Trading EUR/JPY

The EUR/JPY currency pair is a highly liquid and often volatile duo, making it popular with short-term traders. In fact, the Euro and Japanese Yen are the second and third most traded currency pairs globally, according to the Bank of International Settlements.

This guide will help you understand the EUR/JPY and how to start day trading this forex combination.

Quick Introduction

- Trading the EUR/JPY currency pair involves buying or selling the Euro against the Japanese Yen.

- The EUR/JPY is the seventh most traded forex pair according to Saxo, which adds its “regular volatility [attracts] day traders”.

- The EUR/JPY is notably choppy following economic news like interest rate decisions from the Bank of Japan and European Central Bank.

- The optimal time to day trade EUR/JPY is from 07:00 to 10:00 UTC, during the European and Asian session overlap, when liquidity and volatility peak.

Best EUR/JPY Brokers

These 4 brokers offer excellent platforms and pricing for day trading the EUR/JPY:

Understanding The EUR/JPY

This currency pairing illustrates the exchange rate between two of the world’s biggest currencies: the Yen, which is the official currency of Japan; and the Euro, which is shared by 20 European countries including regional economic heavyweights Germany, France and Italy.

This crossover is not considered one of the world’s major currency pairings. Such assets typically involve the US Dollar paired up against the Euro (EUR/USD), the Yen (USD/JPY) and the British Pound (GBP/USD).

The EUR/JPY is known as a ‘cross’ currency pair, which is the broad term for combinations that don’t involve the North American currency. It is also broadly categorized as a ‘minor’ forex pair, unlike those mentioned above.

Having said that, the significance of the eurozone and Japanese economies to the global economy means it sits on the very edge of this elite group.

The EUR/JPY is informally known by traders as the ‘Yuppy’!

