Forex Signals

Forex signals are best described as detailed trade recommendations or ideas. The sources of the best forex signals are usually experienced investors. Many online services and websites provide forex trading signals, for a fee, or even for free. But how can you find the best? Read on for a list of the top forex signals in 2026.

Brokers with Forex Signals

Here is a short overview of each broker's pros and cons

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

Cons

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The broker offers leverage up to 1:2000 for certain account types, which is among the highest in the industry. This high leverage allows day traders to maximize their trading potential, albeit with a corresponding increase in risk.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Introduction To Forex Signals

Because a forex signal is essentially a small bundle of text-based information, it can be transmitted through a variety of channels.

Forex signal providers deliver their recommendations through live messaging, email, Skype, YouTube, Twitter, Reddit, Instagram, Facebook, trading forums, dedicated apps or even on WhatsApp groups with a straightforward sign-up link. There are even forex signal Telegram groups.

The FX signal ecosystem has created fully-featured, dedicated trading environments as well. These signal-based investing solutions allow providers to use interactive charts, stream videos and monetize their activities.

Importantly, profitable trading is the Holy Grail of many investors and the most straightforward path to returns is arguably through forex signals.

If you are looking for a dedicated, specialist service, see our list of forex signal providers below.

Forex Signal Providers

How Forex Signals Work

Forex signal systems are one the most important tools in the arsenals of many profitable traders. Beginners, as well as advanced and experienced investors, use them. In fact, there is an entire industry built around trading signals and investment recommendations.

Key Considerations

Quality forex signals do not just tell you when to jump into a certain trade and the direction of said trade. They also include detailed information on the configuration of your Stop Losses and Take Profits.

The best way to make certain that you are dealing with quality trading signals is to test them on a demo account. This way, you will not lose real money if it turns out your forex signals are subpar.

Time Frames

You should also pay attention to time frames. Due to their transmission nature, forex trading signals do not work well for strategies like scalping. By the time you receive the signal, the scalping opportunity has probably already come and gone. That said, there are scalpers out there who still use this type of service.

Every FX signal system is a reflection of the personal methods and preferences of the signal provider. Therefore, each system is different.

With that said, there are two key categories into which most forex trading signals fit:

- Technical analysis (TA) based

- Fundamental analysis-focused

TA-based forex signal systems derive their trade ideas from past price movements coupled with various mathematical formulas and trend recognition techniques.

Signal providers analyzing current events and deriving investment opportunities from the impact of these events are in the second category.

Finding The Best Forex Signals

The quality of your forex trading signals can make or break your profitability. Since there is not much skill involved in applying them, the only variable in the equation is the selection process.

Go through this checklist:

- Time Zone – Before you start, take a look at the time zone of the provider. You want your forex trading signals to trickle in while you are awake.

- Free Trial – Sign up for a free trial period. This will clue you in on the quality of the service, without requiring you to pay “tuition” in the form of losses incurred on bad signals.

- Compare – Continue looking and comparing the FX signal services that suit your trading style and risk appetite. In the end, pick out the best one.

- Track Record – Look at the track record of your provider. This should tell you everything you need to know about the setup performance-wise. Only track records verified by a 3rd party should be considered. Also look for the best forex signals reviews online.

- Full Analysis – Go for the total package. Low-effort providers, such as those only giving you the entry price and the SL/TP, should be ignored. You need to know why it is supposed to work. To that end, you need your FX signal provider to provide supporting charts and market analysis.

- Focus On You – Make sure the style of the forex signals fits your trading needs. There are short- and long-term signals focused on intraday breakouts and reversals etc. Profitability should always be your top priority, along with how the trade idea is delivered, be it via WhatsApp, social media, or email.

- Extras – If possible, choose a provider that offers additional services. These can be educational or social trading-oriented. Provided you are dealing with quality trading signals, such perks can add a great deal of value to the setup.

Note, finding MT4 forex signals is a different story. In the Terminal window, select the Signals tab. This section features scores of forex signal providers with handy graphs of their trading performance.

Comparing Forex Signal Providers

Run a search on forex signal rankings. There are scores of websites out there comparing signal services. Pick a few off the top and read the reviews. Alternatively, see our detailed rankings.

Sign up for any trials they offer and use the checklist above to determine how well they stack up. Take into account the communication channels the providers use. Do they deliver their trade recommendations through Skype, email, SMS or Telegram? Do they use specialized platforms?

Forex Signal Providers

How To Use Signals

Opening a position based on a forex trading signal is simple:

- Your first step is to log into the provider’s channel

- Grab the data delivered and copy it to your account

- Wait for the trade to close and pick up the proceeds

What Is Included In The Best Signals?

More precisely, a forex trading signal should tell you the following:

- Comments, charts and explanations concerning the recommended trade setup.

