Bubinga Review 2026

Pros

- Bubinga’s order execution speed is decent. During active trading, the platform handled quick entries and exits without noticeable lag. For day traders, this responsiveness is important for catching tight expiry windows, which start from 1 minute.

- Bubinga’s web platform has been built with beginners in mind – no cluttered interface – just a simple chart and basic settings to configure the expiry time, stake and binary direction.

- Bubinga stands out from most competitors by offering Tradeback, which repays part of the previous week’s trading losses, with payments made to accounts every Tuesday.

Cons

- The lack of regulation at Bubinga is a concern. Without oversight from a trusted body in DayTrading.com’s regulator tracker, there’s always a risk that your funds won’t be fully protected.

- The platform’s limited research tools means you have to juggle multiple apps or sites for market info. Not having live news or market analysis inside the platform makes it harder to react quickly.

- Withdrawal limits on lower-tier accounts can be frustrating. When you start, you might find it hard to cash out more than a small amount at once, which slows your access to your profits. It pushes you to keep funding your account beyond what you might feel comfortable with.

Bubinga Review

This Bubinga review reveals the findings of our extensive tests after opening an account, trying the various tools, placing trades on the platform, and exploring the broker’s suite of services, including support and research features.

Regulation & Trust

Bubinga is a binary options platform launched in 2023 and focused on the Asia-Pacific market.

The company behind it – NORTANA LTD- operates out of Saint Vincent and the Grenadines (an offshore location commonly used by binary brokers), though it also has an office in Cyprus under NORTANA SERVICES LIMITED, registration HE433385.

The Saint Vincent and the Grenadines Financial Services Authority (SVGFSA) is classified as ‘red tier’ in DayTrading.com’s Regulation & Trust Rating.

SVGFSA has also stated it does not license or regulate retail binary options brokers, so being incorporated in SVG is not the same as robust oversight or client protections.

If a broker is effectively unregulated, you’re leaning on softer signals like community feedback, track record, and complaint history, all of which can be gamed by bots or fake reviews.

Think about what that means for you. When I trade with a regulated broker, I know my funds sit in segregated accounts, separate from the company’s operating cash. There are clear procedures if I have a dispute. There are safeguards against fraud.

With Bubinga, those protections aren’t there. If something goes sideways, you don’t have a regulatory body to turn to. Getting your money back becomes much harder, if not impossible.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Regulation & Trust Rating | |||

| Regulators | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Accounts & Banking

Live Accounts

Let me break down how Bubinga’s account structure actually works, because it’s not as straightforward as it first appears.

There are five account types: Start, Standard, Business, Premium, and VIP. What Bubinga doesn’t tell you upfront is that your account tier isn’t based on how much money you currently have in your account – it’s based on your total cumulative deposits over time.

- Start: under $100 total deposited

- Standard: $100 to $500

- Business: $500 to $2,000

- Premium: $2,000 to $5,000

- VIP: over $5,000

And here’s the kicker: once you hit a new tier, you’re there permanently. Even if you withdraw most of your funds later, you don’t drop back down. So if you’ve deposited $600 total and you’re now in the Business tier, withdrawing $500 won’t push you back to Standard – you’ll stay in Business.

On the plus side, this means the perks you unlock are yours to keep. You also get access to more assets as you climb – starting with 68 tradable options on the Start account and expanding to 121 once you reach VIP. The entire upgrade process happens automatically, so you don’t have to check thresholds or request tier changes constantly.

But what frustrated me is that Bubinga doesn’t explain this clearly when you first open your account. You might think you’re choosing an account type, but really, you’re just beginning a one-way ladder.

My take? If you’re testing the waters, start small. You can always add more as you gain confidence. Just know that every deposit pushes you up permanently—there’s no going back.

One more thing: when I was testing the platform, Bubinga was offering a 100% bonus on first deposits of $50 or more. That’s automatic once you sign up and can double your starting balance.Sounds great, but make sure you read the bonus terms carefully – there are usually trading volume requirements or withdrawal restrictions attached to promotions like this.

Demo Accounts

Bubinga’s demo account is handy, but comes with a catch. You get $10,000 in virtual funds to practice with, but you can only access it after you’ve registered for a live account.

That said, the setup is quick. I’m talking seconds. Once you’ve registered and logged in, you’ll see a simple toggle that lets you flip between demo and live mode right there in the platform. No extra paperwork, no deposits required at that point, and no risk while you’re in demo mode.