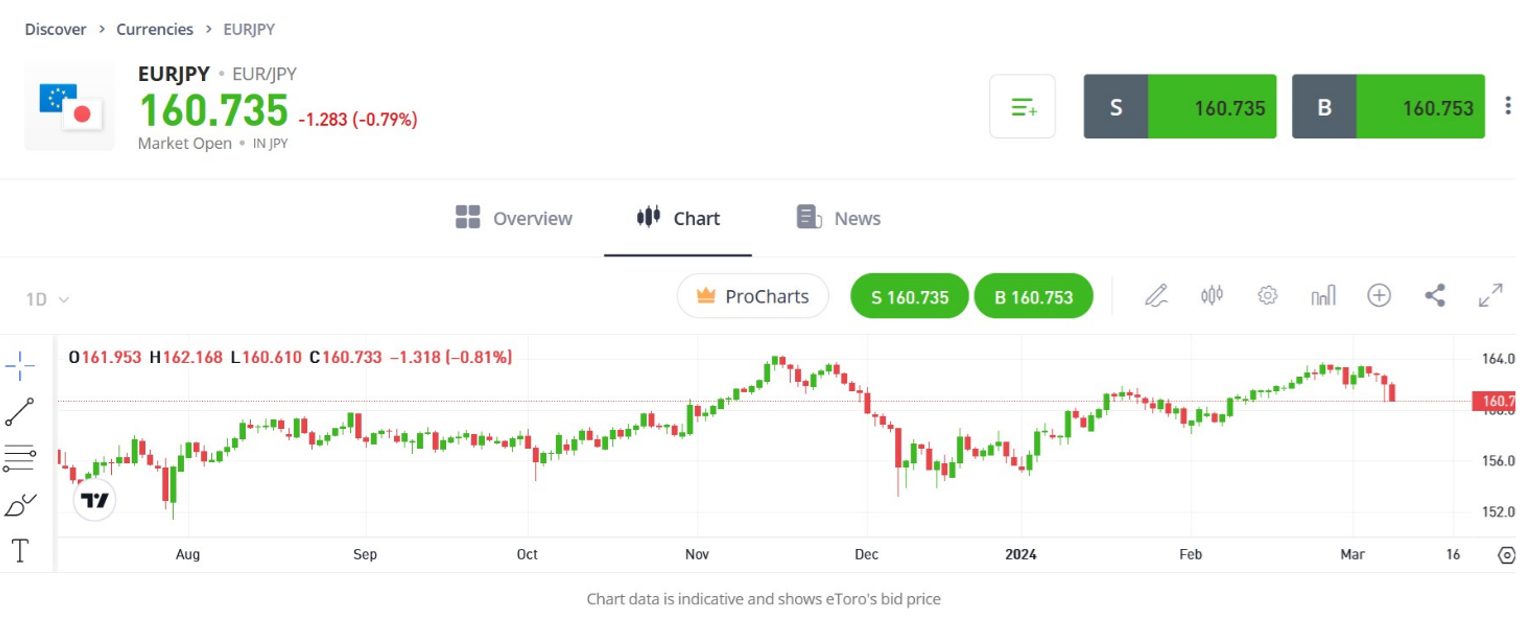

Live Chart

Why Trade The EUR/JPY?

With hundreds of currency pairings to speculate on, why choose the Japanese and eurozone counters?

- Deep Liquidity. The pairing is traded across the globe, which makes it easy to find buyers and sellers at all times of the day. This allows short-term traders to enter and exit positions quickly and easily. High liquidity also means that bid and ask spreads tend to be quite narrow, so the EUR/JPY can help day traders keep costs down.

- Frequent Volatility. The EUR/JPY is famous for having higher levels of volatility than most other currency pairs. As a consequence, it provides short-term traders with regular opportunities to profit from steep price fluctuations. That said, rapid and severe price changes can also see traders rack up large losses in a short space of time. For this reason, new traders should be especially careful and use risk management tools like stop loss instructions and take profit orders.

