News Trading: How To Trade The News

‘Trading the news’ is a type of strategy that involves making decisions based on the release of impactful news events in the financial markets.

This guide will help you learn how to trade the news.

Quick Introduction

- Trading the news requires closely monitoring economic reports, geopolitical developments, corporate earnings releases, and other news events, to capitalize on short-term volatility.

- Understand market sentiment and consensus expectations regarding news events. Deviations from these expectations often drive market movements, impacting trading decisions.

- Act proactively to news-related price action. Quick decision-making is key for capitalizing on short-term movements triggered by breaking news.

- Implement strong risk management, including setting stop-loss orders and defining entry/exit points, to control losses and protect profits.

Best Brokers For News Trading

These 4 brokers offer excellent resources for trading the news, including news feeds and economic calendars:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

What Is News Trading?

Trading the news involves seizing short-term opportunities in financial markets by reacting swiftly to impactful news releases.

Positive economic data, for instance, might boost stock prices or strengthen a country’s currency.

Trading the news demands a deep understanding of how different news events impact various assets. You will need to grasp market consensus and sentiment surrounding the news and interpret its implications quickly.

This strategy also carries inherent risks due to the rapid and unpredictable nature of market movements during news releases.

Efficient risk management is crucial to safeguard against potential losses amid heightened market volatility.

A news trading approach centers on trading aligned with market expectations preceding and following news releases.

Engaging in trades during news announcements often demands rapid decision-making due to the almost immediate impact on financial markets.

Scheduled News Trading

Scheduled news trading is a type of strategy where you focus on specific, pre-scheduled news events or economic releases that have a notable impact on financial markets.

This approach involves preparing and positioning trades before, during, or immediately after the release of such scheduled events.

Several scheduled economic events have a significant impact on financial markets due to their ability to influence market sentiment and direction. The most crucial ones include:

- Nonfarm Payrolls (NFP) Report: Published monthly by the US Bureau of Labor Statistics, the NFP report provides insights into the employment landscape, including job creation, the unemployment rate, and wage growth, influencing currency, equity, and bond markets.

- Federal Reserve (Fed) Meetings: Regular meetings by the Federal Open Market Committee (FOMC) determine key interest rate decisions and policy outlook, impacting currencies, bonds, and equities globally.

- Gross Domestic Product (GDP): GDP data offers a comprehensive measure of a country’s economic performance, influencing investor sentiment in multiple markets.

- Central Bank Rate Decisions: Announcements on interest rates and policy guidance by major central banks like the ECB (European Central Bank) or the BoE (Bank of England) heavily influence currency, bond, and equity markets.

- Consumer Price Index (CPI) & Producer Price Index (PPI): CPI and PPI data measure inflation at the consumer and producer levels, respectively, impacting currency valuations and interest rate expectations.

- Retail Sales: Retail sales data provides insights into consumer spending, affecting markets sensitive to consumer behavior, such as retail stocks and currencies.

- Trade Balance: Reports on a country’s trade balance influence currency markets by revealing the state of exports and imports.

When employing this strategy you need to meticulously plan your trades around the timing of these scheduled events to capitalize on the ensuing market volatility and directional movements caused by the news.

Successful scheduled news trading demands careful consideration of factors such as market expectations, historical reactions to similar news, the significance of the news event, and the potential influence on market sentiment.

You need to manage risks effectively, given the increased volatility and rapid market movements typically associated with scheduled news releases.

Efficient execution and swift decision-making are essential to capitalize on the fleeting opportunities presented by these events.

Unscheduled News Trading

Unscheduled news trading involves reacting swiftly to unexpected or unplanned events that significantly impact financial markets.

Unlike scheduled news events, which you anticipate and prepare for in advance, unscheduled news occurs unexpectedly and can include geopolitical events, natural disasters, unexpected corporate developments (such as mergers, acquisitions, or management changes), or unforeseen economic data releases.

To utilize this strategy effectively you must react promptly to breaking news, assessing its potential impact on various financial instruments and swiftly adjusting your trading positions accordingly.

The goal is to capitalize on the immediate market reactions and volatility generated by the unexpected news.

However, this strategy comes with increased uncertainty and risk, as you might not have adequate time to fully assess the implications of the news before making trading decisions.

Successfully navigating unscheduled news trading demands quick analysis, efficient risk management, and the ability to adapt swiftly to rapidly changing market conditions.

You need to stay updated on current events and market sentiment to effectively interpret and respond to unexpected news developments, seeking opportunities amid heightened market volatility while managing potential risks associated with sudden market movements.

