Forex Binary Options

Forex binary options are a simple way to speculate on foreign currency markets. In this guide, we explore how to trade forex binary options successfully. We also look at strategy examples, how to choose between brokers and the best indicators and signals. Find out whether FX binary options could meet your trading ambitions.

Forex Binary Options Brokers

List all Binary Options Brokers

Forex Trading Explained

Forex trading refers to the practice of buying and selling different currencies to profit from relative changes in price. Currency markets are enormous and highly liquid, with over $5 trillion traded every day across multiple worldwide exchanges. Forex prices are closely linked to global events and can be volatile. This makes FX trading a dynamic but risky activity for retail investors.

Forex traders deal with currency pairs, such as the EUR/USD pair (Euro – US Dollar). The first currency in the pair is the base currency, and the second is known as the buying currency. For instance, if the EUR/USD pair is valued at 1.13, this tells you that it costs 1.13 USD to buy 1 EUR.

Forex pairs can be divided into majors, minors, and exotics, with major pairs being the most widely traded instruments. The four major pairs are EUR/USD, USD/JPY, GBP/USD and USD/CHF. Minor and exotic currencies include the Turkish Lira (TRY), Hong Kong Dollar (HKD), and Swedish Krone (SEK).

How Forex Binary Options Work

Binary options are a type of financial contract with two possible outcomes: the trader receives a fixed payout or loses their initial investment. Traders predict whether an underlying asset is worth more or less than a set price (known as the strike price) at a set expiry time. In the case of forex binary options, the underlying asset is a foreign currency pair such as EUR/USD or USD/GBP.

As an example, imagine that you stake $100 on a prediction that the USD/GBP pair will be above 0.72 by 12:00 AM. Your broker offers you a payout of 70%. If your prediction is correct, you receive $170 ($70 plus your initial investment). If you are incorrect, you lose $100.

To make a consistent profit when trading forex binary options, you need to win over half your trades: a typical pay-out level of 75% requires traders to be successful more than 57% of the time. This makes it vital to have a robust strategy in place, as this can help you to avoid making rash or emotional decisions. Trading strategies also make your decisions repeatable and quantifiable.

There are a number of different types of forex binary options contracts:

- Over/Under: The classic binary options trade. Clients bet on whether an asset’s value will be over or under the strike price at expiry.

- In/Out: The bet is placed on whether an asset’s price will fall inside or outside a particular range. Also known as the ‘tunnel’.

- Touch/No Touch: If the asset’s price ‘touches’ a set value before it expires, the trader receives an immediate pay-out.

- Ladder: Similar to up/down trades, the ladder has strike prices that are staggered up or down. These normally involve a substantial price move to reach. Pay-outs are often higher than in other contracts, however.

- Highline/Lowline: The trader wins if the Highline target price is higher than the current price, while the Lowline is lower than the current price. This is usually a high-payout contract.

Pros & Cons Of Forex Binary Options

Advantages of trading forex binary options include:

- Binary options are simple assets to trade, offering an advantage for inexperienced investors

- Traders can choose from a large number of major and minor forex pairs to trade with

- Many brokers support a good range of technical tools to help your trading strategy

- The forex markets are dynamic with multiple factors affecting prices

- Binary options limit losses to no more than your initial investment

However, some notable disadvantages include:

- As binary options are a form of fixed-odds trading, profits are limited

- It can be difficult to trade binary options alongside other assets

How To Create A Forex Binary Options Strategy

In this section, we introduce four simple strategies to help you understand the basic principles of forex binary options trading. In day trading, most binary options trades are short, perhaps only lasting 5 or 10 minutes.

Since short-term price fluctuations are purely driven by the number of traders buying or selling, technical analysis is key. Many traders use indicators or signals to inform their decision-making. Others use programmable algorithms known as bots to robo-trade, executing orders automatically.

In addition to a trading strategy, forex binary options require sensible money management. A notable technique is the percentage method, whereby only a set percentage of your total capital is invested per trade. This means that profits will grow as you become more successful, while also ensuring that your funds never run dry.

Hedging Forex With Binary Options

Binary options can also be used as part of a hedging strategy to complement a direct forex investment. Alternatively, some FX traders invest in multiple related currency pairs to exploit correlations between the two markets. In general, ‘hedging’ refers to the strategy of opening two or more trades as a protection measure against possible losses.

For instance, if you open a bullish forex binary options position, you could also open a smaller bearish position on a forex trading platform. In theory, you could open an equally-sized but opposite position, but this usually leads to a net loss overall. Most traders using a hedging strategy adjust the size of their positions to account for the relative levels of confidence they have in their investments.

