Best Forex Brokers In Singapore 2026

Forex traders in Singapore should sign up with a broker that is authorized by the Monetary Authority of Singapore (MAS). Through a MAS-licensed forex broker, you’ll be able to trade in the world’s third-largest foreign exchange centre, with highly developed regulations protecting retail traders.

We’ve pinpointed the best forex brokers in Singapore after extensive testing. All of these platforms cater to forex traders in Singapore with authorization from the MAS and currency pairs containing the SGD, such as USD/SGD.

6 Top Forex Brokers In Singapore

These 5 forex brokers that accept clients from Singapore came out ahead of the rest after our exhaustive analysis and hands-on tests:

-

1

FOREX.com

FOREX.com -

2

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money. -

3

IG

IG -

4

Swissquote

Swissquote -

5

MultiBank FX

MultiBank FX -

6

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money.

This is why we think these brokers are the best in this category in 2026:

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- Plus500 - Plus500 provides forex trading through CFDs, featuring narrow spreads across an impressive selection of over 60 currency pairs. During testing, spreads came in as tight as 0.6 pips on the EUR/USD, which is notably lower than many alternatives. Plus500 offer a first deposit bonus, up to $10,000 AUD. Also get leverage up to 1:300.

- IG - IG offers an above-average suite of 80+ currency pairs on its proprietary web platform, mobile app or MetaTrader 4, with more advanced charts and forex analysis tools available on the ProRealTime software. Forex spreads are competitive based on tests, starting from 0.1 pips on majors like the EUR/USD.

- Swissquote - Swissquote offers compelling conditions for active forex traders, with an extensive range of 80+ currency pairs, plus ultra-fast execution speeds averaging 9ms and access to the industry’s favorite MT4 software.

- MultiBank FX - MultiBank FX offers trading on 50+ major, minor and exotic currency pairs. Spreads are tighter than many competitors and the broker offers higher leverage than most alternatives. Automated trading strategies are also permitted.

- CMC Markets - CMC presents an extensive array of 300+ forex pairs characterized by tight spreads and rapid executions, surpassing the offerings of many competitors in terms of currency diversity. Forex indices also present a fairly unique and holistic way to speculate on the value of key currencies like the USD, EUR and GBP.

Best Forex Brokers In Singapore 2026 Comparison

| Broker | MAS Regulated | SGD Account | Minimum Deposit | Forex Assets | EUR/USD Spread | Forex App Rating |

|---|---|---|---|---|---|---|

| FOREX.com | ✔ | - | $100 | 84 | 1.2 | / 5 |

| Plus500 | ✔ | - | $100 | 60+ | Dynamic | / 5 |

| IG | ✔ | ✔ | $0 | 80+ | 0.8 | / 5 |

| Swissquote | ✔ | ✔ | $1,000 | 80+ | 1.3 | - |

| MultiBank FX | ✔ | - | $50 | 45+ | 0.3 | - |

| CMC Markets | ✔ | ✔ | $0 | 300+ | 0.7 | / 5 |

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:400 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| GBPUSD Spread | Dynamic |

|---|---|

| EURUSD Spread | Dynamic |

| EURGBP Spread | Dynamic |

| Total Assets | 60+ |

| Leverage | Yes |

| Platforms | WebTrader, App |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- The customer support team continue to provide reliable 24/7 support via email, live chat and WhatsApp

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

- Plus500 has recently bolstered its suite of short-term trading products, including introducing VIX options with enhanced volatility and extended hours trading on 7 stock CFDs

Cons

- Plus500’s lack of support for MetaTrader or cTrader charting tools might be a deal breaker for advanced day traders looking for familiarity

- Algo trading and scalping are not supported, which may deter some day traders

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

IG

"IG continues to provide a comprehensive package with an intuitive web platform, best-in-class education for beginners, advanced charting tools bolstered by its recent TradingView integration, real-time data, and robust trade execution for experienced day traders."

Christian Harris, Reviewer

IG Quick Facts

| GBPUSD Spread | 0.9 |

|---|---|

| EURUSD Spread | 0.8 |

| EURGBP Spread | 0.9 |

| Total Assets | 80+ |

| Leverage | 1:30 (Retail), 1:250 (Pro) |

| Platforms | Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD |

Pros

- The IG app offers a superb mobile trading experience with a clean design that helped it secure Runner Up at our 'Best Trading App' award.

- IG offers an extensive collection of professional and engaging educational resources, including webinars, articles, and analysis.

- IG obtained a crypto asset license from the FCA, allowing it to re-enter the UK market to provide buying, selling and storing opportunities on 55+ digital tokens with fees from 1.49%, and all within an FCA-licensed environment.

Cons

- Beginners might find IG’s fee structure complex, with various fees for different types of trades or services, potentially leading to confusion or unexpected charges.

