Best Binary Options Brokers 2026

We’ve spent hundreds of hours each year running hands-on tests of binary options platforms – opening accounts, placing trades, logging platform changes, monitoring regulator alerts, and revisiting brokers as trading conditions evolve. The result is this updated ranking of the top binary options platforms.

You can use our comparison tables below to find a provider that suits your binary trading needs, considering factors like maximum payouts on winning trades, contract expiry times, and minimum deposits.

DayTrading.com may receive compensation from binary brokers featured on this page. This helps fund the content on our website, but it does not dictate our platform ratings. See our advertising disclosure.

Top 6 Binary Options Brokers

These are the top-rated binary options trading platforms based on our tests and analysis. Some of these platforms may be based offshore and not authorized in your country - this means you may have limited recourse options in case of disputes. We provide more details on this further down.

What Makes These Brokers The Best For Binary Options Trading?

Here’s a rundown of why these binary options brokers topped our rankings:

- CloseOption is the best binary options broker in 2026 - CloseOption offers binary options trading on 30+ fiat and digital currencies through an easy-to-use web-based platform. 15 contract timeframes are available from 30 seconds to 1 month, suiting both short-term and long-term traders. New users also get a joining gift.

- Capitalcore - Capitalcore has expanded its suite of trading products, introducing binary options on forex, metals and crypto with payouts up to 95%. Geared towards short-term traders, contract lengths range from 1 minute to 1 hour. It’s a snap to place trades on the intuitive web platform, requiring just the click of the button – ‘Call’ if you think the price will rise and ‘Put’ if you think it will fall.

- IQCent - IQCent offers binary options with above-average payouts up to 98%. The broker supports an online platform with basic analysis tools but a wide range of timeframes, from 1 minute to 1 month, catering to short and long term trading strategies. Considering the negatives, there are no binaries on stocks.

- Videforex - Videforex continues to offer binary options with 20% payouts on crypto and up to 98% on less volatile assets, beating many competitors. A wide range of contract lengths are also supported from 5 seconds up to 1 month. New users will appreciate the welcome deposit bonus.

- RaceOption - RaceOption offers 100+ binaries with decent payouts up to 95% and ultra-fast expiries from 5 seconds. With a $200 minimum deposit, clients can enjoy free deposits and fast withdrawals.

- AZAforex - AZAforex offers binary options trading with time-dependent payouts that can be taken out from 30 seconds to 1 day. Over 50 binary options are available with a $1 minimum stake and payouts up to 90%.

Compare The Top Brokers Across Contract Variables

Discover the best broker for your needs using our comparison of elements important to binary traders:

| Broker | Maximum Payout | Contract Lengths | Ladder Contracts | Boundary Contracts |

|---|---|---|---|---|

| CloseOption | 95% | 30 seconds - 1 month | ✘ | ✘ |

| Capitalcore | 95% | 1 minute - 1 hour | ✘ | ✘ |

| IQCent | 98% | 5 seconds - 1 month | ✘ | ✘ |

| Videforex | 98% | 5 seconds - 1 month | ✘ | ✘ |

| RaceOption | 95% | 5 seconds - 30 days | ✔ | ✘ |

| AZAforex | 90% | 30 seconds - 1 day | ✘ | ✘ |

Are The Top Binary Options Brokers Good For Beginners?

Beginners should choose brokers that allow binary trading in a demo account plus other features for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| CloseOption | ✔ | $5 | $1 | ||

| Capitalcore | ✔ | $10 | 0.01 Lots (CFD/Forex), $1 (Binaries) | ||

| IQCent | ✔ | $250 | $0.01 | ||

| Videforex | ✔ | $250 | $0.01 | ||

| RaceOption | ✔ | $200 | $0.01 | ||

| AZAforex | ✔ | $1 | 0.0001 Lots |

Compare The Ratings Of Top Binary Options Providers

See how our top brokers for trading binaries scored in every vital area in our latest tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| CloseOption | - | ||||||||

| Capitalcore | - | ||||||||

| IQCent | - | ||||||||

| Videforex | - | ||||||||

| RaceOption | - | ||||||||

| AZAforex |

How Popular Are These Binary Options Trading Platforms?

