CFD Trading in South Korea

Contract for difference (CFD) trading in South Korea has gained popularity due to its flexibility, leverage, and ability to long or short. It appeals to those seeking opportunities in volatile assets like Korean securities.

However, South Korean regulators restricted CFDs for four months in 2023 following a loophole exploited by stock manipulators that led to losses of $77M. It has since resumed under strict rules.

Interested in CFD trading in South Korea? This guide for beginners covers the essentials.

Quick Introduction

- With CFDs, you don’t own the asset. Instead, you enter into a contract to exchange the difference in the asset’s price from when you open and close the position.

- If you think the price of an asset like USD/KRW will rise, you buy a CFD (go long) and profit from the upward movement. If you predict the price to fall, you sell a CFD (go short).

- Trading CFDs on Seoul stock markets, led by the Korea Exchange (KRX), plays a large role in the global economy. The KOSPI market features blue-chip companies like Samsung.

- CFD trading is supervised by the Financial Supervisory Service (FSS) and Financial Services Commission (FSC), with strict warnings and leverage limits to reduce excessive risk.

- Due to the risks associated with leverage, risk management tools like stop-loss orders are essential with CFDs. You can set predefined exit points to limit potential losses.

Best CFD Brokers in South Korea

Based on our experts' latest tests, these 4 platforms are the top options for CFD traders in South Korea:

How CFD Trading Works

CFDs provide an accessible way to speculate on the price movements of a wide range of assets, whether it’s Korean stocks, foreign currencies like the US dollar, or high-risk cryptocurrencies. You’re essentially betting on whether the value of an asset will rise or fall, without actually owning it.

One of the key draws is leverage. This allows you to control larger positions with a relatively small deposit, known as margin. Leverage magnifies both potential profits and risks, making it a double-edged sword.

Imagine you expect the KOSPI 200, the benchmark South Korean stock index, to rise. Let’s assume the price of one CFD contract on the KOSPI 200 is set at ₩1,200,000, and your broker requires a margin of 5%.

If you decide to trade 5 contracts, your required margin would be ₩3,000,000 (₩1,200,000 x 5 contracts x 5%).

Now, if the KOSPI 200 increases to ₩1,260,000, your profit would be ₩60,000 per contract. For 5 contracts, this totals ₩300,000 (₩60,000 x 5 contracts), minus any brokerage fees.

However, if the index drops to ₩1,140,000, your loss would be ₩60,000 per contract, leading to a total loss of ₩300,000 across all 5 contracts, highlighting the inherent risks.

There are several costs associated with CFD trading:

- Spread: The difference between the buy (ask) and sell (bid) prices.

- Commission: Some firms charge a commission on CFD trades, particularly for assets like stocks.

- Overnight Financing: If you hold a position overnight, you may be charged a financing fee, as you’re borrowing money to maintain the leveraged position. You can avoid this by day trading in South Korea.

For Korean traders who are new to CFDs, I recommend starting with a demo account. It provides a risk-free environment where you can learn how this instrument works.

Is CFD Trading Legal In South Korea?

CFD trading is legal in South Korea and regulated by the Financial Supervisory Service (FSS) and Financial Services Commission (FSC).

In 2023, the South Korean authorities suspended some forms of CFD trading for four months after a stock price manipulation scandal. Manipulators exploited vulnerabilities in the CFD market, causing eight South Korean companies to hit their daily lower limit for nearly a week and leading to losses of approximately $77 million.

Due to the risks, Korean agencies have implemented strict measures to protect investors, especially retail traders:

- Regulators limit the leverage available to retail traders to mitigate excessive risk, often 1:5 or 1:10. The leverage available to retail traders is usually lower compared to institutional traders.

- Only licensed brokers are authorized to offer CFDs in South Korea, ensuring they comply with local laws and maintain the appropriate financial standards.

- Brokers must disclose the risks associated with CFD trading, particularly the potential for significant losses due to leverage.

Is CFD Trading Taxed In South Korea?

CFD trading is taxed in South Korea. The taxation on CFDs falls under capital gains tax, which applies to profits from trading financial instruments.

The capital gains tax rate for CFDs varies depending on the asset class and the trader’s resident status. South Korea has announced plans to introduce a 20% capital gains tax for profits exceeding 50 million KRW ($38,000) from financial investments, including CFDs and stocks.

Traders must report their CFD trading income to the National Tax Service (NTS) as part of their annual tax filings.

Non-resident traders may also be subject to taxation on profits earned from South Korean assets, but the tax rate may vary depending on tax treaties between South Korea and their home country.

An Example Trade

To show you how CFD trading can really work in South Korea, let’s go through a detailed trade…

Background

Seoul’s stock markets, led by the KOSPI and KOSDAQ, have a diverse array of listed companies ranging from technology giants like Samsung Electronics to smaller growth companies on KOSDAQ.

In this example trade, I’m looking at Hyundai Motor Group, one of the world’s biggest car manufacturers. The stock’s daily market volume and continually high levels of liquidity make it an appealing day trading opportunity.

I’ll always separate my analysis into two distinct areas: fundamental and technical. The fundamental analysis skills required to trade stocks differ from those needed to analyze forex.

