After Hours Trading

After hours trading on popular exchanges such as the NYSE or Nasdaq is more accessible to retail investors than ever before, but how easy is it and who can do it? In this guide, we lay out how the after hours trading market works, including times, prices and strategies. We also list the top after hours brokers in 2026.

Brokers With Extended Hours Trading

What Is After Hours Trading?

After hours (or extended hours) trading takes place outside of the usual market sessions. In the US markets, the New York Stock Exchange and the Nasdaq usually operate between 09:30 and 16:00 ET, Monday through Friday. After hours trading on these exchanges includes the post-market (between 16:00 and 20:00 ET) and pre-market trading (ending at 09:30 ET).

In the UK market, the London Stock Exchange is open from 08:00 until 16:30 GMT, so the pre-market and post-market hours are 05:05 to 07:50 GMT, and 16:40 to 17:15 GMT, respectively.

While the NYSE and Nasdaq close on weekends, some brokers (notably IG) offer limited weekend trading via synthetic indices or low-liquidity mechanisms. However, this is not exchange-based trading and carries higher risks and wider spreads.

After hours investing will typically use an electronic communications network (ECN) or alternative trading system (ATS) to match buyers and sellers without using a traditional stock exchange. European markets refer to them as multilateral trading facilities (MTFs), as per regulatory requirements.

However, some investors think that trading before and after closing times is unfair as many don’t have access to this option and results can only be obtained by very few.

Why Trade After Hours?

Some of the most important market moves occur outside of regular sessions, with high volatility acting as a gauge of how the market will behave when it opens. These opportunities can be very profitable. For example, the S&P 500 futures contract is popular within pre-market sessions because it can indicate market sentiment for the day.

This method is also popular in the stock market since high-volume stocks can continue to see aftermarket activity for some time after the 16:00 close. News events are often released after hours, meaning investors will rush to act on the numbers before other traders. This can cause rapid and significant moves in stock prices.

Because this type of investment is time-bound, yesterday’s information from the press might be expired and the market is now moving on today’s news.

It is important to keep up with live graphs and trackers to make the most of these price movements. Some platforms that offer access to this information include Interactive Brokers, Webull, and Qtrade.

You can find the biggest movers on the Marketwatch After Hours Screener website or the Nasdaq Most Active List – note that while you might be tempted to trade the biggest stocks, it’s the key movers of the day that will provide the biggest opportunities.

After Hours Trading Strategy

A popular method of trading extended hours is to closely follow fundamentals such as macroeconomic releases and geopolitical events. This is known as news trading and is a popular strategy.

As mentioned earlier, the after hours market is often moved by news events that occur outside of typical hours. This could be anything from a government interest rate announcement or inflation data to a natural disaster or news of a war.

Furthermore, the expected outcome of an event will usually be reflected in market prices before it actually happens, so it’s important to keep on top of these updates. You could also open a position early, though always make sure you are using limit orders.

Many investors will opt to trade breakouts during these periods. They usually occur after a period of consolidation, whereby the price is fairly stable as traders anticipate a wide market move.

You will need to analyze live charts and employ technical indicators to take advantage of these opportunities. Bollinger Bands are particularly popular for breakout strategies, so we’ll cover these in more depth later on.

Pros Of After Hours Trading

If you’re wondering whether this method would be good or bad for your investment portfolio, it will largely depend on your risk profile and experience level.

With that said, some of the main benefits of after hours trading include:

- Convenience – Depending on individual circumstances, it allows some investors to trade at more convenient and flexible times

- Get ahead of the game – Investing with an after hours strategy allows you to react to news and events quickly before the normal trading day begins

- Price opportunities – Volatility in these markets can reveal some appealing prices when trading after hours. Investors will look to capitalize on these price swings

Cons Of After Hours Trading

However, there are some notable risks:

- Tough competition – The after hours market may not seem entirely fair to opportunistic traders, who will still have to compete with institutional investors that have access to better technology and resources.

- More costly – Due to low liquidity and a smaller number of traders in after hours markets, spread quotes may widen, making it more difficult to execute deals at favorable prices.

- Uncertain prices – The SEC warns that prices during after hours trading may not reflect the price during regular trading.

- Risk of volatility – Dramatic price fluctuations can occur more frequently and is, therefore, not a recommended strategy for beginners.

