Netherlands Authority for the Financial Markets (AFM) Brokers 2026

Brokerages under the strict regulation of the Netherlands Authority for the Financial Markets, or Autoriteit Financiële Markten (AFM), operate within a framework of stringent rules.

This authority is designed to protect Dutch investors and ensure the integrity of the financial markets, making AFM-regulated brokers a reliable choice for your day trading activities.

These rules are based on the Financial Supervision Act, or Wet op het financieel toezicht (Wft), and other relevant EU regulations and directives.

The Netherlands AFM is a ‘green tier’ body in line with DayTrading.com’s Regulation & Trust Rating, reflecting its active oversight of online brokers and robust safeguards for traders.

Explore our selection of the top AFM-regulated trading platforms in the Netherlands. We’ve checked that every provider is on the AFM’s Financial Services Register, and is either directly authorized or registered for passporting through the EU’s cross-border scheme.

Best AFM Brokers

After hands-on tests, these 3 Dutch-regulated trading platforms lead the pack:

Here is a summary of why we recommend these brokers in March 2026:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- LiteForex Europe - LiteForex Europe is a CFD broker established in 2008 and authorized by the CySEC. The brokerage offers forex, commodities and indices via the MT4 and MT5 platforms. Spreads are ultra tight on ECN accounts and leverage is available up to 1:30 in line with EU regulations. LiteForex also offers a rich education centre for new day traders and social trading capabilities.

AFM Brokers Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| Interactive Brokers | $0 | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | 1:50 |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| LiteForex Europe | $50 | CFDs, Forex, Indices, Commodities | MT4, MT5 | 1:30 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- The new IBKR Desktop platform takes the best of TWS while adding bespoke tools like Option Lattice and Screeners with MultiSort to create a genuinely impressive trading experience for day traders at every level.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

LiteForex Europe

"LiteForex is a good option for active day traders with variable spreads from 0.0 pips, daily analysis and high-quality training guides. The forex copy system also lets you duplicate the positions of experienced traders."

William Berg, Reviewer

LiteForex Europe Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities |

| Regulator | CySEC, AFM |

| Platforms | MT4, MT5 |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CHF |

Pros

- The broker offers a VPS server for experience day traders looking to run their auto strategies continuously

- There's a comprehensive analytics portal by Claws&Horns, which offers video reviews, expert insights and short-term trading signals

- Low $50 minimum deposit makes LiteForex accessible for beginners

Cons

- There is no swap-free trading account for Muslim day traders

- There are limited funding methods compared to other brands

- Fees are fairly high, with spreads starting from 2.0 pips in the Classic account and $10 forex commissions in the ECN account

Methodology

To locate the top brokers that are regulated in the Netherlands, we:

- Examined our records of 139 brokers to identify those self-proclaimed as AFM-authorized.

- Entered their details into the regulator’s online verification system to confirm their authorization.

- Combined the insights from our practical testers with over 100 data points to create a ranking of the top AFM-authorized trading platforms.

How Can I Check If A Broker Is Regulated By AFM?

Verifying a broker’s AFM regulation is a straightforward process, which we used to assess the credibility of every recommended platform.

You can do it in three simple steps:

- Head to the AFM’s Register page on its website.

- Enter the provider’s name in the search bar.

- Filter the search results if necessary, or click on a company name to view details like full business trading name(s) and AFM registration date(s).