- While there is negative balance protection in the UK and EU, there is no account protection or guaranteed stop losses for US clients.

- Stock and CFD spreads still trail the cheapest brokers like CMC Markets based on tests.

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| GBPUSD Spread | 1.7 |

|---|---|

| EURUSD Spread | 1.3 |

| EURGBP Spread | 1.5 |

| Total Assets | 80+ |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote provides advanced research services like Autochartist for technical analysis and integration of real-time news from Dow Jones. Its proprietary Market Talk videos and Morning News reports deliver expert analysis daily, appealing to active traders.

Cons

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

MultiBank FX

"MultiBank FX is a great option for active forex traders with 55 currency pairs, spreads from 0.0 pips and high leverage up to 1:500."

Tobias Robinson, Reviewer

MultiBank FX Quick Facts

| GBPUSD Spread | 0.8 |

|---|---|

| EURUSD Spread | 0.3 |

| EURGBP Spread | 0.8 |

| Total Assets | 45+ |

| Leverage | 1:500 |

| Platforms | MultiBank-Plus, MT4, MT5, cTrader |

Pros

- MultiBank revamped its web and mobile platform in 2024, now offering a slick design that matches the website and a powerful TradingView charting package

- MultiBank has a global presence with 10+ regulatory licenses, including ASIC (Australia) and MAS (Singapore), boosting its trust score

- There's MAM, PAMM and FIX API access for high-volume or pro traders, plus EAs and VPS hosting for algorithmic trading, making it a solid broker for serious traders

Cons

- MultiBank charges a $60 monthly inactivity fee, which is significantly higher than the industry average from our broker tests

- The education and market research from MultiBank still needs work, trailing the best brokers in this category like IG and XTB

- The $5,000 minimum deposit required to access the tightest ECN spreads makes for a high entry barrier for many retail traders

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| GBPUSD Spread | 0.9 |

|---|---|

| EURUSD Spread | 0.7 |

| EURGBP Spread | 1.1 |

| Total Assets | 300+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | Web, MT4, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- The CMC web platform delivers a fantastic user experience with advanced charting tools for day trading and customizable features, catering to both beginners and experienced traders. MT4 (but not MT5) and TradingView (added in 2025) are also supported.

- We've bumped up its 'Assets & Markets' rating after almost monthly product additions in early 2025, from extended hours trading on US stocks to new share CFDs.

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

Cons

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

- An inactivity fee of $10 per month is applied after 12 months of inactivity, which may deter casual investors.

How We Rate Forex Brokers In Singapore

Trust & Regulation

The first thing we look for when reviewing a forex broker is proof that it’s a reliable brand. We urge anyone who is thinking of trusting their money with an online broker to do the same.

Forex traders in Singapore benefit from oversight by the Monetary Authority of Singapore (MAS), a ‘green-tier’ regulator that also serves as the country’s central bank.

The MAS requires that all forex brokers operating in Singapore obtain a Capital Markets Service license, and this brings several important protections for retail traders:

- Brokers must segregate client and business funds to obtain a license.

- Brokers must regularly submit detailed reports of their finances, trading statistics and complaints.

- Brokers must limit leverage to a maximum of 1:50 to cap potential losses.

- The MAS regularly audits platforms to ensure they’re keeping to regulatory requirements.

While leverage is limited in Singapore, unlike some regulators, notably the FCA and ASIC, the MAS does not mandate negative balance protection. That means you can lose more than is in your account.Fortunately, some forex brokers still provide this, so I recommend signing up with one of these to protect yourself from heavy losses.

We also suggest keeping abreast of the MAS’s Investor Alert List for scam forex brokers, who are more active than ever across the world.

One notable example saw US fraudster Michael Philip Atkins extradited to Singapore after defrauding around 1000 investors in an $18 million scheme that he ran through a scam forex investment company.

- There’s good reason IG has held its superb 4.9/5 Trust score from our experts for years: It’s an exceptionally transparent company with around 50 years in the business, a listing on the London Stock Exchange, and regulation from a host of top watchdogs including the MAS.

Currency Pairs

We recommend forex brokers with dozens of currency pairs because a broad range of currencies can mean more flexibility in terms of short-term trading strategies and more opportunity to profit.