- The instrument/currency pair you will be trading (EUR/USD, BTC/USD etc).

- The direction of your trade. Next to the actual asset price, a BUY or SELL action should be indicated.

- The entry price is self-explanatory. It is the price level at which the provider recommends that you should jump into the trade.

- The take profit (TP) is the price level at which your trade is automatically closed if it goes your way. Taking your profits at the right time is as important as protecting yourself through a stop loss.

- The stop loss (SL) is where your position will automatically close if the market turns against you. This is a damage control feature and as such, it is important for long-term profitability.

- The status: forex signals can be Active, Get Ready and Closed. Active signals can be put to use immediately as they are. Get Ready signals are not yet active, but they may become shortly. They may also disappear. Keep your eyes on them, but do not act unless they become Active. Closed signals are expired.

Trades can be closed in three different ways. Besides the automatic closure triggered by the SL or the TP, the provider can close it manually as well. In such cases, an explanation is provided in the comments section, together with the closing price.

Under certain circumstances, the signal provider may even recommend the extension of the TP, to increase the profit margin.

How To Use Different Types Of Forex Signals

To maximize the potential of your trading signals, you may want to tweak some of the variables.

Take Profit And Stop Loss

Moving your take profit is an obvious way to expand profit potential. Most services use a fixed pip amount when setting the take profit level as well as the stop loss. They rarely jump in to tweak these variables as the trade unfolds.

If you deem the potential of the trade better than what the profit level allows, you can move it. In some cases, completely removing the take profit may be justified. Just remember not to hold the signal service liable if your bold move backfires.

Moving your stop loss may in some cases save an otherwise doomed trade. Like the profits, the stop loss is normally set to a fixed pip limit. Furthermore, it sometimes lands just below a moving average or a resistance level. In such cases, moving it above the critical level may be a good idea.

The entry price is not set in stone either. In this instance too, many services prefer to err on the safe side. As the price evolves, a better entry price may develop as well.

Manually closing a trade may be the right course of action when the asset price is rattled by a sudden real-world event. There is no way for the forex signal provider to predict such events. If one does come about, the bets are obviously off.

Trade Size

Tinkering with the lot size is another signal-optimization avenue.

Some of the FX signals provided by a service will offer a higher probability of profits than others. As you rack up experience, you will be able to tell which investments are which.

Increasing your traded lot size on high probability signals makes good sense. The same is true for decreasing your traded amount on low probability signals.

Correlation

Keep an eye on correlated FX pairs. If you get a signal for the AUD/USD for instance, the same signal can probably be applied to the NZD/USD pair. Sometimes the trade “derived” through this method will turn out to be more profitable than the original recommendation suggested.

Investors sometimes forget to take the spread into account when setting their stop losses and take profits. Adjust your automatic closing points accordingly. Keep in mind that the spread is different from one FX pair to another.

Free Forex Signals

Signal service providers generally use free forex signals for promotional purposes. They will make them available while looking to sell some sort of service or product further down the line.

As a promotional vehicle, a free forex signal cannot afford to be of inferior quality. Sometimes, however, that is exactly what transpires.

Premium

A premium forex signal service needs to deliver from the very beginning. Since premium forex signals represent the bread and butter of the service provider’s offer, they are usually high quality.

Let’s not lose sight of the fact, however, that no forex signal provider can ever guarantee winners.

Live / Daily Signals

Live/ daily trading signals are in essence run-of-the-mill forex signals, which are delivered with higher frequency. Such signals are suitable for intra-day trading.

Notable Services

- Forexsignals.com – Live streaming and promo cash giveaways, forexsignals.com offers signals and education in equal measure

