LonghornFX Review 2026

Please see the list of similar brokers or the Best Brokers List for alternatives.

See the Top 3 Alternatives in your location.

Awards

- Best Newcomer Broker - 2020

- Best New Forex Broker - 2020

Pros

- Traders willing to forego certain regulatory protections can access high leverage up to 1:500, amplifying both profits and losses on forex, stocks, indices and cryptos.

- LonghornFX stands out by offering an unlimited demo account and virtual bankroll, allowing aspiring day traders to test and refine strategies before risking real funds.

- LonghornFX supports traders with 24/7 assistance that was fast and helpful during testing, plus an extensive Academy featuring 1,650+ market analysis articles, 10 educational pieces, and 4 video guides.

Cons

- LonghornFX hasn't earned the reputation and regulatory credentials of DayTrading.com’s most trusted trading platforms, increasing the risk to your funds in the event of disputes or broker insolvency.

- Despite reasonable daily market analysis, LonghornFX still lacks the webinars, live trading sessions and comprehensive research provided by best-in-class brokers, which could help inform trading decisions.

- The less than 200 instruments seriously limits potential trading opportunities, with an especially weak selection of stocks that falls way behind the 12,000+ shares at IG.

LonghornFX Review

LonghornFX is a multi-asset ECN broker offering trading opportunities on the MetaTrader 4 platform. Day traders can access leverage up to 1:500, an unlimited demo account, plus Bitcoin deposits and withdrawals. This review will cover the broker’s regulatory status, login security, minimum deposit requirements, withdrawals, and more. We also unpack the pros and cons of trading with LonghornFX.

Company Details

The online brokerage was established in 2020, with headquarters in Saint Vincent and the Grenadines.

LonghornFX is a true ECN broker, providing traders with Direct Market Access (DMA) using Straight Through Processing (STP). Clients benefit from tight spreads via the firm’s liquidity providers alongside low commissions and swap fees.

The broker offers 150+ assets including stocks, indices, cryptocurrencies, commodities, and forex pairs. 24/7 customer support and a $0 minimum deposit requirement also make LonghornFX accessible for beginners.

The company is not regulated by a trusted financial authority.

Trading Platform

LonghornFX provides the MetaTrader 4 (MT4) platform.

MT4 is available as desktop software, via major browsers, or through Apple and Android-compatible apps.

The award-winning, multi-asset terminal provides in-depth technical analysis features, trading tools, and charting software. Functionality includes:

- VPS hosting

- Nine timeframes

- One-click trading

- Three order execution types

- 30 built-in technical indicators

- Hedging and scalping permitted

- Fully customizable and in-depth charts

- Four pending order types and trailing stops

- Direct access to Expert Advisors or build your own algorithms

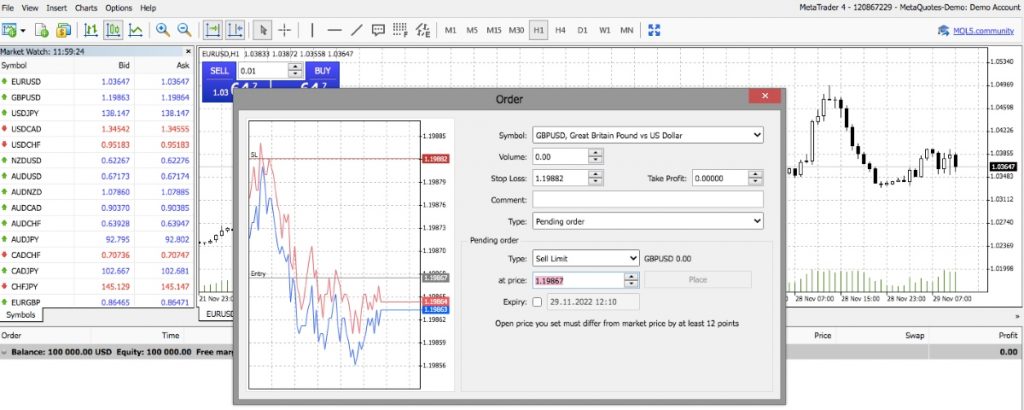

How To Place A Trade

- Download the MT4 platform or log in via the WebTrader or mobile app

- Select the asset you wish to trade using the drop-down menu or search bar

- Select ‘new order’; the icon is located second from the left in the top navigation bar

- The ‘new order’ screen should pop out

- Enter trade details including volume, order type, and risk management

- Choose ‘buy’ or ‘sell’

