Trading USD/JPY

As a result of relatively low bid-ask spreads and enticing liquidity, trading the USD/JPY is a popular major currency pair. Also, its characteristics make it a tempting proposition for both beginners and experienced traders. This page will break down the history of the currency pair, as well as its benefits and drawbacks. How to start day trading the USD/JPY in 2026 will then be covered, from charts and signals to strategy and trading hours.

USD/JPY Trading Brokers

-

1

Interactive Brokers

Interactive Brokers -

2

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

3

RoboForex

RoboForex -

4

AvaTrade

AvaTrade -

5

IC Markets

IC Markets -

6

IC Trading

IC Trading

This is why we think these brokers are the best in this category in 2026:

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

| Currency Pairs | USD/CHF, USD/JPY, USD/CNH |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/JPY |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- Day traders can enjoy fast and reliable order execution

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

| Currency Pairs | EUR/AUD, EUR/JPY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, USD/JPY |

Pros

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

| Currency Pairs | USD/CHF, USD/JPY |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/JPY, USD/CNH, EUR/AUD, EUR/SGD, EUR/TRY, EUR/CAD, EUR/GBP, GBP/AUD, GBP/CAD, GBP/JPY, USD/HKD, USD/SGD, USD/THB |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

| Currency Pairs | USD/CHF, USD/JPY |

Pros

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

- Customer support performed woefully during testing with multiple attempts to connect via live chat and no one available to assist, plus unanswered emails, raising concerns about its ability to address urgent trading concerns.

Chart

Breaking Down ‘USD/JPY’

Firstly, what precisely does USD/JPY actually mean? Quite simply, it represents the exchange rate between the US dollar and Japanese yen. So, the figure you see quoted is how many Japanese yen you need to buy one US dollar. The US dollar is the base currency in this major currency pair.

In the BIS Triennial Survey (April 2025), USD/JPY averaged about $1.37 trillion in daily turnover and accounted for roughly 14.3% of global FX turnover (net-net basis), making it the second-most traded currency pair after EUR/USD.

Why Day Trade USD/JPY?

There are a number of reasons why real-time USD/JPY day trading is an enticing prospect. Some of the most appealing characteristics are as follows:

- Relatively low spreads – The USD/JPY remains popular. This is partly because of its comparatively low bid-ask spreads.

- Volatility – This currency pair displays high levels of volatility, often driven by Asian market forces. As a result of this implied volatility, day traders have plenty of opportunities to turn a profit.

- Volume – As it is based on two of the most active currencies in the world, market volume is huge. As a result, this popularity ensures that finding trading tips and forex signals is relatively easy.

- Predictability – USD/JPY is heavily influenced by monetary policy and interest-rate expectations in the US and Japan, as well as broader risk sentiment. Many traders track central bank communications, government bond yields, and major data releases to form a view.

- Diverse trading vehicles – As such a popular currency pair, there are numerous trading vehicles you can use to generate profits. From futures and options to ETFs and more (see CME Japanese Yen futures contract specifications and CME Micro JPY/USD futures (Micro JPY)).

- Beginner-friendly – Relatively smooth trends and fantastic liquidity make the USD/JPY pair appealing to both beginners and experienced traders.

- Availability of resources – In many ways, conducting technical analysis within a streaming chart is easier now than ever before. This is because you have direct access to bar charts, average daily ranges, exchange rate history graphs, and more. For example, conducting Elliott wave analysis is more straightforward. In addition, there is an active online trading community in the form of blogs. Also, websites offer up-to-date market reviews and hourly forecasts.

So, firstly, this pair is one of the most actively traded. Also, the technical outlook and availability of resources add to the benefits the USD/JPY currency pair offers.

USD/JPY Drawbacks

Before you load up your live online USD/JPY chart and decide whether to buy or sell, you should also be aware of the associated drawbacks and risks:

- Japanese FX intervention risk – In Japan, the Ministry of Finance determines whether to intervene in FX markets, with the Bank of Japan executing interventions as its agent. Intervention can cause sharp, sudden moves, so traders should monitor official signals and monthly intervention operations data.

