Best Unregulated Stock Brokers in 2026

Traders opt for unlicensed stock platforms for perks like zero commissions, high leverage, easy account setups, and joining bonuses like free shares. However, the risks are huge.

You may get zero investor protection, poor quality stock screeners and market analysis, and potential scams like the one reported by The Economic Times where victims lost millions to a stock trading fraud on social media. This is why we primarily recommend trading stocks through a regulated broker.

However, for those willing to forego legal safeguards, launch into DayTrading.com’s pick of the best unregulated stock trading platforms. Every brokerage has been evaluated by our stock market experts and enthusiasts.

Top 4 Unregulated Stock Brokers

Based on our tests, analysis and ratings, these 4 unlicensed platforms stand out as the best for trading stocks:

Here is a short overview of each broker's pros and cons

- HeroFX - Stock trading at HeroFX gives you access to around 60 US and European names like Apple, Tesla and Lufthansa, enough variety for a small watchlist but limited compared with the thousands of stocks available at top stock brokers. In testing it worked fine for occasional equity plays alongside FX, but the thin selection and lack of research or fundamentals made it hard to treat as a serious stock trading platform.

- Defcofx - Defcofx offers 55 US stock CFDs—including big names like Coinbase, Meta, and Tesla—exclusively for Gold account holders, with up to 1:10 leverage. It’s a solid lineup for equity traders, but there’s no fractional shares and no non-US stocks, which limits access for beginners and global investors.

- PrimeXBT - You can trade major indices including the NASDAQ, S&P 500 and Nikkei. There’s a powerful platform for technical and fundamental analysis of the market, although it’s a shame that shares are not offered.

- LMFX - Trade highly leveraged CFDs on shares from 36 global companies traded on the NYSE, NASDAQ and LSE. On the downside, there aren't opportunities in European, Asian and Australian markets.

Best Unregulated Stock Brokers in 2026 Comparison

| Broker | Stock Exchanges | Leverage | Platforms | Minimum Deposit |

|---|---|---|---|---|

| HeroFX | CAC 40 Index France, DAX GER 40 Index, Euronext, FTSE UK Index, Nasdaq, Russell 2000, S&P 500 | 1:500 | TradeLocker, MT5 | $5 |

| Defcofx | CAC 40 Index France, DAX GER 40 Index, Euronext, FTSE UK Index, Hang Seng, IBEX 35, Nasdaq, New York Stock Exchange, S&P 500 | 1:2000 | MT5 | $50 |

| PrimeXBT | Australian Securities Exchange (ASX), CAC 40 Index France, DAX GER 40 Index, Dow Jones, Euronext, FTSE UK Index, Hang Seng, IBEX 35, Japan Exchange Group, Nasdaq, S&P 500 | 1:1000 | Own | $0 |

| LMFX | Australian Securities Exchange (ASX), CAC 40 Index France, DAX GER 40 Index, FTSE UK Index, Nasdaq, New York Stock Exchange | 1:1000 | MT4 | $50 |

HeroFX

"HeroFX is best for algo traders who want to deposit and withdraw in crypto and are willing to sacrifice regulatory protections for raw spreads from 0.0, high leverage up to 1:500, and access to the powerful charting package from TradeLocker or Expert Advisors on MT5. It also suits demo traders with competitions offering cash prizes and a $1M virtual balance – the highest we’ve seen."

Christian Harris, Reviewer

HeroFX Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | TradeLocker, MT5 |

| Minimum Deposit | $5 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

HeroFX offers trading on 7 stock exchanges:

- CAC 40 Index France

- DAX GER 40 Index

- Euronext

- FTSE UK Index

- Nasdaq

- Russell 2000

- S&P 500

Pros

- Free demo accounts allow for multiple simultaneous setups on MT5 or TradeLocker with Raw, Zero, Islamic or Contest configurations and up to $1,000,000 in virtual balance per account, letting high-leverage day trading ideas be trialled, though no stocks are available in the MT5 demo.

- The Raw Spread account delivered spreads from 0.0 pips with $1-per-lot commissions during our use, which undercuts the ~$3-per-lot charge we've seen at many mainstream brokers and noticeably outperformed the Zero Commission account on busy market days.

