Best Low Minimum Deposit Binary Options Brokers In 2026

A binary options broker with a low minimum deposit offers a more accessible route for beginner traders and those with a limited bankroll. We’ve listed the lowest deposit binary options trading platforms in 2026.

Top Low Deposit Binary Options Brokers

After recording their initial investment and weighing that with the results of our hands-on tests, these binary providers emerged as the best. Note some of these brokers may not be authorized by your local regulator - you may lose regulatory safeguards by opening an account with one.

-

1

CapitalcoreMinimum Deposit: $10

CapitalcoreMinimum Deposit: $10 -

2

CloseOptionMinimum Deposit: $5

CloseOptionMinimum Deposit: $5 -

3

AZAforexMinimum Deposit: $1

AZAforexMinimum Deposit: $1 -

4

BubingaMinimum Deposit: $10

BubingaMinimum Deposit: $10 -

5

BinariumMinimum Deposit: $5

BinariumMinimum Deposit: $5 -

6

World ForexMinimum Deposit: $1

World ForexMinimum Deposit: $1

This is why we think these brokers are the best in this category in 2026:

- Capitalcore - Capitalcore has expanded its suite of trading products, introducing binary options on forex, metals and crypto with payouts up to 95%. Geared towards short-term traders, contract lengths range from 1 minute to 1 hour. It’s a snap to place trades on the intuitive web platform, requiring just the click of the button – ‘Call’ if you think the price will rise and ‘Put’ if you think it will fall.

- CloseOption - CloseOption offers binary options trading on 30+ fiat and digital currencies through an easy-to-use web-based platform. 15 contract timeframes are available from 30 seconds to 1 month, suiting both short-term and long-term traders. New users also get a joining gift.

- AZAforex - AZAforex offers binary options trading with time-dependent payouts that can be taken out from 30 seconds to 1 day. Over 50 binary options are available with a $1 minimum stake and payouts up to 90%.

- Bubinga - Bubinga offers binary trading on over 120 assets, with payouts hitting 95% and longer than average expiries of up to 3 months. While there are limited contract variations, with no touch, ladder or boundary options, the Tradeback feature, which repays part of any losses, marks it out from the crowd.

- Binarium - Binarium is an experienced binary options broker offering access to a range of financial markets with a proprietary, sleek platform and TradingView integration with 100+ technical indicators. New users can open a real-money account or practice in the demo account with $10,000.

- World Forex - World Forex offers binary options where you simply decide the stake, price direction and contract timeframe. The payouts are high at up to 100% on American contracts and 85% on European, which also offers a partial refund to traders who close contracts before expiry.

Comparison of Low Deposit Binary Trading Platforms

Alongside a small deposit, it's worth considering the minimum required trade size, demo accounts and the quality of educational tools and support:

| Broker | Minimum Deposit | Minimum Trade | Demo Account | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Capitalcore | $10 | 0.01 Lots (CFD/Forex), $1 (Binaries) | ✔ | / 5 | / 5 |

| CloseOption | $5 | $1 | ✔ | / 5 | / 5 |

| AZAforex | $1 | 0.0001 Lots | ✔ | / 5 | / 5 |

| Bubinga | $10 | $1 | ✔ | / 5 | / 5 |

| Binarium | $5 | $1 | ✔ | / 5 | / 5 |

| World Forex | $1 | $1 (Binaries), 0.01 Lots (Forex/CFDs) | ✔ | / 5 | / 5 |

Capitalcore

"Capitalcore runs one of the most advanced binary options platforms we’ve tested, making it a stellar option if you need serious charting power, with TradingView integration offering over 5 chart types and 90 indicators. Its 'double up' and 'rollover' capabilities to replicate or extend short-term trades with a click, are also excellent for strategy development."

Christian Harris, Reviewer

Capitalcore Quick Facts

| Minimum Deposit | $10 |

|---|---|

| Payout % | 95% |

| Expiry Times | 1 minute - 1 hour |

| Copy Trading | No |

| Platforms | WebTrader, Pro |

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Account Currencies | USD |

Pros

- Capitalcore is one of the only brokers to charge zero swap fees, which may appeal to Islamic traders looking to comply with Islamic Finance.

- Capitalcore has added binary options trading on 30+ currency pairs, metals and crypto with one-click trading and payouts up to 95%.

- While a relative newcomer to binary options space, its transparent, accessible service earned it runner up in DayTrading.com's 2025 'Best Binary Broker' award.

Cons

- The web platform was inconsistent during testing, with occasional technical glitches that meant the trading platform wouldn’t load.

