Best CFD Trading Platforms and Brokers in Singapore 2026

CFD trading is popular in Singapore, allowing investors to make short-term trades without incurring stamp duty from the Inland Revenue Authority of Singapore (IRAS). CFDs are regulated by the Monetary Authority of Singapore (MAS), which also authorizes online brokers and trading platforms.

Explore the best CFD trading platforms in Singapore, tested, evaluated and compared by our experts. Every CFD broker recommended is trusted and accepts traders from Singapore.

Top 6 CFD Trading Platforms in Singapore

These 6 brokers stand out as the best for CFD traders in Singapore:

-

1

IC Markets

IC Markets -

2

RoboForex

RoboForex -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Trade Nation

Trade Nation

This is why we think these brokers are the best in this category in 2026:

- IC Markets - You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

- RoboForex - RoboForex offers a growing suite of over 12,000 CFDs, encompassing forex, stocks, indices, commodities, futures and ETFs. With an initial deposit of $10 and micro lot trading through to very high leverage up to 1:2000, RoboForex caters to a broad range of derivative traders. On the downside, analysis reveals execution speeds of 1-3 seconds, noticeably slower than IC Markets at 0.35 seconds, and suboptimal for fast-paced strategies like scalping.

- XM - XM delivers for CFD traders with flexible leverage and a huge range of markets, including bespoke thematic indices for exposure to popular sectors like artificial intelligence. The MT4/MT5 platforms are also fast and dependable while a free VPS is available to qualifying XM traders running algo trading strategies.

- AvaTrade - AvaTrade's 1250+ leveraged CFD products span a wide range of asset classes including stocks, indices, commodities, bonds, crypto, and ETFs. What we love is that you can speculate on rising and falling prices in the broker’s feature-rich web and mobile platforms with market-leading research tools to help you discover short-term trading opportunities.

- Pepperstone - Pepperstone maintains its position as one of the fastest and most dependable CFD brokers during our latest round of testing. With execution speeds averaging around 30ms and an outstanding fill rate of 99.90%, the broker ensures a seamless trading experience without requotes or dealing desk interference. It also provides ample trading opportunities across over 1,300 assets.

- Trade Nation - Trade leveraged CFDs on over 1000 assets with low-cost spreads. You can also take advantage of the broker's integrated signals to help you determine when to enter and exit positions.

Best CFD Trading Platforms and Brokers in Singapore 2026 Comparison

| Broker | SGD Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|

| IC Markets | ✔ | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| RoboForex | - | $10 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | R StocksTrader, MT4, MT5, TradingView | 1:2000 |

| XM | - | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| AvaTrade | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Pepperstone | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | 1:30 (Retail), 1:500 (Pro) |

| Trade Nation | - | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | MT4 | 1:500 (entity dependent) |

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | 0.02 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| Stocks Spread | 0.01 |

| Leverage | 1:2000 |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Account Currencies | USD, EUR |

Pros

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| FTSE Spread | 1.4 |

|---|---|

| GBPUSD Spread | 0.8 |

| Stocks Spread | 0.002 |

| Leverage | 1:1000 |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| FTSE Spread | 0.5 |

|---|---|

| GBPUSD Spread | 1.5 |

| Stocks Spread | 0.13 |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.4 |

| Stocks Spread | 0.02 |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| FTSE Spread | From 0.4 |

|---|---|

| GBPUSD Spread | From 0.6 |

| Stocks Spread | Variable |

| Leverage | 1:500 (entity dependent) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- There is a low minimum deposit for beginners

- Multiple account currencies are accepted for global traders

Cons

- Fewer legal protections with offshore entity

How We Chose The Best CFD Trading Platforms In Singapore

To find the best CFD trading platforms in Singapore, we took our extensive database of 140 brokers, identified those that accept traders from Singapore and then ranked them based on their overall rating, which takes into account the following key criteria.

