Copy Trading Crypto

From understanding how it works to selecting the best platforms, this guide demystifies the process of copy trading crypto, empowering both novice and experienced traders to replicate the strategies of successful traders in the digital currency space.

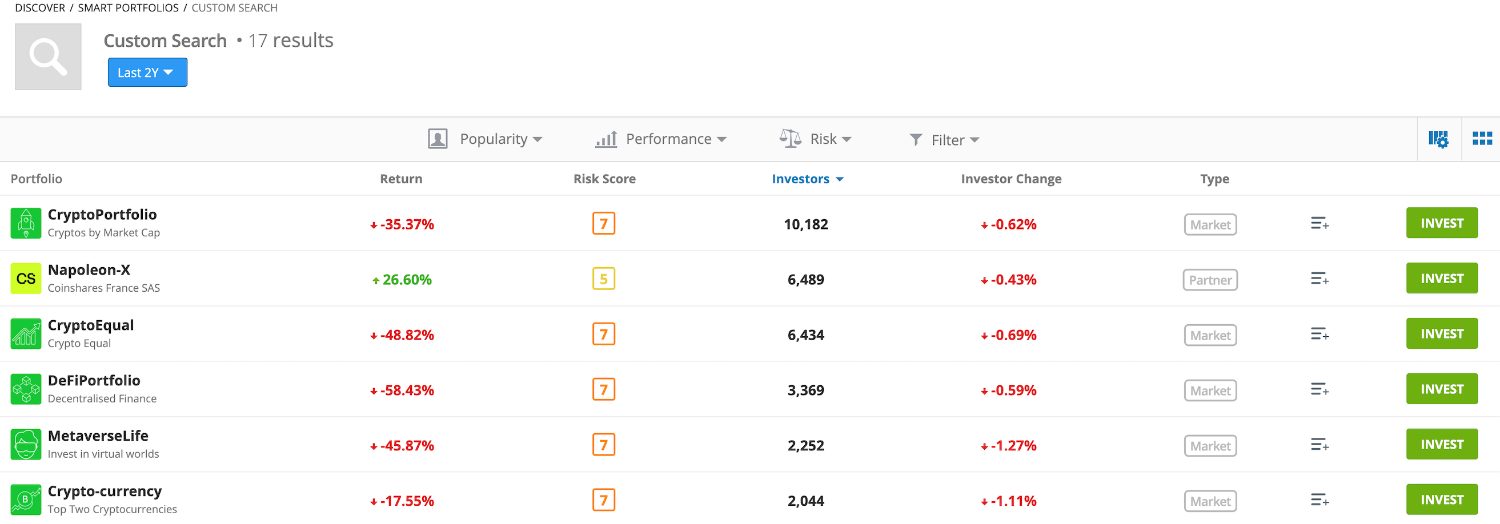

Best Crypto Copy Trading Platforms

These are the highest-rated platforms that offer copy trading on cryptocurrencies based on our reviews:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

xChief

xChief -

3

InstaTrade

InstaTrade -

4

Optimus Futures

Optimus Futures -

5

Pionex

Pionex -

6

XM

XM

This is why we think these brokers are the best in this category in 2026:

- eToro USA - You can mirror the positions and strategies of up to 100 other traders with the market-leading eToro US copy trading service. Unlike many competitors, eToro gives you more control over your portfolio, allowing you to stop or pause a copied trade at any time. Pricing is also fairly competitive, with only $1 required to copy a position. eToro copy trading is for crypto only.

- xChief - Clients can follow copy trading signals on the MetaTrader platform. Alternatively, signal providers can generate extra income by selling their positions. You can start copy trading in a few easy steps.

- InstaTrade - InstaTrade offers hands-off trading through its Fixed Income Structured Product, where clients automatically replicate the positions of active traders. What’s distinctive is InstaTrade’s offer to ensure clients make a 50% return by compensating any shortfall if other users are referred.

- Optimus Futures - Copy trading services are available across some of the broker's extensive range of platforms.

- Pionex - Pionex clients can find other successful investors and copy their trading bot setups. This allows users to buy and sell cryptos 24/7 from a user-friendly platform and app.

