Best Day Trading Platforms and Brokers in Singapore 2026

With one of the most stable economies underpinned by thriving manufacturing and financial services industries, Singapore offers diverse opportunities for short-term traders.

To trade currency pairs containing the Singapore dollar (SGD) like USD/SGD, stocks listed on the Singapore Exchange (SGX) or key export commodities like copper, you’ll need an online broker.

Following in-depth testing by our experts, we’ve pinpointed the best day trading platforms in Singapore. Every broker listed is authorized by the Monetary Authority of Singapore (MAS).

Top 6 Platforms For Day Trading In Singapore

Our assessments have uncovered the following 6 platforms as standout options for Singaporean day traders:

-

1

FOREX.com

FOREX.com -

2

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money. -

3

IG

IG -

4

Moomoo

Moomoo -

5

CMC Markets68% of retail CFD accounts lose money.

CMC Markets68% of retail CFD accounts lose money. -

6

MultiBank FX

MultiBank FX

Here is a short overview of each broker's pros and cons

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

- IG - Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- CMC Markets - Established in 1989, CMC Markets is a respected broker listed on the London Stock Exchange and authorized by several tier-one regulators, including the FCA, ASIC and CIRO. More than 1 million traders from around the world have signed up with the multi-award winning brokerage.

- MultiBank FX - MultiBank FX is an established broker offering forex and CFD products since 2005. With 20,000+ instruments, plenty of local payment methods and 24/7 multilingual customer support, the broker is a popular choice among traders globally. New clients can also access a variety of bonus offers and access the hugely popular MT4 and MT5 trading platforms.

Best Day Trading Platforms and Brokers in Singapore 2026 Comparison

| Broker | MAS Regulated | SGD Account | Minimum Deposit | Markets | Platforms |

|---|---|---|---|---|---|

| FOREX.com | ✔ | - | $100 | Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto | WebTrader, Mobile, MT4, MT5, TradingView |

| Plus500 | ✔ | - | $100 | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto | WebTrader, App |

| IG | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Moomoo | ✔ | ✔ | $0 | Stocks, Options, ETFs, ADRs, OTCs ,Futures | Desktop Platform, Mobile App |

| CMC Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | Web, MT4, TradingView |

| MultiBank FX | ✔ | - | $50 | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies | MultiBank-Plus, MT4, MT5, cTrader |

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Stock CFDs, Indices, Commodities, Futures, Options, Crypto |

| Regulator | NFA, CFTC, CIRO, FCA, CYSEC, ASIC, SFC, FSA, MAS, CIMA |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:400 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- Plus500 has recently bolstered its suite of short-term trading products, including introducing VIX options with enhanced volatility and extended hours trading on 7 stock CFDs

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

Cons

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

- Educational resources are limited compared to best-in-class brokers like eToro, impacting the learning curve for beginners

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

IG

"IG continues to provide a comprehensive package with an intuitive web platform, best-in-class education for beginners, advanced charting tools bolstered by its recent TradingView integration, real-time data, and robust trade execution for experienced day traders."

Christian Harris, Reviewer

IG Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting |

| Regulator | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB, AFM, JFSA |

| Platforms | Web, L2 Dealer, MT4, TradingView, AutoChartist, TradingCentral, ProRealTime |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:250 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, ZAR, SEK, DKK, CHF, HKD, SGD |

Pros

- The proprietary web-based platform continues to caters to traders of all levels, with advanced charting tools and real-time market data useful for day trading, while IG has also added TradingView integration.

- As a well-established broker, IG operates under strict regulatory guidelines in multiple jurisdictions, maintaining a high level of trust.

- IG obtained a crypto asset license from the FCA, allowing it to re-enter the UK market to provide buying, selling and storing opportunities on 55+ digital tokens with fees from 1.49%, and all within an FCA-licensed environment.

Cons

- IG has discontinued its swap-free account, reducing its appeal to Islamic traders.

- IG applies an inactivity fee of $12 per month after 2 years, deterring casual investors.

- While there is negative balance protection in the UK and EU, there is no account protection or guaranteed stop losses for US clients.

Moomoo

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, ADRs, OTCs ,Futures |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- The ‘Moomoo Token’ generates dynamic passwords for transaction security - a unique and helpful safety feature

- Moomoo's analytics and insights are impressive and detailed compared to other brands

- There are reduced options contract fees from $0.65 to $0

Cons

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

- There is no phone or live chat support - common options at most other brokers

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

CMC Markets

"With advanced charting tools and an extensive range of tradable CFDs, including an almost unrivalled selection of currencies and custom indices, CMC Markets provides a fantastic online platform for traders of all levels. "

Christian Harris, Reviewer

CMC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting |

| Regulator | FCA, ASIC, MAS, CIRO, BaFin, FMA, DFSA |

| Platforms | Web, MT4, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SEK, NOK, SGD, PLN |

Pros

- CMC offers excellent pricing, including tight spreads and low trading fees for all but stock CFDs. The Alpha and Price+ schemes also offer perks for active traders with up to 40% discounts on spreads.