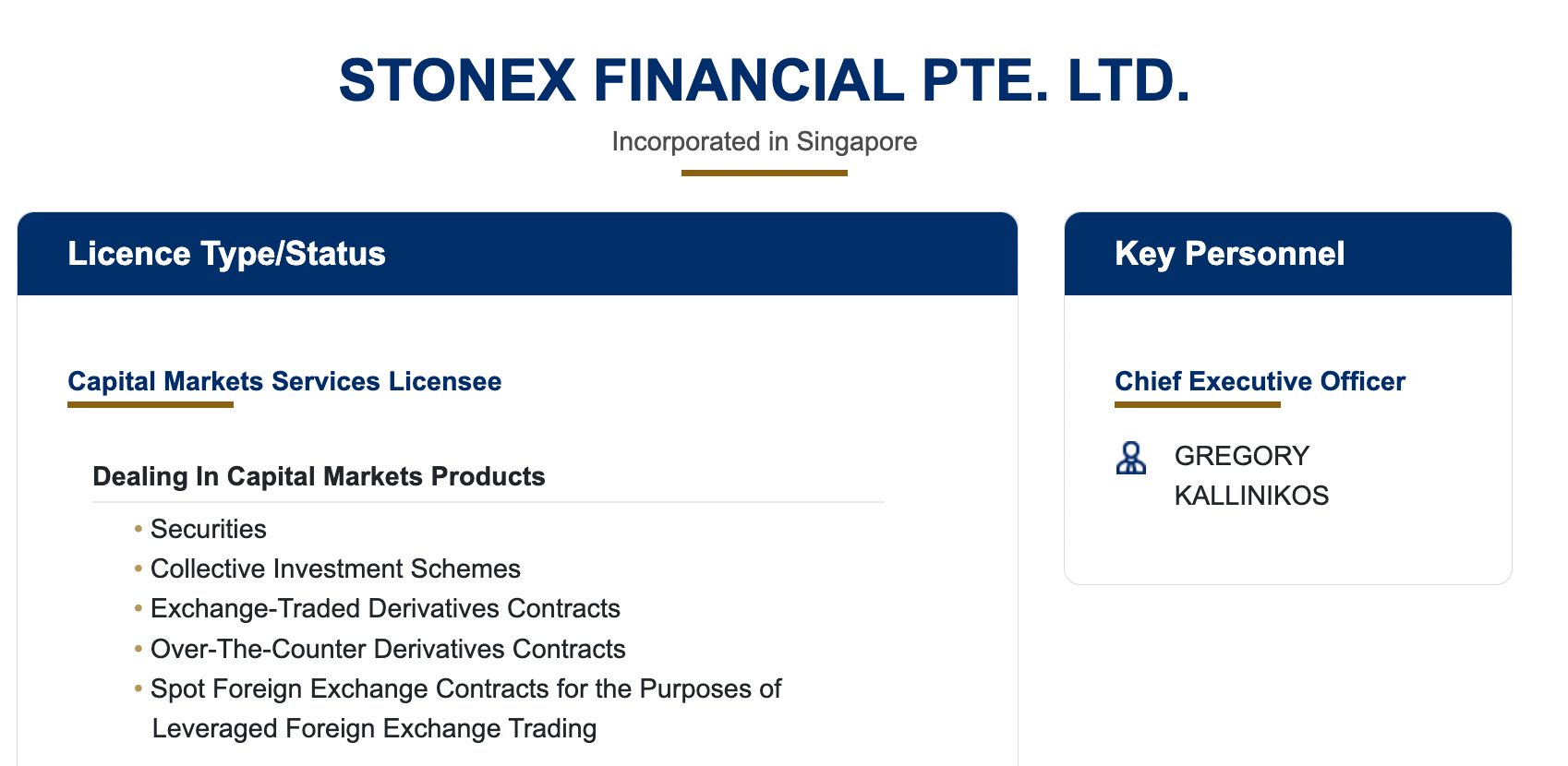

We Chose Platforms Licensed By A Trusted Regulator

CFD traders will receive the best safeguards by opening an account with a brokerage authorized by a ‘Green Tier’ regulator, such as the Monetary Authority of Singapore, which is responsible for ensuring licensed brokers operate responsibly.

City Index, for example, has earned our trust over the years for its secure trading environment and authorization from the MAS. It’s also one of a select few CFD providers listed on a stock exchange (through its parent company StoneX Group), underscoring its reliability.

If not the MAS, we selected CFD trading platforms that are regulated in other respected jurisdictions, such as the US, UK, Australia or Europe, as these are promising signs of a trustworthy operation.

We prioritize well-regulated CFD brokers because this will help protect traders from scams and fraudulent trading platforms, which the Singapore Police Force has warned are promising “lucrative investment opportunities” that have cost victims over 25.5 million SGD since June 2023.

We Chose Platforms With Leverage Trading And Clear Margin Requirements

One of the draws of CFD trading is the availability of leverage, which allows investors to amplify their buying power and trading results for a small outlay, known as margin.

Let’s say you want to speculate that the share price of Singapore Airlines (SGX: SIA) is going to rise today following an earnings announcement. A CFD broker with 1:5 leverage, such as AvaTrade, would multiply your trading power, and potential returns, by 5x.

Importantly, the maximum leverage available to retail investors at Singapore-regulated CFD trading platforms is 1:20. There are brokers with higher leverage, but these are often based in offshore jurisdictions and not suitable for beginners.

I recommend using risk management tools like stop-loss orders when trading CFDs with leverage. This can protect against large losses by automatically closing positions when prices hit a pre-set level.