- Capitalcore’s threadbare education and research seriously trail category leaders like IG, making it less suitable for aspiring traders.

- Platform support is limited to proprietary software, so there's no integration with the market-leading MetaTrader or cTrader, which offer built-in economic news and support automated trading.

CloseOption

"CloseOption is the most accessible binary broker we’ve evaluated for newer traders – signing up takes less than 5 minutes, the starting deposit is just $5, and the smallest stake is $1. CloseOption is also suitable for traders who want to compete in binary trading competitions, with weekly tournaments and cash prizes up to $1,300."

Tobias Robinson, Reviewer

CloseOption Quick Facts

| Minimum Deposit | $5 |

|---|---|

| Payout % | 95% |

| Expiry Times | 30 seconds - 1 month |

| Copy Trading | No |

| Platforms | Own |

| Instruments | Binary Options on Forex & Cryptos |

| Account Currencies | USD |

Pros

- The user-friendly platform is compatible with most web browsers

- Free demo account

- Multiple global payment methods are available

Cons

- Clients need to deposit $50,000+ to qualify for the best payouts

- CloseOption is not regulated by a well-regarded trading authority

- Binary options are only available on fiat and digital currencies

AZAforex

"AZAforex is best suited to active traders looking for a choice of American and Chinese options, with different payout structures to standard high/low options. It’s also excellent for mobile traders, offering a dedicated app that provides a more comprehensive experience if you’re trading on the go compared to the mobile-optimized web browsers most firms use."

Christian Harris, Reviewer

AZAforex Quick Facts

| Minimum Deposit | $1 |

|---|---|

| Payout % | 90% |

| Expiry Times | 30 seconds - 1 day |

| Copy Trading | No |

| Platforms | Mobius Trader 7 |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Binary Options |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, MYR, IDR, CHF, RUB, THB, VND, UAH, CNY |

Pros

- AZAforex supports a huge and growing variety of payment methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies, providing flexibility for funding and withdrawals. This variety accommodates traders from different regions and preferences.

- Few brokers offer binary options as part of their portfolio. Still, AZAforex includes them, allowing you to speculate on short-term price movements with fixed risk and reward up to 90%.

- AZAforex provides high leverage of up to 1:1000, allowing for potentially greater returns with smaller capital. While this comes with increased risk, it's an attractive feature if you are an experienced trader looking for aggressive growth strategies.

Cons

- While functional during testing, the Mobius Trader 7 platform is proprietary and not widely used by other brokers. This creates risks of potential price manipulation or discrepancies in market data, as there's no external verification like with MetaTrader or cTrader.

- AZAforex still operates without regulation from a recognized financial authority, which raises concerns about transparency, fund safety, and accountability. You may have no recourse in disputes, making it riskier than regulated brokers.

- AZAforex offers basic trading guides and a blog but lacks robust educational tools such as video tutorials, webinars, or interactive learning resources. This makes it less appealing for beginners who need comprehensive learning support. A lot of the content is outdated, too.

Bubinga

"With an account that takes under 2 minutes to create, trade sizes from $1, and popular assets like U.S. technology stocks and key currency pairs, Bubinga suits aspiring traders looking to make simple high/low trades on well-known assets."

Christian Harris, Reviewer

Bubinga Quick Facts

| Minimum Deposit | $10 |

|---|---|

| Payout % | 95 |

| Expiry Times | 1 minute - 3 months |

| Copy Trading | No |

| Platforms | Own, TradingView |

| Instruments | Binary Options, Forex, Stocks, Indices, Commodities, Crypto |

| Account Currencies | USD, EUR, JPY, KRW |

Pros

- Bubinga stands out from most competitors by offering Tradeback, which repays part of the previous week’s trading losses, with payments made to accounts every Tuesday.

- Bubinga’s order execution speed is decent. During active trading, the platform handled quick entries and exits without noticeable lag. For day traders, this responsiveness is important for catching tight expiry windows, which start from 1 minute.

- Bubinga’s web platform has been built with beginners in mind – no cluttered interface – just a simple chart and basic settings to configure the expiry time, stake and binary direction.

Cons

- Withdrawal limits on lower-tier accounts can be frustrating. When you start, you might find it hard to cash out more than a small amount at once, which slows your access to your profits. It pushes you to keep funding your account beyond what you might feel comfortable with.

- The platform’s limited research tools means you have to juggle multiple apps or sites for market info. Not having live news or market analysis inside the platform makes it harder to react quickly.

