentives, all backed by top-notch security and regulatory compliance. However, ratings from Android users show the interface trails its Apple counterpart, with issues relating to the user experience and notifications.

Crypto Trading Apps Comparison

| Broker | Android App Rating | iOS App Rating | Minimum Deposit | Crypto Coins | Crypto Spread |

|---|---|---|---|---|---|

| Interactive Brokers | / 5 | / 5 | $0 | 4 | 0.12%-0.18% |

| OANDA US | / 5 | / 5 | $0 | 8 | $100 |

| Optimus Futures | / 5 | / 5 | $500 | 1 | Variable |

| Focus Markets | / 5 | / 5 | $100 | 4 | Variable |

| InstaTrade | / 5 | / 5 | $1 | 12 | - |

| Coinbase | / 5 | / 5 | $0 | 14 | 0.5% - 1% (BTC) |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The broker offers a transparent pricing structure with no hidden charges

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Regulator | NFA, CFTC |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Account Currencies | USD |

Pros

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Coins | BTC, ETH, XRP, LTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Regulator | ASIC, SVGFSA |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

Cons

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Coins | BTC, ETH, XRP, LTC, SOL, UNI, DOGE, BCH, FIL, ADA, DOT, LINK |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Regulator | BVI FSC |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

Coinbase

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Coins | BCH, BTC, ETH, LTC, XRP, IOTA, NEO, EOS, XMR, FIL, WBTC, SHIB, BNB, TRUMP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.5% - 1% (BTC) |

| Crypto Lending | Yes |

| Crypto Staking | Yes |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT, TradingView |

| Minimum Deposit | $0 |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | No |

| Instruments | Crypto |

| Account Currencies | USD, EUR |

Pros

- Coinbase Advanced bolstered its leveraged trading offering with a suite of new futures products in 2025, including Ripple (XRP), Natural Gas (NGS), and Cardano (ADA), providing accessible ways to trade, hedge, or diversify.

- Coinbase Advanced has added TradingView integration, a feature rarely offered by crypto exchanges, allowing users to trade spot and futures markets directly from real-time charts with powerful technical analysis tools.

- There are platforms for all levels: beginners can use the simple Coinbase app, while Advanced Trade provides lower fees and pro-level tools.

Cons

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

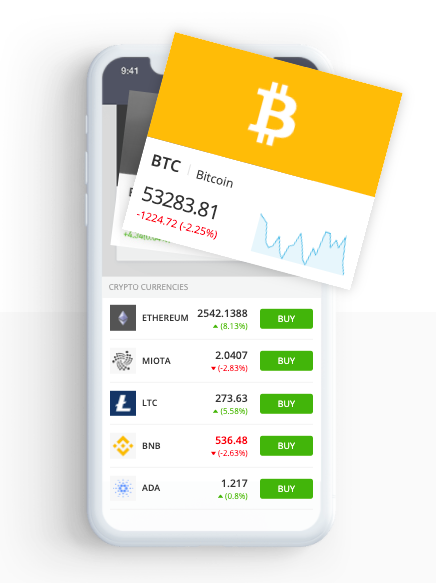

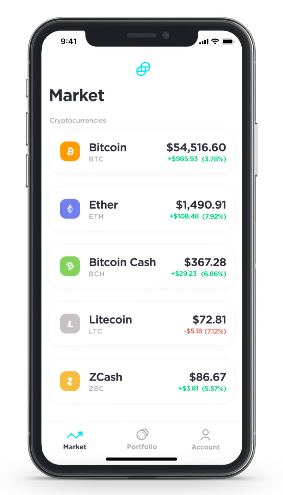

What Is A Crypto Trading App?

A cryptocurrency trading app is a mobile platform that enables you to buy, sell and hold crypto. The majority of applications are easy to use, with the high demand for digital currencies leading to increasingly convenient and affordable solutions.

With most crypto exchange apps, you can purchase digital currencies with a bank card, PayPal, or Apple Pay for iPhone (iOS) and Google Pay for Android (APK). Nowadays, many of the best cryptocurrency apps also offer an integrated wallet, so you can purchase and store your altcoins in one place.

Using a crypto app is relatively straightforward. An investor opens an account, downloads the app, buys and trades altcoins with their fiat currency, and stores the purchased coins in a crypto wallet. Most crypto trading apps take a commission, spread or a flat fee for their services.

Top Crypto Trading Apps

The best crypto trading apps of 2026 offer hassle-free account opening, low fees and an extensive list of tradable altcoins. Our list of the top apps below compares key features, trading tools and account options.

Coinbase

One of the top free cryptocurrency trading apps, Coinbase is a solid option for beginners. The exchange was founded in 2011 by Brian Armstrong, who was previously an AirBnB engineer. Fred Ehrsam joined in 2012 when they launched the platform as a service for buying, selling and storing Bitcoin. Coinbase is now the most widely used Bitcoin app in the USA. The exchange boasts over 56 million users across more than 100 countries.