Trading The News

Forex markets are traditionally very sensitive to the global news cycle. By keeping an eye on current affairs, binary options traders can profit from the short-term price movements that occur when a big announcement is broadcast.

Important information to look out for includes:

- Consumer/business confidence surveys

- Interest rate decisions

- Unemployment

- Retail sales

- Inflation

American economic releases tend to have the biggest impact on the forex market, as the US dollar is incorporated into many currency pairs. When significant news events hit the market, there is usually a quick, strong reaction. You can trade this reaction with a high/low option, one-touch option, or ladder option, depending on your preference and risk tolerance.

Momentum Strategy

Momentum trading is perhaps the most intuitive forex binary options strategy. The aim of the strategy is to capitalise on short- to medium-term movements in the value of a currency pair. Trends often draw the attention of traders, pushing the price upwards or downwards.

Momentum traders use a variety of tools to determine the strength of a trend and when it might reverse. These include the ADX (Average Directional Index), Relative Strength Index (RSI), and Stochastic Oscillator. You can observe how the Stochastic Oscillator reflects the price momentum of GBPUSD in the chart below.

On a candlestick chart, a strong trend is displayed when each peak is higher than the previous peak, and each trough is higher than the previous trough.

Once a trend is identified, all that remains in forex binary options trading is to open an up or down position. Typically, trends with greater momentum will last longer, and so it may be worth opening a long trade. Alternatively, many traders prefer to open several short trades, providing them with greater flexibility and a chance to exit trends before they reverse.

Rainbow Strategy

Rainbow strategies utilise multiple moving averages in conjunction. Moving averages calculate the average price of an asset across a particular time period – for instance, 5 minutes, 10 minutes, or 50 minutes. Crossovers of different moving averages can be used in forex binary options trading to predict future price movements.

For instance, imagine that you have plotted three moving averages, as well as the current market price. The shortest moving average should best reflect recent price changes. Therefore, when the shortest moving average crosses over the medium average, which is in turn above the longest average, this may indicate that the market is about to move strongly upwards.

Conversely, when the shorter averages are below the longer averages, prices may be about to enter a downwards trend. This information will instruct the type of forex binary options call that you go for.

Forex Binary Options Signals & Indicators

RSI

The Relative Strength Index, or RSI for short, has a value that oscillates between 0 and 100. When the RSI is over 70, this indicates that the market has been overbought, which could push forex prices downward. On the other hand, a value below 30 means that the market has been oversold, which could lead to an upwards trend.

MFI

The Money Flow Index (MFI) compares the number of assets bought to the number of assets sold, producing a number between 0 and 100. If every trader wanted to sell a currency pair, the MFI would read 0.

Conversely, if the MFI was 100, everyone who wanted to trade the pair was attempting to buy it. In short, the MFI helps forex binary options traders to identify overbought and oversold conditions, and thus in turn predict future price movements.

Bollinger Bands

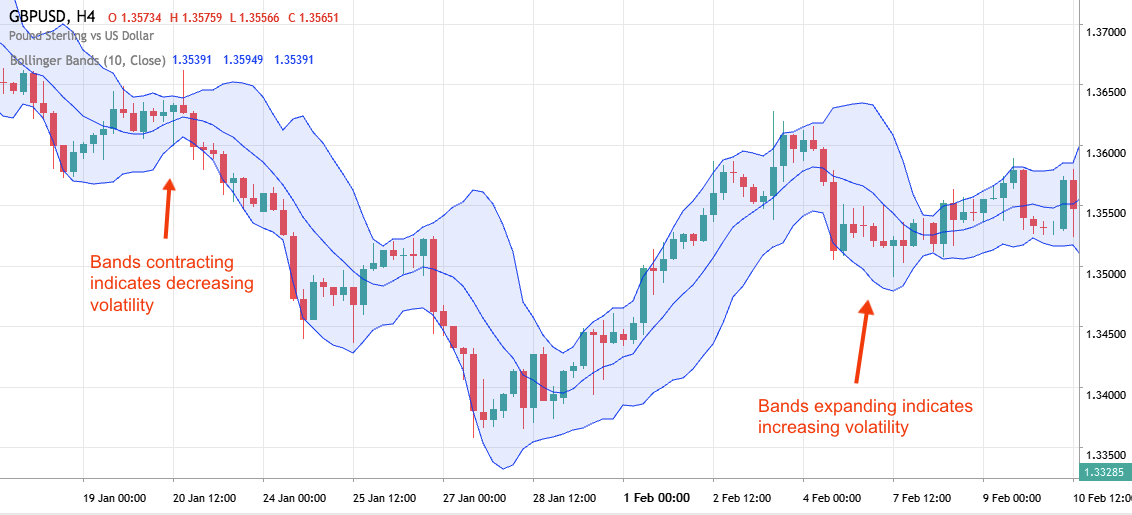

Bollinger Bands plot a moving average price, an upper line located two standard deviations above the mean, plus a lower line two standard deviations below the mean. They are often used in forex binary options trading as a volatility indicator.