- Volatility – Whilst volatility is a benefit, it can also mean sudden price fluctuations. If traders aren’t vigilant, a winning position can quickly become a costly loss. For example, natural disasters can materially affect Japan’s domestic activity, supply chains, and risk sentiment—factors that can spill into JPY volatility.

- Dangers of leverage – Whilst borrowing funds enables you to capitalise on winning opportunities, it can also amplify losses. So, when margin trading is used with a volatile pair like the USD/JPY, it can be all too easy to lose serious capital.

- Automated competition – Traders of today face a significant challenge in the form of trading algorithms. These intelligent bots can use yearly charts and current drops to make forecasts now. You’re still manually drawing head and shoulders patterns. However, these automated systems are already entering and exiting positions. As a result, competitive forward rates and US dollar vs Japanese yen forecasts for this coming week are more important than ever.

Overall, the USD/JPY pair has its advantages. However, it also comes with challenges. This is all the more reason to learn how to read the USD/JPY and conduct a thorough market analysis.

Influences On Movement

Accurate USD/JPY chart investing requires a detailed understanding of what causes movement. Therefore, the most significant influences are as follows:

- Economic strength – A key driver of USD/JPY is the relative outlook for growth, inflation, and interest rates in the US versus Japan. Risk sentiment also matters: at times, the yen can behave like a defensive ‘safe-haven’ currency, though this relationship is not constant. For Japan, watch releases such as Japan Cabinet Office quarterly GDP estimates and Statistics Bureau of Japan CPI releases.

- Japanese imports vs exports – Japan’s trade balance can affect FX flows, but USD/JPY is also heavily shaped by capital flows and interest-rate differentials, so the impact of imports/exports is not one-directional. Additionally, Japan’s status as a significant exporter means that its trading relations with countries like China can also affect the USD/JPY pair.

- Japanese national disasters – Due to its size, any natural disaster can have a substantial effect. However, the US economy is unlikely to be impacted to such a significant extent.

- Pace of currency growth – Over the long run, USD/JPY tends to be most sensitive to relative inflation and interest-rate paths (and the policies that drive them). Periods of dollar strength or yen strength can persist for years, but the broader trend is cyclical, not one-way.

- Government intervention – The Federal Reserve of the US (Fed) and the BoJ are responsible for monetary policies. Although this is currently of particular importance in Japan. This is because the government has introduced a number of initiatives to bolster the economy. So, traders should pay close attention to any breaking news in relation to new measures, such as changes to interest rates, quantitative easing, and inflation.

To conclude, spotting trade opportunities in the USD/JPY requires an understanding of how these underlying forces work to tip the balance in favour of each currency. With that knowledge, telling whether prices will start going up or down may be easier.

Currency Correlations

Currencies do not move independently of each other, and the USD/JPY pair is no exception. USD/JPY can show meaningful co-movement with other majors, but correlations shift over time. Many traders check rolling correlations (eg, 30–90 days) rather than assuming a fixed relationship.

- Positive correlation – This is when currency reacts in line with each other. Pairs that share a common currency (like USD) can sometimes move together, but the strength and direction of correlation depend on the macro driver (rates, risk sentiment, commodity shocks, etc.).

- Negative correlation – When currency pairs move in the opposite direction, they are negatively correlated. Some pairs may move opposite each other in certain regimes, but there is no permanent ‘negative correlation’ set. Verify with recent data before using it in a strategy.

Of course, it isn’t quite that straightforward; the degree of correlation can also change. It is taken as a measurement from -1 to +1. So, an understanding of this will allow you to use movements in other pairs to predict fluctuations in the USD/JPY.

In fact, several Japanese yen pairs are highly correlated to the USD/JPY:

- CAD/JPY

- CHF/JPY

- EUR/JPY

- SGD/JPY

- HKD/JPY

USD/JPY & Gold Correlation

Although gold isn’t a currency per se, it often trades like a macro ‘risk’ asset. That said, gold and FX correlations can vary materially over time, so it’s better to check a rolling correlation (e.g., 30–90 days) before using XAU/USD movements to inform a USD/JPY view.