- XM - XM offers copy trading through its intuitive app with exclusive crypto pairs. XM global offers a pre-integrated signals service via the MT5 platform. Aspiring investors can view detailed performance metrics and copy the trades of strategy managers. It's easy to set up, only requiring a handful of steps after logging in to your MQL5 community account.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

Cons

- The broker trails competitors when it comes to research tools and educational resources

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

Cons

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

Pionex

"Pionex is an excellent option for crypto traders with an interest in cutting-edge AI like ChatGPT and automated trading."

William Berg, Reviewer

Pionex Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | FinCEN |

| Platforms | Own |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 USDT |

Pros

- Low trading fees compared with other major exchanges at 0.05% maker and taker

- 40+ cryptocurrency funding coins accepted

- 12 free integrated trading bots with no coding or programming requirements

Cons

- Limited contact options

- Withdrawal fees and limits may apply

- Weak regulatory oversight raises safety concerns

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

How To Choose The Best Crypto Copy Trading Platforms

Choosing the best crypto copy trading service requires careful consideration of various factors to ensure a reliable and effective experience:

- Research & Due Diligence: Consider the platform’s reputation, user reviews, and historical performance. Verify the legitimacy of the service, checking for licenses and compliance with regulations. eToro stands out as a multi-regulated and widely embraced social trading platform. I’ve personally used eToro’s copy trading service for years and can vouch for its legitimacy.

- User Interface & Experience: Assess the overall trading experience of the platform. A user-friendly interface can make it easier for you to navigate, monitor your trades, and make informed decisions. Bybit provides a distinctive copy trading feature, allowing you to participate as either a trader to be copied or an investor seeking to replicate the strategies of others. This platform creates a fun social trading atmosphere.

- Fees & Costs: Understand the fee structure of the crypto copy trading service. Different platforms may charge subscription fees, performance fees, or spreads. Evaluate how these fees may impact your overall returns and choose a platform that aligns with your goals. Vantage keeps things simple for copy traders, appealing to beginners especially by charging no additional fees beyond the crypto spread.

- Traders’ Track Record: Evaluate the track records of the signal providers available. Examine their historical performance, risk management strategies, and consistency. Diversify your investments by selecting crypto traders with proven success in different market conditions. eToro excels here, providing you with diverse filters to locate crypto traders, complete with detailed performance information.

- Risk Management: Assess the risk management features offered by the platform. Look for tools that allow you to set stop-loss limits, allocate capital easily, and manage the overall risk exposure of your crypto copy trading portfolio. These are all features available at Pepperstone.

- Customer Support: Consider the quality of customer support provided by the platform. Quick and responsive support can be crucial in addressing any issues or concerns you may have during your crypto copy trading journey. AvaTrade is a great option if you want reliable support that is available 24/5 with fast response times based on our tests.

- Community & Social Features: Some platforms offer social features that allow you to interact and share insights, which can be a great tool for beginners in particular. eToro stands out here as one of the largest social investment networks with millions of users globally, providing helpful insights into crypto market trends.

How To Avoid Dodgy Crypto Copy Trading Platforms

There are many legitimate and trustworthy brokers in the cryptocurrency market, but due to the decentralized and relatively new nature of the industry, there have been instances of scams.

Regulators now group copy trading, mirror trading and social trading under the umbrella of online imitative trading practices, highlighting both the potential benefits and the specific risks for retail investors in a 2025 report from the International Organization of Securities Commissions (IOSCO).

European regulators, led by the European Securities and Markets Authority (ESMA), have issued supervisory briefings on firms offering copy trading services, stressing transparent risk disclosures, robust suitability checks, and clear information about the traders being copied.

Always prioritize security and due diligence and watch out for these warning signs that we’ve collated following our own experiences in this space:

- Unclear Fee Structure: Be wary of platforms with unclear or exorbitant fee structures. Legitimate crypto copy trading services are transparent about their fees, including subscription fees, performance fees, and any other costs associated with using their platform.