- Lower liquidity – There is generally a lower volume of market participants during off-peak times. If you need to quickly close out a position, there may not be any buyers or sellers. For example, say you wanted to sell your GameStop (GME) shares for $300, but the highest bid for your shares might only be $290. If you choose to keep your price, there is a possibility that your order may not even be executed.

How To Start After Hours Trading

1. Choose A Broker

Your first step in starting after hours trading will be to find a good brokerage that offers robust platforms or mobile apps and attractive features.

It’s a good idea to practice in a demo account, as it gives you the chance to familiarize yourself with the platform’s technical tools and charts during extended trading hours.

The broker’s fees are also going to be a key factor in your decision, as after hours trading can involve wider spreads. You’ll want to choose the company offering the most competitive fees for the assets you intend to trade.

You should also consider which payment methods are available and watch out for any deposit or withdrawal fees.

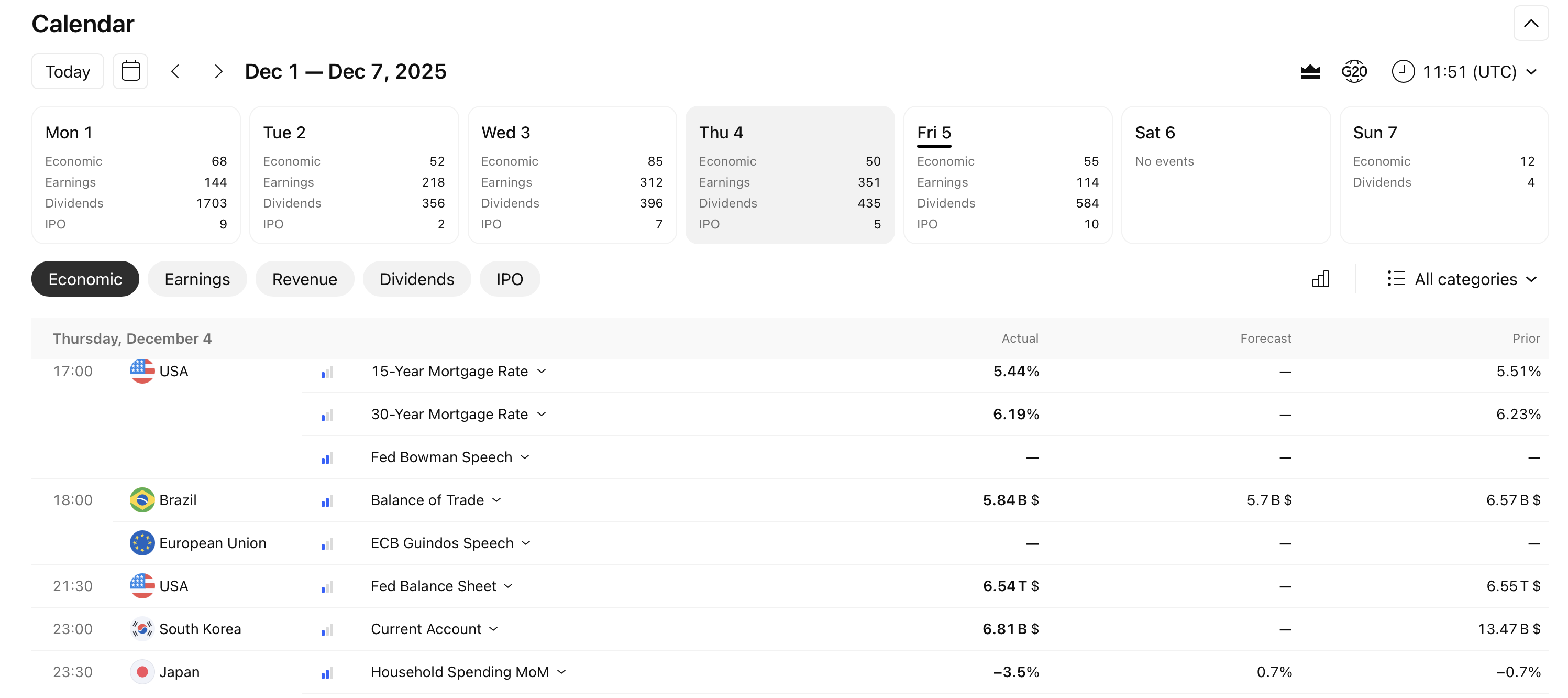

Any additional features that can broaden your analysis and keep you on top of global events will also be essential for after hours trading. Most top brands will offer a range of educational material, market analysis, a news feed and an economic calendar within the platform.

