Binary Options Contract Lengths

Binary options contract lengths, also known as expiry times, are a key variable for active traders. On many platforms we’ve used, you can choose from preset expiries or set your time in the future in a few clicks. This guide for beginners breaks down the typical contract durations available to binary traders and explains the pros and cons of different expiry times.

Binary Options Brokers With Flexible Expiry Times

Each of these brokers offers a wide variety of expiry times, from short contracts of seconds up to hours and longer:

List of top binary options platforms

Different Binary Expiry Times

Many binary options brokers offer a wide range of contract lengths to cater to different strategies. These can be broadly split into three groups.

| Category | Example Expiry | Best use | Pros | Cons | Tips |

|---|---|---|---|---|---|

| Short | 3 seconds | Ultra-fast price moves in volatile sessions | Near-instant results; suits scalps | Lots of noise; overtrading risk is high; execution issues | Use tiny stake sizes, have max trades/day, and pause after a small number of losses |

| Short | 60 seconds | Very quick moves on busy markets | Lots of chances; fast results | Price “randomness”; fast mistakes; can trade too much | Trade only when markets are active; avoid big news; set a daily trade limit |

| Medium | 15 minutes | Moves from clear support/resistance | Still fast but more reliable than 60s | Choppy markets; fake breakouts | Trade near clear levels; avoid quiet times; don’t enter in the middle of a range |

| Medium | 30 minutes | Bigger intraday swings | Cleaner signals than 15m | Can reverse before expiry; boredom trades | Only trade strong setups; write a “wrong if…” rule before entering; don’t keep re-trying |

| Medium | 1 hour | Trends and pullbacks during main sessions | Less noise; fewer impulse trades | Surprise headlines; slow drifting price | Check the bigger trend first; enter on a pullback; avoid entering right near expiry |

| Medium | 1 day | Day-to-day direction (swing style) | Less short-term noise | Overnight surprises; money tied up | Use smaller size; avoid major event days unless planned; base idea on daily chart |

| Long | 1 week | Slow trends and big-picture themes | Least noise; less screen time | News over the week can flip the move; ties up funds | Only your best ideas; keep positions few; choose providers that allow early exit (if possible) |

Short-Term Contracts

Short-term binary options contracts have expiry times of a few seconds up to five minutes. Sometimes referred to as turbo binaries, expiry intervals with popular brokers include 60 seconds.

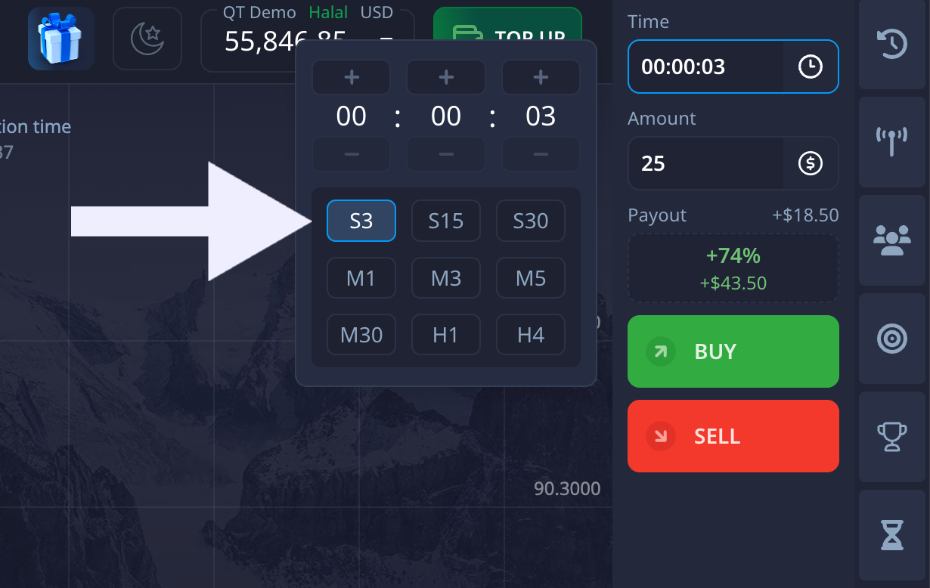

However, some platforms in recent years, such as Pocket Option, have also dropped their shortest contract length to just 3 seconds. You can see this next to the arrow in the platform image below.

This type of turbo contract that lasts just seconds, often suits momentum or correction-based trading, where prices may move in a single direction in a very short time frame.

Breaking market or global news can often catalyse these patterns for forex and commodity markets, as can earnings reports and stock dividend announcements.

Medium-Term Contracts

While trading binary options, we found that medium-term contracts with five-minutes to one-day expiry times offered day traders flexibility in setups. Popular intervals in this area include 15-minute, 30-minute, 1-hour and 1 day binaries.

Medium-term contracts are short enough to capitalize on market momentum while sometimes long enough for asset values to ride out slight deviations from a solid directional trajectory.

Long-Term Contracts

Some brokers offer longer-term contracts with expiry times of over one day through to several months.