For new traders diving into news trading, patience and gradual immersion are key.

Start by understanding the fundamental impact of news events on markets, develop a robust strategy, and begin with smaller positions.

Example Trade

Let’s consider I want to trade an upcoming Nonfarm Payrolls (NFP) report, a significant economic indicator in the United States, and how I might approach this event:

- Preparation & Analysis: Ahead of the NFP release, I conduct thorough research, studying historical NFP data, market expectations, and recent trends. I assess the potential impact on various markets, particularly currencies, stocks, and bonds.

- Risk Management: I determine my risk tolerance and set appropriate risk management strategies. I decide on position sizing, maximum risk exposure, and the use of stop-loss orders to manage potential losses.

- Positioning Before the Event: As the NFP release approaches, I take a position based on my analysis. For example, if I expect positive job growth, I might take a bullish position on the US dollar (long USD) against another currency.

- Monitoring During The Event: As the NFP data is released, I closely watch the immediate market reaction. Sudden volatility and price movements might trigger automatic stop-loss orders or prompt me to reconsider my position.

- Decision-Making Post-Release: Depending on the actual NFP figures compared to expectations and the resulting market movements, I must decide whether to hold, adjust, or exit my position. If the actual numbers significantly differ from forecasts, I might reassess my strategy in real-time.

- Exiting Or Scaling Positions: Based on my trading plan and market conditions, I exit my position, either locking in profits or cutting losses. I might also scale out of my position gradually to secure gains as the market stabilizes.

- Reflection & Learning: After the event, I evaluate my decisions, learning from both successes and failures. I review my analysis, execution, and overall strategy to refine my approach for future news trading events.

Pros And Cons Of Trading The News

- Volatility Opportunities: News releases often cause increased market volatility, providing ample opportunities for short-term profits. Price fluctuations following news events can create favorable trading conditions for those skilled at rapid decision-making.

- Market Catalysts: Significant news events act as catalysts that can trigger sustained market trends. Successful interpretation of news and its impact on market sentiment can lead to substantial trading opportunities in the direction of the trend.

- Timely Information Access: Focussing on news gives you access to information almost simultaneously as it is released. This enables you to react swiftly to market-moving events and position yourself advantageously ahead of slower participants.

- Global Market Participation: News events span across global markets, offering you the chance to trade a wide range of financial instruments across various time zones. This accessibility allows for round-the-clock trading opportunities.

- Diverse Trading Instruments: News trading isn’t limited to specific markets. You can take positions in currencies, stocks, commodities, and derivatives, providing a diverse range of trading options to suit different strategies and preferences.

- Increased Volatility: Heightened volatility during news events can lead to erratic price movements, triggering unexpected market reactions. Sudden swings and price spikes may result in unexpected losses if positions aren’t managed carefully.

- Whipsaw Effects: Market reactions to news can be swift and unpredictable. You might experience whipsaws, where prices rapidly oscillate in both directions, causing false breakouts or breakdowns, resulting in losses if you are heavily leveraged.

- Slippage & Execution Risks: Due to rapid price movements during news releases, you might encounter slippage, where orders are executed at prices different from the expected level. This can impact profitability, especially with larger positions or illiquid markets.

- Noise & False Signals: News releases might generate noise in the market, leading to false signals and unreliable price action. Misinterpretation or misreading of news content can result in trading decisions based on incorrect assumptions.

- High Stress & Emotion: Trading the news demands fast decision-making and quick actions, leading to increased stress levels. Emotional reactions to market movements can cloud judgment and result in impulsive or irrational trading decisions.

Bottom Line

Trading the news offers the potential for quick profits due to increased market volatility but comes with heightened risks, including unpredictable price movements and rapid market reactions.

Success requires thorough preparation, risk management, and the ability to interpret news impact accurately. It should complement a broader trading strategy, emphasizing discipline and continuous learning to navigate the challenges of news-driven markets.

You should also find a good broker that can facilitate your news trading strategy and offer you the best quality tools and features, including charts, news feeds and economic calendars.

FAQ

What Does It Mean To Trade The News?

Trading the news involves capitalizing on short-term market movements triggered by significant economic, geopolitical, or corporate events.

The aim is to exploit rapid price fluctuations resulting from news events, often executing short-term trades to capitalize on volatility and make quick profits.

What Is The Best Way To Trade The News?

The best way to trade the news involves thorough preparation, including staying updated on economic calendars, understanding market sentiment, and anticipating the potential impact of news events.

It’s crucial to have a trading plan in place, define entry and exit points, implement risk management strategies such as setting stop-loss orders, and be prepared to adapt swiftly to unexpected market reactions.