You can enjoy such features with various brokers, including eToro. In the US, Interactive Brokers also provides tools such as charts for GME or quotes.

Buying after hours on IG is also popular among UK clients. Make sure to also check out the broker’s extended hours rules on their website.

2. Analyze Markets

Once you’ve registered with a broker and decided on the asset that you wish to trade, you can start analyzing the market and price history to make a prediction. For example, historical information for Grayscale Bitcoin Trust (GBTC) or 10 year treasury assets may be available.

As mentioned earlier, many participants in this market will act on news events and announcements that are released before or after the regular trading day. For example, Amazon might announce that it’s releasing the next quarterly earnings report at 16:30 ET. Investors might identify a period of consolidation prior to this time before a breakout occurs.

It’s important to have a strong grip on fundamental resources that could affect prices, such as economic calendars, market sentiment analysis and tops news outlets. The NASDAQ-100 pre-market indicator is also a useful tool for gauging market sentiment before the market opens. The indicator is based on real after hours trading data.

3. Use Technical Indicators To Confirm

You will then need to confirm any trends or price action that you spot on your chart, using technical indicators such as Bollinger bands or moving averages. Bollinger bands can help you determine whether prices are high or low using a moving average as a central band.

They can be excellent tools for breakout trading. For example, if the upper and lower bands start moving towards each other, or the distance between the two becomes narrow, this can indicate that the market is consolidating.

This is known as a price ‘squeeze’. If the price moves above the high of the consolidation, this would mean an upside breakout, whilst a close below the low would suggest a downside breakout.

Occasionally, after hours trading can increase the opening price of a stock, for example, if a news event in the pre-market attracts a lot of investing and pushes demand up. However, a trend will not necessarily continue in the regular session, as extended hours trading only represents a very small portion of market sentiment.

Whatever method or strategy you opt for, it is vital that you apply appropriate risk management rules to protect your positions. Remember that spreads can widen in the after hours market and low liquidity could leave positions un-executed.

Final Word On After Hours Trading

After hours trading can be attractive and convenient for experienced investors who want to react to news events before the day begins. If you do decide to invest after hours, remember that there are fewer participants in the market during these times and spreads can widen. As such, it’s worth considering the big movers which tend to experience greater activity and offer more profitable opportunities.

See our list of the best brokers that offer after hours trading to get started.

FAQ

After Hours Trading: What Does It Mean?

The definition of after hours trading is when investors buy and sell securities outside of normal trading hours. This can be explained and split into two categories: pre-market and post-market. In the US market, pre-market hours are before 09:30 ET, whilst post-market hours are between 16:00 and 20:00 ET.

What Is The Difference Between After Hours Trading Vs Pre-Market Trading?

Pre-market trading is a form of extended hours trading, whereby you can trade up to 09:30 ET in the US stock market. After hours trading is simply a generalized term, whilst pre-market specifies the period of time before the trading day begins. Some exchanges, such as Nasdaq, even allow you to invest the pre-market from 4AM ET.

What Is The Difference Between After Hours Trading Vs Day Trading?

Generally, day trading will take place within one investing day. Liquidity and volatility are central to day trading, so investors will look to open positions in the hours after the stock market opens (after 09:30 ET) and in the last hour before the end time of 16:00 ET. After hours trading occurs outside of these times.

How Can I Start After Hours Trading?

This type of investing requires a good understanding of news releases and how they can affect price movement. It’s also worth finding out what the biggest gainers or movers are, as these will offer better opportunities. You will need to sign up to a broker to do this. See our list of recommended after hours trading platforms.

Is After Hours Trading Illegal?

After hours trading is a legal practice offered by many top brokerages. Make sure you always use a trusted and regulated provider to ensure that your capital is secure. It’s worth noting, however, that some critics argue that after hours trading is unfair to investors since manipulation of stock prices can occur as a result of institutional investors moving the market.