Automated Forex Trading

Automated forex trading is a hands-off approach to investing which makes use of advanced software and tools. A computer program essentially analyses price patterns, decides whether to buy or sell, and executes forex trades on the investor’s behalf. Human intervention is then about choosing and tweaking trading algorithms based on performance.

Importantly, the liquid and high-speed world of forex auto trade copiers has been steadily taking the place of manual trading in many fields, and institutional FX traders have been using automated trading robots for many years – a trend confirmed by regulatory bodies including FINRA, which acknowledges that algorithmic trading strategies have “grown more widespread in US securities markets”. The technology is also available to retail traders through trading bots for Apple and Windows computers, plus iOS, Android and other operating systems.

This tutorial explains how automated forex trading works and lists the best bots and supporting brokers in 2026.

The Best Brokers For Automated Forex Trading

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

4

FOREX.com

FOREX.com -

5

CEX.IO

CEX.IO -

6

xChief

xChief

Here is a summary of why we recommend these brokers in March 2026:

- Interactive Brokers - For automation, IBKR’s massive strength is its native APIs (TWS/IB Gateway, FIX, Python) - you can integrate strategies directly and run them on third-party VPS. Fills are fast and consistent across equities, FX and futures from tests.

- NinjaTrader - NinjaTrader excelled for custom builds in our latest round of tests: we could code and deploy strategies natively and via its API, and keep them running 24/7 on a VPS. Order handling on futures, FX and index products is precise under load.

- OANDA US - OANDA US works really well for automated setups via MT4 EAs and its REST API; VPS keeps everything online constantly. We saw accurate fills and modest slippage across FX and other assets in our use.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- CEX.IO - CEX.IO’s crypto APIs are straightforward to automate against; you can host on a VPS for 24/7 continuity. Orders hit quickly and reliably across spot crypto and stablecoins in our latency checks.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Automation

Capitalise.ai, TWS APIPros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Automation

NinjaScript or via Automated Trading InterfacePros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Automation

Expert Advisors (EAs) on MetaTraderPros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The broker offers a transparent pricing structure with no hidden charges

- Beginners can get started easily with $0 minimum initial deposit

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Automation

Expert Advisors (EAs) on MetaTraderPros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

CEX.IO

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | GFSC |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Automation

APIPros

- The range of 200+ cryptocurrencies is competitive and will serve more experienced traders

- CEX.IO continues to offer competitive pricing with 0.01% taker and 0% maker fees for high-volume traders

- The $20 minimum deposit makes the broker accessible for beginners

Cons

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

- It's a shame that there's no demo account for traders looking to practice strategies

- The broker has limited regulatory oversight

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Automation

Expert Advisors (EAs) on MetaTraderPros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

Automated Forex Trading Explained

The top autopilot forex trading systems scan the markets to identify price patterns and execute trades. Software follows a set of rules and criteria, programmed by the developer and/or tailored by the individual forex trader.

Let’s say an investor knows how to code and create an automated forex trading robot. This means they could instruct it to short the EUR, for example, if the European Central Bank (ECB) eases its monetary policy. The investor can dictate the lot size, plus the profit to accumulate before closing the position.

Trading platforms like MetaQuotes’ MT4 and MT5, all support with the build of automated forex trading systems, including with Expert Advisors (EAs) that follow a set of rules rooted in technical analysis. MT5’s programming language is MQL5. Python and R are also suitable for programming automated forex trading systems.

Types of Forex Trading Automation

You can separate forex trading systems into two groups:

- Fully automated trading systems derive their signals and execute positions (openings and exits). You may also hear them referred to as ‘forex auto trading robots’. They allow human intervention through settings concerning lot size, take profits, stop losses, and various other risk-management parameters.

- Partial systems include forex signal providers. They follow a set of criteria and useful information based on technical analysis to make trade suggestions. However, the investor will have to manually execute positions.

Popular Services

Copy Trading

One of the best forms of forex automation is through copy trading. This is a time-saving and beginner-friendly way to speculate on currencies while learning from the pros. All you need to do is find an experienced investor and copy their positions.

On most platforms, after you select an investor, you simply set the system to ‘follow’ or ‘copy, and your account automatically mirrors the positions of the master trader.

The best-known and most popular forex copy trading platforms include:

The auto robot solutions listed above offer a wide range of automation-related features. MT4 and MT5, for example, provide everything from social trading with large community support to free and fully automated forex trading software downloads. eToro, on the other hand, does not feature bots, but it has a solid copy and social trading framework.

Forex Signals

The top brokers offer forex trading signals on iOS, APK and desktop devices. Some offer this service for free, while others charge a subscription. Brokerages may have teams of experts churning out signals while other rely solely on automated analysis.

The human factor is an important component of a quality signal service. Humans will mix various economic indicators with fundamental and technical triggers.

Robots

Bots generate and react to signals automatically. They essentially act on market data without human intervention. Thus, they completely remove the emotion-based element of forex investing.

The profitability of forex trading robots, however, varies. Traders will have to supervise and tweak code as robots are not infallible. Even the most lucrative programs need attention now and then.

