Trade Nation Review 2026

See the best Trade Nation alternatives in your location.

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- There is a low minimum deposit for beginners

Cons

- Fewer legal protections with offshore entity

Trade Nation Review

Trade Nation is a global forex, indices, commodities, shares and crypto broker, which prides itself on being fair and transparent. Read our 2026 review of Trade Nation’s trading platforms, apps and market offerings to find out whether you should open an account. We also break down the brokerage’s regulatory status, trading fees, and leverage opportunities.

Company History & Overview

The online broker was known as Core Spreads from 2014 to 2019. The company has since expanded globally under Trade Nation and is regulated by the FCA in the UK, the ASIC in Australia, the FSCA in South Africa, the SCB in the Bahamas, and the FSA in the Seychelles.

The firm facilitates straightforward financial market access by removing complicated jargon and providing customer support throughout the trading process.

The company also offers alternative data and market insights to help switched-on investors make informed trading decisions. Additionally, traders benefit from competitive fees and market-leading trading tools.

Trading Platforms

Trade Nation offers its own trading platform in addition to the popular MetaTrader 4 (MT4).

Made To Trade

The bespoke platform is intuitive and provides flexible charting functionality through a sleek user interface.

When we used Trade Nation, we found a multitude of interactive graph styles were available such as histograms and candle charts, as well as the ability to vary timescales from one minute to one month.

It is also easy to overlay information on graphs, with a decent selection of drawing tools available. The optional deal button in the chart view means positions can be executed quickly.

Trade Nation accommodates first-time users by supplying several demonstration videos on how to use their platform.

MetaTrader 4

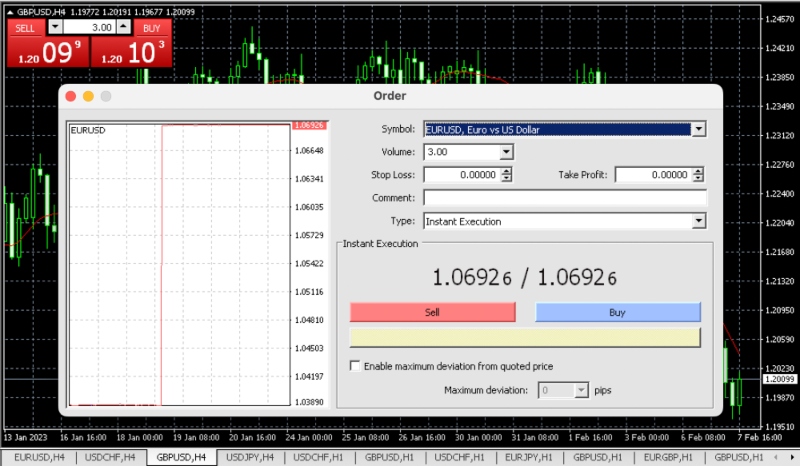

The broker also provides the popular MT4 platform for forex trading. A demonstration video detailing how customers can link their Trade Nation account to the MT4 terminal is available on the broker’s website.

MetaTrader 4 is favored among investors due to its selection of customizable and interactive charts, plus the ability to run trading robots. It offers a selection of 38 built-in indicators and 2,000 free custom indicators for market analysis, as well as 24 analytical objects for detecting trends.

The MQL4 programming language enables users to write algorithms for automated trading, which can also be downloaded from the MT4 codebase. In addition, live trading signals are available in the MetaTrader marketplace.

How To Place A Trade

- Download the MT4 desktop software and log in. Alternatively, open the web trader

- Use the ‘Market Watch’ widget in the left of the platform to choose an asset, for example, the EUR/USD

- Click ‘New Order’ from the top menu

- Enter the trade size and any stop loss or take profit levels

- Input any comments (optional entry)

- Choose between ‘Instant Execution’ or ‘Pending Order’