What I actually liked is that the demo isn’t some watered-down version. It mirrors the real trading environment completely – same interface, same tools, same feel. You can place test trades, experiment with strategies, and watch how things perform when the market shifts. It’s genuinely helpful in getting your bearings.

You also get full access to the same resources you’d have with a live account. That includes an economic calendar and a library of trading strategy guides built right into the platform.

But here’s where it falls short: you can’t create multiple demo accounts, and if you blow through your $10,000 in virtual funds, that’s it. There’s no way to manually top it back up. So use it wisely while you’re learning the ropes.

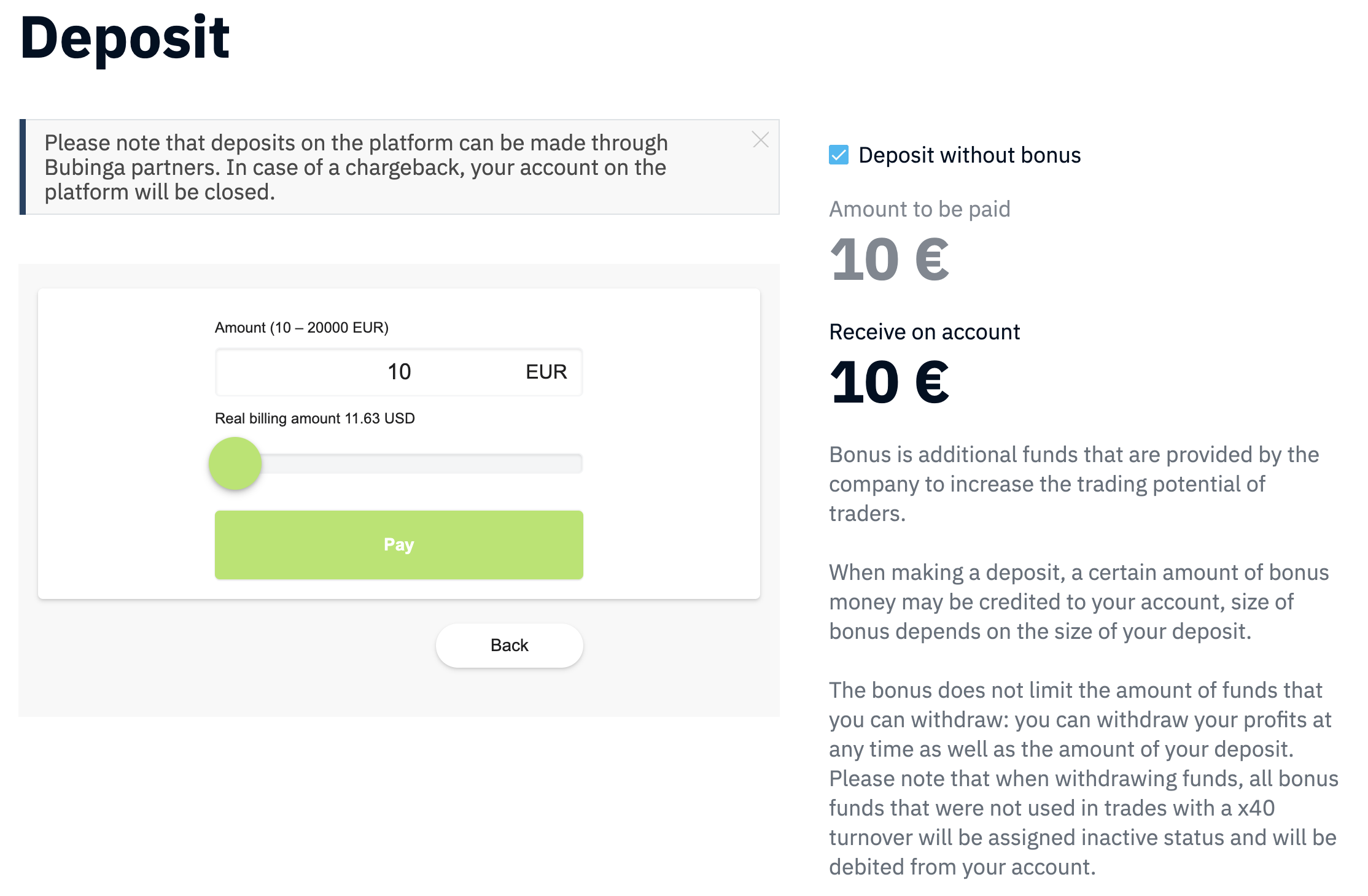

Deposits & Withdrawals

Getting money into Bubinga is pretty straightforward. You can deposit as little as $10, and it accepts most of the payment methods you’d expect: debit card, credit card, bank transfer, e-wallets like Sticpay and PayPay, plus cryptocurrencies including Bitcoin, Ethereum, and USDT.

