PU Prime Review 2026

See the best PU Prime alternatives in your location.

Pros

- PU Prime has upped its game over the years, including launching its PU Social app in 2022, securing ASIC authorization for its Australian entity in 2025, and adding over 200 trading instruments, bringing the total to 1,000+.

- Prime and ECN pricing can be very competitive for active traders, and in our tests spreads tightened notably in liquid sessions to hit ~0.0 pips.

- The platform lineup is strong, with the PU Prime Web Trader and app especially smooth to use with a modern design, easy-to-configure order tickets and responsive charts for fast entries and exits.

Cons

- The ECN account’s $10,000 minimum deposit puts the best pricing out of reach for some active retail traders who may end up paying more for spreads and commissions on Prime, Standard or Cent accounts.

- Getting through to customer support can be fiddly and slow to reach a human – in our latest checks we had to navigate multiple chatbot menus and questions then enter contact details before getting to an agent.

- The in-house market updates are useful for a quick read, but they’re generally high-level and don’t go deep enough for serious strategy building or advanced analysis.

PU Prime Review

Our review of PU Prime is based on the hands-on tests we’ve been conducting since 2021. We’ve opened accounts, used its trading tools, and tracked changes over the years, including to its regulatory credentials. Find out how PU Prime stacks up against the competition.

Regulation & Trust

PU Prime is a trusted broker because it holds licenses with multiple regulators, including at least one ‘green tier’ body (ASIC) in our Regulation & Trust Rating. It’s also well-established having been founded in 2015, has over 450,000 users, and a solid track record our team have followed over years of testing.

In Australia, PU Prime Trading Pty Ltd is authorised by the Australian Securities & Investments Commission (ASIC) (a ‘green tier’ regulator) under AFSL 410681. PU Prime (PTY) Ltd is also authorised by the Financial Sector Conduct Authority (FSCA) in South Africa (a ‘yellow tier’ regulator) under FSP No. 52218.

These onshore frameworks generally require high standards around conduct and client-money handling, and are often accompanied by safeguards like negative balance protection and segregated client accounts.

PU Prime also operates internationally via additional regulated entities, including oversight in the UAE via the Capital Market Authority (CMA) (a ‘yellow tier’ regulator), via PU Prime Financial Services L.L.C.

There are also offshore authorisations with the Financial Services Authority (FSA) of Seychelles (a ‘red tier’ regulator) under SD050, and the Financial Services Commission (FSC) of Mauritius (also ‘red tier’), under PU Prime Ltd (GB23202672). These offshore licenses can provide greater flexibility in trading conditions, such as higher leverage, but you may lose some of the stronger protections typically associated with green/yellow tier jurisdictions, such as access to investor compensation in case of broker insolvency.

Trader feedback is generally positive, including the user feedback we track at the bottom of our PU Prime review, where it has generally received over 4/5 in ratings.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | ASIC, FSCA, CMA, FSA, FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Segregated Client Accounts | Yes | Yes | Yes |

| Negative Balance Protection | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

PU Prime offers four account types, catering to a wide range of traders and strategies:

| Account | Account Currencies | Spreads | Commission | Minimum Deposit | Margin Call | Stop Out | Best For |

|---|---|---|---|---|---|---|---|

| Standard | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | From 1.3 pips | $0 | $50 | 50% | 20% | General Traders |

| Prime | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | From 0.0 pips | $3.5 per side/lot | $1,000 | 50% | 20% | Active Traders Seeking Low Spreads |

| ECN | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY | From 0.0 pips | $1 per side/lot | $10,000 | 50% | 20% | High Volume Active Traders |

| Cent | USC | From 1.3 pips | No | $20 | 50% | 20% | Newer Traders |

PU Prime also offers the option to open an Islamic variation on their Standard, Prime, and Cent accounts. Islamic accounts are structured to be compliant with Sharia law, and do not charge nor accrue overnight interest on positions. Instead Islamic accounts are charged an administrative fee for overnight positions determined by the broker’s liquidity providers.

It is quick and easy to open a live account with PU Prime, and even can be done through the mobile app. You complete an online registration form and provide identification verification documents, such as proof of residency.

Promotions

PU Prime offers various incentives. This includes a 50% credit bonus up to $10,000 (50% on the first $1,000 and 20% thereafter) and a free VPS if you meet deposit and volume requirements ($1,000 deposit and monthly notional value of $0.5 million/$1 million on closed trades).