The binary options space has been home to many scams so traders often prefer the firms with established client bases:

| Broker | Popularity |

|---|---|

| CloseOption | |

| Videforex | |

| RaceOption |

CloseOption

"CloseOption is the most accessible binary broker we’ve evaluated for newer traders – signing up takes less than 5 minutes, the starting deposit is just $5, and the smallest stake is $1. CloseOption is also suitable for traders who want to compete in binary trading competitions, with weekly tournaments and cash prizes up to $1,300."

Tobias Robinson, Reviewer

CloseOption Quick Facts

| Minimum Deposit | $5 |

|---|---|

| Payout % | 95% |

| Expiry Times | 30 seconds - 1 month |

| Copy Trading | No |

| Platforms | Own |

| Instruments | Binary Options on Forex & Cryptos |

| Account Currencies | USD |

Pros

- CloseOption offers weekly trading tournaments with cash prizes

- The user-friendly platform is compatible with most web browsers

- New traders can get started with a $5 minimum deposit

Cons

- Clients need to deposit $50,000+ to qualify for the best payouts

- CloseOption is not regulated by a well-regarded trading authority

- Binary options are only available on fiat and digital currencies

Capitalcore

"Capitalcore runs one of the most advanced binary options platforms we’ve tested, making it a stellar option if you need serious charting power, with TradingView integration offering over 5 chart types and 90 indicators. Its 'double up' and 'rollover' capabilities to replicate or extend short-term trades with a click, are also excellent for strategy development."

Christian Harris, Reviewer

Capitalcore Quick Facts

| Minimum Deposit | $10 |

|---|---|

| Payout % | 95% |

| Expiry Times | 1 minute - 1 hour |

| Copy Trading | No |

| Platforms | WebTrader, Pro |

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Account Currencies | USD |

Pros

- The support team are available 24/7 and responded within minutes during testing with helpful responses.

- Capitalcore is one of the only brokers to charge zero swap fees, which may appeal to Islamic traders looking to comply with Islamic Finance.

- Capitalcore has added binary options trading on 30+ currency pairs, metals and crypto with one-click trading and payouts up to 95%.

Cons

- Capitalcore is not regulated by major financial authorities and has an unproven reputation, raising concerns about the safety of client funds.

- Platform support is limited to proprietary software, so there's no integration with the market-leading MetaTrader or cTrader, which offer built-in economic news and support automated trading.

- The web platform was inconsistent during testing, with occasional technical glitches that meant the trading platform wouldn’t load.

IQCent

"IQCent is great for traders wanting bespoke binary assets, with a growing roster of 150+ products, including ‘Hype Pool’ contracts, which track trending events. Short-term expiries from 5 seconds, payouts that can hit 95% (with up to a 3% boost), and a TradingView charting package with 100+ indicators, also make it ideal for serious, fast-paced traders."

Jemma Grist, Reviewer

IQCent Quick Facts

| Minimum Deposit | $250 |

|---|---|

| Payout % | 98% |

| Expiry Times | 5 seconds - 1 month |

| Copy Trading | Yes |

| Platforms | Online Platform, TradingView |

| Instruments | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Account Currencies | USD, EUR |

Pros

- Keen traders can take part in trading contests with cash prizes

- CFD trading fees are competitive based on tests, including 0.7 pips on major forex pairs such as EUR/USD

- IQCent has bolstered its asset range with 60+ new assets, including hot cryptos like TON and SHIB; top-tier stock CFDs such as TSLA and NVDA; plus exotic FX pairs like THB and HUF

Cons

- The broker is not overseen by a respected regulator, though this is common among binary options firms

- IQCent trails binary brokers like Quotex with its narrow investment offering of around 175 assets with limited stocks

