Best CFD Trading Platforms and Brokers in Spain 2026

CFD trading is popular in Spain, allowing investors to speculate on international and local markets, such as the IBEX 35. CFDs are regulated by the Spanish Securities Market Commission (CNMV), which tightened marketing rules in 2023, banning advertising by public figures and call centers.

We’ve reviewed 139 brokers to bring you the best CFD trading platforms in Spain. Every broker accepts traders from Spain and has earned the trust of our experts.

Top 6 CFD Trading Platforms in Spain

These 6 platforms consistently stand out as the best for CFD traders in Spain:

-

1

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

2

Ingot Brokers

Ingot Brokers -

3

Trade Nation

Trade Nation -

4

IC Trading

IC Trading -

5

Fusion Markets

Fusion Markets -

6

FBS

FBS

Here is a short overview of each broker's pros and cons

- Eightcap - Eightcap offers a wide range of trading options with 800+ CFDs across stocks, indices, bonds, commodities, and cryptocurrencies (depending on location), with leverage up to 1:30/1:500. It excels in its tools, notably the AI-enabled economic calendar covering 25+ countries with impact filters (high, medium, low). However, its commodities offering, particularly in softs like cotton and wheat, as well as the limited precious metal and energy assets, is its weakest area.

- Ingot Brokers - Ingot Brokers offers CFD trading on 1000+ instruments including stocks, commodities and cryptocurrencies. The MT4 and MT5 platforms offer comprehensive features for active CFD traders, including multiple order types and pre-integrated technical tools.

- Trade Nation - Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

- IC Trading - IC Trading specializes in CFD trading with over 2,250 tradable assets spanning sought-after markets including forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and cutting-edge bridge technology, the broker provides excellent trading conditions for short-term traders looking for leveraged derivatives.

- Fusion Markets - You can go long or short on a range of CFDs covering forex, commodities, shares, indices and cryptos. High leverage up to 1:500 is available for experienced traders in some locations, whilst beginners will appreciate access to micro-lots. There are no restrictions on short-term trading strategies using CFDs.

- FBS - FBS is a CFD broker, allowing you to speculate on the price movements of these assets without actually owning them. CFDs are available in various asset classes, including forex, commodities, indices, and stocks, but there are no opportunities for trading ETFs, bonds, or options. However, what truly empowers traders is the competitive spreads and generous leverage up to 1:3000 (capped at 1:30 for EU traders), all without inactivity or withdrawal fees.

Best CFD Trading Platforms and Brokers in Spain 2026 Comparison

| Broker | CFD Trading | EUR Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Eightcap | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 |

| Ingot Brokers | ✔ | - | $10 | CFDs, Commodities, Stocks, Indices, ETFs, Forex, Cryptocurrencies | MT4, MT5 | 1:500 |

| Trade Nation | ✔ | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) |

| IC Trading | ✔ | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 |

| Fusion Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| FBS | ✔ | ✔ | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| FTSE Spread | 1.2 |

|---|---|

| GBPUSD Spread | 0.1 |

| Stocks Spread | 0.03 (Apple Inc) |

| Leverage | 1:30 |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

Ingot Brokers

"Ingot Brokers is a good choice for day traders looking for a no-frills broker with a wide range of instruments. Experienced traders will appreciate access to the advanced MT5 platform, although beginners may be disappointed in the lack of educational resources."

William Berg, Reviewer

Ingot Brokers Quick Facts

| FTSE Spread | From 0 pip |

|---|---|

| GBPUSD Spread | From 0 pip |

| Stocks Spread | From 0 pip |

| Leverage | 1:500 |

| Regulator | ASIC, FSCA, JSC, FSA, CMA |

| Platforms | MT4, MT5 |

| Account Currencies | USD, AUD |

Pros

- Ingot Brokers holds multiple regulatory licenses, including one from the top-tier regulator, ASIC

- Multiple free payment methods are available, including bank transfers and crypto payments

- Ingot Brokers offers a copy trading service with passive income opportunities for experienced strategy providers

Cons

- The ECN account offers fewer assets than the other account types

- The broker’s educational resources and market research trail most competitors

- The range of 30+ currency pairs is below the industry average and won’t be sufficient for serious forex traders

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| FTSE Spread | From 0.4 |

|---|---|

| GBPUSD Spread | From 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:500 (entity dependent) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- There is a low minimum deposit for beginners