Benefits of the Coinbase crypto trading app include:

- Products – You can trade approximately 40 leading currencies, including Bitcoin, Ethereum and Litecoin. All digital currencies can also be stored in Coinbase’s secure mobile wallet.

- Ease of use – It’s easy to get started. Simply open an account, link your bank card and submit a photo of your ID for verification. The graphic layout of the application also makes it easy to get to grips with. Charts are basic for new users while Coinbase Pro offers advanced analytics and lower fees for established investors.

- Security – Sensitive data and 98% of customer funds are stored offline. Data is then split with redundancy, which essentially means a group of participants all hold a share which is of no use individually. It is then AES-256 encrypted and backed up on FIPS-140 USB drives and copied to paper. Wallets are also stored with AES-256 encryption. We trust that Coinbase is safe and secure.

- Fees – The app is free to use and Coinbase offers competitive fees for making transactions. The standard UK flat fee is around 1.49%, up to £2.99 depending on the value of the transaction. There are variable fees too including 3.99% for instant debit card buys, free bank transfer deposits and £0.15 withdrawals. Instant card withdrawals cost a minimum of £0.55 and up to 2% of any transaction.

- Additional features – Other useful features include the Coinbase blog and the learning page on their website. The educational area includes crypto basics, trading tips and tutorials, plus market updates.

eToro

Founded in 2007 in Tel Aviv by Yoni and Ronen Assia, eToro launched as a social investment platform in 2010. The platform boasts unique copy trading features which allow beginners to view and copy the trades of expert investors. They initiated crypto trading capabilities in 2017, launching an app in the USA a year later. The company has facilitated over 340 million trades so far.

Benefits of the eToro crypto trading app include:

- Products – Alongside leading cryptocurrencies such as Bitcoin, Ethereum, Ripple, and more, you can trade stocks, ETFs and CFDs at low rates.

- Ease of use – You can store over 120 cryptocurrencies with the eToro Money crypto wallet. You can set a range of technical indicators and tools, plus use stop losses and profit parameters to protect your investments.

- Security – eToro is one of the more regulated cryptocurrency trading apps, holding a license with the FCA in the UK and the CySEC in Europe. This, coupled with industry-standard security protocols, inspires trust in the company.

- Fees – eToro is one of the best global Bitcoin apps, with a competitive minimum deposit in all regions. eToro offers free accounts, 0% commission on stocks and no management fees for their copy trading services. Spreads on cryptocurrencies range from 0.75% on Bitcoin to 4.5% on other coins. Transfer fees range from 0.005 units and withdrawals incur a $5 fee.

- Additional features – Copy trading is the most prominent feature of eToro, but you can also practise trading with $100,000 in a demo account.

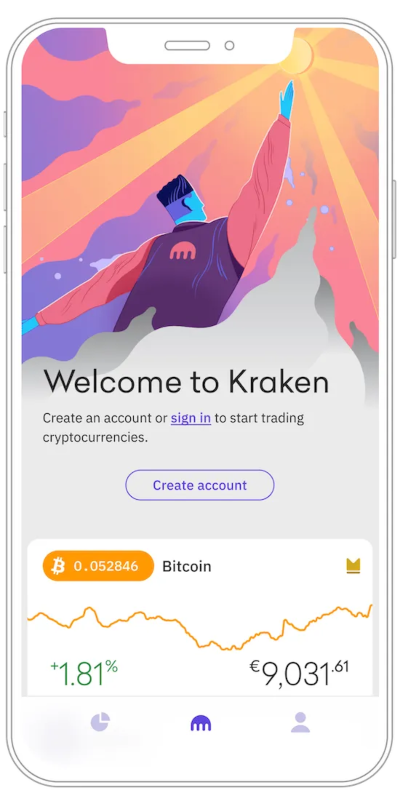

Kraken

Kraken is a cryptocurrency exchange, headquartered in San Fransisco, US. Founded in 2011 by Jesse Powell, the platform provides crypto to fiat trading. Amongst other projects, Jesse Powell later joined other major Bitcoin players to form the self-regulatory body DATA.

Available in over 175 countries and 48 US states, Kraken is one of the most popular crypto trading apps in Japan, Australia, Nigeria, the UAE, the UK and is widely regarded as the safest exchange in the world. In 2020, Kraken became a legally chartered bank in the US, one of the first two digital asset companies to do so.

Benefits of the Kraken crypto trading app include:

- Products – There are over 55 cryptocurrencies to chose from at Kraken including Bitcoin, Ethereum, Ripple and Dogecoin. Leveraged crypto trading is also available.