- Click on ‘Sell’ or ‘Buy’ to place the trade

Assets & Markets

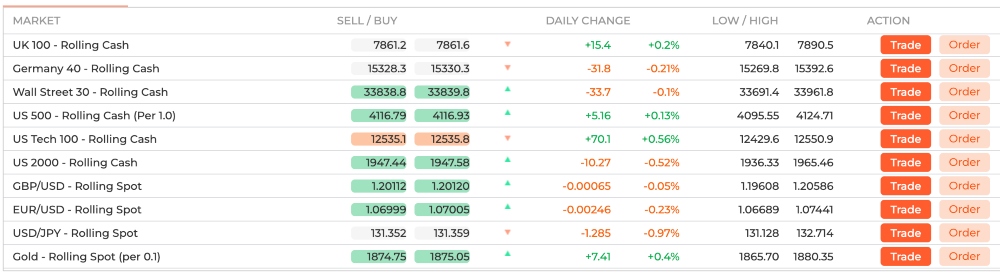

Trade Nation is transparent about its investment options, supplying a market information sheet with details of every instrument, associated spreads and trading hours. This includes 30+ forex pairs, 20+ popular indices (cash and futures), differential indices, a handful of commodities (energy and metals), bond options and shares from the UK, Europe and Asia. Cryptocurrencies are also available through the broker’s Bahamas entity.

In total, over 1000 assets are available, providing a wider range of trading opportunities than many alternatives.

Spreads & Commission

Trade Nation offers variable spreads on forex through its web dealing platform, allowing the broker to provide competitive fees on popular assets while reflecting market conditions.

Customers also benefit from fixed spreads on indices, commodities and bonds. This is good news for traders looking for upfront price transparency, though it is worth noting that the broker increased its fixed spreads in 2023.

Importantly, the company is open about its trading fees. Aside from spreads, the only other charge is overnight interest applied to opened positions. The amount depends on the market and the direction of the investment.

Trade Nation Leverage

The leverage offered depends on which financial authority the trader’s account is regulated by.

For FCA and ASIC regulated accounts, leverage up to 1:30 is available, which is the maximum rate available under these regulators. For FSCA and SCB accounts, leverage up to 1:200 is offered. For FSA Seychelles accounts, higher leverage up to 1:500 is available.

Note, traders should be aware of the risks associated with using leverage to increase position sizes. While margin trading offers the opportunity to enhance earnings on a given investment, it can also result in increased losses.

Mobile Apps

Made To Trade

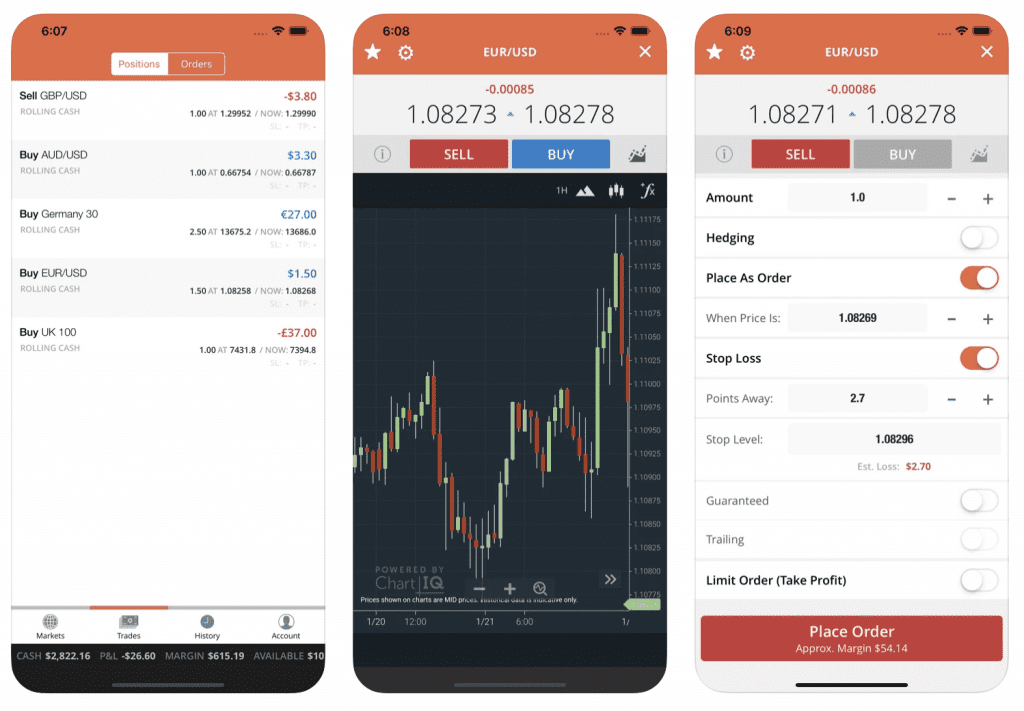

Trade Nation provides an app for its investing platform which is available for iOS and Android users to download.