- The Hero10X account multiplies deposits by 10 (e.g. $50 to $500 tradable balance, up to a $1M ceiling), creating a prop-firm-style buffer for taking more positions without evaluation phases or profit splits.

Cons

- There’s no in-house economic calendar, news feed, market commentary or education hub, forcing all research and learning to be sourced externally and leaving newer traders with zero structured support.

- The product range is average at best, with around 70 FX pairs (five majors), nine indices, seven metals, three energy markets, around 60 stock CFDs and a dozen or so crypto pairs, enough for newer traders but sparse next to multi-asset brokers that offer hundreds of FX pairs and thousands of shares.

- Withdrawals require an internal transfer from the trading account back into the wallet area before a request, and with only crypto payouts available, moving profits to a bank means jumping through an extra hoop via a separate exchange, which feels slow and fiddly compared with brokers that allow direct fiat withdrawals.

Defcofx

"Defcofx is best suited for experienced traders who want ultra-high 1:2000 leverage, seamless MT5 execution, and crypto-based funding—with one-click trading and chart-based order placement that felt fast and intuitive in our hands-on tests."

Christian Harris, Reviewer

Defcofx Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | MT5 |

| Minimum Deposit | $50 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP |

Stock Exchanges

Defcofx offers trading on 9 stock exchanges:

- CAC 40 Index France

- DAX GER 40 Index

- Euronext

- FTSE UK Index

- Hang Seng

- IBEX 35

- Nasdaq

- New York Stock Exchange

- S&P 500

Pros

- With leverage up to 1:2000, Defcofx gives day traders serious exposure - we tested this ourselves with small balance trades and saw how quickly positions could grow (or shrink). It’s definitely not for beginners, but when used strategically, it offers powerful flexibility.

- If you're into crypto, Defcofx makes it easy to fund your account via popular tokens like Bitcoin, Tether and Solana. It's a great option if you're looking for low-cost transactions without using traditional banking methods, with deposits credited to our account in under 1 hour during testing.

- Trades are completely commission-free, there are no overnight swap fees for holding positions, and you won’t get charged for leaving your account idle. It’s a very cost-effective setup for both casual and active traders.

Cons

- Defcofx isn’t regulated by any major financial body. We couldn’t find much in terms of third-party fund protection or formal dispute resolution processes during our investigations - so it’s a case of 'trade at your own risk'.

- While spreads are competitive based on our analysis, there’s no zero-spread account option, which will matter to scalpers or high-frequency traders. Over time, even a small spread can erode tight-margin strategies.

- If you’re new to trading, don’t expect much help. We found no structured learning tools - just basic calculators. Compared to category leaders like IG, the lack of education resources makes Defcofx harder to recommend for beginners.

PrimeXBT

"PrimeXBT is perfect for aspiring traders looking for crypto derivatives alongside traditional markets like forex and indices, all tradable on an intuitive, web-based platform. The copy trading solution is also ideal for hands-off traders with 5-star ratings and performance graphs to help you find the right trader."

William Berg, Reviewer

PrimeXBT Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | Own |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP |

Stock Exchanges

PrimeXBT offers trading on 11 stock exchanges:

- Australian Securities Exchange (ASX)

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

Pros

- PrimeXBT has added fresh opportunities with new tokens for exchanging and funding, including 1Inch, Aave, and Injective.

- 24/7 customer support, available via live chat, proved excellent during testing, while the extensive help centre is perfect for self-help.

- PrimeXBT seriously bolstered its suite of Crypto Futures in 2025 with over 100 tokens spanning AI, NFTs, Metaverse, Layer 1 &2, and more.

Cons

- While common in the crypto industry, PrimeXBT lacks authorization from a trusted regulator, seriously elevating the risk for retail traders.

- Despite improvements, the selection of around 100+ instruments still seriously trails competitors, notably OKX with its 400+ assets.

- The lack of integration with established platforms like MT4 will be limiting for traders familiar with the world’s most popular forex trading software.

LMFX

"Experienced traders who want highly leveraged CFDs and a choice between fixed and floating spreads should consider LMFX. On the downside, new clients should note the weak regulatory oversight."