- Multiple account currencies are accepted for global traders

- The trading firm offers tight spreads and a transparent pricing schedule

Cons

- Fewer legal protections with offshore entity

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| FTSE Spread | 2.133 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | Variable |

| Leverage | 1:500 |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

- Trading Central and Autochartist are valuable tools for in-depth technical summaries and actionable trading ideas and are accessible from within the account area or the cTrader platform.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.13 |

| Stocks Spread | 0.01 |

| Leverage | 1:500 |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| FTSE Spread | 0.0 |

|---|---|

| GBPUSD Spread | 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Account Currencies | USD, EUR |

Pros

- FBS offers lightning-fast execution speeds from just 10 milliseconds, placing it among the industry leaders for highly active traders like scalpers who demand rapid order processing.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

Cons

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

How We Chose The Best CFD Trading Platforms In Spain

To pinpoint the best CFD trading platforms in Spain, we filtered our 139-strong database of brokers that have been exhaustively tested over several years, prioritizing those accepting Spanish traders and sorting them on their overall rating which considers crucial elements, notably:

We Selected Trusted Brokers

We picked CFD brokers we trust, leveraging our firsthand experience using their platforms and balancing their regulatory status with their industry reputation.

The Spanish Securities Market Commission (CNMV) is responsible for overseeing CFD trading, however as a European nation, the European Securities and Markets Authority (ESMA) and MiFID II are influential.

ESMA passed judgment on CNMV’s 2023 decision to amend the rules regarding the marketing of CFD products, largely agreeing with the changes, despite noting a divergence in approach.

Under the CNMV resolution, advertising CFDs to retail investors, including through sponsorships, brand promotions, and public figures, is banned.

- XTB stands out as a highly trusted CFD provider for Spanish traders, with authorization from five ‘Green-Tier’ regulators, including the CNMV, an office presence in Madrid, alongside a listing on the Warsaw Stock Exchange, demonstrating a high degree of financial transparency.

We Chose Brokers With Transparent Leverage Requirements

Leverage is a common component in CFDs, allowing traders to open positions larger than their cash balance, multiplying trading results (profits and losses).

Let’s say I’ve seen that Spanish telecoms company Telefonica (BME:TEF) is about to complete a major deal that could increase its share price. I may want to open a long position to capitalize on this using a leveraged stock CFD.

If I bought €1,000 worth of Telefonica stock at €5 a share using 1:5 leverage, I’d only need to put down €200 (5 x €200 = €1,000).

We review the CFD trading conditions of all brokers we recommend, ensuring they are transparent about the required outlay to trade with leverage, known as margin, plus the level at which a margin call will be issued (a request to deposit more funds) and that stop-outs will take place (the automatic closure of trades to prevent further losses).

- Eightcap excels here, offering leverage trading with clear margin requirements, including leverage up to 1:30 for Spanish retail investors in line with EU regulations.