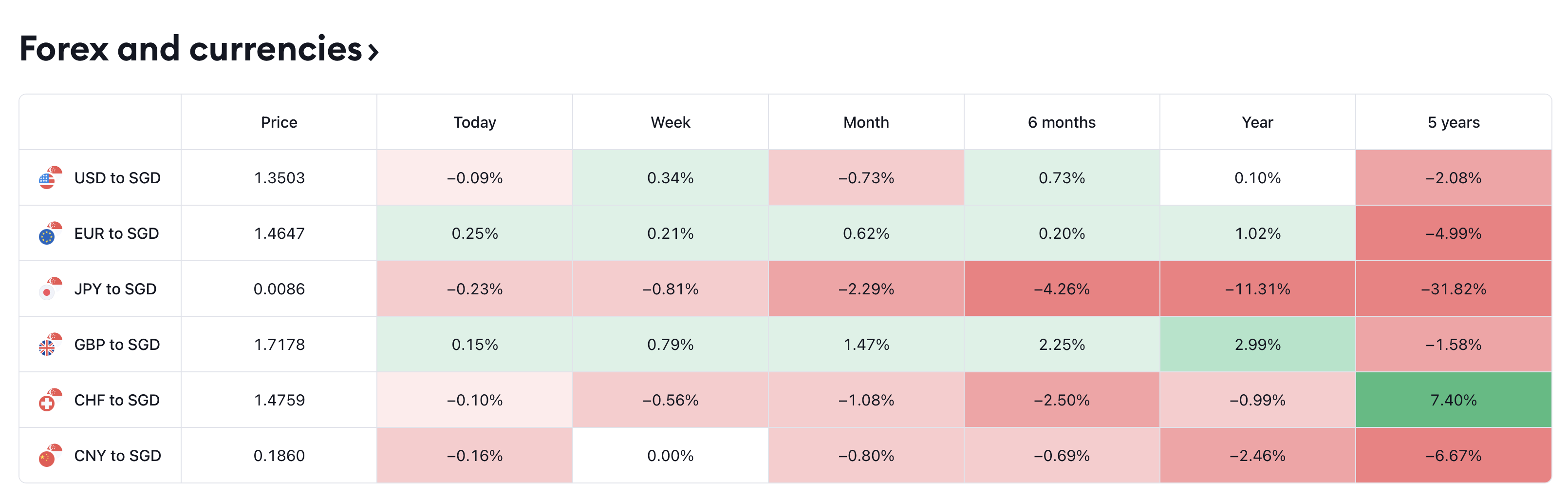

Traders in Singapore benefit from their currency, the Singapore dollar (SGD), being fairly popular and available in various currency pairs, such as the USD/SGD, EUR/SGD and NZD/SGD.

- Interactive Brokers continues to impress forex traders in Singapore as a MAS-regulated firm with a huge range of 100+ forex pairs, including an outstanding selection of six pairs featuring SGD.

Forex Platforms

Choose a trading platform that’s quick, responsive and feature-rich and it will give you a cutting edge when you hit the foreign exchange markets.

Experienced forex day traders have long preferred third-party platforms like MetaTrader 4 and cTrader because they pack a lot of charting and algorithmic trading power into an intuitive interface.

However, we have found that newer platforms like TradingView combine these advantages with slicker looks and cutting-edge integrated research tools.