- Confirm the order

Assets & Markets

LonghornFX offers 150+ global instruments:

- Speculate on US Dollar futures contracts

- Invest in four precious metals and two energies including UK and US Oil

- Trade 60+ company stocks such as Tesla, Amazon, Coca-Cola, Facebook, and Netflix

- Trade on 10 of the world’s largest indices including the FTSE 100, S&P 500, and ASX 200

- Speculate on 50+ currency pairs including the EUR/USD, GBP/USD, EUR/NZD, and GBP/SEK

- Take crypto positions on 35 digital currency pairs including BTC/USD, ETH/USD, LTC/USD, ZEC/BTC, and OMG/BIT

Spreads & Fees

The online brokerage offers tight floating spreads using ‘institutional grade liquidity from global institutions’.

When we used LonghornFX, we were offered the EUR/USD currency pair with a 0.6 pip spread. US Oil CFDs were offered at 0.8 pips.

The broker also charges a $6 commission per lot traded. There are no fees to open a LonghornFX account or for inactivity.

LonghornFX Leverage

Due to the lack of regulatory oversight, LonghornFX can offer substantial margin trading opportunities.

Maximum leverage by instrument:

- Stocks – 1:20

- Forex – 1:500

- Metals – 1:500

- Energies – 1:200

- Indices – 1:200

- Cryptocurrencies – 1:100

The margin call is 100% with a stop-out level of 70%.

Mobile App

LonghornFX does not offer a proprietary mobile app. Nonetheless, the MT4 terminal can be used on mobile and tablet devices. It is available for free download to iOS and Android devices.

You can manage your account, open and close positions, plus customize graphs and charts while on the go. You can also set up price movement alerts and notifications. All order types are available, alongside financial market news and an in-app chat.

Payment Methods

Deposits

Users can deposit to trading accounts through Bitcoin, Bitcoin via Instacoins, bank wire transfers, and credit/debit cards.

There is no minimum deposit requirement to open a LonghornFX live account, though the broker advises transferring at least $10. It is also worth noting that there are minimum deposit amounts for certain payment methods ($10 for BTC and $50 for credit/debit cards).

LonghornFX does not charge any deposit or withdrawal fees, though third-party charges, including blockchain network fees, may apply.

Processing times vary by method. Credit/debit cards often provide instant funding. Cryptocurrency payments are subject to network confirmation times.

Withdrawals

Withdrawals can be made via Bitcoin only.

There is a minimum withdrawal amount of $10. The blockchain network implements a 0.0005 BTC fee per transaction.

The broker submits all withdrawal requests on the same day. Processing times are dependent on blockchain confirmation speeds, typically taking around one hour.

Demo Account

LonghornFX offers a free demo account service. You can practice trading, test platform features, or finesse a strategy risk-free.

Retail traders can use the demo service with flexible leverage and unlimited virtual funds.

How To Open An MT4 WebTrader Demo Account

Once you have registered for an account you can request the demo service.

From the client dashboard, select ‘Demo Accounts’ from the navigation bar located along the left side. Scroll to the bottom and choose a platform to practice trading on (WebTrader, MT4 for Windows, or mobile).

- Select the embedded link to open the WebTrader

- An ‘Open Account’ pop-out window will appear

- Enter your name, email address, and account type

- Choose the size of your virtual balance

- Select the leverage ratio

- Click ‘Next’

- Your registration details will be displayed on the next screen (make note of these so you can access your demo account)

- Select ‘Complete’

Deals & Promotions

LonghornFX does not offer any bonuses or financial incentives. While using LonghornFX, we also did not come across any friends/family referral schemes, monetary rewards, or trading contests.

Although this may be disappointing, instead the broker aims to provide competitive trading conditions with tight spreads and flexible leverage.

Regulation & Licensing

The broker operates under the company name Longhorn LLC, registered in St Vincent and the Grenadines.

LonghornFX is not regulated by a top-tier financial authority. Broker-dealers without regulatory oversight may not offer the same levels of protection or security as brands that hold licenses with the US Securities and Exchange Commission (SEC) or the UK Financial Conduct Authority (FCA), for example.

Having said that, it is good to see that LonghornFX complies with Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) protocols.

Additional Features

Our experts were pleased to see some basic educational resources and trader guides. We were able to access price trend technical analysis and educational articles. It would be good to see these updated regularly though, as the majority of posts are dated back t0 2020.