- The brokerage continues to stand out with its wide range of value-add resources, including pattern recognition scanners, webinars, tutorials, news feeds, and research from respected sources like Morningstar.

- CMC Markets has added an AI News feature, using AI to surface and summarise market stories rather than place trades for you, hinting at where broker research tools are heading.

Cons

- While CMC offers an above-average suite of assets, there is no support for trading real stocks and UK clients can’t trade cryptocurrencies.

- Despite improvements, the web platform still requires enhancements to make it as intuitive to trade on as software from rivals like IG.

- The CMC Markets app offers the complete trading package but the design and user experience trails category leaders like eToro.

MultiBank FX

"MultiBank FX is a great option for active forex traders with 55 currency pairs, spreads from 0.0 pips and high leverage up to 1:500."

Tobias Robinson, Reviewer

MultiBank FX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies |

| Regulator | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC |

| Platforms | MultiBank-Plus, MT4, MT5, cTrader |

| Minimum Deposit | $50 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 |

Pros

- MultiBank has a global presence with 10+ regulatory licenses, including ASIC (Australia) and MAS (Singapore), boosting its trust score

- There's MAM, PAMM and FIX API access for high-volume or pro traders, plus EAs and VPS hosting for algorithmic trading, making it a solid broker for serious traders

- MultiBank revamped its web and mobile platform in 2024, now offering a slick design that matches the website and a powerful TradingView charting package

Cons

- The $5,000 minimum deposit required to access the tightest ECN spreads makes for a high entry barrier for many retail traders

- MultiBank charges a $60 monthly inactivity fee, which is significantly higher than the industry average from our broker tests

- The education and market research from MultiBank still needs work, trailing the best brokers in this category like IG and XTB

Methodology

To identify the best day trading platforms in Singapore, we analyzed our library of 139 online brokers, removed all those that don’t accept Singaporean traders, and sorted them by their overall score.

Our ratings combine 100+ data points with findings from our hands-on evaluations.

- We selected brokers that accept Singaporean day traders.

- We recommended trusted brokers authorized by the MAS.

- We prioritized brokers with competitive day trading fees.

- We favored brokers with a wide range of financial markets.

- We focused on brokers with reliable charting platforms.

- We preferred brokers with transparent leverage.

- We investigated each broker’s execution quality.

- We checked that brokers offer convenient account funding.

How To Choose A Day Trading Broker In Singapore

There are several categories to consider when choosing a day trading broker:

Regulation & Trust

Choose a trustworthy broker with licensing from a reputable authority.

This will help to protect you from misconduct and trading scams, which have become frequent in Singapore. One notable example that hit the headlines was the notorious Ponzi-style scheme reported by the Straits Times where American national, Michael Philip Atkins, used his Singapore-based firm, Aureus Capital, to defraud his victims of over $18 million.

The Monetary Authority of Singapore (MAS) is a highly respected ‘green tier’ authority in line with our Regulation & Trust Rating and enforces strict transparency rules and safeguards for traders. The MAS also acts as the central bank of Singapore, further highlighting its pivotal role in the nation’s financial system.

Importantly, the MAS has the power to issue penalties, prosecute individuals and revoke licenses from day trading platforms that do not adhere to its rules. The website offers a useful Warning List of all enforcement actions against individuals and companies.

- IG stands out as a highly trusted option for Singaporean traders, with multiple ‘green tier’ licenses, including from the MAS, plus a long history spanning an impressive 50 years. The firm is also publicly listed on the London Stock Exchange, underscoring its credibility.

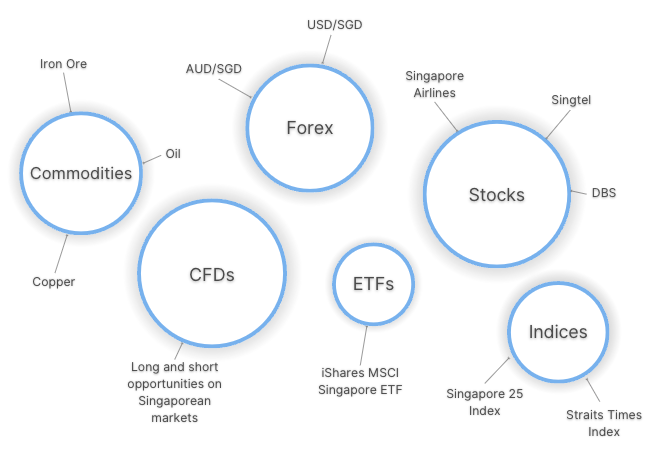

Financial Markets

Choose a broker with the financial markets you’re interested in.