We Prioritized Brokers With A Strong Investment Offering

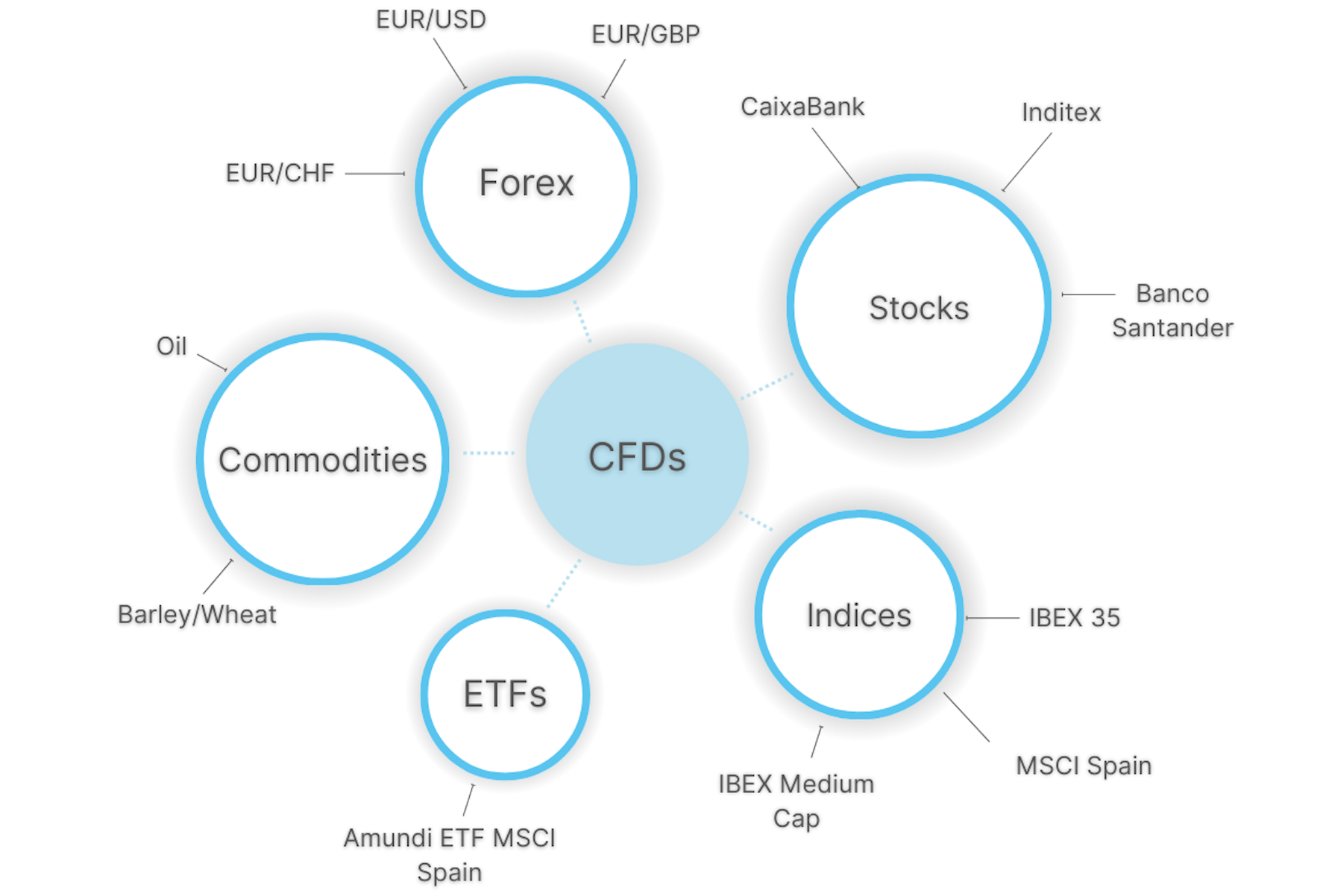

We’ve selected CFD trading platforms that offer a wide range of underlying assets, including forex, stocks, indices, commodities and cryptos, covering local markets and international ones.

The Spanish economy is a strong player on the global stage. There are four major stock exchanges: Madrid, Bilbao, Barcelona and Valencia, all owned by the Bolsas y Mercados Españoles (BME).

It has a thriving financial sector, with Banco Santander (BME:SAN), Banco Bilbao (BME:BBVA), and CaixaBank (BME:CABK) all top five companies in the IBEX 35 index. It is also huge in fashion and textiles, with Inditex (BME:ITX), the conglomerate owning famous brands like Zara, Oysho and Massimo Dutti.

Additionally, Spain has four of the top 125 busiest seaports in the world, making it an influential economy in foreign trade. It is also part of the Eurozone, making CFD trading in currency pairs containing the EUR an attractive proposition.

- SaxoBank is a great example of a CFD broker that offers fantastic opportunities to speculate on the Spanish economy. Traders can access Spanish stocks such as Telefonica SA, CaixaBank SA and Acerinox SA. It also offers popular EUR pairs, including the EUR/GBP, EUR/CHF and EUR/USD.

We Selected Brokers With Excellent Pricing

A low-cost pricing structure is essential to build a profitable CFD portfolio, especially for day traders executing a large volume of trades where transaction fees can mount.

That’s why we analyze spreads on popular CFD assets, notably forex, stocks, indices and commodities, as part of our in-depth testing process. On top of that, we evaluate any additional fees, such as inactivity fees, to ensure there are no hidden extras.

- CMC Markets shines for its industry-low CFD trading fees, notably a 0.7 spread on the EUR/USD, a 5.0 spread on the IBEX 35, plus spread discounts of up to 40% for active traders.