While using Trade Nation’s app, our experts found it was quick and easy to navigate, with the ability to create custom market watchlists. Both live and practice accounts can be managed from the app too.

MetaTrader 4

MetaTrader 4 also has its own app that enables users to invest in forex from anywhere, 24/5. The application has excellent reviews, providing complete control over trading accounts, in addition to financial market news and chat functionality.

Automated bots, plus one-click trading are available on the MT4 app. A selection of instant and pending order types can be used. The only downside is that detailed technical analysis is harder to complete than the desktop terminal.

Deposits & Withdrawals

The firm allows credit and debit card deposits using Visa and Mastercard. Additionally, funds can be deposited via bank transfer or using the digital wallet Skrill. Credit and debit card deposits are instant, while bank transfers can take up to three business days to arrive in Trade Nation accounts. UK customers can also use PayPal.

Importantly, there is no minimum deposit clause in place, making Trade Nation suitable for beginners.

Withdrawals are returned to the deposit source (card, Skrill or bank transfer) where possible to reduce the risk of fraud. All funds take up to five business days to arrive in accounts. The broker doesn’t charge any fees for deposits or withdrawals, however, your bank or third-party might.

The minimum withdrawal is set at 50 of the currency your account is in, for example, $50.

Demo Account

Trade Nation offers a free practice platform, where customers can test out investment strategies with $5,000 in virtual funds. We were impressed to discover that the broker provides a one-to-one walkthrough with the demo account, which can also be requested via a callback service on the website.

How To Register For A Demo Account

- Select ‘Insights’ from the broker’s official website

- Click on ‘Try Our Demo’

- Click on ‘Sign Up’

- Enter your name, email address and a password

- Answer the on-screen questions about your location, trading experience and account type

- Activate the paper trading account and sign in

Bonuses & Promotions

The broker offers a loyalty scheme, where customers receive cashback for every opened position. Each trader will receive a sign-up bonus of 200 points upon opening an account, and one additional point for every USD traded.

These points are totaled at the end of each month and a rebate is applied the following month, which can then be kept in the account to invest with or withdrawn as cash. The value of these points increases with the amount invested.

Rebates range from 2% for customers with 200 points to an impressive 20% for customers with over 10,000 points in their account. Unfortunately, this loyalty scheme is only available to non-FCA and non-ASIC Trade Nation customers.

The broker has also previously held competitions with partnership companies, so investors are advised to look out for future promotions on the official website.

Regulation & Licensing

Trade Nation holds licenses in the countries that it operates in. In the UK, Trade Nation is a firm name of Finsa Europe Ltd, which is authorized by the reputable Financial Conduct Authority (FCA) and provides an £85,000 deposit protection scheme through the FSCS.

Additionally, Trade Nation uses Signal Centre which gives trading signals for a range of indices, currencies and commodities. This provider is also authorized and regulated by the FCA.

In Australia, Trade Nation is a company name of Finsa Pty Ltd, which is regulated by the ASIC. In South Africa, Trade Nation Financial (Pty) Ltd is regulated by the FSCA, while in the Bahamas, Trade Nation Ltd is regulated by the SCB. Trade Nation Financial Markets Limited is also regulated by the FSA in Seychelles. On the downside, there is no compensation scheme for accounts registered under these three authorities.

Additional Features

A great feature offered by Trade Nation is Smart News, which is available on their trading platform and mobile app.

Smart News aims to provide insights that keep investors ahead of the market, providing ‘alternative news’ acquired from independent sources, rather than traditional data reported by companies themselves. By cross-referencing social media with specific financial events, such as central bank meetings, Trade Nation is able to provide investors with specific threads relevant to their trading interests that might offer new market insights.

Additionally, the brokerage has a selection of online educational tools. This includes a jargon buster page and a wide range of articles that can be searched by category including market updates, company news and how to invest safely. These are useful for beginner traders.

We also rate the signals and copy trading available through Trade Nation Seychelles. You can get started in a few straightforward steps and replicate the positions and strategies of experienced traders. This will appeal to time-poor traders and those looking to learn from established investors.