- Guaranteed Profits: Be cautious of crypto platforms that promise guaranteed profits. Trading, including copy trading, always involves risks, and there are no guarantees of consistent or high returns.

- Poorly Designed Platform: A poorly designed or unprofessional-looking platform may suggest a lack of commitment to providing a reliable service. Legitimate crypto copy trading platforms invest in user-friendly interfaces and robust security measures.

- Limited Information on Traders: If a platform provides limited information about the crypto traders available for copy trading, it raises concerns. Reliable platforms offer detailed profiles of their crypto copy traders, including their trading strategies, risk management practices, and historical performance.

- Absence of Customer Support: Lack of responsive and accessible customer support is a warning sign. Legitimate platforms prioritize customer service to address user inquiries and concerns promptly.

- Unsolicited Contact: Be cautious of unsolicited contact, especially if it involves aggressive marketing tactics. Credible platforms do not typically resort to unsolicited messages or pressure tactics to attract users.

How To Copy Trade Crypto

Copy trading cryptocurrency involves automatically replicating the strategies of experienced traders, allowing you to mirror their trades and potentially profit from their expertise in this volatile market.

Here’s how you can get started with this hands-off trading strategy in five steps:

- Open a trading account

- Select a crypto trader to copy

- Allocate your investment capital

- Start copy trading crypto

- Monitor your portfolio

Open A Trading Account

Begin by selecting a reputable crypto copy trading broker following our guidance above.

Opening an account typically involves a straightforward registration process, where you’ll provide some personal details and, often, verify your identity.

You’ll also need to fund your account. Options for depositing funds often include bank transfers, credit cards, e-wallets like PayPal, and sometimes even direct cryptocurrency deposits.

The initial deposit requirement can vary significantly, from as low as $10 to several hundred dollars, depending on the platform you choose.