- There's no automated trading support for algo traders

Videforex

"Videforex will serve traders looking for an easy-to-use platform to speculate on the direction of popular financial markets through binaries, especially cryptos and stocks, with dozens of assets added. The integration of TradingView charts also caters to technical traders. However, it requires a trade-off – no regulatory oversight, making it a risky choice. "

William Berg, Reviewer

Videforex Quick Facts

| Minimum Deposit | $250 |

|---|---|

| Payout % | 98% |

| Expiry Times | 5 seconds - 1 month |

| Copy Trading | Yes |

| Platforms | TradingView |

| Instruments | Binary Options, CFDs, Forex, Indices, Commodities, Crypto |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- Traders can earn up to 98% payouts on 150+ assets with the broker’s binary options, bringing it in line with competitors like IQCent.

- With the addition of over 60 new assets, Videforex now gives traders access to in-demand crypto (TON, ARB, PEPE, SHIB), top-performing tech stocks (Tesla, Meta, Nvidia, Amazon), and a more diverse FX portfolio (THB, ZAR, and MXN).

Cons

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

RaceOption

" RaceOption is amongst the best binary firms for its range of assets, notably US technology stocks and niche cryptocurrencies. With 5 second turbo contracts and tick charts through the TradingView-powered charting package, it’s well-suited to intraday traders. Regular contests also provide an extra layer to the binary trading experience. "

William Berg, Reviewer

RaceOption Quick Facts

| Minimum Deposit | $200 |

|---|---|

| Payout % | 95% |

| Expiry Times | 5 seconds - 30 days |

| Copy Trading | Yes |

| Platforms | TradingView |

| Instruments | Binary Options, CFDs |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- RaceOption is in the less than 1% of brokers that offers video chat, available 24/7 in multiple languages, although the knowledge of agents about trading and regulatory issues needs improvement from our direct experience.

- RaceOption makes account funding a breeze with fee-free and near-instant deposits via bank cards and cryptos, plus guaranteed withdrawals processing within 1 hour.

- Payouts on popular underlying assets like EUR/USD can reach 95%, beating out most alternatives based on our evaluations, and increasing potential returns, while the first 3 trades are risk-free in Silver and Gold accounts.

Cons

- RaceOption is an unregulated, high-risk broker that doesn’t provide investor compensation or legal recourse options should you run into trading or withdrawal issues.

- While still affordable for many retail investors, the $200 minimum deposit raises the entry barrier, especially compared to Deriv and World Forex who are designed for budget traders.

- RaceOption has an absence of decent educational resources for, making it a poorer choice for beginner binary traders who must understand the risks of these typically all-or-nothing contracts.

AZAforex

"AZAforex is best suited to active traders looking for a choice of American and Chinese options, with different payout structures to standard high/low options. It’s also excellent for mobile traders, offering a dedicated app that provides a more comprehensive experience if you’re trading on the go compared to the mobile-optimized web browsers most firms use."

Christian Harris, Reviewer

AZAforex Quick Facts

| Minimum Deposit | $1 |

|---|---|

| Payout % | 90% |

| Expiry Times | 30 seconds - 1 day |

| Copy Trading | No |

| Platforms | Mobius Trader 7 |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

Cons

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

How Did DayTrading.com Choose The Best Binary Options Brokers?

We began testing binary options platforms in 2017 and we keep our rankings moving – retesting existing brokers, adding new entrants, and removing platforms that close, deteriorate, or trigger serious trust concerns – check our list of scam binary providers.

Our review process covers 200+ data points per broker, including payouts on winning trades, platform stability, execution, KYC/withdrawal, and how responsive support is.

Where possible, we validate claims by doing – not just reading. By this we mean placing trades, exploring client areas, and trying different tools when they’re added to platforms.

We’ve paid special attention to elements that matter to binary traders:

- Payout Percentages: We track the highest payouts on winning binary trades and how consistently they appear across instruments and market hours. Keep in mind that advertised payouts can and do shift with volatility and liquidity.

- Binary Contract Types: We assess coverage across contract types such as high/low and boundary, since different structures suit different binary trading strategies.

- Practical Trading Tools: We take note of tools like early close and rollover/double-up (where offered), charting quality, plus whether the platform provides clear order confirmations and trails of closed trades.