- The lack of regulation at Bubinga is a concern. Without oversight from a trusted body in DayTrading.com’s regulator tracker, there’s always a risk that your funds won’t be fully protected.

Binarium

"Binarium has been designed with simplicity in mind, featuring a fast, fully digital sign-up process and an intuitive platform and app with 100+ indicators. With binaries spanning 60 seconds to 3 months, it caters to both short and longer-term traders."

William Berg, Reviewer

Binarium Quick Facts

| Minimum Deposit | $5 |

|---|---|

| Payout % | 92% |

| Expiry Times | 60 seconds - 3 months |

| Copy Trading | No |

| Platforms | TradingView |

| Instruments | Forex, Stocks, Cryptos |

| Account Currencies | USD, EUR, AUD, RUB |

Pros

- Binarium has the best education centre we’ve seen amongst binary options brands, complete with information on core topics like trading basics and account options, plus professional video guides to using the platform.

- Binarium claims to segregate client funds with EU banks, meaning traders’ money should not be misused and providing an important layer of protection, which is especially relevant given its offshore status.

- The $10,000 demo account, deposit-doubling welcome bonus, smooth sign-up, and 24/7 support make for an attractive onboarding experience.

Cons

- Despite being operational since 2012, Binarium is an unregulated broker with limited transparency on its website, raising safety concerns and potentially putting your capital at risk.

- Binarium has some way to go to match the investment offering of binary firms like Quotex, with a particularly weak selection of around 20 currencies and 3 cryptocurrencies.

- Payouts of up to 80% are on the low side of binary options platforms based on our evaluations, which may deter traders looking for the possible best returns, though you can get back up to 15% of losing trades.

World Forex

"World Forex is best for traders wanting to place all-or-nothing trades on currencies or metals through digital contracts. It’s also a stand-out option for traders wanting to use advanced third-party platforms like MetaTrader, plus mobile traders due to the dedicated binary options app via the FX BO Lite add-on."

Tobias Robinson, Reviewer

World Forex Quick Facts

| Minimum Deposit | $1 |

|---|---|

| Payout % | 100% (American), 85% (European) |

| Expiry Times | 1 minute - 7 days |

| Copy Trading | Yes |

| Platforms | MT4, MT5 |

| Instruments | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Account Currencies | USD, EUR, RUB |

Pros

- Several different account types with varied pricing structures

- 10+ accepted payment methods

- Copy trading solution

Cons

- Withdrawal fees apply

- No negative balance protection

- Weak regulation

Minimum deposit requirements may vary by country and payment method.

How We Chose The Best Low Deposit Binary Brokers

We took a two-pronged approach:

- We documented the minimum deposit at every top binary options firm in our database. We consider anything under $50 to be ‘low’, but some platforms require even less.

- We overlaid the results of our hands-on tests, with over 200 other data points and the observations of our research panel, which includes experienced binary traders.

We sorted brokers to reveal those that have a low initial deposit requirement and scored the highest in our evaluations.

How Much Do I Need To Deposit To Trade Binaries?

This varies amongst providers but generally falls within $1 to $250 from our analysis.

Some firms charge more than this, into the thousands of US dollars, for premium account tiers, but these are aimed at well-capitalized, experienced traders who can benefit form perks like higher maximum payouts.

For those starting out, many platforms let you start with a reasonable sum, which you’ll need to send via an accepted payment method before you can place a live trade on their platform. Typical payment methods at binary firms include bank cards, wire transfer, and increasingly cryptos and digital wallets.

Payment methods themselves may have their own minimum transfer requirements, so you might need to deposit $10 to open an account but the minimum send by wire transfer could be $30 as an example.

When Do I Need To Transfer Funds?

You’ll need to make a payment before you can place a real-money trade. On some platforms this can be done when you register for an account, providing your personal details, selecting an account currency, and so on.