William Berg, Reviewer

LMFX Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Platforms | MT4 |

| Minimum Deposit | $50 |

| Automation | Yes |

| Account Currencies | USD, EUR |

Stock Exchanges

LMFX offers trading on 6 stock exchanges:

- Australian Securities Exchange (ASX)

- CAC 40 Index France

- DAX GER 40 Index

- FTSE UK Index

- Nasdaq

- New York Stock Exchange

Pros

- The world-leading MetaTrader 4 platform and app is available

- Excellent, flexible pricing options with raw and fixed spreads available

- Bonuses, contests and awards

Cons

- No support on weekends

- Unregulated status lowers its safety score

- No cryptocurrency and Bitcoin trading

Our Methodology

To find the top unlicensed stock brokers, we took our database of 140 online trading platforms, identifying all those that offer stock trading and that are not regulated by a financial body.

Then we ranked the remaining stock brokerages by their overall rating, assigned by our experts after weighing hard data with direct observations during hands-on tests.

Choosing A Non-Regulated Stock Trading Platform

Finding the right brokerage will depend on your individual trading needs. However, drawing on our own experience examining unlicensed stock brokers, there are several things to consider:

Trust

Find a stock trading platform you can trust.

Unregulated stock brokers will not provide the same level of protection as firms licensed by authorities recognized by DayTrading.com’s Regulation and Trust Rating, particularly ‘green tier’ regulators.

However, there are still clues that a broker is legitimate: A clean record with no lawsuits, many years of offering equities, and positive reviews from other stock traders and industry experts.

What regulatory protections could I lose with an unregulated stock broker? You may lose investor protection in the event your broker goes under (eg $500k in US) and dispute resolution services to address issues (eg Financial Ombudsman in UK). Also, you might not get negative balance protection (eg required in Europe) to stop you losing more than your deposit, which is key for day traders using leveraged stock CFDs.

Check out our policy on evaluating and showing less regulated trading brokers.

- NordFX is among the most established unlicensed stock platforms we’ve tested, with a long history since 2008 and operations in multiple regions including Latin America, Europe and Asia, catering to global traders.

Stock Markets

Choose a brokerage with access to the stocks and indices you want to trade.

Unlicensed brokers sometimes provide access to niche stock markets, but in our experience, they usually offer fewer equities.

For example, regulated XM offers over 1,300 stocks, covering European, US and Latin American markets, whilst many unlicensed firms like OspreyFX offer fewer than 100 shares covering just one or two regions.

What stock markets could I lose access to with an unregulated broker? You may not get stock markets in further afield regions such as South America or Asia Pacific. Our investigations also show you likely won’t get opportunities through fractional stocks, share baskets, or extended hours trading.

- EagleFX offers 70+ equities, which surpasses most unlicensed brokers. You can trade shares on US and European stock exchanges, which should be sufficient for beginners but restricting for experienced investors.

Tools

Pick a provider with a platform or stock trading app you enjoy using, and that has the tools you need.

Our investigations show unlicensed stock brokers typically offer fewer platform options than their regulated peers, especially when it comes to in-house terminals.

Having said that, MetaTrader 4 (MT4) is still widely available which sports a highly customizable interface and enough charting power to meet the needs of most short-term stock traders.

What stock trading tools could I lose with an unregulated broker? You may not get a choice of desktop, web and mobile platforms to suit your trading needs, or access to supplementary tools like stock screeners, market analysis, economic calendars, stock recommendations, and company metrics like EBITDA and P/E ratio.