Your account can be held in USD, EUR, JPY, KRW, BTC, or LTC, so you’ve got options depending on where you’re based.

Getting money out is where things get more restrictive. First, you’ll need to withdraw using the same method you deposited with – that’s standard across most brokers, so no surprise there.

But what caught my attention is how withdrawal limits are tied directly to your account tier. And they’re pretty tight at the lower levels.

- Start: $50 per day max, $25 per request

- Standard: $200 per day, $50 per request

- Business: $500 per day, $100 per request

- Premium: $1,500 per day, $250 per request

- VIP: $15,000 per day, no per-request cap

So if you’re starting small and you hit a good run, you could be stuck withdrawing in tiny chunks. That’s frustrating if you want quick access to your profits.

Before you can make your first withdrawal, you’ll also need to verify your account. This involves confirming your email address, uploading ID documents, and verifying your payment method.

It’s not unusual, but it can take up to 24 hours, and Bubinga can hold your withdrawal requests until verification is complete. Plan so you’re not caught waiting.

Even after verification, withdrawals can take up to 72 business hours to process. That’s three full business days. Compare that to brokers offering same-day or instant withdrawals, and you’ll feel the difference.

On the positive side, Bubinga covers all deposit and withdrawal fees on its end. Just watch out for any charges from your bank or payment provider – those are beyond the broker’s control.

If you’re just starting and testing the platform with small amounts, the payment setup works fine. But if you’re planning to trade seriously and move larger sums, those withdrawal caps and processing times could become a real bottleneck. Keep that in mind before you commit.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Accounts & Banking Rating | |||

| Payment Methods | AstroPay, Bitcoin Payments, Credit Card, Debit Card, JetonCash, Sticpay, WebMoney, Wire Transfer | American Express, Apple Pay, Bitcoin Payments, Credit Card, Ethereum Payments, Google Pay, Mastercard, Neteller, Visa | Bitcoin Payments, Ethereum Payments, PayPal, Perfect Money |

| Minimum Deposit | $10 | $250 | $10 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Assets & Markets