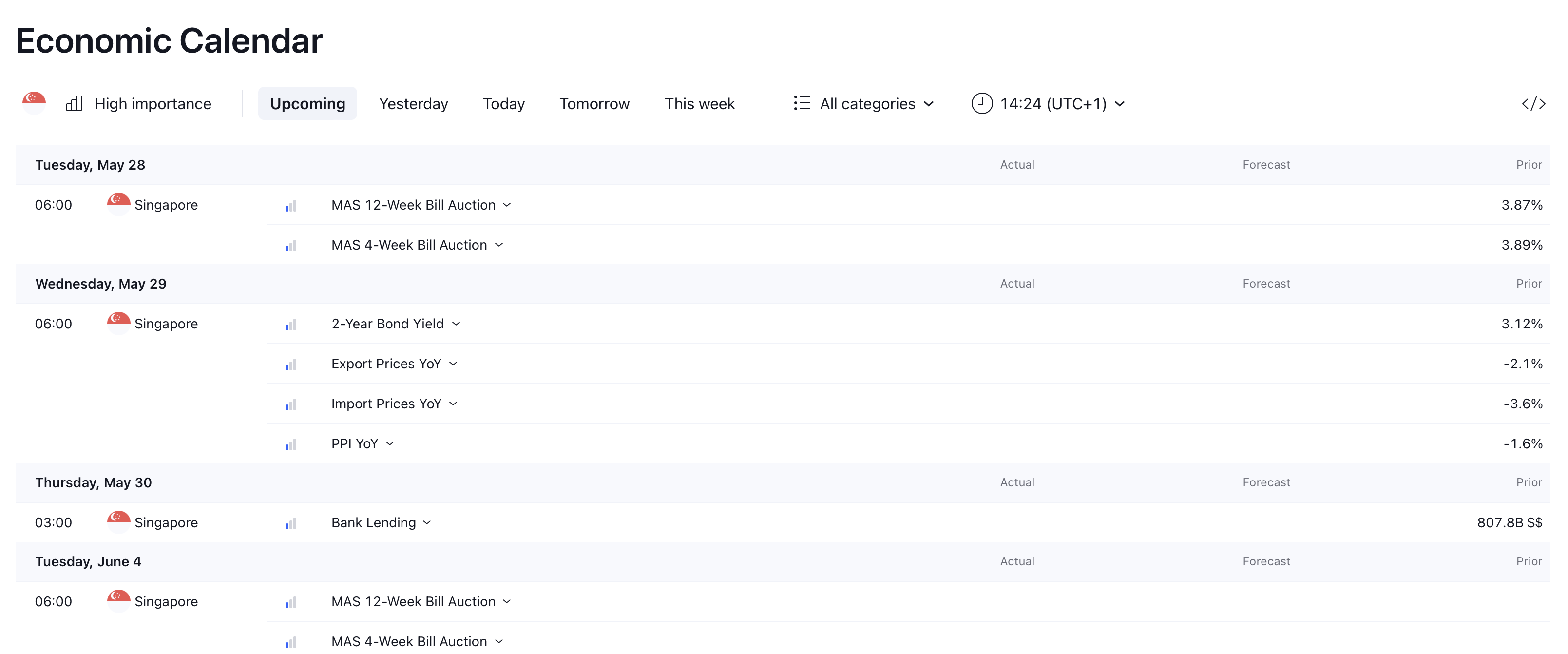

TradingView and several top brokers’ bespoke platforms also have a huge advantage for traders in Singapore as they provide sophisticated economic calendars and data feeds, making it easy to research new positions by checking MAS decisions and reports.

I’m a big fan of TradingView’s analysis features. With a couple of clicks, it lets me bring up a full feed of upcoming events or recent news from Singapore, and I can also easily compare the SGD to numerous currencies in a table or search for regional news.It’s the most convenient way I know of to quickly review a range of news and forex data.

- FOREX.com has maintained a stellar reputation among forex day traders by providing superb platform options – including MetaTrader 4 and 5, TradingView and a WebTrader platform – backed up by superb third-party tools like AutoChartist.

Trading Fees

Many day trading strategies like scalping operate on very slim margins, making it crucial to choose a forex broker that charges low fees.

The spread between bid and ask prices is often the most important fee to look at when you make frequent short-term trades.

However, securing the tightest spread generally involves paying a commission – usually no more on a round turn than $10 (13.5 SGD) per lot – though I’ve been impressed lately to find several budget brokers offering tight spreads with no commission.

- IC Markets remains our leading forex broker for trading fees, which start from 0 pips on its Raw account with competitive commissions of $3.50 (4.70 SGD), plus rebates of up to $2.50.

Account Funding

We look for forex brokers that provide inclusive account options with a good range of fast and affordable funding methods.

A low minimum deposit means you can start trading forex without forking out hundreds of SGD, and swap-free accounts allow Muslims (the third biggest religion in Singapore) to speculate on currency markets while adhering to Islamic law.

We’ve found that among the most convenient ways to fund your forex trading account is often an e-wallet like PayPal. Since these have fast become a leading payment method in Singapore, where e-wallets accounted for 22% of POS payments in 2023, you’ll have a choice of digital payment options to pick from at most top forex brokers.

- CMC Markets consistently impresses with its range of account options for traders in Singapore, who can sign up for SGD accounts with no minimum deposit. There is also a good range of payment options available, including PayPal as well as online banking and cards.

Methodology

To find the top forex trading platforms in Singapore, we shortlisted brokers accepting traders from Singapore and ranked them by their rating, taking into account various factors, such as:

rating, taking into account various factors, such as:

- Highly trusted with authorization from the MAS.

- A good range of currency pairs, such as USD/SGD.

- Powerful charting platforms with superior tools.

- Excellent trading environment at a competitive price.

- Convenient accounts to suit FX traders in Singapore.

FAQ

Is Forex Trading Legal In Singapore?

Forex trading is legal in Singapore, and the strong regulatory framework in the country makes it a good place to trade.

We also recommend speaking to an accountant and understanding your tax liabilities in Singapore if you profit from forex trading, as this may count toward your regular income in line with the Inland Revenue Authority.

Who Regulates Forex Trading In Singapore?

The Monetary Authority of Singapore, or MAS, is the country’s central bank and sole financial regulator.

This is a strong watchdog that we classify as a ‘green-tier regulator’, so you can consider Singapore a relatively safe place to trade currencies online.

How Much Money Do I Need To Start Trading In Singapore?

After years spent reviewing hundreds of forex brokers, we can say it’s unusual for a trading platform to require more than $250 (around 335 SGD) to sign up.

However, even this is on the high end, with many forex trading platforms requiring significantly lower minimum deposits and some requiring zero, notably IG and CMC Markets.

Recommended Reading

Article Sources

- Monetary Authority of Singapore (MAS)

- Investor Alert List (MAS)

- Inland Revenue Authority of Singapore (IRAS)

- Forex Trading Scheme - Channel News Asia

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com