Best Brokers With API Access 2026

Brokers with API access (application programming interface) are gaining popularity thanks to the rise of automated trading, advancements in technology and the increasing size of financial markets. Our tests show APIs are not just trivial trading tools, but provide opportunities for advanced software integration and strategy implementation.

Dig into our selection of best brokers with API access and find out how to get the most out of an application programming interface for online trading.

Top 6 API Brokers

After our latest hands-on tests, we recommend these brokers with a trading API:

What Makes These Brokers The Best for API Access?

Here’s why these platforms stood out in our API tests, from reliability and documentation to speed and integration options:

- FOREX.com is the best broker for API trading in 2026 - FOREX.com’s REST API provided reliable automation in our investigations; average execution speeds around 20 ms, and most trades filled under one second, ideal for algo strategies. Spreads on raw‑pricing accounts dipped to ~0.2 pips with ~$7/100k commission. Support for Lightstreamer streaming is functional but less polished than competitors’ endpoints.

- CEX.IO - During our latest tests, CEX.IO’s REST and WebSocket APIs proved dependable with near-instant execution on major crypto pairs. We saw sub-50 ms tick updates and minimal slippage thanks to deep liquidity. While there's no FIX support, order fills were reliable even during market swings, making it solid for automation-focused traders.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- Zacks Trade - In our latest round of tests, Zacks’ public API delivered near-instant access to EPS, sales, target price, and ratings consensus for ~4,500 US stocks. The JSON/XML endpoints are easy to integrate. Queries returned full historical layers with average, high/low, SD for each field. Pricing is usage‑unit based, starting with free up to enterprise tiers.

- Coinbase - When we tested Coinbase’s REST and WebSocket APIs, execution was consistently stable on their AWS-backed International Exchange, with smooth real-time data delivery, even during periods of high volatility. The integration process was developer-friendly thanks to their sandbox environment. While not built for ultra-low latency in our view, the infrastructure reliably supported institutional-grade automation.

- AvaTrade - During our tests, AvaTrade’s API stood out for its reliable execution and low-latency order routing, especially when paired with their AvaOptions platform. We found integration straightforward, though limited to FIX protocol. Spreads held steady even during volatility, which made automated strategy performance more predictable across major FX pairs.

How Safe Are These Platforms For API-Based Trading?

We assessed each broker’s trustworthiness to help API traders protect their funds and systems:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| FOREX.com | ✘ | ✔ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| Zacks Trade | ✘ | ✘ | ✘ | |

| Coinbase | ✘ | ✘ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ |

Are These API Brokers Good for Advanced Traders?

Experienced developers will value these brokers’ low-latency infrastructure, flexible data access, and other complementary tools:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| CEX.IO | API | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Zacks Trade | Yes (algos) | ✔ | ✘ | ✘ | - | ✘ | ✘ |

| Coinbase | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

Compare The Top API Broker Ratings

See how each broker with API access scored across all our testing areas:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| FOREX.com | |||||||||

| CEX.IO | |||||||||

| Optimus Futures | |||||||||

| Zacks Trade | |||||||||

| Coinbase | |||||||||

| AvaTrade |

Why Use FOREX.com For API Trading?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Use CEX.IO For API Trading?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | GFSC |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Pros

- The broker offers 24/7 support with fast response times during tests

- The range of 200+ cryptocurrencies is competitive and will serve more experienced traders

- The $20 minimum deposit makes the broker accessible for beginners

Cons

- It's a shame that there's no demo account for traders looking to practice strategies

- A maintenance fee applies after 12 months of no activity

- The broker has limited regulatory oversight

Why Use Optimus Futures For API Trading?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

Why Use Zacks Trade For API Trading?

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Regulated by FINRA with access to the Securities Investor Protection Corporation

- 20+ account denominations

- Demo account

Cons

- No MT4 or MT5 platform integration

- Shortcomings regarding platform loading times and technical glitches

- High minimum requirement of $2,500

Why Use Coinbase For API Trading?

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- Coinbase Advanced bolstered its leveraged trading offering with a suite of new futures products in 2025, including Ripple (XRP), Natural Gas (NGS), and Cardano (ADA), providing accessible ways to trade, hedge, or diversify.

- Coinbase Advanced has added TradingView integration, a feature rarely offered by crypto exchanges, allowing users to trade spot and futures markets directly from real-time charts with powerful technical analysis tools.

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

Cons

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

Why Use AvaTrade For API Trading?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

How DayTrading.com Chose The Best Brokers With API Access

For each broker in our toplist, we conducted hands-on testing of their API access. We evaluated connection reliability, speed, documentation quality, and overall user experience, focussing on the needs of active traders.

Our goal was to assess how well each API supports fast execution, strategy automation, and seamless integration, and we recorded our findings to rank the best options available.