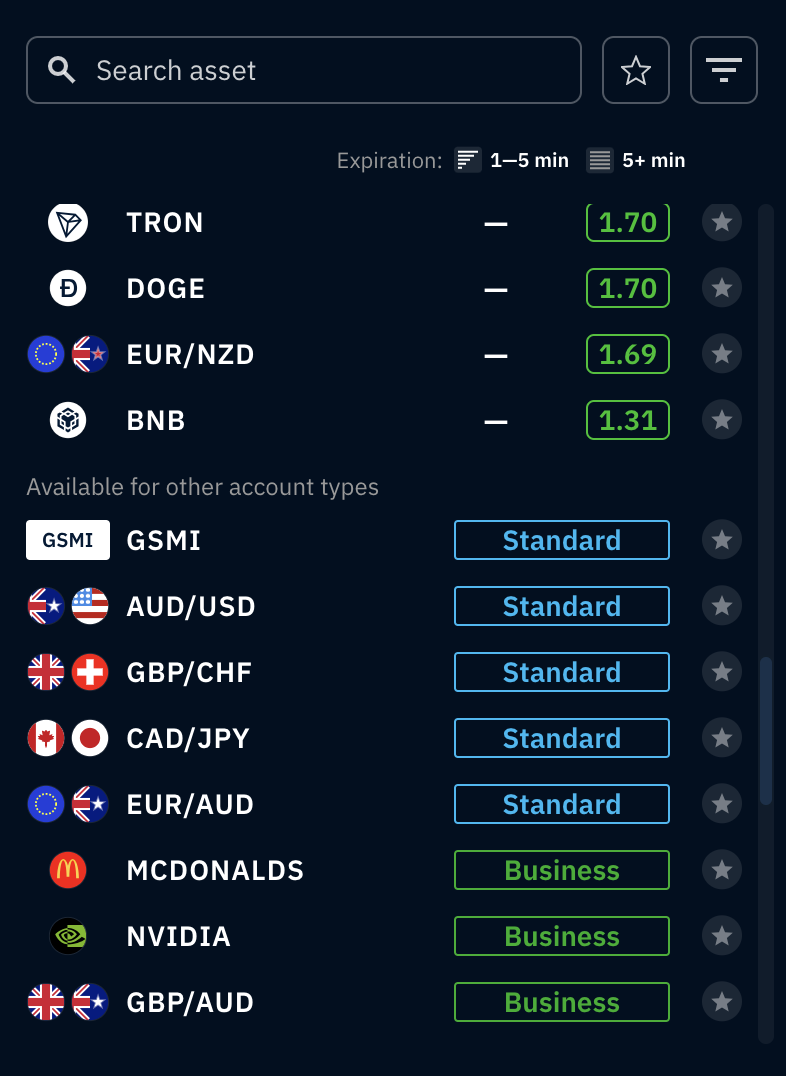

What assets you actually have access to when you start trading on Bubinga is more limited than you might think.

When you’re on the Start tier, you’re working with a pretty narrow selection. I’m talking about 15 major forex pairs like EUR/USD, GBP/USD, and USD/JPY.

You’ll also get seven cryptos – Bitcoin, Solana, DOGE, and a few others. Add in three commodities (gold being the main one), 11 big-name US stocks like Tesla, Apple, and Microsoft, and three minor indices.

That’s your starting lineup. It’s enough to get going, but you’ll definitely feel the limitations if you’re used to more variety.

Now, as you deposit more and your account bumps up to Standard or higher, you’ll see new assets gradually unlock. Stocks like Nvidia and Intel start appearing. Silver shows up alongside gold. Ethereum and Litecoin join your crypto options.

By the time you hit VIP, you’ve got the whole menu – 121 tradable assets in total. But let’s be real: most beginners are sticking with forex and crypto for the first stretch.

But here’s the trade-off: if you want access to a broader range of markets, you have to keep funding your account. There’s no way around it. You can’t just pick a higher account type at sign-up – it’s entirely based on how much you’ve deposited over time.

For someone just dipping their toes in, this setup is clean and straightforward. But suppose you’re the kind of trader who wants flexibility and variety from day one. In that case, you’ll find yourself having to commit more capital than you might be comfortable with just to unlock basic asset classes.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Assets & Markets Rating | |||

| Trading Instruments | Binary Options, Forex, Stocks, Indices, Commodities, Crypto | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Expiry Times | 1 minute - 3 months | 5 seconds - 1 month | 1 minute - 1 hour |

| Boundary Options | No | No | No |

| Ladder Options | No | No | No |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Fees & Costs

While it looks simple on the surface, there are some details worth knowing about Bubinga’s fee structure.

The good news first: there are no commissions or spreads on your trades. What you see is literally what you get. If your trade wins, you collect the full payout. If it loses, you’re only out what you staked – nothing more. Clean and straightforward, like binary options often are.

The broker also doesn’t hit you with inactivity fees or monthly maintenance charges, which is a relief if you’re not trading every single day.

The bigger issue is the withdrawal limits. Even if there are no direct fees, those tight daily and per-request caps – especially on Start and Standard accounts – mean you’re stuck withdrawing in small chunks.

So if you’ve had a good trading day and want to cash out a decent amount, you’ll drip-feed it over multiple days or even weeks.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Fees & Costs Rating | |||

| Maximum Payout | 95 | 98% | 95% |

| Inactivity Fee | $0 | $10 | $0 |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Platforms & Tools