LonghornFX also provides integrated YouTube video content to help new traders get started. This includes details on how to make a deposit, how to sign up and how to use the MetaTrader 4 mobile app.

Account Types

LonghornFX offers a single retail trading account.

Nonetheless, you can be flexible with leverage and your chosen account denomination. You can deposit in USD, GBP, EUR, or BTC. The maximum trade size is 1000 lots, with a minimum of 0.01 lots.

Swap-free Islamic accounts are also available. You can select this option at the sign-up stage.

How To Open A LonghornFX Account

- Select the ‘Sign Up’ logo located in the top right of the navigation bar on the official website

- Enter basic contact details including name and email address

- Verify your account with the email confirmation link

- You will then have access to a trading dashboard where you can finish your account registration

- Verify your phone number

- Make a deposit

- Create a MetaTrader account

- Confirm all account details and begin trading

Note you cannot open a trading account without adding funds to a live profile.

Trading Hours

The broker’s trading servers operate on a GMT+3 time zone which is synchronized with the MT4 platform.

Trading hours will vary by instrument. Stock markets are typically open from 9:30 AM to 4 PM local time, Monday to Friday. Cryptocurrency works slightly differently with digital assets available 24 hours a day, 7 days a week.

Customer Service Review

LonghornFX customer support is available 24/7. Day traders can contact the broker through email (help@longhornfx.com) or via their live chat function. When we tested LonghornFX’s live chat, we received a response within one minute.

Alternatively, you can search for common queries on the broker’s FAQ portal. Topics include trading accounts, making payments, MetaTrader 4, and affiliate program queries.

LonghornFX is also present on social media channels including Twitter and Facebook.

Security & Safety

LonghornFX uses a cold storage system to store client funds. The solution segregates company funds from customer money in a secure offline vault.

The MetaTrader platform also offers security features. The server encrypts all transactional data and IP addresses are hidden when making trades through the platform. RSA digital signatures are also used.

Our experts also recommend enabling two-factor authentication (2FA). If this is enabled, a unique code will be generated on an authenticator app of your choice.

Note, if a trade is subject to a technical error or platform fault that resulted in a monetary loss, LonghornFX may reimburse traders following an investigation.

LonghornFX Verdict

LonghornFX is a multi-asset broker with a low minimum deposit, flexible leverage, and direct market access. The MetaTrader 4 terminal and unlimited demo account service also mean that the broker is set up to meet the needs of beginners.

However, be wary of LonghornFX’s unregulated status. You may not have access to the same safety features and account coverage provided by regulated brands.

FAQs

What Is The Minimum Deposit At LonghornFX?

There is no minimum deposit required to register for a LonghornFX account. With that said, some deposit methods (Bitcoin and credit/debit cards) do have a minimum payment amount, starting at $10 and $50 respectively.

What Leverage Opportunities Does LonghornFX Offer?

Day traders can access flexible leverage. This includes leverage up to 1:500 for currency pairs and metals, 1:200 for indices, and 1:20 for stocks.

Apply suitable risk management strategies when trading with high leverage.

Is LonghornFX Regulated?

No, LonghornFX does not hold a license with a trusted regulator, such as the FCA, SEC or CySEC. As a result, the broker is less restricted in terms of the leverage and account safeguards that it has to provide.

Does LonghornFX Offer A Demo Account?

Yes, LonghornFX offers a free MT4 demo account with unlimited access, flexible leverage, and virtual funds. Clients can maintain both live and demo accounts when trading with longhornFX.

What Trading Platform Can I Use At LonghornFX?

Retail investors can trade on the MetaTrader 4 (MT4) platform. The terminal can be downloaded to desktop devices, used via internet browsers, or downloaded to mobile and tablet devices. The multi-asset platform offers multiple order types, a range of technical indicators and drawing tools, plus one-click trading.

Best Alternatives to LonghornFX

Compare LonghornFX with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

LonghornFX Comparison Table

| LonghornFX | Interactive Brokers | World Forex | |

|---|---|---|---|

| Rating | 3 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Cryptos | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SVGFSA |

| Bonus | – | – | 100% Deposit Bonus |

| Platforms | MT4 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:1000 |

| Payment Methods | 4 | 6 | 7 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by LonghornFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| LonghornFX | Interactive Brokers | World Forex | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

LonghornFX vs Other Brokers

Compare LonghornFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of LonghornFX yet, will you be the first to help fellow traders decide if they should trade with LonghornFX or not?