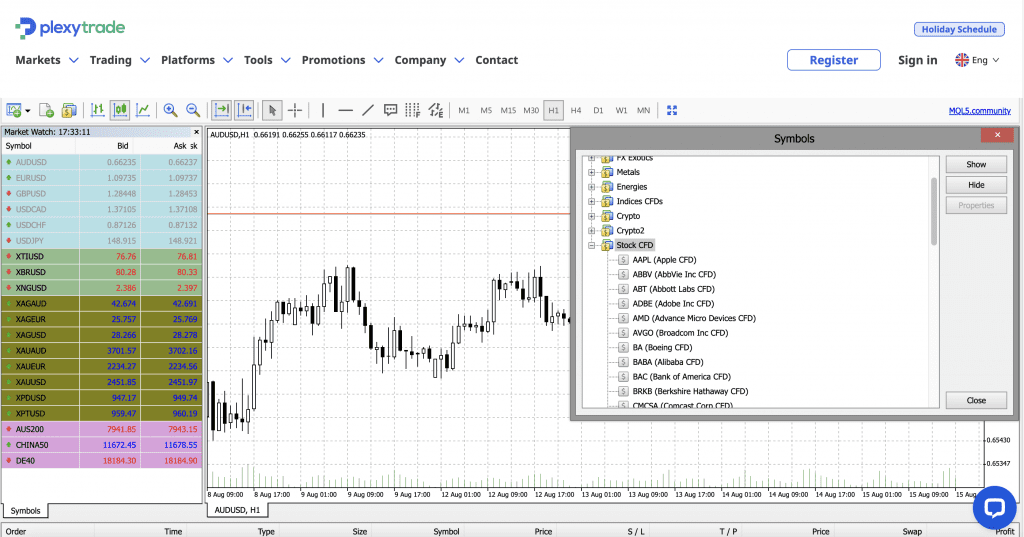

- Plexytrade is one of the few unregulated stock trading firms to offer both MT4 and MT5, catering to day traders at every level. Both platforms have dozens of indicators and drawing tools, and integrated research features from one flexible workspace.

Trading Conditions

Select a platform with transparent, competitive stock trading conditions.

Be wary of unauthorized stock trading providers advertising commission-free stock trading (a trend in recent years), but then charging higher costs elsewhere, for instance access to stock screeners, market data, and analyst stock picks.

Leverage is also a key consideration. Stock traders often turn to unregulated platforms to access higher leverage (sometimes 1:20+) than is available in tightly controlled regions.

This means a $10 outlay on Amazon shares will multiply your results 20x, increasing the potential for large profits but also huge losses. We don’t recommend beginners trade stocks with high leverage.

What financial protections could I lose with an unregulated broker? You may lose responsible leverage limits (eg 1:5 on stocks in the EU), upfront information about stock spreads and commissions (average spreads are a more reliable cost indicator than minimum spreads), and order execution guarantees (fast execution with minimal slippage is important for active stock traders).

- HeroFX is a strong option for those looking for transparent pricing, with zero commissions on stocks and access to dozens of popular US equities. It also doesn’t charge deposit or withdrawal fees (though third-party charges from payment providers may apply).

Customer Support

Select a company with customer support you can rely on. This can be key for active stock traders who need queries answered urgently.

However, don’t expect the same level of assistance at non-licensed stock trading providers. We’ve spent countless frustrating hours getting unhelpful responses to our stock trading queries through automated chatbots and live agents who can barely write in English and have little to zero understanding of their company’s own stock trading products.

What customer support features could I lose with an unregulated broker? You may not get access to multilingual customer support or localized assistance 24/7. You may also experience slow response times and sometimes no answer at all. Dedicated account managers are also rare at unregulated stock brokers.

- LonghornFX refreshingly performs better than the vast majority of unlicensed stock trading firms we’ve examined, with around-the-clock assistance via email and live chat, and response times of less than one minute during our latest round of testing with enquiries into its stock trading conditions.

Bottom Line

Choosing an unregulated broker is an enticing proposition for many aspiring stock traders looking for huge leverage, trading bonuses, and account opening that can take less than 5 minutes.

To find the right broker for you, see DayTrading.com’s choice of the best unregulated stock trading platforms.

Unauthorized stock brokers are extremely high risk. Barely any of the unlicensed stock trading platforms we’ve used provide investor protection and they are often cagey when it comes to trading fees and order execution. You could lose your investment.

FAQ

Am I Safe If I Trade Stocks Through An Unregulated Broker?

No. Trading stocks through an unlicensed broker will never be safe.

Unauthorized brokerages simply aren’t subject to the same level of scrutiny as regulated firms. Your funds and personal data may not be secure and the overall quality of the stock trading environment is usually far below the level we expect from authorized brokers.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com