A refer a friend scheme is also available, where traders can earn up to $150 for each friend that opens a live account and meets the eligibility criteria.

Still, we never recommend choosing a broker based on their promotions. Incentives to open an account are restricted by regulators in certain regions due to concerns they may encourage overtrading. We’ve also combed through the terms and conditions and sometimes there are withdrawal restrictions that make it hard to extract trading credit.

Deposits & Withdrawals

PU Prime provides traders with flexible deposit options. The broker does not charge a fee for any account funding methods, however third-party charges may apply. The good news is PU Prime offers up to a $20 rebate for any charges that third parties like banks might impose.

| Method | Deposit Time | Withdrawal Time | Fees | Min Deposit | Currencies | Notes |

|---|---|---|---|---|---|---|

| Local Bank Transfer | Instant | Instant–1 day | $0 (may vary by bank) | $50 | All | Most convenient where local banking supported |

| International Bank Transfer | 2–5 business days | 2–5 business days | $0 (first monthly withdrawal fee waived) | $50 | USD, EUR, CAD, GBP, AUD, AED | Best for large transfers |

| Credit/Debit Card | Instant | Instant–2 days | $0 | $50 | All | Max ~$10,000 per transaction |

| E-wallets (Skrill, Neteller, etc.) | Instant | Instant | $0 | $50 | All | Fastest overall processing |

| Cryptocurrency | Depends on network | Fast (block confirmations) | Network fees only | $50 | Crypto-based | Processed via crypto gateway |

| Regional Instant Bank Transfers | Instant | Instant–1 day | $0 | $50 | Local currencies | Available in select countries |

Demo Accounts

A demo trading account is available at PU. We’ve opened multiple over the years and found these accounts are a good way to practice execution, navigate PU Prime’s platform features, and test strategies risk-free.

Traders can access up to $100,000 of virtual funds and experience real-time trading conditions and prices on the MT4, MT5, or PU Prime trading terminals.

Sign up is required to open an account via a simple online registration form. These accounts expire automatically after 60 days.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, B2BinPay, Bitwallet, Credit Card, Debit Card, FasaPay, Mastercard, UnionPay, Visa, Wire Transfer | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer | ACH Transfer, Credit Card, Debit Card, Mastercard, Neteller, PayNow, Skrill, Visa, Wire Transfer |

| Minimum Deposit | $20 | $0 | $100 |

| Fast Withdrawals | No | No | Yes |

| Islamic Account | Yes | No | Yes |

| Demo Account | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

PU Prime offers a strong choice of trading instruments that has improved over the years, jumping from around 800 assets to over 1,000. We logged into the platform to record and evaluate the range of assets – you can trade:

- Commodities: Speculate on 20+ energies, metals and softs like CL-OIL (WTI), UKOUSD (Brent), and XAU/USD (GOLD).

- Indices: Trade 30+ major global indices like DJ30, NAS100, GER40, and HK50, plus the VIX.

- Forex: Trade 65+ major FX pairs like EUR/USD, USD/JPY, GBP/USD, and AUD/USD.

- Shares: Trade 800+ share CFDs on big names like AMAZON, TSLA, VISA, and IBM.

- Crypto: Trade 65+ cryptos paired with fiat currencies and digital tokens, including BTC/USD and BTC/BCH.

- ETFs: Trade 55+ ETFs like BITQ, BLOK, BKCH, and GOAU.

- Bonds: Trade 5+ sovereign bond markets like USNote10Y and LongGilt, plus Europe-focused instruments like EUB10Y.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Number of Instruments | 1000 | 1000000 | 5700 |

| Extended Hours Trading | No | Yes | No |

| Fractional Shares | No | Yes | No |

| Margin Trading | Yes | Yes | Yes |

| Maximum Leverage | 1:1000 | 1:50 | 1:50 |

| Fast Execution | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

PU Prime operates a no dealing desk model resulting in competitive pricing, alongside fewer outages and a great depth of liquidity.

Fees are variable between account types, but the Prime and ECN solutions generally offer the tightest spreads for day traders, with quotes directly from major liquidity providers. During particularly liquid times, we’ve observed that spreads can be as low as 0 pips.

There is no commission applicable on any trades executed under the Standard account. A $3.50 commission per side/lot applies across the majority of trading instruments under the Prime account. For the ECN account, an ultra-low $1 commission per side/lot applies; however, the ECN account has a minimum deposit of $10,000, putting it out of reach for many retail traders.