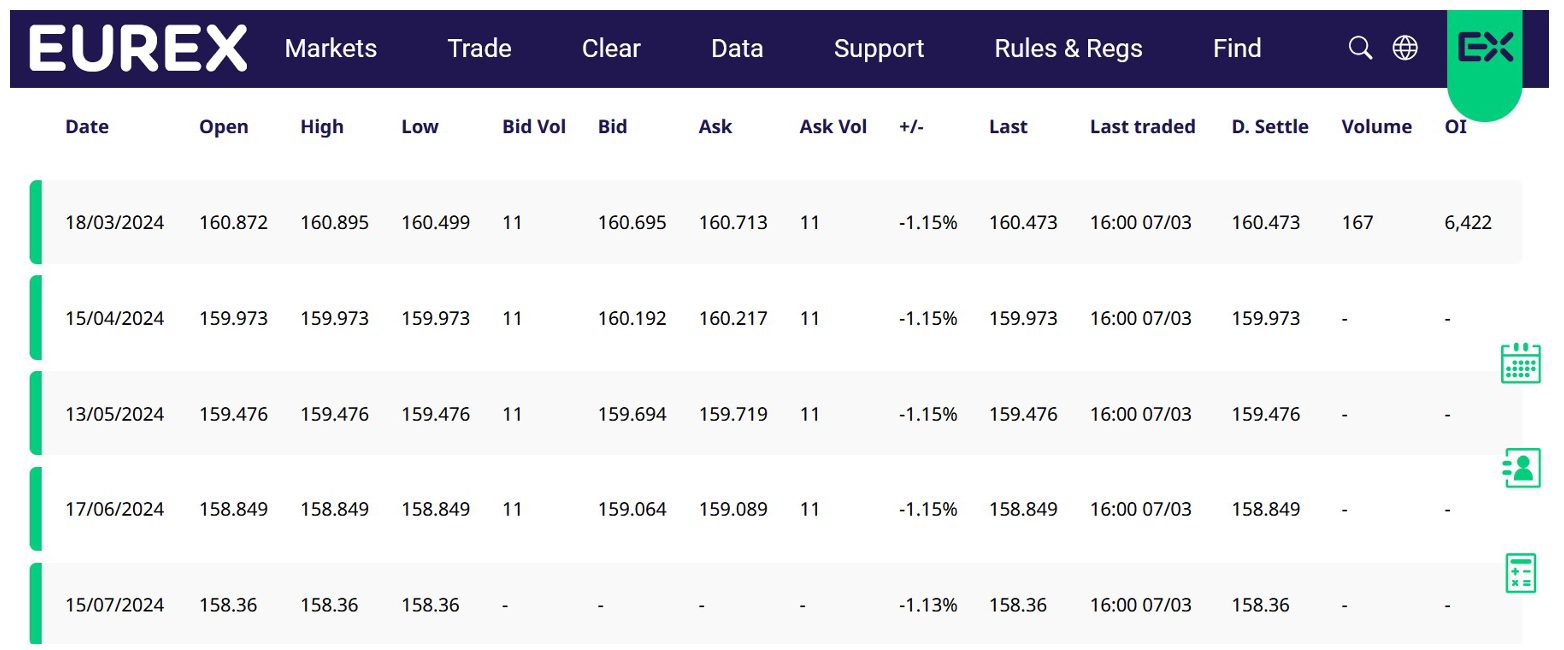

- Multiple Ways To Trade. Speculators can try to profit from the EUR/JPY pair using a wide variety of different instruments. They can trade the forex combination itself by buying or selling the Euro itself against the Asian counter. Traders can also use derivatives like contracts for difference (CFDs), futures and options, which allow them to bet on price changes without owning the counters themselves. Or they can choose to invest in an exchange-traded fund (ETF).

What Moves The EUR/JPY?

The EUR/JPY pair can be influenced by a wide range of factors, notably:

- Interest rate decisions and commentary from the Bank of Japan (BoJ) and European Central Bank (ECB). Japan’s quantitative easing measures in recent years have been the most aggressive in the world – even bigger than the US, despite its economy being half the size.

- Gross domestic product (GDP), employment, inflation and purchasing managers’ index (PMI) numbers from both regions. PMIs are released each month and report on the strength of each sector. Inflation must be kept below or close to 2% by the ECB. Movement in this could cause the bank to take action.

- Trade data, as Japan is famous for being a major goods exporter. Equally, in recent years, Japan has been the fourth-largest importer of crude oil and the second-biggest importer of natural gas. The relationship between the Yen and energy pricing, therefore, can impact the EUR/JPY.

- Information on the Bank of Japan’s bond-buying programme. The Bank is a major purchaser of government bonds, and in 2023 it owned more than 50% of these instruments.

- Natural disasters. Earthquakes and tsunamis are common phenomena in Japan that have serious economic consequences on its economy.

- Political events like election results, news on trade deals, and government stimulus initiatives. Political disagreements as to the future of the Euro may also cause it to weaken vs the Yen.

On top of this, the pairing is also highly sensitive to factors outside Japan and the eurozone. It can whipsaw wildly according to economic news from other major economies like the US and China. As a cross-currency pair, it is also influenced by movements in the US dollar.

All this means that traders need to have a good grasp of fundamental analysis to succeed, though this is not the only requirement. As with short-term trading of any forex pairing, EUR/JPY traders also need to be up to speed when it comes to technical analysis.

Studying charts reveals information on price and volume trends that investors can use to identify trading opportunities. Identifying support and resistance levels, and utilizing technical indicators (like the relative strength index (RSI) and Bollinger Bands), are essential tools in the successful trader’s toolbox.

Price History

Trade

The EUR/JPY relationship blossomed to some extent, by the increased trading activity between Japan and the EU. Consequently, Japan is the fourth largest global economy and much of its trade is driven by exports to the EU.

Having said that, between 2005 and 2015, political disagreements and tariffs saw the EU consistently run a negative trade balance with Japan. In fact, from 2005 to 2011, the trading relationship generated an average annual negative balance of £28,741 million to the EU.

However, to try and tackle this one-sided trade balance, both the EU and Japan have looked to promote the following measures:

- Pursuit of a comprehensive Free Trade Agreement (FTA)

- Development of the EU-Japan Business Roundtable (BRT)

- Participation in the Asia-Europe Meeting (ASEM)

Financial Crisis

The EUR/JPY relationship has been turbulent since the introduction of the Euro in 1999. In fact, one of the most influential events was the 2008 global financial crisis. As a result, the EUR/JPY fell from 169.78 in July 2008 to a low of 115.00 in February 2009.

The EUR/JPY downtrend resulted in a 30% appreciation of the JPY. It illustrates why traders and investors have traditionally seen the Japanese Yen as a safe haven currency. It also appears that Japan’s economy is relatively isolated from global economic crises, attracting investment during these times.

In these periods both domestic and international investors choose to retain their capital in the Yen, resulting in the Yen strengthening against other currencies, such as the Euro.

‘Abenomics’

EUR/JPY rates and prices are also affected by significant political decisions. For example, in 2012, Japanese Prime Minister Shinzo Abe introduced his “Abenomics” plan to bolster the economy.