Trade Nation Account Types

Trade Nation’s account structure is simple, with the only two types of accounts available being the low leverage (up to 1:30) and high leverage (up to 1:200 or 1:500) accounts. Customers will not benefit from FCA or ASIC regulation and any financial compensation scheme if applying for the high-leverage solutions. Market access, fees and trading tools are the same across each account.

Muslim traders will also appreciate the Islamic-friendly account available in certain countries under the SCB and FSA branches. These accounts waive swap fees.

Trading Hours

Forex is open 24/5, while other markets are subject to local trading times. The company has a handy market information sheet that provides trading hours for each market offered.

Customer Support

Trade Nation prides itself on offering a high level of personal support without the use of robots. Customer service is available 24/5 (Sunday 10 PM – Friday 10 PM, GMT). This includes a live chat service, which we found to be responsive and accommodating upon testing.

Additionally, users can contact the broker via email or telephone:

- Email – support@tradenation.com

- Telephone – +44 (0) 203 180 5952 (for all offices)

Security & Safety

We were impressed that Trade Nation requires all clients to answer a series of short questions about their trading background, prior to opening an account. If these questions are not answered satisfactorily, the broker will prevent customers from opening a live account until a practice account has been used first.

All of the broker’s bank accounts are segregated. The company follows strict data privacy practices, with consistent standards in place across all account types. Negative balance protection is also provided. Overall, our experts found that the brokerage provides a relatively secure investing environment for its users.

Trade Nation Verdict

Trade Nation goes a long way to fulfilling its promise of challenging industry norms by being transparent and honest. It offers competitive spreads for a range of popular financial markets. We were particularly impressed by the measures in place to support customers, such as the one-to-one walkthrough of the demo account and extensive video demonstrations. This regulated broker is a good choice, especially for savvy traders.

FAQ

Is Trade Nation A Good Broker?

Our 2026 review found Trade Nation to be a transparent broker that provides low, fixed spreads across a range of markets including indices and commodities. Variable spreads are available on forex. The company also offers a decent range of high-quality online educational materials and trading tools, including MT4.

How Much Capital Do I Need With Trade Nation?

Trade Nation has no minimum deposit requirement. Customers are only asked to cover the minimum margin requirements of their position. This makes the brand popular with new investors.

Is Trade Nation Legit Or A Scam?

Trade Nation is regulated by the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), the South African Financial Sector Conduct Authority (FSCA), the Securities Commission of The Bahamas (SCB), and the Financial Services Authority (FSA) in the Seychelles. This is a good sign that the broker is legit and trustworthy.

Does Trade Nation Offer A Demo Account?

The broker offers a practice account with $5,000 of virtual funds. The demo account can also be accessed using Trade Nation’s app. New users can sign up for the free demo account on the Trade Nation website.

Does Trade Nation Offer A Sign-Up Bonus?

Trade Nation operates a loyalty scheme to non-FCA and non-ASIC regulated account customers, which includes 200 bonus points when opening a live account. This entitles clients to receive a minimum cash rebate of 2% on any opened positions the following month, which can be withdrawn or applied to future investments.

Best Alternatives to Trade Nation

Compare Trade Nation with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Trade Nation Comparison Table

| Trade Nation | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 4.6 | 4.3 | 3.9 |

| Markets | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $10 |

| Minimum Trade | 0.1 Lots | $100 | 0.01 Lots |

| Regulators | FCA, ASIC, FSCA, SCB, FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 200 Sign-Up Reward Points | – | $100 No Deposit Bonus |

| Platforms | TN Trader, MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500 (entity dependent) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Trade Nation and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Trade Nation | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | Yes | No | No |

| Volatility Index | No | No | No |

Trade Nation vs Other Brokers

Compare Trade Nation with any other broker by selecting the other broker below.

The most popular Trade Nation comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 Trade Nation customer reviews submitted by our visitors.

If you have traded with Trade Nation we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of Trade Nation

Article Sources

- Trade Nation Website

- Trade Nation FCA License

- Trade Nation ASIC License

- Trade Nation FSA License

- Trade Nation FSCA License

- Trade Nation SCB License

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Speaking as someone that’s used north of 10 online trading platforms now, Trade Nation is great for active forex traders. Low spreads even when the market gets choppy, TNTrader packs a punch for technical analysis with got to be pushing 100 indicators and drawing tools. They’re also one of the few brands I’ve seen that run decent webinars with actually knowledgable market experts and analysts where you learn stuff that you can then apply in your trades.