The broker does not charge an inactivity fee, account opening fees, or deposit fees. However swap rates for positions held overnight apply – a consideration for swing traders.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Fixed Spreads | No | No | No |

| Inactivity Fee | $0 | $0 | $15 |

| EUR/USD Spread | 0.2 pips (ECN) | 0.08-0.20 bps x trade value | 1.2 |

| FTSE Spread | 23 (ECN) | 0.005% (£1 Min) | 1.0 |

| Oil Spread | 2.2 (ECN) | 0.25-0.85 | 2.5 |

| Crypto Spread | 27.5 (BTC) | 0.12%-0.18% | BTC 1.4%, ETH 2% |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

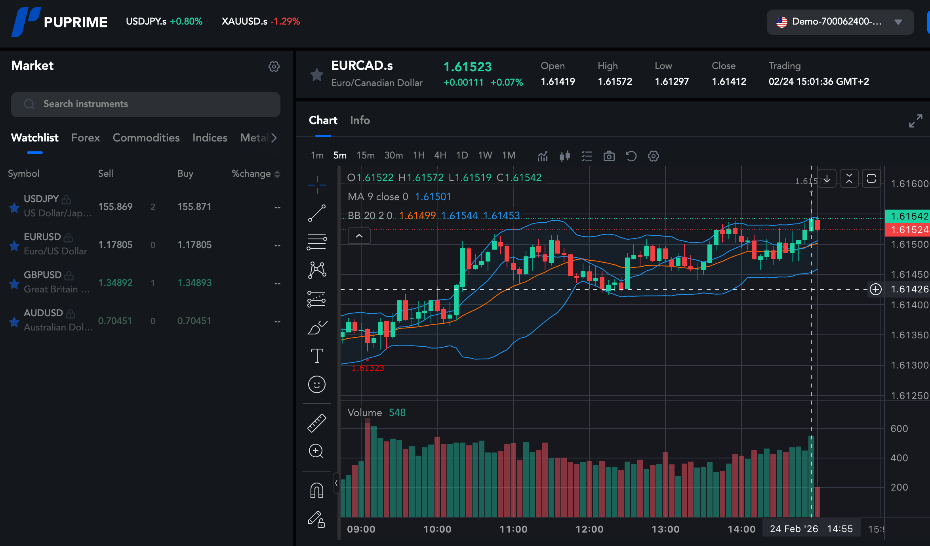

PU Prime offers an excellent choice of trading software, including a mobile app, which combines full dealing functionality and charting tools with an easy-to-use interface. The app also allows customers to access account management features, promotions, and trading insights like news and analysis.

Additionally, PU Prime offers both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) terminals. Both are globally recognized platforms amongst active traders, sporting rich technical analysis tools and algo trading features, available for download to desktop and mobile devices.

The broker also hosts the PU Web Trader terminal, allowing clients to trade directly via major web browsers without the need for software download. We prefer the dark mode to the light design – it has a neat look and feel, and with either you can get live chat support in the top-right menu without having to leave the platform interface.

After spending hours using the broker’s platforms and apps, we’ve documented our testing observations and compared each tool side-by-side:

| Feature | PU Prime Mobile App | PU Web Trader | MT4 | MT5 |

|---|---|---|---|---|

| Compatibility | Android, iOS | Windows, Mac, Linux | Desktop (Windows, Mac) | Desktop (Windows, Mac) |

| Charting & Timeframes | Charting + indicators; 9 timeframes | 3 chart types; 9 timeframes; 24 graphical objects | 3 chart types; 9 timeframes; 24 analytical charting tools | Customizable charts; up to 100 charts; 21 timeframes |

| Trading & Orders | Full dealing; one-tap trading; SL/TP; limit + stop orders | One-click trading; supports all trading operation types; netting + hedging | One-click trading; live price streaming; 4 pending order types; instant execution | One-click trading; 8 order types; pending/stop/trailing stops |

| Indicators/Tools | RSI, BB, MACD, KDJ + more | 30 technical indicators; advanced market depth | 50+ preinstalled indicators; EAs; MQL4 | 80+ built-in indicators; trading bots; sentiment + economic calendar |