So, technical analysis now needs to cover more than the basics of support and resistance levels. If you can also utilise currency correlations to your advantage, you may be able to factor greater returns into your profit calculator.

USD/JPY Day Trading Strategy

Timing

Whether you opt for a USD/JPY scalping or breakout strategy, when you trade could make all the difference to your intraday profits. This is because in the day trading forex space, timing is everything.

Capitalising on USD/JPY targets requires trading during prime time slots. Spot forex day trading is typically available 24 hours a day, five days a week, but you could be better off focusing on quality rather than quantity.

Normally, when London and Europe are open for business, pairs with the Euro, British pound, and Swiss franc are most actively traded. Then, when New York opens, currency pairs with the US dollar and Canadian dollar gather momentum.

The USD/JPY, however, doesn’t quite follow this tradition. The pair sees relatively consistent volume throughout the day, of course, with occasional spikes in volatility. Liquidity is often highest during major session overlaps, especially London–New York, but USD/JPY can also be very active during the Tokyo session and around major US/Japan data releases. Rather than relying on a fixed window, many traders align activity with scheduled economic events and the periods of highest liquidity for their strategy.

At these times, you will also benefit from the tightest spreads and potentially the greatest opportunities to generate profits. So, check for intraday volatility and focus your trading capital on this time slot.

Rise & Shine

Determined USD/JPY day traders are at their desks premarket, preparing for the trading day ahead. Furthermore, they may have their economic calendar in front of them, along with historical exchange rate data on an Excel spreadsheet. Whilst everyone else is just waking up, they’ve pored through discussion forums and data, so they have clear expectations for the day ahead. Related stock shifts and daily pivot points may surprise others, but early risers are often ready and waiting to react. By closing time, unlike most, they haven’t sunk into the red.

So, in the forex world, where short and sharp reversals are a regular occurrence, preparation is key. Even if it means working outside of your normal market hours.

Simple Moving Average Cross & Bounce

The good news is, the USD/JPY is ideal for intraday trading. Volatility often increases around major session opens and high-impact economic releases, which can create rapid intraday moves. So, what strategy can you use to capitalise on rich price action movement?

The simple moving average cross and bounce is a straightforward strategy to set up and execute. Although some prefer USD/JPY 15-minute charts, this technique works best with a 4-hour candlestick chart.

The indicators you will need are as follows:

- MA (50/200)

- BB (20)

Buy Entry Rules

1. The BB (MA20) must be above MA (50).

2. Price needs to cross above both BB (MA20) and MA (50).

3. Price also must test BB (MA20) as support whilst above MA (50).

4. Look for a bullish confirmation candle from support.

5. Enter a buy/long entry.

Sell Entry Rules

1. BB (MA20) needs to be below MA (50).

2. Price has to cross below both BB (MA20) and MA (50).

3. Price needs to test BB (MA20) for the resistance whilst staying below MA (50).

4. Look for a bearish confirmation candle from resistance.

5. Place a short/sell entry.

To minimise risk, you should also look to incorporate stop losses. So, place a stop-loss at the bottom/top wick of the confirmation candle, dependent, of course, on whether you are buying or selling. You should then allow the price to move in the trade direction.

Once the price retests MA (20), you should move the stop-loss to the top/bottom wick of the candle. Keep repeating this until the price no longer stays above/below MA (20) and hits the stop-loss.

News

The latest market news updates on the USD/JPY currency pair can quickly affect market sentiment and lead to shifts. However, you can only capitalise on these moments if you understand how the markets reacted last time something like this happened.

So, to keep abreast of live news updates, recommendations, daily, weekly, and monthly forecasts, plus technical analysis and commentary, consider some of the popular resources below:

- Federal Reserve calendar

- Japan MoF intervention releases

- BoJ announcements

- Bloomberg

- Forex Factory

- Yahoo Finance

- Google Finance

- Reuters

- CNBC

In addition, here are just a few more benefits some of the sources above can offer:

- Daily forex outlook.

- Latest USD/JPY forecasts.

- Historical prices.

- 20 years, 30 years, and 50 years worth of historical graphs and long-term charts.

- Trading definitions.

- Weekly and monthly data.