The longer expiry times of such binary contracts allow investors to take advantage of more fundamental and gradual price changes. However, long-term contracts have disadvantages.

One concern is that your trading capital is locked up for a prolonged period. This is particularly pertinent for a fixed-return instrument such as binary options. Another is that payouts are sometimes lower on longer-term contracts – more on this later.

Example: How Expiry Time Changes the Outcome

Let’s say EUR/GBP is trading at 0.85000.

Trader A (very short-term idea)

Trader A expects a quick push higher over the next 30 seconds based on short-term momentum. They place a $100 “High/Buy” binary with a 30-second expiry. The broker offers an 85% payout, so:

- If they win: they receive $185 back ($100 stake + $85 profit)

- If they lose: they lose the $100 stake

After 30 seconds, EUR/GBP has slipped slightly to 0.84992 (a small move lower). Because the price finished below the entry level at expiry, Trader A’s trade expires out-of-the-money and they lose their stake.

Trader B (longer-term idea)

Trader B agrees EUR/GBP could rise, but expects it to play out over days, not seconds (for example, due to broader market sentiment). They place a $100 “High/Buy” binary with a 1-week expiry. The broker offers a 75% payout, so:

- If they win: they receive $175 back ($100 stake + $75 profit)

- If they lose: they lose the $100 stake

Over the week, EUR/GBP fluctuates up and down (including small dips similar to Trader A’s). By the end of the week, EUR/GBP closes at 0.85210. Trader B’s trade expires in-the-money, so they earn $75 profit on top of their original stake.

Key point: Short expiries can be decided by tiny, normal price wiggles. Longer expiries give the trade more time to work, but you’re exposed to more events and your capital is tied up longer.

Cashing Out

Some binary options brokers offer investors the chance to cash out early on a contract to either lock in profits or reduce losses. However, this is primarily a viable option for medium to long-term contracts, as short-term expiry times sometimes leave investors little time to readjust to changing market conditions.

Broker Availability

We’ve found the available binary options contract lengths can differ significantly between online brokers.

Extreme binary options contract lengths on either end of the expiry time scale, such as 3 seconds or several months are rare. However, we found that almost all brokers support contract expiries in the several minutes or hours range.

Negative Expected Value Still Matters At Every Expiry

Most over-the-counter (OTC) binaries on offshore platforms have a negative expected value because payouts are asymmetric (e.g., risk $100 to win $80). So you must win over 55.6% just to break even at an 80% payout.

Expiry length doesn’t remove the house edge on some platforms: 60s, 1h, 1d, 1w – if the payout is “risk more than you can win,” the math stays against you unless your win rate (or pricing edge) is high enough.

Short expiries can worsen it: more noise and execution effects mean your realized win rate tends to drop, so the negative expected value structure can hit harder.

How Expiry Times Impact Strategies

Multiple strategies are available to binary traders, with different plans suited to various contract lengths. Here are a couple of systems and considerations:

Trading Fundamentals

Fundamentals trading is all about the long-term outlook of an asset, also taking into account the price history of an asset. For example, this can be if an asset’s sector is due for a seasonal boost or your analysis of its price determinants reveals an asset as overvalued.

Technical analysis can also play a part in these trades, with historical data from trading graphs a valuable tool to corroborate fundamental beliefs.

Long-term binary options typically suit to this type of trading technique, as price movements tend to reflect fundamentals more than market momentum over an extended period such as weeks or months.

Trading Momentum

Trading momentum is based more on short-term price direction, with asset fundamentals not playing such a significant part. Momentum is often triggered by events like news, such as layoffs at a company, interest rate changes that affect a currency, or the announcement of a global commodities shortage.

Short or medium contract length binary options are suited for momentum-based trading. 1-minute and 5-minute binary options contracts allow traders to shoot for returns from momentum-based moves.

Bottom Line

Binary traders can access a variety of expiration times to implement different trading strategies. However, the right expiry time for you will ultimately depend on your plan and how you like to trade.

FAQs

What Is The Best Expiry Time For Binary Options?

There is no universal best expiry time. While short-term contracts lasting just a few seconds are popular on some platforms, in part due to the prospect of high percentage payouts, they require a careful strategy and emotional resilience to prevent overtrading.

Which Binary Options Expiry Times Offer The Greatest Payouts?

For many markets, short contract-length binaries offer the highest payouts, sometimes climbing above 90%. But while attractive this means you could potentially lose your stake just as quickly. See our pick of binary brokers with the best payouts for winning trades.

Can I Make Binary Options Contract Length Extensions?

Yes, some platforms we’ve used have introduced ‘rollover’ features. These let traders extend binary positions.

Regulatory Disclaimer

- US: Binary-style ‘event contracts’ exist on regulated venues; be cautious of off-exchange platforms – regulators warn about fraud/manipulation risks.

- UK: Binary options providers are banned from soliciting retail clients (sale/marketing/distribution).

- EU/EEA: Binary options were prohibited for retail clients under ESMA’s intervention measures (national rules continue).

- Elsewhere: Rules vary – many offshore firms accept clients where protections are limited, making them high risk. Verify broker authorization before depositing.