| Notable Extras | In-app promotions; weekly trading summary; news & analysis; account management | Real-time quotes; 24/7 online support; reliable data protection | Multilingual UI; huge EA/community ecosystem | Real-time market news; deeper tooling vs MT4 |

| Design Observations | Clean, app-first layout; simplified navigation; built for quick actions over multi-chart work | Modern web-style UX; info-dense but intuitive; strong chart/order-ticket balance | Classic/dated but familiar; fast + lightweight; chart-centric | More polished than MT4; powerful workspace that’s faster with more tools |

| Best For | Casual traders on the go/mobile-first users | Active traders seeking a modern design in-browser | Forex traders focused on technical analysis and MT4 EA users | Technical analysis and algo traders; traders wanting an integrated economic calendar |

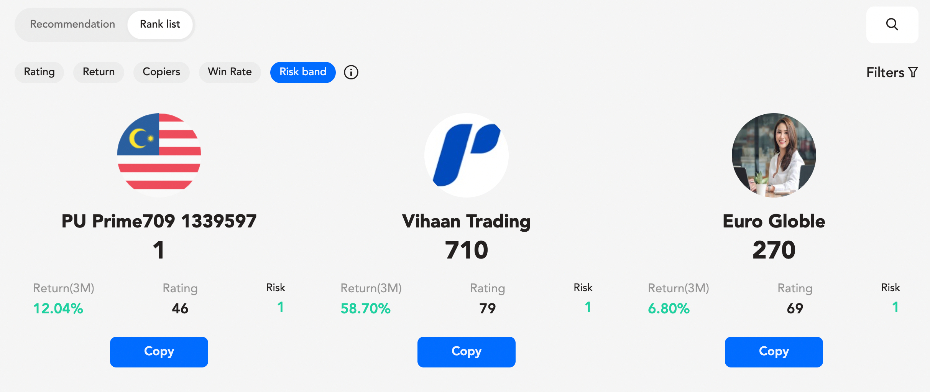

PU Social

PU Prime also released a proprietary social trading application in 2022. Available from the App Store, Google Play and web browsers, clients can follow the positions and strategies of the broker’s top traders. This is an enticing proposition for newer traders looking to learn about different assets and investment techniques, and they can get started with $50.

We’ve tried it and PU offers a string of insights to help beginners find the right Master Trader for their needs, including details of monthly returns, markets traded, and their risk band. In addition, traders maintain flexible control over trading parameters, including position sizes.

It really impressed during testing and other users agree, with more than 150,000 copiers and over 3 million trades copied from more than 32,000 strategy providers.

For seasoned traders, the PU Social application could provide a second revenue stream. Master Traders can choose to charge a subscription or a commission on profitable trades.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile App | iOS & Android | iOS & Android | iOS & Android |

| Automated Trading | Expert Advisors (EAs) on MetaTrader | Capitalise.ai, TWS API | Expert Advisors (EAs) on MetaTrader |

| Copy Trading | Yes | No | No |

| VPS | Yes | No | Yes |

| Guaranteed Stop Loss | No | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

PU Prime’s research offering is pretty solid – split between in-house market insights and a decent set of built-in analysis tools.

Market Insights is organised into streams like Chart The Market, Market Pulse, and Weekly Outlook, with articles covering current themes across major markets.

PU Prime also supports third-party provider, Autochartist, which includes a Market Scanner, Market Reports (pre-major-session technical snapshots), and a research portal for pulling everything together in one place. Pretty handy for day traders.

You also get practical trader staples like an economic calendar plus trading calculators (profit, margin, currency converter, Fibonacci, position size, notional volume) and a heatmap for forex, shares, and ETFs.

We’ve been impressed with the breadth, especially with Autochartist and calculators, but when we dug through them the ‘insights’ content is fairly high-level.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Research Rating | |||

| Autochartist | Yes | No | No |

| Trading Central | No | Yes | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

PU Prime is set up well to educate beginners through its Trading Academy, which is structured by Beginner/Intermediate/Advanced.

You can filter by topic tags like How-to, What-is, Technical Analysis, and Trading Strategies, plus there’s a dedicated Copy Trading learning avenue.

Beyond written lessons, they provide video tutorials (including intro to trading, technical analysis, and strategies, interactive quizzes grouped by level (e.g., Rookie/Proficient/Master), and downloadable e-books (e.g., trading tips, managing risk, chart patterns, plus copy trading content). They also offer some webinars led by in-house analysts/strategists, with presenter bios by region.