Copying Trades & Social Investing

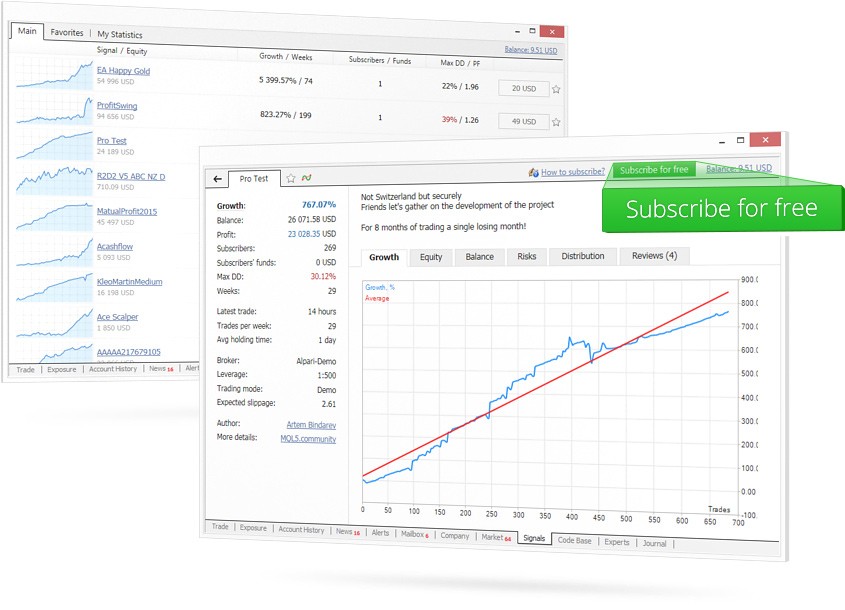

Social trading or copy trading is about using the forex signals provided by successful investors. As mentioned, MT4 offers a Signals section, where it displays the trades and statistics of those who decide to share this information with the community.

The system rewards investors for their “signal-providing service” through fees paid by their subscribers. The Signals page displays the most successful forex signal providers at the top. This way, it more or less takes care of the selection process for users.

There are quite a few similar (and even better) trade copier services out there. eToro is a good example in this regard.

Forex Signals For Technical Analysis Traders

TA is generally suitable for investing over the short-term across supply/demand inefficiency-induced price swings. Fundamentals, on the other hand, typically lend themselves to longer time-frame positions. The best forex signals often take fundamental factors into account as well.

Price Action

Forex signal providers churn out most of their hot tips based on price patterns, which mostly consist of support and resistance levels. Other technical indicators and price structures/patterns can be used as well. This is ultimately the very definition of TA-based forex signal generation.

Forex Signals For Scalping

While longer-term trading signals aim for hundreds and even thousands of pips in profits, some FX signal providers will settle for a few pips at a time. Short-term forex trading signals lend themselves well to scalping.

Note that despite their short-term nature, scalping signals are not based exclusively on technical analysis. They can incorporate a fair share of fundamentals too. This way, they combine indicators such as trend lines, support and resistance levels and stochastic oscillators with economic news, data releases and announcements.

Scams

The pseudo-science behind the forex signals industry is by no means an exact one. Therefore, it is conducive to scamming. Crooked operators have plenty of room to maneuver in this vertical. While we have already filtered out scam-suspicious services, you should be able to spot a forex signal scam yourself:

- Services with unrealistically good (and unverified) track records are almost guaranteed to be scams

- FX signal providers offering to trade in your stead, with your money, are most definitely scams as well. Such a setup is no longer signal-based trading, but auto-trading on a hijacked account

- If a provider uses various pushy and underhanded promotional methods to sell forex signals for binary options, for example, it should arouse suspicion too

If you feel something does not add up about your forex signal provider, just forget about it and move on to the next one.

Bottom Line

There are many forex trading signals available today. The best options will suit your financial goals, investing style and risk tolerance. Read online reviews and have a selection process in place before purchasing to ensure the service provider is of high quality. A good signal service can impact your profitability.

Use our list of the best specialist forex signals providers to get started. Alternatively, check out our ranking of online brokers that offer forex trading signals.

FAQ

Are Forex Signals Available Worldwide?

Yes, many services are available internationally in countries such as Canada, Australia, Malaysia, South Africa, and many others. The best forex signals in the world will be the ones that suit your goals and trading style, not to mention producing high profits.

What Is Forex Signal 30?

Forex Signal 30 Gold Edition is a no repaint service offering price movement indications for when an investor should open or close a position on an FX pair. It is a paid service, so make sure you read the reviews before purchasing. There are also other free forex signals for pairs like the EUR/USD.

Where Can I Find Live Forex Signals Without Registration?

Today, there are many free forex signals with no registration requirement. First check with your direct broker as such robots may already be part of your account as a factory setting. You can also look for honest reviews be it regionally specific, such as daily forex signals UK reviews, or international rankings.

Are There Apps For Free Forex Signals Online With Real-Time Data?

Yes, there are many iPhone, Android and APK forex signals apps available online. You can find them by doing a simple Google search. Before downloading an app, make sure you read the reviews to ensure you get the best quality possible.

Where Can I Find 100% Accurate Forex Signals?

It’s easy to get daily tips from social channels. Many claim 99.9% and higher success rates, but that’s not always the case. Social media sources may not always give the best winning forex signals. Instead, investors can seek pdf ebooks, courses (such as Vladimir Forex Signals), investment clubs (provided by a reputable company), subscriptions and software from established firms. Make sure you check the live reviews before making a purchase.

What Is The Forexsignals.com Trading Room About?

The website offers a selection of forex signals, educational videos, daily live streams, and promo codes as part of its trading room. They aim to educate investors on how to trade on the forex market.