Unlike FX trading, I’m not looking for macro events or individual governments or central banks to make decisions or alter policy. Instead, I look for metrics and data concerning a particular company. Hyundai’s financials were impressive;

- The latest revenue was up 6.6% annually

- Net income was up 22.71%

- Earnings per share were up 22.27%

I also look for news about the stock, whether positive or negative. Hyundai’s partnership with GM indicated the company’s vision and commitment to clean energy vehicles. The firm’s ambition for electric cars was evident in its double-digit market share in the USA.

I believed the stock is undervalued, and then I’ll conduct my forensic technical analysis and research to confirm this belief.

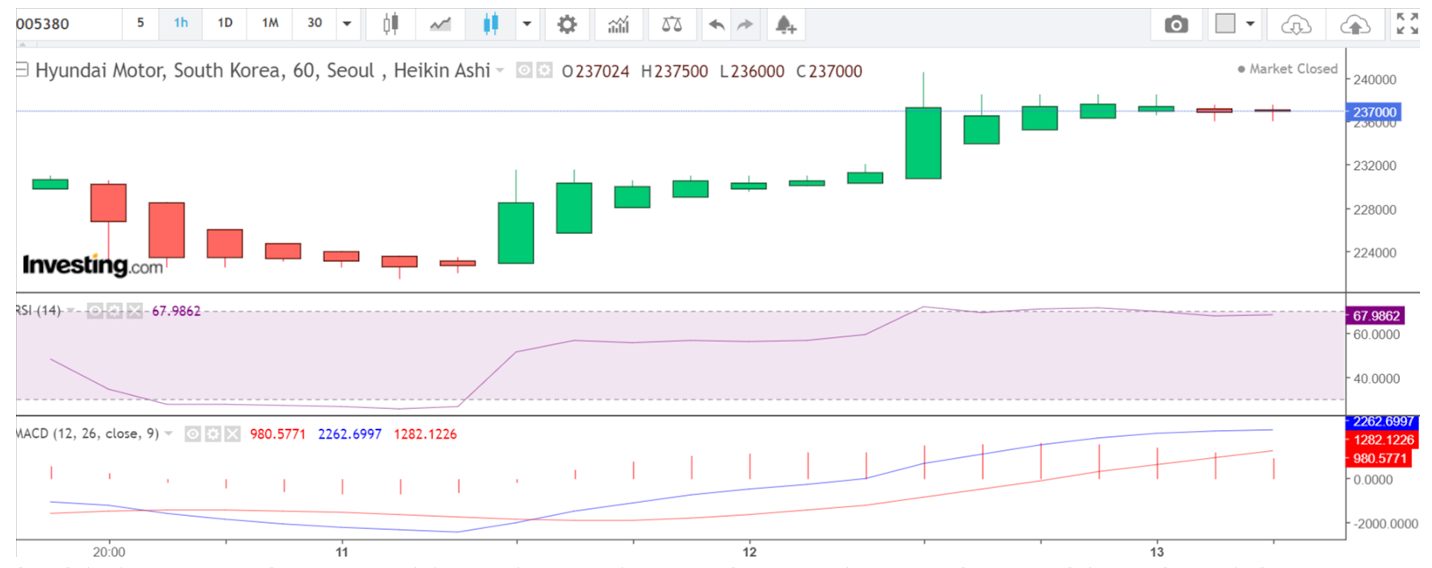

I’ll analyze two timeframes on my charts: the 1-hour (1HR) and the daily (D1) timeframe. Combining the two is ideal for identifying daily trends and trading opportunities. You can quickly observe price action on the 1HR and then search for reasons to support your decision (to go long or short) on the daily timeframe.

1HR Timeframe

In this instance, I saw positive price action as the sentiment changed from bearish to bullish. The Heikin Ashi bars (HA), my preferred method to smooth out price noise, began to make higher highs, and the closed bars suggested momentum.

The relative strength index (RSI) indicated increased volatility, and the reading below 30 meant the stock was oversold during the bearish trend. The MACD moving averages crossed, suggesting the trend direction had stopped and reversed.

Daily Timeframe

Turning our attention to the daily time frame, I’m looking for my theories regarding the technical analysis of the 1HR to be backed up.

We can see that the HA Doji formed, indicating market indecision and a potential trend reversal. The MACD moving averages began to converge, and the RSI printed a reading below 40, which was a strong indication that the stock was oversold.

However, when the trend changed the reading was short of the median 50 level, which means the volatility and potential upside bullish movement still had potential.

- My market order was triggered at 228000

- My stop-loss order was placed at 223000

- I closed the trade at 237000

Bottom Line

With increasing foreign participation and dynamic trading opportunities, the Seoul stock market remains a hub for domestic and international investors looking to capitalize on South Korea’s economic growth and innovation through CFD trading.

The markets operate under tight regulation from the FSS and FSC, especially following the 2023 stock market scandal, boosting transparency and investor protection.

Still, CFDs remain high-risk. The value of your investment could go up or down.

To get started, check out DayTrading.com’s pick of the top CFD trading platforms in South Korea.

Recommended Reading

Article Sources

- Financial Supervisory Service (FSS)

- Financial Services Commission (FSC)

- National Tax Service (NTS)

- Korean Stock Exchange (KRX)

- South Korea Introduces Tight CFDs Trading Regulations - TradingView

- Hyundai Motor Group

- Double-Digit Market Share in the USA - Elecctrek

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com