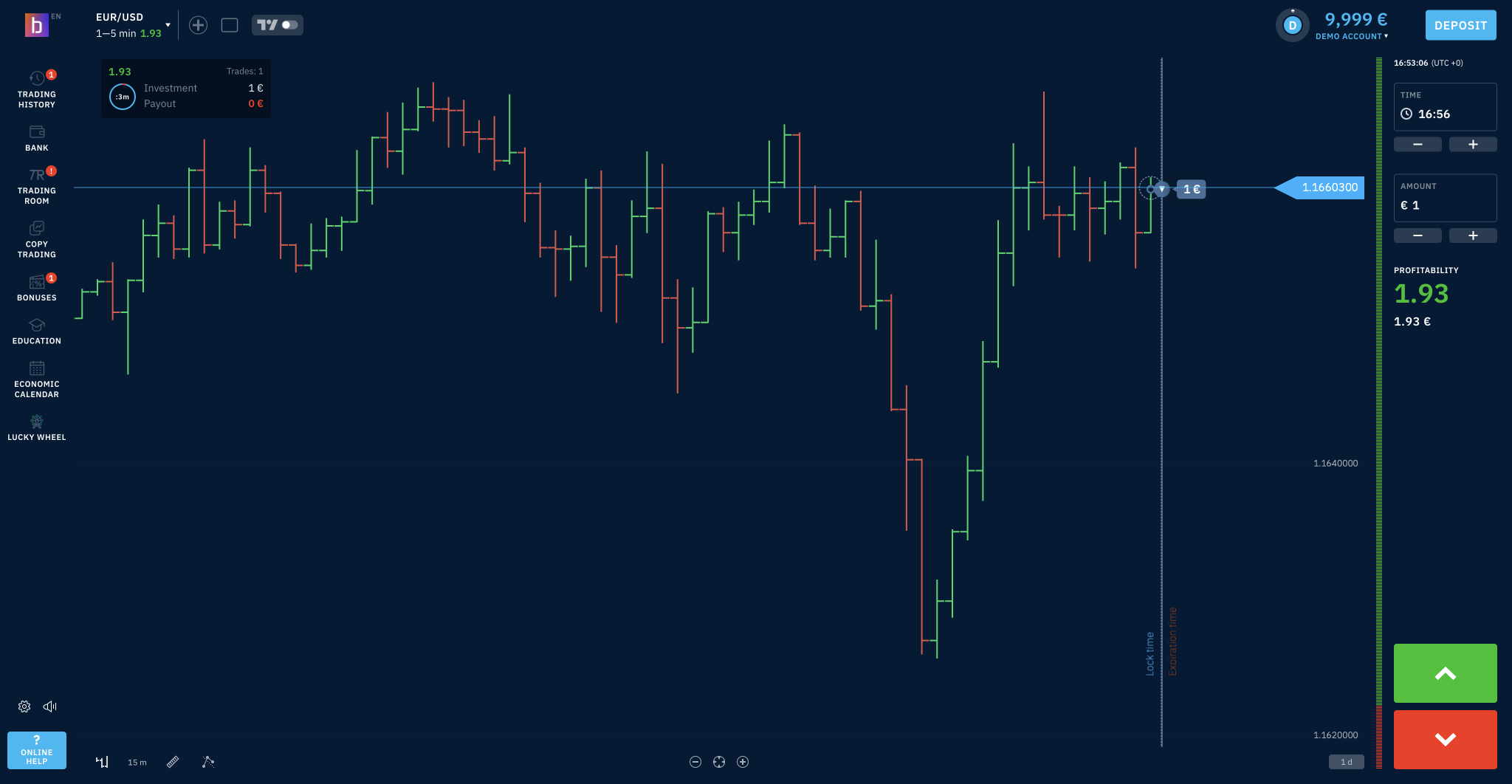

Bubinga’s platform experience is a mixed bag. You get two options: Bubinga’s own proprietary web platform and a TradingView-based platform.

Both are accessible from your browser, and there’s also an Android app if you want to trade on the go. Just know that iPhone users are out of luck for now – it’s Google devices only.

The proprietary platform is clearly built for beginners. It’s clean, simple, and doesn’t overwhelm you with options. You’re trading standard Call/Put binary options with fixed contract times – anywhere from one minute out to a few months. The payouts are competitive and fixed upfront, so you know exactly what you’re risking and what you stand to gain.

But in practice, I found it frustratingly clunky. The platform sometimes freezes, especially when markets are moving fast and you need speed the most. There’s also noticeable lag during busy trading periods, which is the last thing you want when you’re trying to time an entry or exit.

The charting tools are another weak spot. You don’t get many timeframe options, which makes proper technical analysis harder than it should be. Zooming in and out of charts is also hit-or-miss. Compared to the slick, responsive platforms from bigger brokers, this one feels rough and unfinished – like it’s still in beta.

The TradingView-based platform is better if you’re already comfortable with TradingView. You get access to powerful charting tools, lots of popular technical indicators, and a familiar interface that many traders already know and love. It’s definitely a step up for analysis.