MT4 & MT5

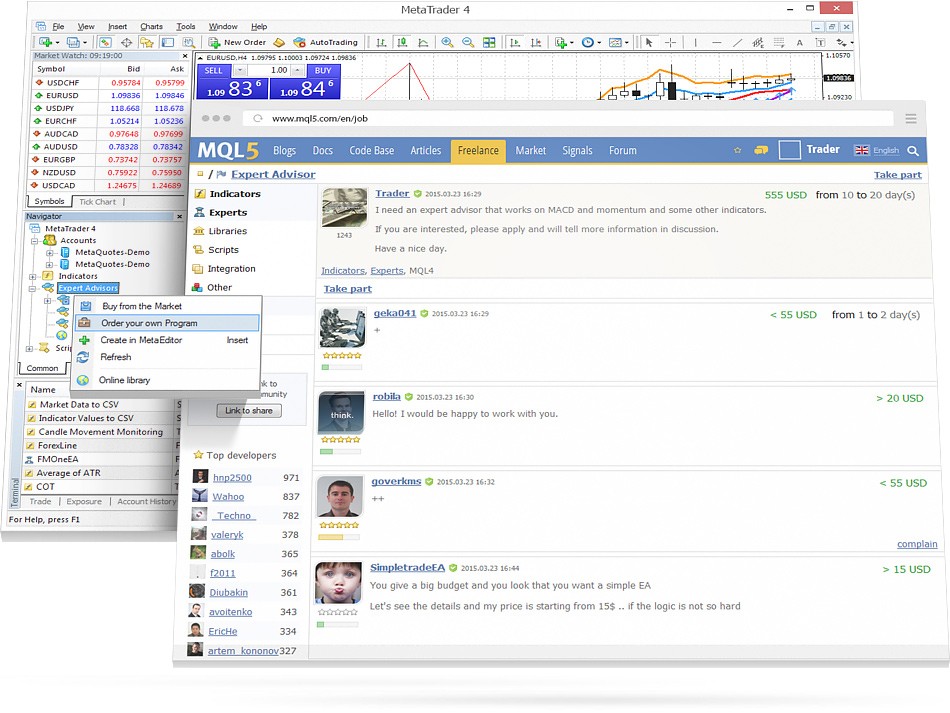

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) were created by MetaQuotes and offer some of the most popular automated forex trading solutions called Expert Advisors (EAs).

Expert Advisors represent the gold standard in automated forex trading. The programs are coded in MQL4 (for MT4) and MQL5 (for MT5), languages with similarities to C++. EAs automatically monitor forex markets and identify trading opportunities based on parameters set by the user.

Benefits include:

- EAs can save time

- EAs help remove emotions from the trading equation

- You can find reviews and educational resources on Reddit and YouTube

- Both MT4 and MT5 allow the importation and installation of third-party EAs so you do not have to code your own

- Users can back-test EAs before letting them handle real money. Note, back-testing does not account for slippage

Of course, there are also some drawbacks:

- Unless you rent a VPS, an EA will only work when your computer is running

- Some Expert Advisors are not “experts”. They are simplistic bits of code developed by amateur traders

Other Popular Solutions

- Lion Forex Auto Trading Gold – known for profitability and its fully automated trading capability. It integrates best with MetaTrader 4

- Galileo Forex Automated Trading – functions on MT4 and MT5. It uses advanced algorithms to make FX investment decisions

- Kairos Automated Trading Platform – the South African-based solution can be integrated into several alert platforms to execute on their data

Free Automated Forex Trading Software

People are usually right to distrust free, too-good-to-be-true deals. With automated currency exchange trading systems, the situation is a tad more nuanced, however.

Scammers will sometimes offer you software for free, then require you to sign up with a certain broker. This way, they can pick up the commission resulting from your registration. Such scams are relatively easy to spot. If the returns sound too good to be true, they probably will be.

Of course, there are no guarantees that expensive solutions will outperform free auto trading packages. However, paid-for solutions tend to yield better results. The most important thing is to look at user reviews and ratings before paying for anything. The best brokers and marketplaces provide details on historical profit and loss, risk metrics and information on the strategies used.

Before working with any broker offering automated trading software, verify registration with the CFTC or another relevant regulator to ensure the broker is properly licensed.

Getting Started

Automated forex trading systems are available all over the world, from Australia and Singapore to India, Canada and South Africa. Beginners should start by testing with small amounts or by using a paper trading account.

Most forex brokers and companies that support this type of investing allow back-testing on demo accounts. This is the process of running your best automated forex trading strategy with past price data to assess its ability to turn a theoretical profit. Such systems are available on demo accounts, so the trader does not have to risk real money to start with.

And whilst it hopefully goes without saying, the key starting point for forex investors should be to automate the manual strategies that are already successful.

Note, you do not have to be a scripting language expert to use software. The MQL community supports virtual marketplaces, where you can discuss, order, and buy ready-made or customized automated trading programs.

Final Word

There are many bots, signals and technology solutions when it comes to automated forex trading. For beginner investors we recommend reading software reviews online and back-testing strategies on free demo accounts. Alternatively, see our list of the best brokers for automated forex trading to get started today.

FAQs

Is Automated Forex Trading Profitable?

How much money you make will ultimately depend on your skill and knowledge as an investor. Institutions can generate serious returns because they employ the best analysts, gather many years of data, and have access to market-leading technology. Fortunately, retail forex traders can build their own robots, download free solutions, or buy programs online at the MetaTrader Marketplace, for example.

What Is The Best Automated Forex Trading Software?

The best automated forex trading software will depend on whether you want a fully automated solution or a partial service that simply provides alerts and signals. Importantly, the better the inputs into an algorithm, the better the results tend to be. The MetaTrader Marketplace is a good place to find the top forex auto trading programs.

Does TradingView Support Automated Trading Forex?

No – TradingView does not currently support automated forex trading. Instead, you may want to use desktop and mobile friendly platforms like MetaTrader 4 and MetaTrader 5.

Can A Forex Robot Make Money?

Using an automated forex robot without proper back-testing and research is risky. Robots cannot guarantee easy or fast money. Fortunately, the top brokers and platforms publish information on previous profit and loss to help traders find the best solutions.

How Does Automated Forex Trading Work?

Some brokers offer forex trading solutions that allow retail investors to automate manual strategies. Traders can code their own algorithms using beginner-friendly scripting languages alongside tutorials and guides available online. See our article above for the main advantages of automated forex trading.