Crypto Margin Trading – Tutorial & Best Exchanges

With a boom in cryptocurrency, margin trading on this volatile asset provides new and potentially lucrative opportunities. In this tutorial, we explain how to trade crypto on margin plus offer tips for choosing the best exchanges and platforms. We also cover the pros and cons of crypto margin trading and a guide to getting started.

Crypto Margin Trading Platforms

-

1

NinjaTrader1:50

NinjaTrader1:50 -

2

Plus500USVariableTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USVariableTrading in futures and options involves the risk of loss and is not suitable for everyone. -

3

Interactive Brokers1:50

Interactive Brokers1:50 -

4

OANDA US1:50CFDs are not available to residents in the United States.

OANDA US1:50CFDs are not available to residents in the United States. -

5

Focus Markets1:500

Focus Markets1:500 -

6

InstaTrade1:1000

InstaTrade1:1000

Here is a short summary of why we think each broker belongs in this top list:

- NinjaTrader - You can get exposure to micro Bitcoin futures through the CME Group’s centralized exchange, which is highly regulated by the US CFTC. Micro contracts allow you to trade a fractional size of one Bitcoin, giving you more risk control and order flexibility.

- Plus500US - Plus500’s Micro-Bitcoin and Micro-Ethereum futures only allow traders to scratch the surface of crypto trading with bets on the two most popular digital assets. Importantly, you cannot buy and own the cryptos with these derivative contracts - you are speculating on their price.

- Interactive Brokers - IBKR lets you purchase and hold Bitcoin, Bitcoin Cash, Ethereum, and Litecoin at competitive commission rates and without needing a crypto wallet. Additionally, there is a range of other diverse assets to explore, such as crypto indices like the NYSE Bitcoin Index, as well as futures contracts like the BAKKT Bitcoin Futures.

- OANDA US - Cryptocurrency trading is offered via Paxos, a separate entity from Oanda. You can speculate on the world’s biggest cryptos by market cap. Commissions are lower than many peers starting at 0.25%. Through the broker’s partnership with Paxos, clients can spot trade cryptocurrencies on the itBit exchange through the OANDA native platform.

- Focus Markets - Focus Markets has clearly been built for crypto traders, offering an impressive 90+ derivatives, including major tokens like Bitcoin, Ethereum and Ripple. With high leverage, a commission-free trading account and fast execution on MT5, it delivers a reliable environment for active crypto traders.

- InstaTrade - InstaTrade offers a modest selection of around 12 cryptos against the USD, tradable via CFDs. Fees are low, especially for major assets like BTC/USD with spreads from 0. There's also a dedicated cryptocurrency blog with useful technical insights to support short-term trading decisions.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Coins | BTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Floating |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD |

NinjaTrader Leverage Trading

At NinjaTrader the available leverage is 1:50Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Coins | MicroBitcoin, MicroEthereum |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Regulator | CFTC, NFA |

| Account Currencies | USD |

Plus500US Leverage Trading

At Plus500US the available leverage is VariablePros

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- Although support response times were fast during tests, there is no telephone assistance

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- While Plus500US continues to broaden its investment offering, it's currently restricted to around 50+ futures with no stocks

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Coins | BTC, LTC, ETH, XRP |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | 0.12%-0.18% |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Interactive Brokers Leverage Trading

At Interactive Brokers the available leverage is 1:50. Margin rate is 1.55 - 2.59%Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Coins | BTC, ETH, LTC, BCH, PAXG, LINK, UNI, AAVE |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | $100 |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Regulator | NFA, CFTC |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

OANDA US Leverage Trading

At OANDA US the available leverage is 1:50. Margin rate is 2%Pros

- The broker offers a transparent pricing structure with no hidden charges

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Day traders can enjoy fast and reliable order execution

Cons

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Coins | BTC, ETH, XRP, LTC |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Spread | Variable |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Regulator | ASIC, SVGFSA |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Focus Markets Leverage Trading

At Focus Markets the available leverage is 1:500Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

Cons

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Coins | BTC, ETH, XRP, LTC, SOL, UNI, DOGE, BCH, FIL, ADA, DOT, LINK |

|---|---|

| Crypto Mining | No |

| Auto Market Maker | No |

| Crypto Lending | No |

| Crypto Staking | No |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Regulator | BVI FSC |

| Account Currencies | USD, EUR, RUB |

InstaTrade Leverage Trading

At InstaTrade the available leverage is 1:1000Pros

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

What Is Crypto Margin Trading?