But here’s the thing: you still can’t automate anything. No bots, no advanced order types, no automated strategies. You’re manually placing every single trade, just like on the proprietary platform.

Neither platform supports complex order types that you’d find standard on most leading brokers. It’s basically Call/Put with predefined times and payouts. You can’t customize much beyond choosing your stake and direction.

There’s also no binary copy trading. If you were hoping to mirror experienced traders as you learn automatically, that’s not happening here.

One interesting feature is Bubinga’s NFX profit model, which it claims can return up to 100x your stake. Sounds exciting, but let’s be honest – that kind of potential comes with serious risk. It’s designed for traders chasing big wins, but you need to understand what you’re getting into before you touch it.

If you’re brand new and just want to place simple trades without a steep learning curve, Bubinga’s platforms are easy to use. But they’re also limited, buggy, and missing features that most established brokers offer as standard.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Platforms & Tools Rating | |||

| Platforms | Own, TradingView | TradingView | WebTrader, Pro |

| Mobile App | iOS & Android via mobile web trader | iOS & Android via mobile web trader | |

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Research

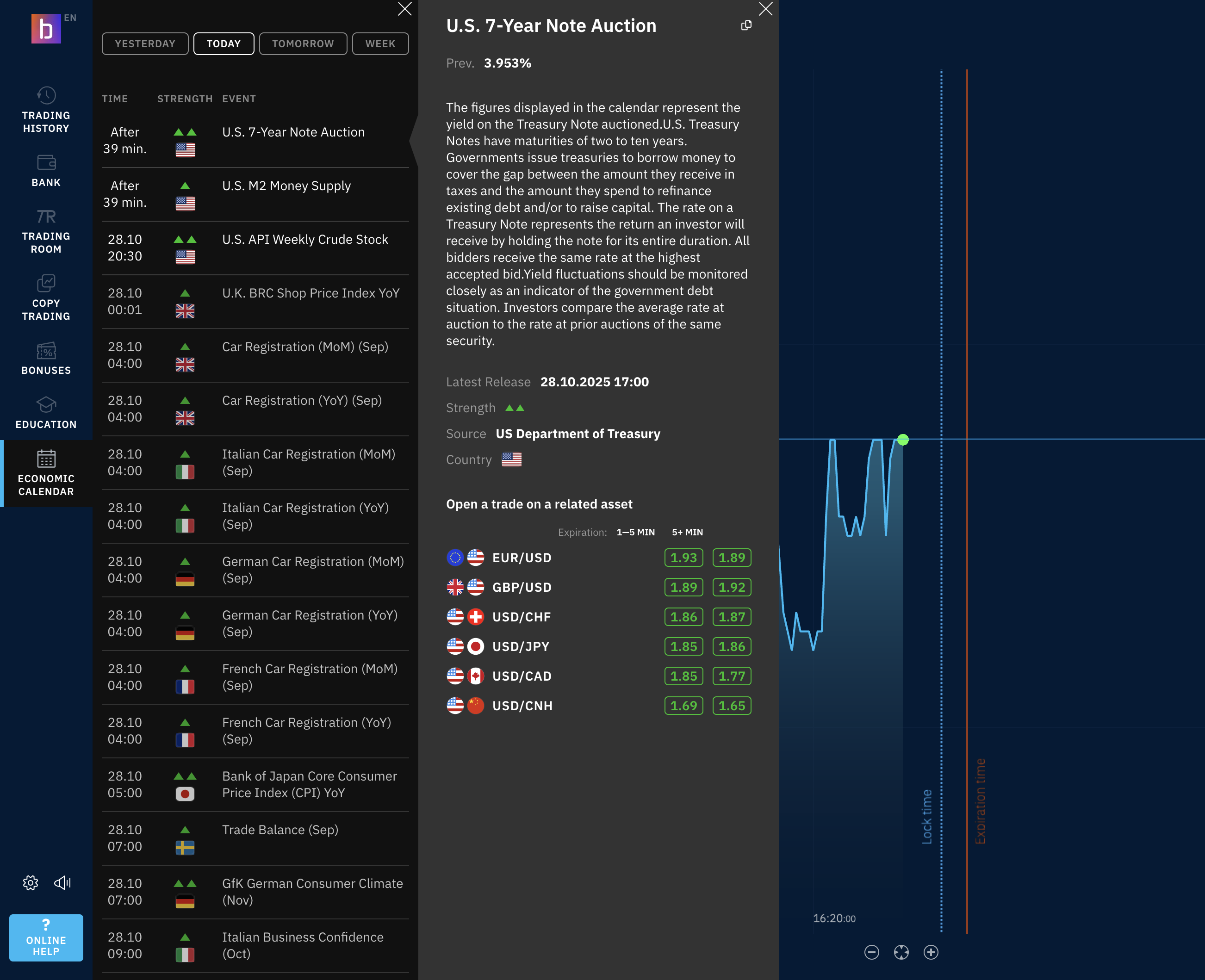

Bubinga’s research tools consist of an economic calendar and trading signals. That’s basically it. No webinars to learn from. No market news feeds updating you throughout the day. No podcasts breaking down what’s moving markets.

If you’re expecting the kind of rich research library traditional brokers provide, you’ll be disappointed.

If you’re new to trading, you’ll be doing extra legwork – finding reliable market info, following analysts on other platforms, and piecing together your own research. It’s doable, but it’s added effort you shouldn’t really need to make.