- Ease of use – The Kraken interface is colourful, clean and well designed. The app has advanced features and high trading volumes, making it great for experienced traders. Investors have, however, been subject to long user verification and capital processing times.

- Security – Kraken is one of the few crypto trading apps that hasn’t been hacked. Their security procedures are transparent on the website. The Kraken CEO Jesse Powell is an expert in cryptocurrency, online payments and fraud. His team’s dedication to safety and security has given the app a reputation as one of the most trustworthy exchanges. 95% of deposits are kept in offline, air-gapped, geographically distributed cold storage. All data is encrypted and access is monitored. SSL encryption is in place and 2FA keeps your account secure.

- Fees – Fees are taken when your order is executed, ranging from 0% to 0.26% of the value of the order. This depends on the currency pair, 30-day trading volume, and whether you are the buyer or seller. If you are using leverage, additional charges apply.

- Additional features – 24/7 support is an attractive benefit of trading with Kraken. The learning centre offers a range of educational resources, including crypto guides, detailing a wide variety of currencies. As part of their mission to bring altcoins to everyone, they offer a crypto 101 course, presented by the CEO. They also have a podcast, ‘How to Grow a Decacorn’, where Christina Yee (Chief Brand Officer) and Jesse Powell invite listeners to join their journey to becoming a company valued at $10 billion.

Gemini

Founded in New York in 2014 by the Winklevoss twins, Gemini has since expanded across Europe and Asia. The company became the first licensed Ether exchange in 2016 and was voted the Best Cryptocurrency Exchange at the 2019 Markets Choice Awards. They have also launched their own altcoin, the Gemini dollar.

Benefits of the Gemini crypto trading app include:

- Products – Gemini has its own wallet and offers over 20 cryptocurrencies. You can trade with most of the leading coins, including Bitcoin, Ether, Litecoin and Uniswap.

- Ease of use – The Gemini app utilises a streamlined trading view with a clean, minimal interface. You can trade assets, manage holdings and schedule orders easily, with technical indicators and simple buy alerts.

- Security – Gemini was the first cryptocurrency custodian and exchange to complete SOC Type 1 and SOC Type 2 examinations. They aim to ‘foster trust through action’, represented in features such as their wallet insurance, cold storage coverage and WebAuthn hardware security keys. Website data is TLS encrypted and 2FA is used amongst a range of other security protocols.

- Fees – Accounts are free to open and a full pricing schedule is available on the Gemini website. There is a convenience fee of 0.5% of the market rate and flat transaction fees which range from $0.99 to 1.49% of the order value.

Other Useful Crypto Trading Apps

Other apps which can add to the crypto trading experience include news and tracking applications. Crypto News and StockTwits, for example, offer stories and articles on scams, bugs, price analysis and current affairs which influence market prices.

A separate tracking and journal app, like Blockfolio Bitcoin or Delta, can be useful for keeping tabs on cryptos. You can track spending and view live updates, which could be helpful if you own a range of cryptos across multiple applications.

Bottom Line

Whether you’re a veteran trader or a complete beginner, there are plenty of crypto trading apps to choose from. The top 5 listed above are a good place to start, offering an excellent selection of coins with the lowest fees and robust security. It could also be worth opening a demo account before you download an app and start trading Bitcoin. Ultimately though, the best cryptocurrency app will depend on individual needs.

FAQ

Are Crypto Trading Apps Profitable?

Many have turned to day trading cryptos in search of profits. Downloadable mobile apps connect investors to the altcoin market with low barriers to entry. However, the potential profits of crypto trading apps should be balanced with the significant risks stemming from market volatility.

What Do You Need To Start Trading Crypto?

It is easier than ever to start trading crypto. You don’t need to be watching multiple currencies at once across a wall of screens. Many apps offer little to no minimum deposit requirement and a user-friendly application. Once you’ve opened an account, you simply need to download the app and deposit funds before you start trading cryptos.

What Are The Best Crypto Trading Apps?

The best cryptocurrency app ultimately depends on your objectives and location. Coinbase, Kraken, eToro and Gemini are all global front runners. See our reviews and comparison above for a deeper dive into the services offered by each.

When Can I Trade Crypto?

Cryptocurrency exchanges are open 24 hours a day, 7 days a week. Most Bitcoin apps don’t have a limit on the number of trades per day. Some exchanges will, however, take time for updates and restructuring.

Is It Safe To Leave Cryptocurrency With A Trading App?

If you hold your crypto in a mobile app, you are leaving the private key to your currency with the exchange. This leaves them open to hacking. Whilst blockchain is notoriously difficult to hack, several exchanges have been targeted before, including Binance. Most exchanges implement high-security protocols and offer insurance for holding your data and cryptocurrency. Hardware and paper keys are among other alternatives for storing your private keys off a mobile crypto trading exchange.