This will allow you to diversify your portfolio and gain confidence using short-term trading vehicles, with one of the most popular being contracts for difference (CFDs) in Singapore.

Singaporean day traders may be looking for local markets, such as currency pairs containing the Singapore dollar (SGD) like USD/SGD or AUD/SGD, as well as stocks listed on the Singapore Exchange (SGX) like DBS and Singtel.

With its manufacturing industry accounting for 20-25% of the country’s annual GDP, you may also be interested in trading the country’s chief import and export commodities like oil, iron and copper.

- Pepperstone remains a top choice for Singaporean traders, with a wide range of local markets including eight SGD currency pairs, the Singapore 25 Index, and the iShares MSCI Singapore ETF (among 1300+ other global assets). You can also leverage the powerful Autochartist pattern recognition tool to uncover trading ideas on any of these assets.

Day Trading Fees

Secure a broker with competitive fees to help protect your profits.

We routinely evaluate spreads and commissions on popular markets, as well as common non-trading costs for active traders, such as deposit or withdrawal fees.

To get a full picture of the broker’s service, we also consider any additional tools and resources available. For example, the best brokers may offer access to Singapore stock market research, or live interest rate updates from the country’s central bank.

- IC Markets continues to deliver market-leading pricing, including spreads averaging 0.85 on USD/SGD and 0.027 on oil. You also get free access to award-winning analysis tools, including Trading Central, where you can get curated insights and chart patterns on SGD currency pairs, commodities and more.