The result – long-lasting devaluation of the Yen against the Euro. Hence in the wake of his election, investors instead chose to hold Euros over Yen. As a result, the EUR/JPY rose from 98.75 on July 1, 2012, to a high of 118.82 on January 1, 2013.

Switched-on day traders will keep abreast of such political trends and announcements to allow them to make more accurate predictions and forecasts on price fluctuations.

A Trade In Action

Let’s put all this together and look at trading this currency pair in real life.

I’m looking to trade the EUR/JPY around the time of an interest rate decision by the ECB. I expect that the central bank will decide to raise its benchmark rate, a development that could push the value of the Euro higher from its current level of 160.00.

At these levels, one Euro is equivalent to 160 Japanese Yen.

I wish to invest €500 in this trade and select a lot size of 100,000.

The Trade

To profit from this, I need to enter a long position at the current price of 160.00. This involves me buying the base currency (the Euro), and simultaneously selling the quote currency (the Yen).

Along with executing this trade, I place a stop-loss order at 159.00 to manage risk and limit losses if the euro instead falls.

I also decide to execute a take profit instruction at 163.00, a move that will lock in my gains if the forex pairing reaches this level.

The Outcome

As I expected, the ECB announces an interest rate hike, causing the Euro to rise. Within a few hours, the single currency has increased to my take-profit level of 163.00, giving me a 300-pip gain.

But what is the monetary profit I’ve made from this trade? It can be worked out with the following calculation:

- Lot Size: 100,000

- Change In Exchange Rate: 163.00 – 160.00 = 3.00 (or 300 pips)

- Pip Value: (0.01 / 160.00) * 100,000 = €6.25

- Profit: €6.25 * 300 pips = €1,875

This simplified calculation does not consider the impact of bid and ask spreads on my eventual profit.

How To Start Trading The EUR/JPY

It takes minutes to start trading the Euro and Yen combination. It requires three simple steps:

Choose A Forex Broker

The first thing to do is check that the forex broker in question is regulated. There is a long list of unauthorized operators out there that could put your funds at risk.

Next, see which financial instruments the company will allow you to trade. The popularity of trading the EUR/JPY cross means that many brokers will let you deal in the currency pairing itself as well as in related instruments like CFDs.

Investors who wish to trade forex with leverage need to remember that the amount of borrowed money can differ substantially from broker to broker and between regulatory jurisdictions. That said, in Europe, leverage is often available up to 1:30 on the EUR/JPY for retail investors.

With both of these essentials ticked off, look at the fees the company charges, the quality of its trading platform, and any additional resources or sophisticated trading tools that it offers, for example, economic calendars that highlight upcoming announcements from the ECB or BoJ.

If you’re happy at this stage, open an account and get ready to trade by depositing funds. This can usually be done quickly and easily via a bank transfer or through a debit card transaction.

Devise A Strategy

Don’t jump straight in and start placing buy and sell orders, of course. It’s essential to come up with a detailed trading strategy first, setting up clear risk management rules and establishing an acceptable risk-to-reward ratio.

You’ll also need to carry out fundamental and technical analysis so you can make an informed decision as to which way the currency pair may move. It can also be a good idea to start with a demo account to ensure you are well-prepared before putting cash on the line.

Place A Trade

When starting out, remember to deal only in small amounts and to never trade with funds you can’t afford to lose.

It’s also important to maintain a close eye on market movements and to keep up to speed with fundamental and technical developments. Forex prices can move sharply, especially in the EUR/JPY, and you may need to act quickly to exploit a profit opportunity or limit a loss.

It can also be a good idea to keep a journal. This can provide valuable data that helps you evaluate the effectiveness of your short-term trading strategy, and pinpoint where you need to make adjustments.

Bottom Line

The EUR/JPY currency pair offers the dual qualities of frequent volatility and deep liquidity. Yet to profit in this competitive marketplace, you will need to keep abreast of developments primarily in the eurozone and Japan and further afield.

Use our ranking of the best EUR/JPY brokers to start trading.

Article Sources

- Forex Trading: The Basics Explained in Simple Terms – Jim Brown

- The Most Commonly Traded Forex Pairs – Saxo Bank

- Foreign Exchange Turnover - Bank of International Settlements

- European Central Bank (ECB)

- Bank of Japan (BoJ)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com