- Regulatory & warning signs: We actively watch for regulator statements and warnings, such as the CFTC RED List (contains dozens of warnings about binary providers at our latest count searching for ‘binary’) and other announcements from major regulators.

Why Some Binary Brokers Listed Are Weakly Regulated

Because retail binary options trading are restricted in some jurisdictions, many platforms still available to global traders operate offshore, often with limited regulatory oversight. Because we know some individuals will still use these platforms – we continue to review some overseas providers to spot untrustworthy platforms and help traders find reliable options from those that are available.

But it’s still important to understand that offshore binary brokers are high risk. The reality is you may not have adequate legal recourse options in case of withdrawal complaints, nor investor compensation in case of brokers going under.

If a regulated, exchange-based alternative is available where you live, it’s usually the safer first stop. For example, in the US, Nadex was the key CFTC-regulated platform for binary traders. However, Nadex shut its doors to new traders in December 2025, as it transitioned to Crypto.com, which still offers prediction markets and binary-style products through its strike options.

Important Regulatory Information To Read Before Opening An Account

As noted above, binary options are restricted or even banned for retail clients in some jurisdictions. Offshore/unauthorized firms may still accept residents in restricted regions. This means you can sometimes open an account (we know we’ve done it), but doing so may mean you have limited or no local protections and ultimately there’s a higher risk of encountering scams or frauds.

That’s why we always recommend verifying authorization on your local regulator register before making a deposit. If the firm is not authorized where you live, treat that as a major risk factor.

We also suggest reading these warnings from prominent regulators about binaries so you understand the risks:

- UK FCA: Permanent ban on the sale/marketing/distribution of binary options to retail consumers (in force from 2 April 2019)

- ESMA: Prohibition on marketing/distribution/sale of binary options to retail investors (EU product intervention – PDF)

- ESMA: National regulators continued/implemented measures after ESMA’s action

- Australia ASIC: Retail binary options ban extended until 2031

- US CFTC: Beware of off-exchange binary options trades

- US CFTC/SEC: Investor alert on binary options and fraud patterns

Can I Legally Open A Binary Options Account Where I Live?

Regulations on binary options have changed over the years and can be nuanced, for example, sometimes restricting providers from offering binaries to retail investors, but not making it illegal for traders themselves to use them. So treat the below as a starting point and consult your local regulator if you’re unsure.

| Region | Retail Status | What To Do |

|---|---|---|

| United Kingdom | Providers are banned from the sale/marketing/distribution of binaries | Be wary of firms targeting UK clients. If you sign up, you may be outside FCA protections and dispute routes. |

| EU | Brokers are generally prohibited from offering binaries, with national measures continuing protections. | Be cautious of offshore providers “accepting EU clients”. Access may be possible, but legal protections can be limited. |

| United States | Binary options can be legal, but only on regulated exchanges. | Stick to regulated, exchange-traded products for safety. Be skeptical of offshore brokers soliciting US residents. |

| Australia | Platforms are not allowed to offer binary options, with the ban extended to 2031. | Treat any broker offering binaries to Australian retail as high-risk. Verify licensing and product permissions. |