On the plus side, Bubinga offers a ‘Trading Room’ where analysts generate trading signals. These are meant to help you spot potential opportunities by flagging favorable market conditions for binary options trades. In theory, that sounds helpful. In practice? It’s clunky.

First, the signals aren’t automated. You’re not getting trades executed for you – you have to manually place every order based on what the signal suggests. That’s fine if you want control, but it slows things down.

What really frustrated me is that when you click a signal, it doesn’t actually open the instrument’s chart. Instead, you have to close the signal panel, manually hunt for the asset on the platform, and then set up your trade.It’s an annoying extra step that breaks your flow, especially when you’re trying to act quickly on a time-sensitive signal.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Research Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Education

You’ll find some tutorials and guides both on the Bubinga website and built right into the trading platform. They cover the basics of binary options and a handful of simple strategies.

Having everything in one place is genuinely convenient – you can learn and trade without jumping between tabs or external sites.

For absolute beginners, this setup works. It’s accessible, it’s straightforward, and it gets you moving quickly. But in reality, it’s pretty bare-bones.

When I compare it to what established brokers offer – comprehensive video courses, interactive walkthroughs, advanced strategy breakdowns, platform demos – Bubinga’s resources feel like the CliffsNotes version.

If you’re brand new and just need the fundamentals, you’ll be fine. But if you’re serious about developing fundamental trading skills or understanding advanced techniques, you’ll quickly outgrow what’s available here.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Education Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Customer Support

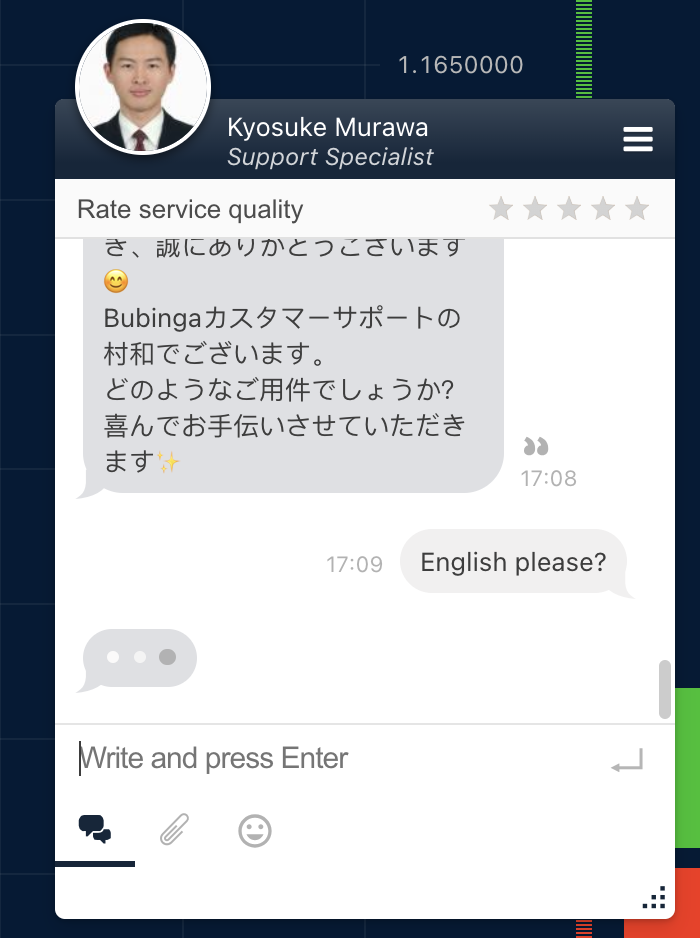

Help options on Bubinga are pretty limited. You’ve got live chat and email. That’s it. No phone number to call, no callback service, no contact form.