Is News Trading Suitable For Beginners?

News trading can be challenging for beginners due to its reliance on rapid decision-making, heightened market volatility, and the potential for unexpected price movements. Novice traders might find it overwhelming to interpret news events accurately and effectively manage risk during volatile periods.

Starting with a strong foundational understanding of markets and gradually gaining experience in more stable trading environments before transitioning to news-based strategies could be beneficial for beginners in the long run.

Article Sources

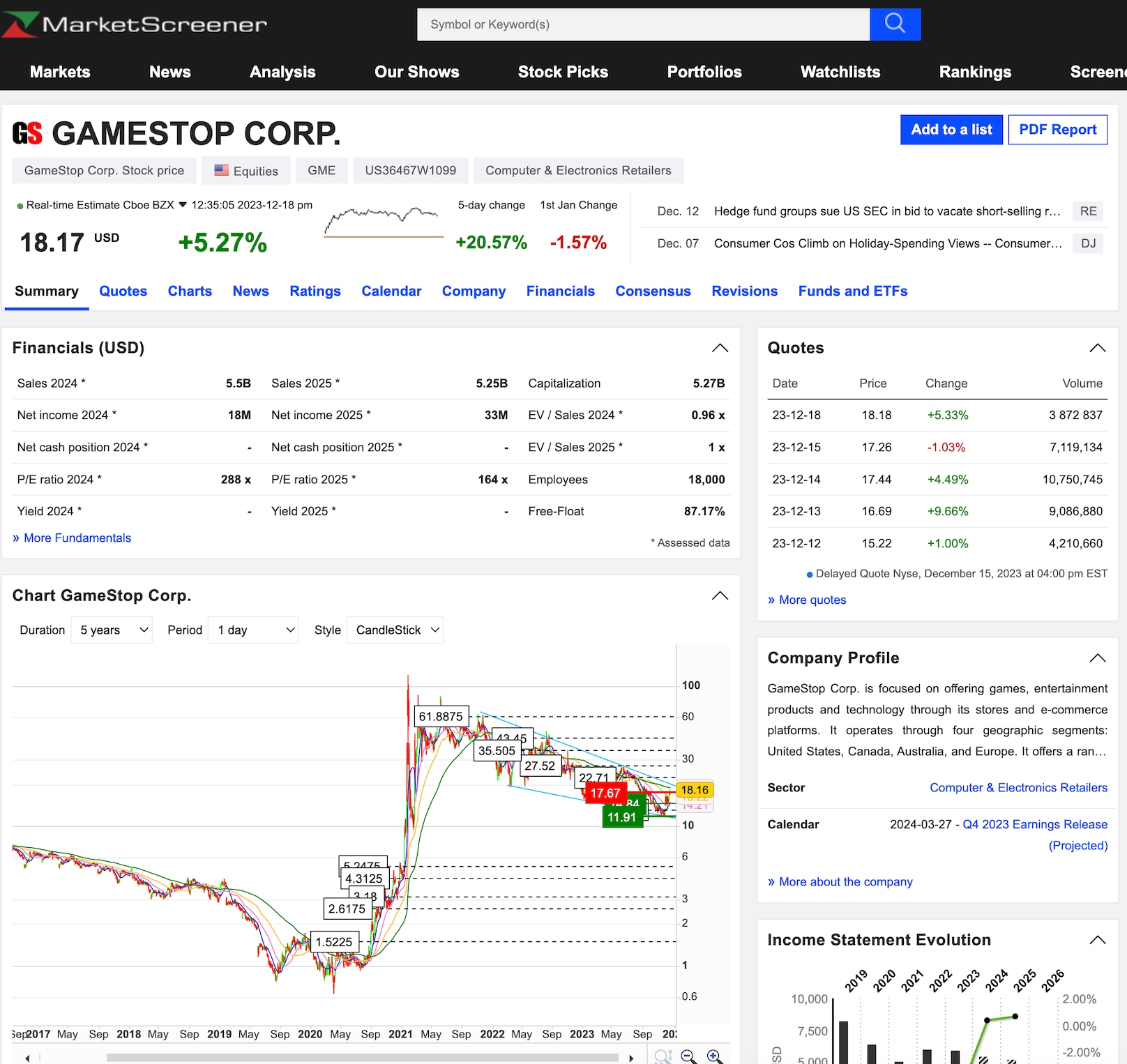

- MarketScreener Financial News

- Interactive Brokers Financial News

- Predicting and Trading the News, Steve Norman, 2023

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com