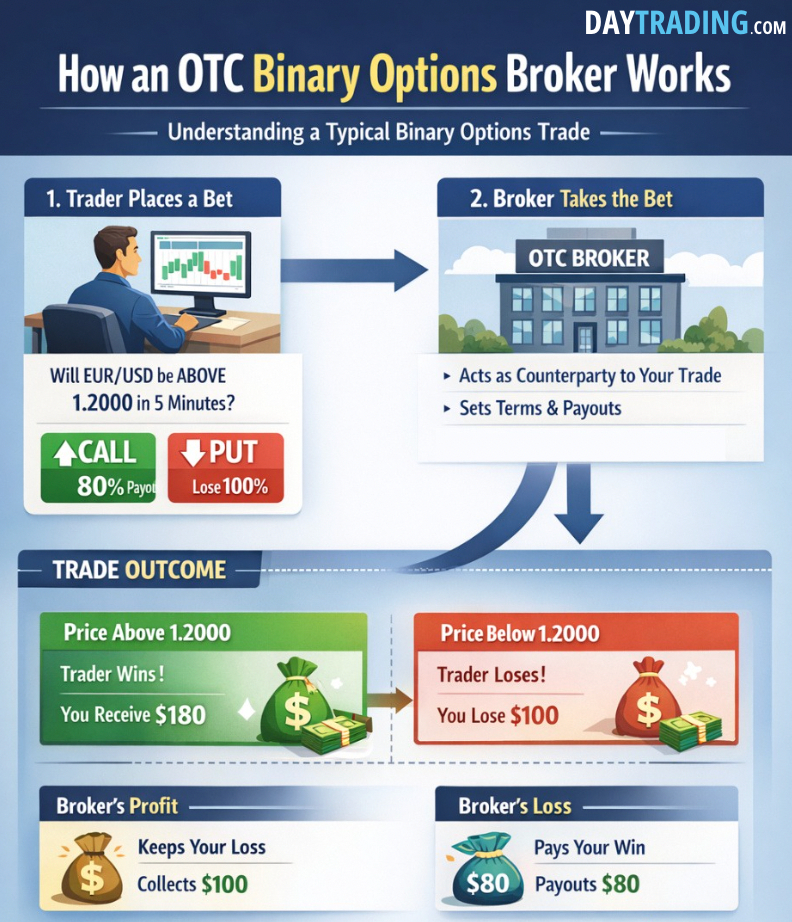

Exchange-Traded vs OTC Binary Options Brokers

‘Binary options’ can describe two very different models. Understanding which one you’re using is important.

| Feature | Exchange-traded binaries (structure-first) | OTC binaries (broker-run platform) |

|---|---|---|

| Where trades happen | On an exchange venue with rulebooks, surveillance, and a formal matching/clearing model. | Inside the broker’s own system where the broker often acts as the counterparty to trades. |

| Pricing & transparency | Typically clearer price discovery and a more standard fee model. | Payouts/quotes can be more opaque; with terms sometimes changing with limited warning. |

| Regulatory position (US example) | Aligns better with US guidance that warns about off-exchange binary offers. | CFTC repeatedly warns that offshore/off-exchange brokers can be risky and are often unregistered. |

| Typical risk profile | Lower risk relative to OTC, though product risk (losing money) remains high. | Higher platform and dispute risk – especially if the firm is offshore, unauthorized in your jurisdiction, or appears on warning lists. |

What Is A Binary Options Broker?

A binary options broker is an online provider that offers a platform and/or app for trading contracts that typically resolve in just two outcomes: you either receive a fixed return if you’re correct, or you lose all (or most) of your stake if you’re wrong.

In simple terms, contracts usually ask a yes/no question: will the price of an underlying asset (like a stock, index, or currency pair) be above or below a defined level at a defined time?

These are often described as “fixed outcome” trades because the potential win/loss is generally shown up-front, though the exact payout level can vary by instrument, expiry, and market conditions.

Many digital options brokers provide access to major markets, from forex binary options to crypto binary options like Bitcoin.

Platforms differ: some integrate with third-party tools (rare now), while most use proprietary web-based software.

How To Choose A Binary Options Broker

When comparing a binary broker, focus on the factors below.

Products

Binary options come in several common formats:

- Up/Down contracts: you’re deciding whether price ends above or below a level at expiry. This remains the most widely offered type in our tests.

- In/Out (range) contracts: you’re predicting whether price finishes inside or outside a boundary. Less common than it once was.

- Touch/No Touch contracts: you’re speculating whether price will hit a target level before expiry. Also less common today.

- Ladder style contracts: multiple touch-like levels across a wider price range. Not widely available across platforms nowadays.

Also check which assets are supported and whether the platform offers multiple markets so you can match instruments to your strategy.

Another key variable is binary expiry times. Expiries can range from seconds to hours, days, or longer. Short expiries can appeal to active traders, but you may also see more market noise and they can encourage overtrading.