The 24/7 live chat is there when you need it, and I’ll give it credit – response times are actually quick. For straightforward questions like “How do I verify my account?” or “Where’s my withdrawal?”, support gets the job done.

But I noticed that English clearly isn’t the support team’s first language. You’ll get answers, but sometimes the phrasing is awkward, or you’ll need to clarify what they mean. It’s manageable, just not consistently smooth.

What really stands out is how bare-bones support feels compared to some brokers we’ve tested. Many established platforms give you multiple ways to reach them – phone support, dedicated account managers, detailed email responses, and even video call options for complex issues.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Support Rating | |||

| Visit | Visit | Visit | Visit |

| Review | Review | Review | Review |

Should You Day Trade With Bubinga?

On the surface, Bubinga is beginner-friendly. The platform is simple to navigate, you can start with as little as $10, and you get a demo account to practice with.

There’s a basic economic calendar, and your asset selection expands as you deposit more. For someone just testing the waters with binary options, it’s accessible.

But here’s what you need to weigh carefully: Bubinga is unregulated. That means no oversight from trusted financial bodies – no segregated client funds, no investor protections, no regulatory safety net if things go sideways.

Add in the restrictive withdrawal limits (especially on lower tiers) and slow processing times, and you start to see the trade-offs. Getting your money out can be frustratingly slow.

FAQs

Is Bubinga Legit Or A Scam?

Bubinga is an unregulated broker registered in Saint Vincent and the Grenadines, with an office in Cyprus. Still, it does not hold a regulation from major financial authorities.

The platform provides a simple, straightforward trading experience, but the lack of official oversight means greater risk when trading with Bubinga. Fund security and withdrawal processing depend heavily on the broker’s internal policies rather than external rules.

Is Bubinga Suitable For Beginners?

Bubinga is beginner-friendly with a simple platform and a low minimum deposit, making it easy to start without risking much. It offers a demo account with $10,000 in virtual funds for risk-free practice, along with educational guides and tutorials to help you learn the basics.

The tools are enough for new traders, with clear charts and indicators. But limitations like tighter withdrawal rules and fewer assets on lower tiers mean it’s best for those who want a straightforward start rather than lots of options or strong protections.

Best Alternatives to Bubinga

Compare Bubinga with the best similar brokers that accept traders from your location.

- Videforex – Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

- Capitalcore – Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from multiple accounts with better pricing as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees on CFDs, though these don’t compensate for the weak oversight and paltry education and research.

Bubinga Comparison Table

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Rating | 2.8 | 3.5 | 3.9 |

| Markets | Binary Options, Forex, Stocks, Indices, Commodities, Crypto | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $10 | $250 | $10 |

| Minimum Trade | $1 | $0.01 | 0.01 Lots (CFD/Forex), $1 (Binaries) |

| Regulators | – | – | – |

| Bonus | – | 100% Deposit Bonus | 40% Deposit Bonus |

| Platforms | Own, TradingView | TradingView | WebTrader, Pro |

| Leverage | – | 1:2000 | 1:2000 |

| Payment Methods | 8 | 9 | 4 |

| Visit | Visit | Visit | Visit |

| Review | – | Videforex Review |

Capitalcore Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bubinga and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bubinga | Videforex | Capitalcore | |

|---|---|---|---|

| Binary Options | Yes | Yes | Yes |

| Expiry Times | 1 minute – 3 months | 5 seconds – 1 month | 1 minute – 1 hour |

| Ladder Options | No | No | No |

| Boundary Options | No | No | No |

| CFD | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | Yes | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | Yes |

| Options | No | No | No |

| ETFs | No | No | No |

| Bonds | No | No | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Bubinga vs Other Brokers

Compare Bubinga with any other broker by selecting the other broker below.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Bubinga yet, will you be the first to help fellow traders decide if they should trade with Bubinga or not?