We Chose Platforms With A Great Investment Offering

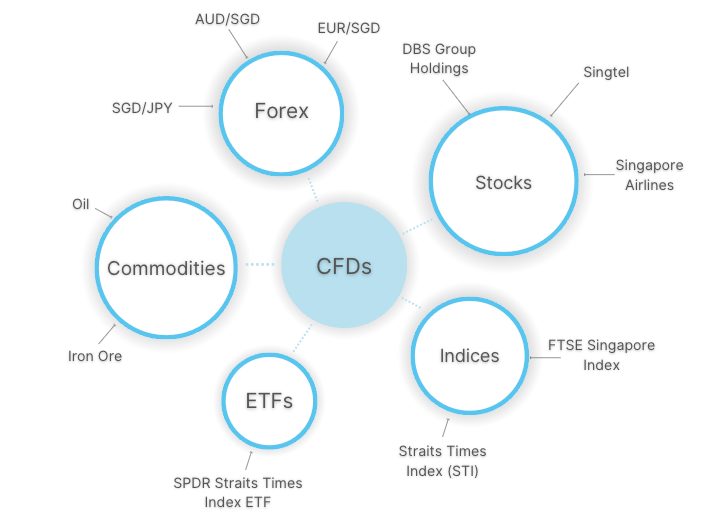

CFD traders of all levels will have access to diverse trading opportunities by picking a broker with a wide range of markets.

Therefore, we prioritized CFD trading platforms that provide access to the most popular asset classes, notably stocks, indices, forex, commodities and cryptos.

Some CFD trading platforms also excelled during our tests by offering key assets that will be of interest to traders in Singapore. IG, for instance, offers CFD trading on shares from the Singapore Exchange, the Straits Times Index (STI), and currency pairs with the SGD, including AUD/SGD, EUR/SGD and SGD/JPY.

Our experts have also been trading at IG for years with real money and consistently praise the excellent CFD trading conditions.

We Chose Platforms With Excellent Pricing

CFD trading is popular with short-term traders where frequent transaction costs can eat into profits. Consequently, choosing a brokerage with tight spreads and low/no commissions is critical.

As part of our personal tests and in-depth analysis, we also weigh fees with the quality of the platforms and tools, such as analyst insights into central bank decisions or economic reports that could impact shares listed on the Singapore Exchange.

Additionally, we factor in non-trading fees, such as conversion costs if depositing Singapore Dollars (SGD) to a live account denominated in another currency, such as the US Dollar (USD). This analysis allows us to identify the lowest-cost CFD brokers that provide a first-rate trading environment.

Our extensive real-money testing shows IC Markets leads the pack here, especially for serious day traders, featuring ultra-tight spreads from 0.0 pips, cash rebates, plus reliable order executions, ensuring you can secure optimal prices in fast-moving CFD markets.

We Chose Platforms With Superb Charting Tools

After years of evaluating hundreds of CFD providers in Singapore, we’ve learnt that a user-friendly and powerful charting platform is essential for an effective trading experience.

MetaTrader 4 and MetaTrader 5 remain the most widely available third-party platform despite an outdated interface we don’t enjoy using. Nonetheless, for experienced traders wanting sophisticated charting tools and algo trading, they’re a solid choice.

For newer CFD traders, the in-house platforms developed by brokers like Forex.com have come a long way, now sporting a genuinely intuitive interface with superior charting tools, including 80+ indicators, 50+ drawing tools and 14 timeframes.

We Chose Platforms With Convenient Account Funding In Singapore

We know from first-hand experience trading CFDs that picking a brokerage with secure and hassle-free payment methods can make for a smooth experience.

The most popular payment methods in Singapore are credit and debit cards, accounting for 53% of transactions according to Commission Factory, while alternative solutions like PayPal, Apple Pay and Google Pay are also widely used.

Every one of our top-rated CFD brokers in Singapore offers at least one of these methods, while Pepperstone excels by providing credit and debit cards, plus PayPal. It also offers no minimum deposit, making it a stand-out option for budget traders.

FAQ

Who Regulates CFD Trading Platforms And Brokers In Singapore?

The Monetary Authority of Singapore (MAS) regulates CFD trading platforms and online brokers operating in the country.

The MAS is a ‘Green-Tier’ regulator in line with our ‘Regulation & Trust’ rating methodology, meaning it offers the highest level of trader safeguards.

How Much Money Do I Need To Open A CFD Trading Account In Singapore?

Our analysis of 140 brokers shows that you normally need 0 to 250 USD, around 0 to 330 SGD, to start trading CFDs in Singapore.

That said, some CFD trading platforms have no minimum deposit, with Pepperstone achieving the highest rating following our exhaustive tests.

Recommended Reading

Article Sources

- Monetary Authority of Singapore (MAS)

- Inland Revenue Authority of Singapore (IRAS)

- Singapore Stock Exchange (SGX)

- Straits Times Index (STI)

- Financial Institutions Directory - MAS

- Singapore Airlines - Singapore Stock Exchange (SGX:SIA)

- Warning On Trading Scams - Singapore Police Force

- Most Popular Payment Methods In Singapore - Commission Factory

- A Look At The Rise And Continuing Influence Of CFD Trading In Singapore - California Business Journal

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com