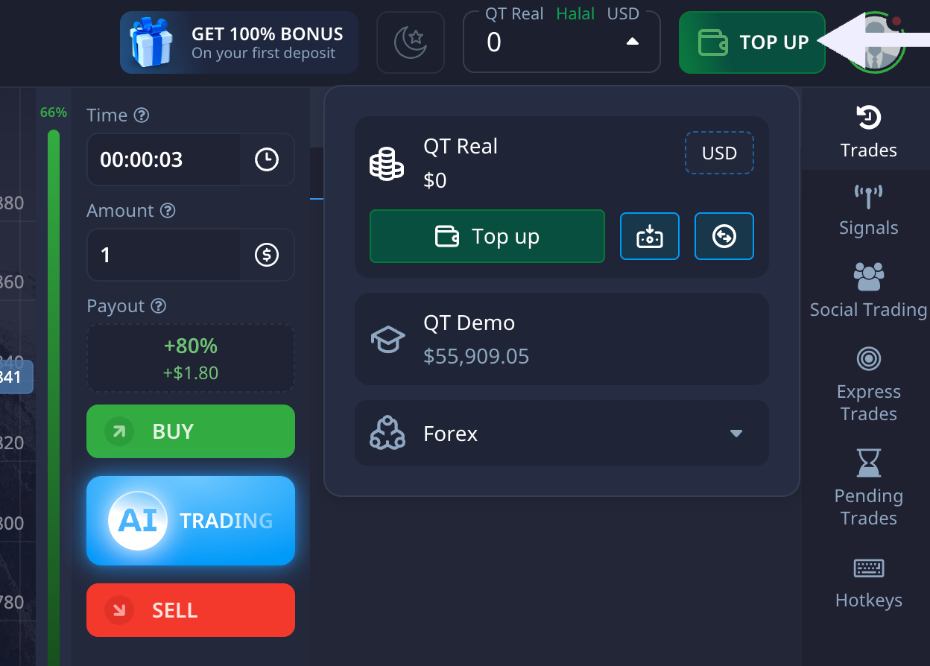

With others, like Pocket Option below, you can explore the platform first and then press ‘Top Up’ or similar to be taken to the payment area where you can choose a supported transfer method and follow the on-screen instructions.

Pros Of Using A Low Deposit Binary Broker

- Reduces Risk: Whilst binary options trading remains high-risk, if you deposit less, there’s less you can lose in total if you blow up your entire account.

- Minimum Trade Size: Brokers with lower minimum deposits may also allow smaller initial trade sizes, sometimes as little as $0.01 on binary contracts.

- Entry Point: For newer traders especially, starting binary trading with a smaller amount may relieve some of the stress and pressure that can be felt compared to having large sums on the line.

What To Consider When Choosing A Provider

Traders looking for a low-deposit binary firm are likely earlier on in their trading career, and thus should look for tools and resources to support their development:

- Demo account: These are a great way to test binary setups risk-free before deploying them in a real account. Many firms we’ve used let you switch seamlessly between binary demo accounts and live mode directly in the platform.

- Education: Some binary firms offer platform tutorials and guides that explain how their binary contracts work, the payout structure, and information on popular asset classes, such as forex binaries. That said, the quality of educational tools provided by binary firms is generally much lower than what we see in other markets.

- Customer support: Newer traders may have more questions about the platform, payments, or binary products, so look for a broker with customer service available during the hours you plan to trade and via an accessible channel. Live chat is the fastest way to get assistance from our experience. But note ‘priority support’ is often reserved for those that deposit more for a higher account tier.

- Market Analysis: Some binary platforms have integrated research tools to help inform trading decisions. These can include technical analysis, social sentiment data, and news feeds.

- Social Trading: Some firms offer copy trading on binaries with a community element where newer traders can ask questions of and learn from more experienced traders. However, copying trades is high-risk – you could lose any money you invest. Careful vetting of binary traders is required, alongside disciplined wallet management.

Bottom Line

Considering a low deposit binary broker allows newer traders to get started with binary options contracts without requiring high quantities of initial capital. Minimum starting deposits can vary between providers, but for entry-level accounts, there are multiple providers that accept traders with less than $50.

However, check that the broker does not have any surprising fees in place. Additionally, experienced traders may find that such brokers compromise on other features like advanced analysis tools, higher potential payouts, and priority customer support.

FAQs

What’s The Smallest Deposit You Can Make To Trade Binary Options?

You can deposit less than $50 on several binary options platforms, and sometimes $5 or $10. You’ll still need to meet their minimum trade size, which can be $0.01 but more often is $1. So keep in mind with the latter, if you deposited $5, you’d only have enough to make five trades, which may not be enough to develop a good strategy and endure losses.

Does Using A Low Deposit Broker Make Binary Options Trading Safe?

No. You can still risk anything you deposit – the amount you can lose in total is just smaller. It also doesn’t negate the regulatory risks. In some jurisdictions, providers are banned from offering binaries to retail clients, including in the UK and Australia, while in places like the US, only regulated exchanges can offer binary contracts.

Offshore brokers may still accept residents worldwide with low deposits, but users may be sacrificing legal safeguards like investor protection and dispute options.