Charting Platforms

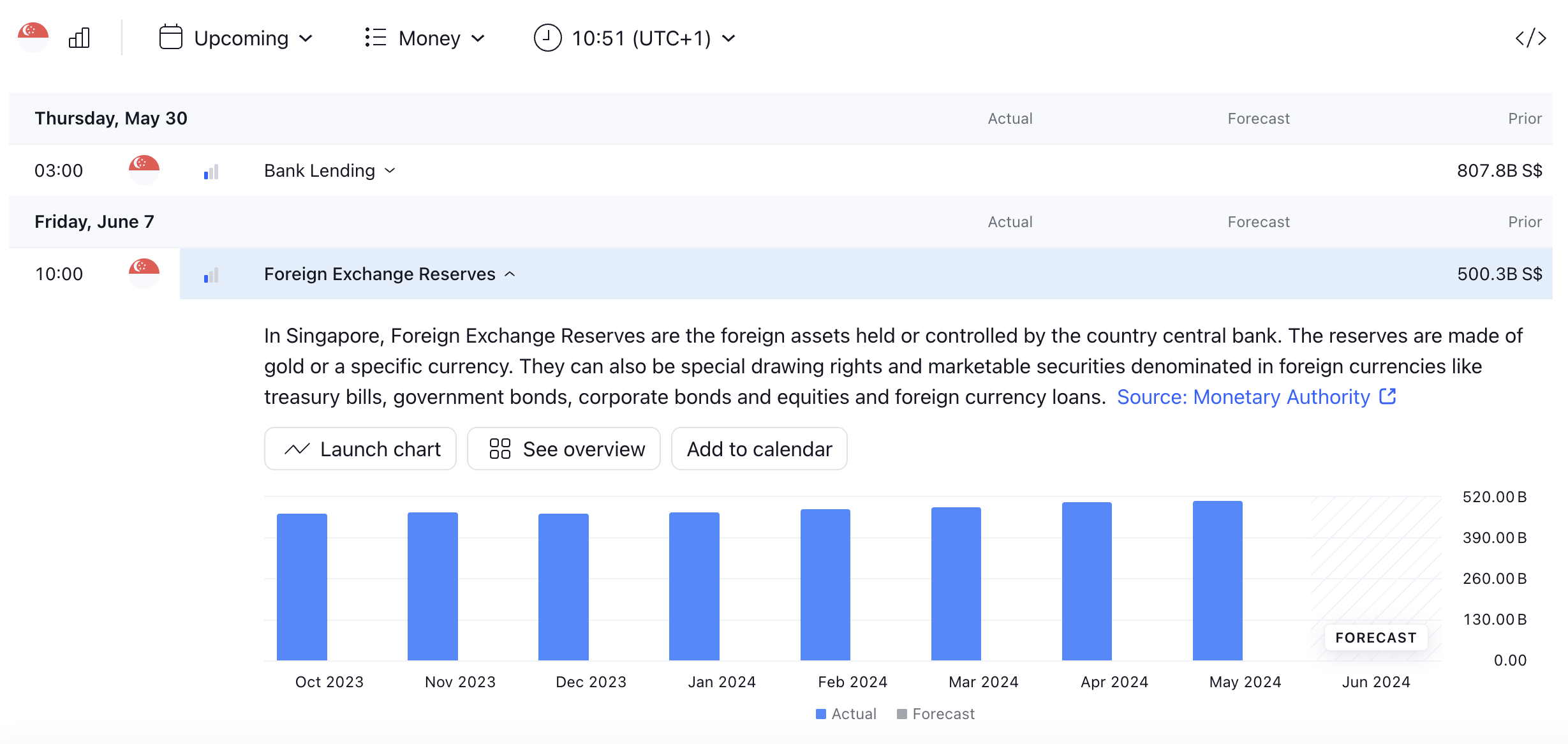

Consider a broker with a range of powerful charting platforms for technical analysis.

This will ensure you can execute short-term strategies in a reliable environment. Most brokers offer MetaTrader 4 and MetaTrader 5, though I personally prefer the sleeker workspace provided by TradingView.

I love using TradingView’s intuitive economic calendar where you can filter events by country and category.For example, you can see in the image below that I can filter by ‘Singapore’ and ‘Money’ to view a central bank release for foreign exchange reserves – a very useful insight if you want to trade gold.

Some brokers also provide their own proprietary solutions which often deliver a scaled-back package of tools, making them ideal for beginners.

- AvaTrade excels when it comes to charting tools, with superior third-party terminals including MT4 and MT5, plus an award-winning proprietary app. There’s also a range of additional features to suit different needs, including auto trading via DupliTrade.

Leverage & Margin

Select a broker with transparent leverage and margin requirements.

Day traders often use leverage to gain exposure to larger trades, essentially allowing you to magnify potential profits while only depositing a small margin.

Let’s say I want to speculate on the USD/SGD pair after an interest rate update from the MAS, using leverage of 1:30.

If my initial margin is 250 SGD, my trade could actually be worth 7,500 SGD (30 x 250 SGD).

However, leverage can also significantly increase the size of losses, so ensure you have a solid strategy for risk management.

- Deriv offers clear leverage requirements, with very high rates up to 1:1000. That said, beginners may be better suited to the broker’s multipliers which are available up to x30 and prevent you from losing more than your initial deposit if the market moves against you.

Execution Quality

Opt for a broker with reliable order execution.

The quality of a broker’s execution can have a significant impact on fast-paced trading strategies.

Execution quality is the measure of how quickly and efficiently trades are filled. Our routine tests involve checking execution data where available, including latency (the time delay) and slippage (the difference in requested and filled price).

- City Index offers impressive average execution speeds of 20 milliseconds, with 99.83% of trades being executed in less than 1 second. It’s also got some of the best analysis resources we’ve seen, including trade ideas on major central bank meetings, including the MAS.

Minimum Deposit

Choose a broker with a minimum deposit that suits your budget.

You will likely need up to 250 USD (approximately 335 SGD) to open a live account, though many of our recommended platforms offer much less.

Many day trading brokers also offer locally supported methods, including e-wallets like Apple Pay and Google Pay, which are increasing in popularity in Singapore. These can help to reduce transaction costs and processing times for Singaporean traders.

- XM lets you start with only $5, making it a top pick for novices or those on a tighter budget. You can also open accounts based in SGD, with convenient and fee-free payment methods including bank cards, Apple Pay and Google Pay.

FAQ

Who Regulates Day Trading Platforms In Singapore?

The Monetary Authority of Singapore (MAS) regulates day trading platforms and online brokers in Singapore.

Traders can also register with other overseas firms, however, we recommend opting for a tightly regulated broker and ensuring that you still adhere to MAS regulations and Singapore’s tax requirements from the Inland Revenue Authority of Singapore (IRAS).

Which Is The Best Broker That Accepts Day Traders In Singapore?

See our list of the best day trading platforms in Singapore to find one that works for you.

For example, Pepperstone is a top pick if you’re looking for local markets, including Singapore indices and ETFs. It also offers some of the best third-party platforms and tools that I’ve seen. Alternatively, XM is a great choice for convenient funding, with SGD-based accounts.

Recommended Reading

Article Sources

- Singapore Economy - GuideMeSingapore

- Singapore Exchange (SGX)

- Monetary Authority of Singapore (MAS)

- Singapore Forex Trading Scam - The Straits Times

- Financial Institutions Directory - MAS

- DBS - SGX

- Singtel - SGX

- Hoe Leong - SGX

- Popular Payment Methods in Singapore - Adyen

- Inland Revenue Authority of Singapore (IRAS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com