- An overview of yesterday’s USD/JPY performance and prices.

Regardless of whether your USD/JPY strategy focuses on resistance and support levels or whether it centres around news events, being aware of current updates in the forex space could seriously enhance your technical analysis.

History

Japanese Economy

To make accurate USD/JPY predictions and forecasts, it also helps to understand some key events in the pair’s relationship.

Japan may lack natural resources and geographic size, but its work ethic, success with technologies, and boundary-pushing manufacturing techniques have ensured the economy has flourished since the damage it suffered in World War II. Japan remains one of the world’s largest economies, recently ranking around fourth by nominal GDP, behind the US, China, and Germany.

However, historical data and news show us the Japanese economy came upon hard times in the early 1990s. This is because the real estate and domestic equity bubbles burst. As a result, the economy decelerated, and there was substantial deflation.

However, the last twenty years have seen the introduction of a number of measures by the Japanese government and Bank of Japan (BoJ) to rejuvenate the economy. Whilst not totally successful, there is little debate that their economy today is a major player on the global stage.

Why does all this matter if you want to start day trading on the USD/JPY? Because an understanding of what and how previous factors have influenced economic strength and growth will give you a clearer future forex outlook. All of which may result in more accurate predictions and forecasts.

Japanese Yen

Since its introduction in 1871, the yen has become the most traded currency in Asia and one of the most actively traded currencies globally. On the whole, when the Japanese economy performs well, the yen increases in strength against the dollar.

In fact, steps that were taken to keep interest rates low to stimulate the economy have led to the yen becoming an increasingly popular carry trade. This is where investors sell the yen to buy higher-yielding currencies. This constant selling has kept the yen at a much lower trade level than it might have reached otherwise. See our carry trade page for more details.

In conclusion, this all means USD/JPY traders need to keep abreast of new data and information about Japan’s economic growth and recovery. So, if a rise in rates takes place and the popularity of the yen carry trade diminishes, this could result in a strengthening of the yen.

US Dollar

The US dollar has been the standard US monetary unit for over two hundred years. However, whilst the Japanese yen and the economy suffered from World War II, the years that followed the war saw the US economy and dollar boom. This is partly because of the 1944 Bretton Woods Agreement.

In fact, if you load up a graph and look at USD/JPY historical exchange rate data, you will quickly see that this agreement played a huge part in securing the success of the US dollar. It helped cement the US dollar’s central role in the post-war monetary system: many currencies were pegged to the dollar, and the dollar was linked to gold under Bretton Woods.

Recent History

The USD/JPY relationship has seen significant fluctuations in the 2020s as inflation, interest rates, and policy paths have diverged. Two BIS surveys and Japan’s 2022 intervention illustrate the scale of modern activity:

- In the BIS Triennial Survey (April 2025), global FX turnover averaged $9.6 trillion per day; the US dollar was on one side of 89.2% of trades, and USD/JPY averaged $1.372 trillion per day (14.3% share).

- In the BIS Triennial Survey (April 2022), global FX turnover averaged $7.5 trillion per day; the US dollar was on one side of 88% of trades, and USD/JPY averaged $1.014 trillion per day (13.5% share).

- Japan’s Ministry of Finance intervention data shows a yen-buying intervention on 22 September 2022 totalling ¥2,838.2 billion (selling USD and buying JPY).

Overall, tracking how liquidity, policy expectations, and intervention risk have shifted in recent years can help traders interpret today’s USD/JPY moves.

Role of USD

You can’t get a clear view of the USD/JPY relationship without understanding the significant role the US dollar plays. So, below are just a few ways it holds a unique position in global finance:

- Numerous banks around the world hold currency reserves in US dollars.

- Many small countries even opt to use US dollar instead of their own currency or peg their currency to its value.

- Global crude oil benchmarks are traditionally priced in US dollars.

- It is often used to settle international financial transactions.

- Gold prices and other popular commodities are also frequently set in US dollars.

- It is currently the most commonly traded currency in the world.

- The US is one of the world’s largest trading economies and has recently been the largest importer of merchandise, according to WTO reporting.

- IMF World Economic Outlook estimates imply the US is roughly 26% of world GDP (nominal) in 2025.