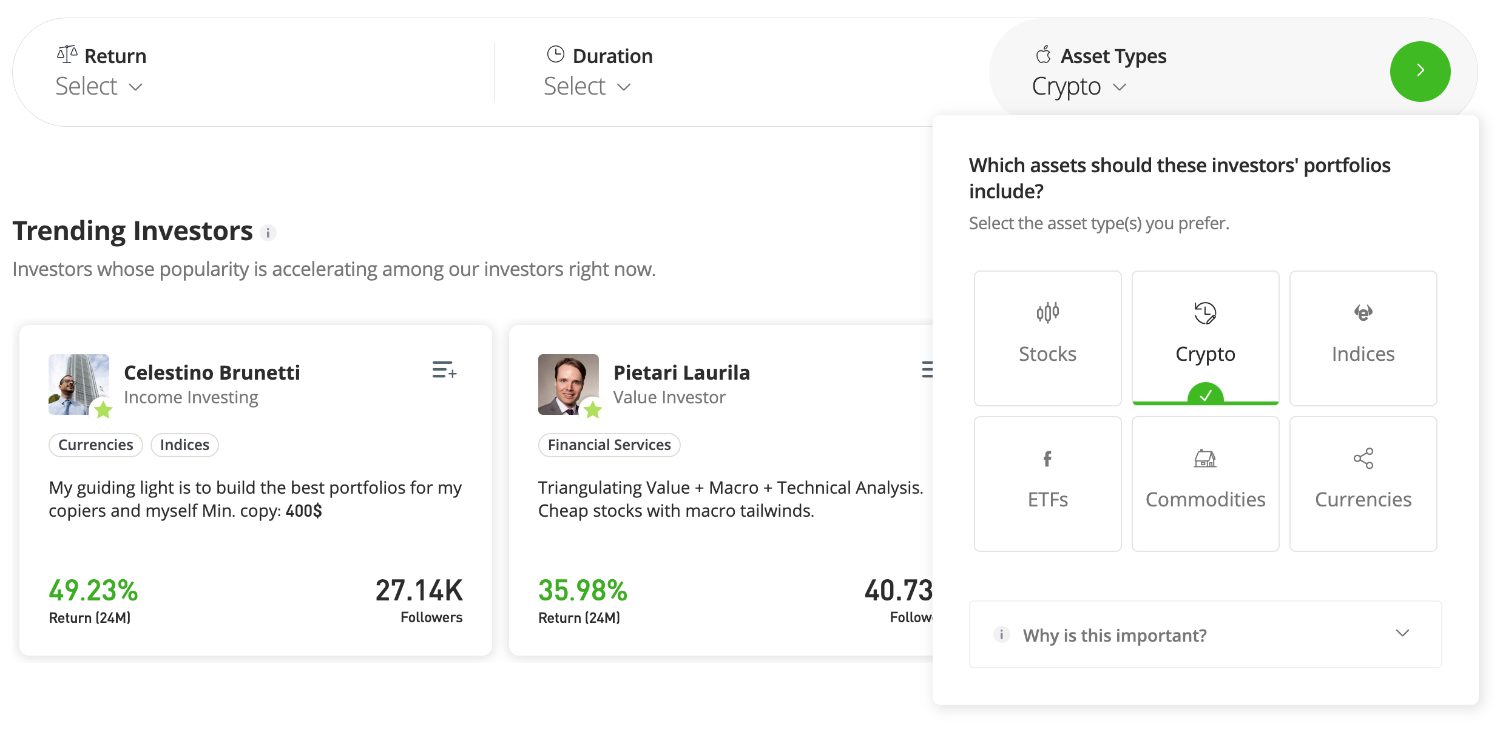

Select A Crypto Trader To Copy

Identify experienced crypto traders whose strategies align with your investment goals and risk tolerance.

Platforms usually offer detailed profiles of each trader, including their performance history, risk level, and the cryptocurrencies they trade.

eToro, for instance, clearly displays helpful metrics like returns over extended periods, the number of followers, and assigns a useful risk score.

Allocate Your Investment Capital

Deciding how much of your capital to allocate to each trader is crucial. Rather than putting all your funds behind one trader, it’s advisable to distribute your capital among several, assigning a percentage of your portfolio to each based on their risk profile and performance.

For instance, you might allocate a larger portion to a trader with a consistent track record in Bitcoin and Ethereum, while dedicating a smaller fraction to someone with a riskier approach, potentially involving newer, more volatile tokens.

Start Copy Trading Crypto

With your chosen traders and allocations set, the platform automatically executes trades on your behalf based on the activity of the crypto traders you’re copying.

There’s no need for further action from you to execute trades, as the system handles this process.

Monitor Your Portfolio

It’s sensible to monitor the performance of your crypto copy trading activities. This includes reviewing the success of the traders you are copying and staying informed on broader market trends, especially given the volatile nature of cryptocurrencies.

Should a trader’s strategy no longer align with your objectives, or if they start underperforming, consider reallocating your funds to other crypto traders. Conversely, if a trader consistently outperforms, you might want to increase your investment with them.

Bottom Line

Successfully copy trading in the crypto market requires a blend of careful research, risk management, and a discerning choice of platforms and traders.

With these elements in place, you can navigate the complexities of the crypto landscape and potentially leverage the expertise of successful traders to optimize your trading strategies.

Just make sure you understand the legal and regulatory landscape in your country before adding funds to a platform.

FAQ

Is Copy Trading Crypto Legal?

The legality of copy trading in the crypto space varies by jurisdiction, so you should familiarize yourself with the regulations in your respective country.

While copy trading itself is generally legal, the platforms facilitating such services may need to adhere to specific financial regulations.

Does Copy Trading Crypto Work?

Copy trading in the crypto market can be effective if you are seeking exposure to the strategies of successful traders without actively managing your portfolios.

However, success depends on various factors, including the skill and performance of the chosen traders, market conditions, and the reliability of the copy trading platform.

Can You Lose All Your Money Copy Trading Crypto?

Yes, there is a risk of losing all your money when engaging in copy trading in the crypto market. The value of cryptocurrencies can be highly volatile, and market conditions can change rapidly. If the traders you are copying incur significant losses, those losses will be reflected in your own investment.

Make sure you carefully consider your risk tolerance, diversify your investments, and thoroughly research the traders and platforms you choose for copy trading to minimize the potential for significant losses.