Crypto margin trading is the practice of using leverage to multiply the results of a trade. The amount a trader has deposited in their account is known as the margin.

A broker offering margin trading will provide traders with a leverage quote, this is usually displayed as either a ratio (e.g 1:2) or a multiple (e.g 2x), meaning that for every 1 base crypto coin, the results of a trade are multiplied by 2.

To enable traders to open larger positions, the broker allows them to borrow capital. This will need to be paid back in full, but the profits can be retained by the trader.

For example, if your leverage is 1:2 and you deposit $1,000, you can open positions with a total value of $2000.

If you use this to purchase Ethereum and the price moves 5%, you’ll have $2,100 worth of ETH.

If you close your trade there and return the $1,000 borrowed, you’re left with $1,100, having made a $100 profit.

If you’d placed the same trade in your spot account, you’d have made a $50 profit.

It’s important to note that profits are amplified, but equally, so are losses. Plus, your borrowed amount will still need to be returned. Therefore, margin trading on cryptos should only be utilised by knowledgeable investors.

Some of the top crypto exchanges offer crypto margin trading, including Kraken and Crypto.com.

What Is A Margin Call?

If the price of the asset held on margin drops in value significantly, a broker will issue a margin call. This means that traders will have to prove that they can return the amount borrowed, by depositing more funds.

The account will usually be suspended from opening new trades until this has been completed, or the asset rises in value again.

A margin call is designed to protect traders from losing more than they can afford.

For example, if you’re trading $1,000 on margin with 5x leverage and the value of ETH drops 17.5%, the value of the asset you hold is now worth $4,125.

Your operating loss is -$875. Since you’ve only deposited $1,000, you’re in danger of losing more than your initial deposit amount if the value slips further. At this point, a margin call may be issued.

Pros Of Crypto Margin Trading

- Lower capital requirements – Some Bitcoin trading strategies that require large amounts of capital. For example, scalping is the practice of executing short and sharp trades to collect small profits regularly. Crypto margin trading allows traders to maximise the results of each trade and means profits can accumulate quickly.

- 24/7 margin trading – Unlike the forex and commodities markets, crypto can be traded 24/7. If you’re a weekend trader, this means you can take advantage of margin trading outside of usual operating hours.

Cons Of Crypto Margin Trading

- Losses are amplified – While crypto trading on margin can mean increased profits, it also means that any losses are multiplied. Losses can exceed the deposit amount, so the risk involved is significantly larger when compared with trading on a cash account. Traders should consider whether they can afford the risk.

- Interest on borrowed crypto – While traders keep all the profits from their trades, some exchanges charge interest on the borrowed amount. The rate varies based on the cryptocurrency and the length of time capital is borrowed.

- Negative balance protection – In the world of forex, margin trading has been around a while. Therefore, most brokers are subject to regulation that aims to protect retail investors. In the EU, regulated forex brokers must provide negative balance protection, for example. This means that traders are prevented from losing more than their deposit amount when trading on margin. This level of protection is not generally available in the crypto industry, leaving altcoin margin traders exposed to significant risk.

- Regulatory challenges – Leveraged crypto trading has been barred outright or severely restricted in some jurisdictions due to its volatility and high risk. For example, measures introduced by the European Securities and Markets Authority (ESMA) in 2018 limited leverage to 1:2, while the UK’s Financial Conduct Authority barred leveraged crypto derivatives for retail traders in 2020.

- Limited trading pairs – Not all crypto margin trading platforms offer leverage on all pairs, sometimes it’s only available on one or two. This limits traders’ scope for utilising an arbitrage strategy.