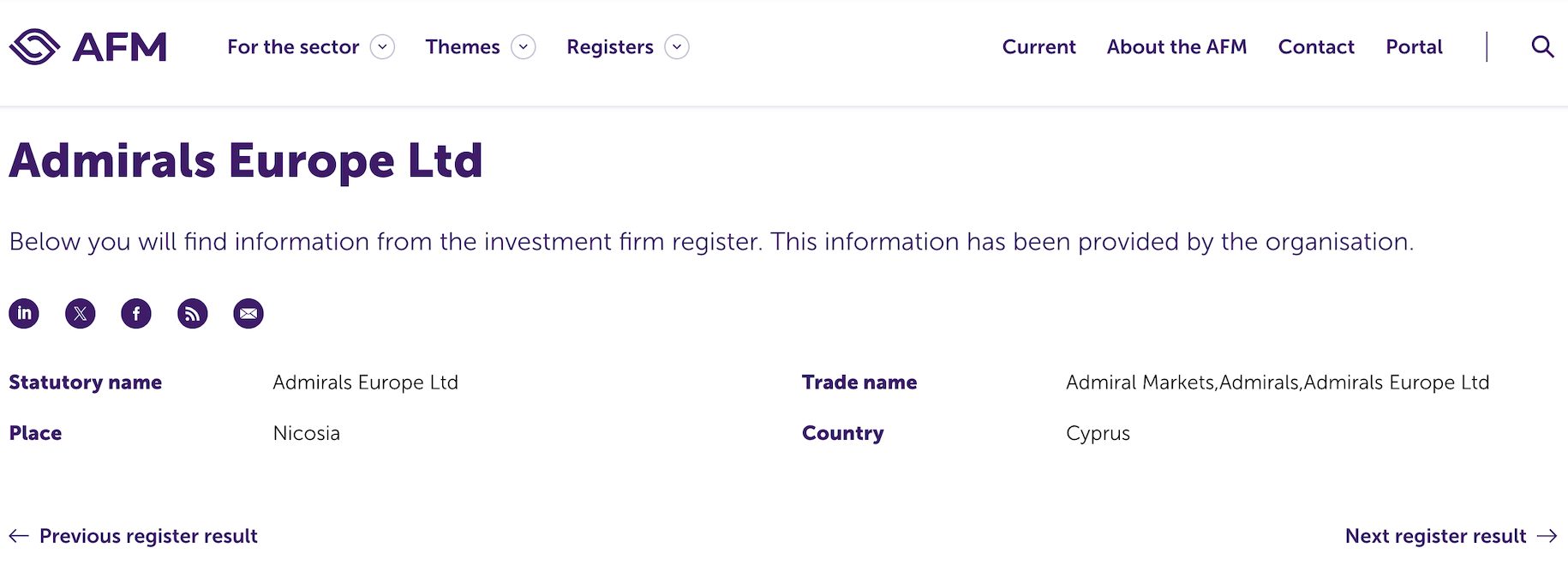

To show you how this works, below you can see where I verified that Admiral Markets is regulated by the AFM.With it taking just a couple of minutes and a few clicks, I recommend all Dutch traders check any brokerage they are considering is authorized before depositing Euros.

What Rules Must AFM-Regulated Brokers Follow?

For an online broker to offer financial services in the Netherlands, they must obtain a regulatory licence from the AFM. This is no small feat, as the application process is demanding and requires meticulous preparation, reflecting the high standards of regulation upheld by the AFM.

Alternatively, providers may serve Dutch traders through the EU’s passporting regulations, which allow firms regulated in their home countries to legally offer trading services in the Netherlands.

To secure an AFM licence, a trading platform must meet the following essential requirements:

- Fit & Proper Requirements: The management board and key personnel must meet ‘fit and proper’ criteria, demonstrating the necessary expertise, integrity, and experience to manage the firm effectively.

- Client Protection & Suitability: Brokers must conduct thorough Know Your Customer (KYC) processes to understand the financial situation, investment experience, and risk tolerance of their clients – a vital step due to the significant risks involved in day trading.

- Transparency & Disclosure: Brokers must provide clear, accurate, and timely information to clients about the risks, costs, and features of the financial products they offer.

- Best Execution: Brokers must establish and implement an order execution policy that ensures they achieve the best possible outcome for their clients when executing orders, considering price, costs, speed, likelihood of execution, and other factors.

- Conflicts of Interest: Brokers must identify, manage, and disclose any conflicts of interest that may arise between themselves and their clients. This includes implementing policies and procedures to prevent disputes or to ensure they do not negatively impact clients.

- Segregation of Client Funds: Brokers must segregate client funds from their own operational funds to protect traders’ funds in the event of the broker’s insolvency.

- Compliance & Risk Management: Brokers must have robust internal controls, including compliance, risk management, and internal audit functions, to ensure they operate in accordance with regulatory requirements. Brokers must implement anti-money laundering (AML) and consolidated trade file (CTF) policies, including client identification, monitoring transactions, and reporting suspicious activities.

- Capital Adequacy: Brokers must maintain a minimum level of regulatory capital to ensure they can meet their liabilities and operate on a sound financial basis. The specific capital requirements depend on the broker’s size and the nature of its business.

- Reporting & Record-Keeping: Brokers must submit regular reports to the AFM, including financial statements, capital adequacy reports, and other regulatory filings. Brokers must maintain accurate and comprehensive records of all transactions, communications, and client interactions for a specified period, usually five years.

- Market Conduct Rules: Brokers must avoid practices that could undermine the integrity of the financial markets, such as market manipulation, insider trading, or dissemination of false information. Brokers must ensure that all clients are treated fairly and that they act in the best interest of their traders at all times.

- Advertising & Marketing: Marketing materials and advertisements must be transparent, fair, and not misleading. They must not exaggerate potential returns or downplay the risks associated with the products offered, including leveraged derivatives that are popular with active traders.

- Complaint Handling: Brokers must have a clear, transparent, and efficient process for handling client complaints. They are also required to report unresolved complaints to the AFM.

- Product Governance: Brokers involved in developing financial products must ensure that they are designed to meet the target market’s needs and that their distribution strategies are appropriate.

- Compliance with EU Regulations: Brokers must comply with the Markets in Financial Instruments Directive II (MiFID II), which sets standards for investor protection, transparency, and market integrity across the European Union. Brokers must also comply with the General Data Protection Regulation (GDPR) to protect clients’ personal data.

Brokers who fail to comply with these rules may face enforcement actions from the AFM, including fines, sanctions, or the revocation of their license.

For example, the AFM has imposed fines. A notable example is the €530,000 administrative fine imposed on BinckBank N.V., operating as Saxo Bank, for failing to implement procedures and measures to protect clients.

The first time the AFM used national product intervention measures was to prohibit binary options and restrict the marketing or sales of CFDs.

Bottom Line

We strongly encourage Dutch traders to open accounts with AFM-regulated brokers. This not only ensures the brokerage is trustworthy but also maintains a fair and transparent trading environment, providing you with peace of mind.

You can verify this in just a few minutes on the AMF website. Alternatively, use our list of the best day trading platforms regulated in the Netherlands.

It’s important to remember that online trading remains risky, regardless of the broker’s regulatory status, and you could lose all the money you invest.

Article Sources

- Netherlands Authority for the Financial Markets (AFM)

- Financial Supervision Act (Wft)

- AFM Fines BinckBank for Infringement of Product Governance Rules - LS Consultancy

- Anti-Money Laundering and Countering the Financing of Terrorism at EU level - European Commission

- Markets in Financial Instruments Directive II (MiFID II)

- What is GDPR? - GDPR.EU

- Measures the AFM May Apply - AFM

- Investor Compensation Scheme - DNB

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com