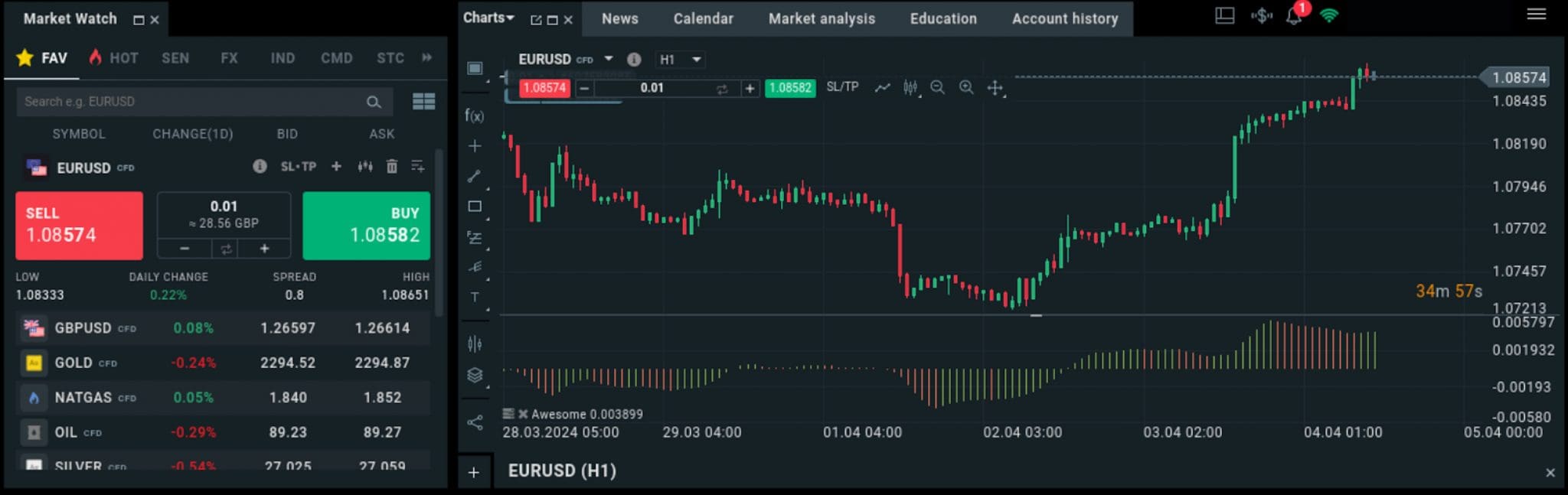

We Choose Platforms With Great Charting And Research Tools

CFD traders, especially short-term traders, need a platform that gives them a great suite of charting tools for technical analysis.

We’re regularly testing platforms and apps to ensure we’re recommending the best around for Spanish traders, paying particular attention to their usability, charting package, and research tools.

Most CFD brokers offer at least one of MetaTrader 4 or MetaTrader 5, and increasingly solutions like cTrader and TradingView, which continue to rival the MetaTrader suite in the charting department while delivering a more user-friendly design.

We Opted For Brokers With Convenient Account Funding For Spanish Traders

Spanish residents generally prefer to use traditional payment methods like debit cards, credit cards or bank transfers, according to findings from Pay.com. However, digital wallets like PayPal are increasingly popular among CFD traders.

All our recommended CFD trading platforms in Spain offer a choice of bank cards, wire transfers and electric payment solutions. They also all have an affordable minimum deposit – we consider anything up to €250 accessible for most retail investors.

- FxPro makes deposits and withdrawals hassle-free for Spaniards with support for bank cards, wire transfers and e-wallets notably PayPal, alongside an easy-to-navigate cashier portal and a low minimum deposit of €100.

FAQ

Who Regulates CFD Trading Platforms And Brokers In Spain?

The Spanish Securities Market Commission (CNMV) is the local regulator in Spain. However, as Spain is part of the EU, it’s also covered by the European Securities and Markets Authority (ESMA) and MiFID II.

This means that CFD trading platforms can be regulated by other European authorities and still provide services in Spain under the EU passporting scheme.

How Much Money Do I Need To Open A CFD Trading Account In Spain?

Our directory of hundreds of online brokers shows you typically need up to €250 to open a CFD trading account in Spain.

However, some CFD trading platforms cater specifically to budget traders with a €0 minimum deposit – the highest-rated is Trade Nation.

Recommended Reading

Article Sources

- European Securities and Markets Authority (ESMA)

- Bolsas y Mercados Españoles (BME)

- Popular Payment Methods in Spain (Pay.com)

- MiFID II

- IBEX 35

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com