A common strategy that utilises Bollinger Bands is to open a buy or call option when the price touches the lower band, as this often precedes an upwards trend. You can also gauge the volatility of an asset by observing the expansions and contractions of the band.

How To Choose The Best Forex Binary Options Brokers

There are a number of factors to take into consideration when choosing a forex binary options broker:

- Technical Tools: Forex binary options trading utilises a large degree of technical analysis. The best brokers, such as Nadex, support a wide variety of charts, indicators, and other tools on their platform.

- Pay-outs & Fees: The potential profits per trade vary between brokers, so it can be worth looking around to find the best possible deal. Some brokers offer big payouts as a reward for placing large deposits, but we recommend that you refrain from investing more than you can afford to lose. In addition, check whether a broker has deposit or withdrawal fees, as these can eat into profits.

- Demo Account Availability: Demo accounts, also known as paper trading accounts, are perfect for developing forex binary options strategies in a risk-free environment. Many brokers offer demo accounts to their customers for free.

- Trading App: Smartphone binary options trading apps allow you to trade remotely. The best mobile trading apps offer easy navigation, interactive charting capabilities, and a streamlined design.

- Bots & Live Signals: Some brokers support the use of forex and binary options trading robots and free signals – programs that execute trades automatically based on a set of inputs. Many traders find that bots can be helpful for enforcing a trading strategy and increasing trading volume. Note, however, that they can never guarantee continued success.

- Security: Unfortunately, there is an increasing number of fraudulent binary options brokers looking to make illicit profits online. Always ensure that your broker is trustworthy by checking it against online blacklists.

Forex Vs. Binary Options

If you’re wondering what the benefits are of binary options over standard forex trading, we’ve listed some key advantages below:

- Smaller losses – in binary options trading, it is impossible to lose more than your initial stake

- Simplicity – Binary options have one of two outcomes: either you receive a fixed payout or nothing at all

- No exposure – forex binary options allow you to profit from changes in the forex market without taking on any exposure

- No need for leverage – forex traders often use leverage to increase the size of their positions, putting them at increased risk

- Fixed trade duration – binary options make it possible to set the duration of your trades precisely, helping you to execute multiple orders in one day

However, there are some disadvantages of forex binary options vs standard FX assets:

- Need to ‘win’ a majority of trades to be profitable

- Limited returns on each trade

Forex Binary Options Verdict

Forex binary options are a simple but dynamic way to profit from foreign currency markets. However, successful forex binary options trading requires strategy, determination and perseverance. Binary options can also be used to complement forex investments as a hedging strategy. It’s important to conduct research to determine the ultimate forex tools & best binary options trading systems for you.

FAQs

Forex And Binary Options: Which Is More Profitable?

The potential pay-outs for an individual forex trade are often higher than an equivalent binary options trade. However, the losses may also be higher, meaning that many traders prefer binary options.

Is Forex And Binary Options The Same?

Binary options and forex have one key difference in how they are traded. Traditional forex trading requires direct investment into foreign currencies. Binary options, on the other hand, are simple fixed-odds financial contracts that can be based on many different underlying markets, including forex.

Is Binary Options Easier Than Forex?

Binary options are generally considered a simpler form of trading than forex. In forex binary options, there are only two possible outcomes: either the trader receives a fixed payout or nothing at all.

Forex And Binary Options: Which Is Better?

There is no definitive answer on whether forex or binary options trading is superior. As such, it is usually down to different individual trading styles and preferences. If you’re unsure, you can check out binary options vs forex trading reviews on brokers forums, as well as community sites such as Reddit and Quora.

How Can I Start Trading Forex Binary Options?

The best way to start is to implement a solid forex binary options strategy, using technical indicators such as moving averages, Bollinger Bands or Relative Strength Index. If you’re a beginner or learning a new strategy, it’s recommended that you practise your techniques within a risk-free demo account first.