Payouts

Look for providers that show a clear payout (or return) before you click buy/sell. If the platform makes it hard to see how the outcome is calculated, treat that as a warning sign.

We’ve found that a binary demo account is often the safest way to test the interface and confirm how payouts and expiry logic actually work – before putting real capital at risk.

Binary Payout Math

Binary options often look deceptively simple: ‘Win 80% if you’re right.’ The hidden question is: how often do you need to be right just to avoid losing money over time?

If your stake is 100 and the payout is ‘P%’ on winning trades (you win P and typically keep your stake), your approximate break-even win rate is: Break-even win rate = 1 / (1 + Payout%)

| Advertised payout (profit on win) | Approx. break-even win rate | What it implies in practice |

|---|---|---|

| 60% | 62.50% | You must win nearly 2 out of 3 trades just to break even. |

| 80% | 55.56% | Still requires more than 5 wins per 9 trades over the long run. |

| 90% | 52.63% | A small edge is needed; any slippage raise the bar. |

| 95% | 51.28% | Near coin-flip break-even, but only if terms are clean and consistent. |

| 98% | 50.51% | Looks attractive – verify it’s real, repeatable, and not conditional. |

This simplified math assumes full stake loss on a losing trade and no extra fees. In reality, payout changes, execution delays especially on short-term binaries, and platform terms can all push your required win rate higher.

Essentially, the chance of losses is high. ASIC found in some of its reviews that 80% of binary options traders lost money.

Trading Platform

Some traders prefer familiar interfaces such as a binary options broker with MetaTrader, but this is uncommon now. Most brokers we test run proprietary web platforms.

Some are easy to use and beginner-friendly, like the Pocket Option trading platform in the image below. Others look like a relic from the 1990s and make for a backward trading experience these days.

We also look for useful analysis tools, from calendars to charting that supports technical decision-making. For many traders, mobile matters too, so we evaluate binary trading apps, considering iOS and Android capabilities where available.

Payments

Many platforms support cards, bank transfers, and e-wallets, and some accept crypto deposits. Faster funding can be convenient, but don’t treat convenience as a safety signal. Before depositing, confirm fees, withdrawal methods, and verification requirements.

Scams

Binary options can exist as legitimate instruments, but the space has a long history of abusive practices. We’ve seen dozens of binary scams come and go over the years.

Regulators have published repeated warnings about common fraud patterns such as refusing withdrawals and manipulating platform outcomes.

Check out our guide to binary scams. If an offer reads like ‘guaranteed returns’, run, and fast.

Bottom Line

The right binary platform depends on what you’re trying to do – short expiries vs longer durations, demo access, and payout transparency. But because scams and dispute issues remain common in this market, you should prioritize finding a reliable broker with clear payout terms and proven withdrawal handling over slick marketing claims.

See our list of the best binary options brokers in 2026 to compare providers.

Note: Islamic traders may want to consult a qualified religious authority to check whether a binary broker is halal.

FAQ

Are Binary Options Brokers Legal?

Binary options legality depends on (1) your country of residence and (2) how the product is offered (exchange-traded vs OTC). In several major jurisdictions, brokers are not allowed to offer binary options to retail clients.

Even when rules restrict retail access, many offshore platforms still accept residents, however, that can expose you to higher fraud risk and weaker legal protections.

How Do Binary Options Brokers Make Money?

Binary platforms can earn revenue through embedded pricing (the payout offered relative to the underlying probability), mark-ups, and – in many OTC models – by taking the opposite side of client trades.

In practice, this means the platform’s incentives may not always align with the trader’s outcomes, which is why transparency and dispute protections matter when picking a firm.

How Do Binary Options Brokers Generate Payouts For Clients?

Payouts are set by the platform’s pricing model and terms. In many broker-run (OTC) environments, the broker controls payout schedules and quoting rules, which is why you should read the contract terms, confirm how expiry is determined, and avoid platforms that lack clear disclosures or have poor withdrawal reputations.