- Services make up the majority of US economic output (see BEA GDP data).

Aspiring day traders would be wise to get an understanding of the reach and prominence the US dollar holds. In fact, monitoring US economic strength will help you to forecast how the USD/JPY will strengthen or weaken in favour of the US dollar. However, effective monitoring means looking out for signals and economic indicators. Some of the key reports to follow include:

- Consumer Price Index (CPI)

- Producer Price Index (PPI)

- Non-farm payrolls

- ISM Services PMI (formerly Non-Manufacturing)

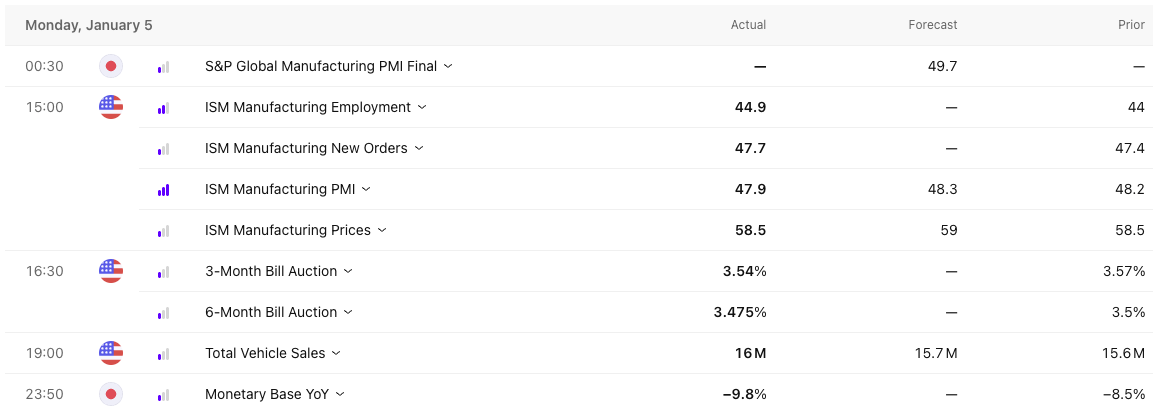

- ISM Manufacturing

- Trade Balance

- FOMC meeting calendars, statements, and minutes

- Retail Sales

- Industrial production

So, by looking at charts and historical graphs, you get a feel for why certain currency pairings react as they do. Hourly charts and key levels may be important for your forex outlook today, but so too is information on events decades ago. Overall, all will enhance your understanding of what drives movement in the USD/JPY currency pair.

Role of JPY

It’s all too easy to focus your attention on the strength and role of the US dollar. However, the Japanese yen also plays a vital role. This is because it is the most liquid currency in Asia. This also makes it a gauge for Asian economic growth.

In times of economic instability and volatility in Asia, traders often respond by buying or selling the yen. This is because other Asian currencies are more challenging to trade. A spike of which can seriously impact market prices and quotes for the USD/JPY.

The yen is traded heavily in part because Japan has had very low interest rates for long periods, making JPY a common funding currency in global positioning. The Bank of Japan has also used large-scale monetary easing (including asset purchases), which can influence liquidity conditions and the exchange rate. A weaker yen can raise import costs and may improve exporters’ price competitiveness, though outcomes vary with global demand and corporate hedging.

The yen is also a major reserve currency. The yen is also a major reserve currency tracked in the IMF’s COFER dataset, which reports the global currency composition of official FX reserves.

Understanding the yen’s global role will allow you to better evaluate trends in the USD/JPY, not to mention conduct real-time fundamental analysis.

Final Word

In conclusion, the USD/JPY currency pairing ranks second for liquidity. In addition, its behaviour promises day traders precisely the volume and volatility required to yield profits. However, competition is fierce, and an understanding of all the market forces at play will be needed to assert an edge.

So, you will have to conduct your own expert analysis, using interactive daily, weekly, and historical charts to make accurate projections. You will also need a forex trading platform that complements your trading style. However, if you tick those boxes, plus utilise the resources outlined on this page, generating those rich forex profits may be a possibility.

For more guidance, see our forex page.