How To Start Crypto Margin Trading

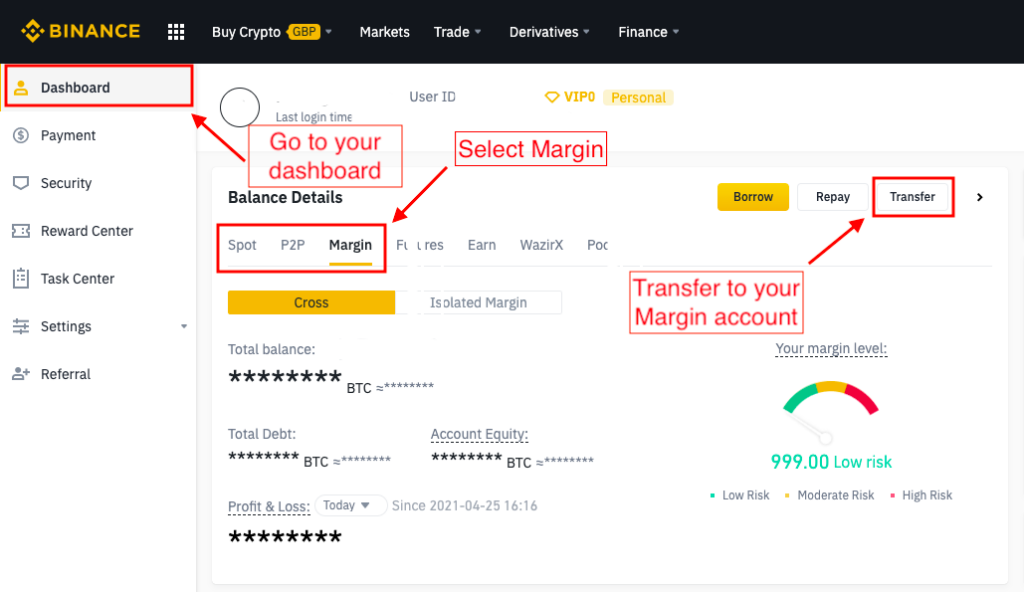

To start crypto margin trading, you’ll first need to select a broker or an exchange that provides the service. Some of the best crypto exchanges that offer margin trading include Kraken. Then sign up to an account and complete any KYC checks – this usually involves inputting proof of identity and some personal information. Next, visit your settings. There will usually be an option to switch your account from spot to margin trading. In some cases, you’ll then need to transfer tokens to your margin account.

Choosing A Crypto Margin Trading Broker

- Leverage offered – Take a look a what leverage a broker is offering to understand how much you can trade. Note that higher leverage isn’t necessarily better – crypto assets tend to be highly volatile, meaning that even leverage of 1:2 can bring tidy profits, while high leverage will expose you to very serious risk if a trade goes the wrong way.

- Fees – The fee structure for margin trading varies per broker. Some operate by allowing traders to borrow tokens as leverage. In this instance, interest is usually charged on the borrowed amount. Kraken, on the other hand, charges an opening and closing fee on the spot value of the trade. A rollover fee is applied based on how long the position is held. Look for a broker whose fee structure you’re comfortable with. Also, taxes will usually need to be paid on any gains, in line with rules in your jurisdiction.

- Demo accounts – Since Bitcoin margin trading involves an increased level of risk, traders must have the opportunity to practice their strategies using signals beforehand. A trading simulator and online courses allow clients to trial strategies before using real money. Profit calculators are also useful to help predict the outcome of a trade and can replace the manual spreadsheet you’ve previously worked with.

Final Word On Crypto Margin Trading

Now we’ve explained the ins and outs of crypto margin trading, you’ve hopefully got the understanding to get started. Bitcoin and other cryptos are highly volatile markets and while trading on margin can mean huge upside, retail investors should also be aware of the risks involved. It’s possible this asset could suffer from increased regulation in the future, but for now, it represents an exciting opportunity for traders.

FAQ

How Does Bitcoin Margin Trading Work?

Crypto margin trading means investors can multiply the results of their Bitcoin trade by utilising leverage. Leverage is the number of times you can multiply the results, it is either written as a ratio (e.g 1:3) or a multiple (e.g 3x). Leverage allows traders to borrow funds from their broker. In this way, a trader can execute much larger positions than their deposit amount and can amplify profits.

Are There Many Crypto Exchanges That Allow Margin Trading?

The top crypto margin trading exchanges that allow margin trading include Kraken, but there are more to choose from. However, availability does vary by location. Some popular exchanges, including eToro and Coinbase, have suspended crypto margin trading at times due to volatility in the market.

Is Crypto Margin Trading Legal In The USA?

The US has taken steps towards crypto margin trading on CFTC‑registered exchanges following 2025 regulatory changes that lifted prior restrictions on spot margin.

Will A Crypto Margin Call Go Away?

A margin call will cease once your account has been deposited with sufficient funds or the asset has increased in value. A margin call is designed to protect a trader from losses that exceed their deposit amount.

Can I Trade Crypto On Margin?

Yes, some of the top Bitcoin exchanges now offer trading on margin, with the opportunity to multiply the results of any trade. Whilst the practice is restricted in some jurisdictions, it is available in Australia, India, and Canada, to name just a few.