What’s good is the range of learning materials, from articles and videos to quizzes, webinars and ebooks, which are generally beginner-friendly from the content we’ve read, watched and listened to, while the progression paths are useful.

The main limitation is that a lot of content reads generalist rather than deeply technical, which may be what aspiring day traders and searching for.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

PU Prime offers multiple support channels: 24/7 live chat, email (info@puprime.com) and phone support (+248 437 3105), plus a searchable Help Center that covers common account, funding, and platform questions.

The catch is that there can be reduced weekend hours rather than true 24/7 hands-on support. This is a consideration for crypto traders deploying weekend strategies – if you run into urgent issues it may be Monday before help is around.

Our only gripe is that they’ve introduced an automated chatbot, which can be frustrating to use. For example, in our last round of tests, I had a question about account opening but had to get through three menus, and check an article that didn’t answer my query, before I could finally get through to an agent. And even then I had to provide my name and email, so I’d waited several minutes and had to make several clicks and actions.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Is PU Prime Good For Day Trading?

PU Prime offers a strong environment for day traders through a direct-to-market execution model. The Prime and ECN accounts are particularly well suited to active traders with their raw spreads and low commissions, while the PU app and web platforms are both enjoyable to use with strong charting packages.

There’s also something for newer traders with the Cent account, copy trading, Trading Academy and easy-to-open demo account.

FAQs

Is PU Prime Legit Or A Scam?

PU Prime (previously Pacific Union) is a legitimate brokerage with hundreds of thousands of clients and authorization from a top-tier regulator – ASIC. We’ve run multiple rounds of tests on it, used its platforms and tools, and interacted with its support team on multiple occasions – we’re comfortable it’s not a scam.

However, some of its entities are authorized by less well-regarded regulators where you may receive less legal protection, such as investor compensation should the company go bankrupt.

Best Alternatives to PU Prime

Compare PU Prime with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

PU Prime Comparison Table

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| Rating | 4.5 | 4.3 | 4.5 |

| Markets | CFDs, Forex, Stocks, Indices, Commodities, Metals, Crypto, Bonds, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $20 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, FSCA, CMA, FSA, FSC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | NFA, CFTC |

| Bonus | 50% Deposit Bonus | – | VIP status with up to 10k+ in rebates – T&Cs apply. |

| Platforms | PU Prime App, PU Web Trader, PU Social, MT4, MT5, AutoChartist | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | WebTrader, Mobile, MT4, MT5, TradingView |

| Leverage | 1:1000 | 1:50 | 1:50 |

| Payment Methods | 10 | 6 | 9 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by PU Prime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| PU Prime | Interactive Brokers | FOREX.com | |

|---|---|---|---|

| CFD | Yes | Yes | No |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | No |

| Silver | Yes | No | Yes |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | No |

| Futures | No | Yes | Yes |

| Options | No | Yes | Yes |

| ETFs | Yes | Yes | No |

| Bonds | Yes | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | No |

PU Prime vs Other Brokers

Compare PU Prime with any other broker by selecting the other broker below.

The most popular PU Prime comparisons:

Customer Reviews

5 / 5This average customer rating is based on 4 PU Prime customer reviews submitted by our visitors.

If you have traded with PU Prime we would really like to know about your experience - please submit your own review. Thank you.

PU Prime is the best copy trading app I’ve messed around with to date (even better than eToro which I know everyone likes to tout as the top dog). It takes seconds to download and you’ve got thousands of signal providers which you can easily filter. I also appreciate how easy it is to STOP copying traders in one click. Obviously I use the list of ‘highest annual returns’ but there’s a ‘low risk & stable return’ board too. If you want a user friendly app that doesn’t overcomplicate what should be a sraightforward process to copy more experienced traders, then PU Prime is worth a punt based on my experience.

The proactive support from my account manager has been key in helping me grow my profits. PU Prime personalized approach is absolutely worth it.

I’ve tried many brokers, but what sets PU Prime apart is their 24/7 support. The team is reliable and genuinely cares about providing assistance. I’m really impressed with their service!

I’ve been trading gold with PU Prime for over a year now, and honestly, PU Prime has been great here in Canada. With so few brokers offering high leverage, PU Prime really stands out.

Overall, the leverage is solid, and the withdrawal process is smooth. The only area I think could use some improvement is the customer service—it could be a bit more responsive, eh?