How APIs Work In Trading

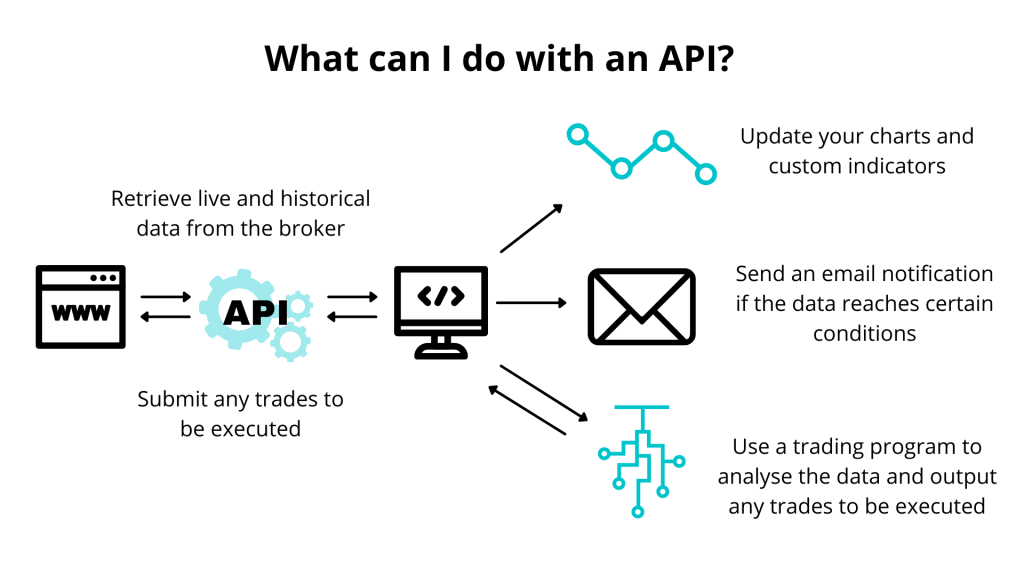

An application programming interface (API) is a set of programming code that requests data and sends instructions between software platforms.

APIs are becoming more and more widespread in a range of industries and the number of trading brokers with APIs is steadily growing from our research.

APIs essentially act as a communication bridge for information between a broker’s servers and custom software applications employed by the user.

APIs have several useful applications including sending orders from third-party trading software or receiving live or historical data. For example, an API can be used to connect a set of automated trading algorithms with your preferred broker’s trading platform.

APIs play an important part in many automated trading strategies. In the past, traders would have had to filter through opportunities on one platform and potentially place trades on another. Now that brokers with APIs are becoming more common, this process has been simplified.

Algorithmic trading via APIs allows users to exploit useful trading opportunities by placing instant, accurate trades, removing the need for manual supervision.

Using programming languages such as Python, traders can develop their own applications or complex strategies and automatically execute trades using their broker’s API.

There are two main uses for APIs in trading:

Third-Party Applications – Traders using third-party applications, such as MetaTrader 4, may need access to the broker’s API for pricing data and the ability to place trades.

Developer Applications – Using programming languages like Python, Java or C++, many short-term traders are now beginning to develop their own automated trading applications. APIs allow them to access a broker’s pricing data and place trades.

If you want to find more broker-specific information about a particular API, you should be able to find the API documentation on the firm’s main site. This will give you information on how to authenticate the API, what data is available, how to place orders through the API and other technical details.

Some brokers with APIs will also provide a library of pre-written code to make interaction easier. This will usually be in the broker’s native coding language. This library will usually contain a set of functions for placing a trade, allowing you to avoid writing your own and speeding up the development process.

Pros Of Trading With An API

- Automate Trading – APIs are essential for connecting your automation algorithms with your broker’s servers. This goes for fully and semi-automated trading strategies. Algorithmic trading is very useful to implement strategies that would be very difficult and time-consuming to do manually, like high-frequency trading.

- Historical Data – Automated trading systems require historical data. With an API, you can seamlessly obtain this information and store, analyze and use it to your liking. Traders often use historical data for backtesting strategies.

- Custom Indicators – APIs allow traders to automate their own trading signals and indicators. There are many libraries within various coding languages in which custom indicator solutions can be found.

- Create Custom Alerts – If you are looking for customized notifications sent to your email, you can use an API to retrieve stock prices, spreads or even the value of your portfolio and notify you when these fulfil certain conditions.

- Create Your Own Trading Terminal – If your broker’s trading terminal is not exactly what you are looking for, you can build your own custom terminal and use your broker’s API to populate it with data and implement trading functionalities.

Cons Of Trading With An API

- Steep Learning Curve – If you are new to coding, APIs can seem quite daunting. It is recommended you practise first with an API for a demo account before placing real trades. There are many tutorials online and brokers with APIs offer examples on their documentation to help you get started.

- Limits & Quotas – Brokerages will often limit the frequency with which you can use the API to avoid overloading their bandwidth. For example, they may limit how many trades you can do per minute or hour, how often you can fetch information or which historical data you can access. Ensure that your broker’s limits are enough for your trading needs and implement limits in your code so you do not exceed the allowed quota.

- Fees – Most brokers with API support offer them for free but, if you want to go over their established limits, you might need to pay a fee and some brokers might charge a commission on your profit only for using the API.

- Security – To access your broker’s API you will need a key, which acts as a password. However, there are different protocols for APIs and they all offer different characteristics, often with a trade-off between speed and security. Research the protocol used by your broker and the security measures they implement for a secure experience.

Getting Started With A Broker’s API

- Consider Your Strategy: Decide which trading strategy you will be using and write a simple version in your programming language of choice. Make sure you understand the requirements of your strategy – for example, consider how much historical data you will need, which will be your trading frequency, any third-party applications you’d like to use and which assets are you looking to trade.

- Choose The Best Broker With An API For Your Specific Needs: You will need to evaluate brokers according to their general features, as well as their API tools. Some of the characteristics to consider are countries where they accept clients, market access, security, fees and customer service. Furthermore, some of the API features you need to think about are:

- API Demo: Do they offer a demo account and can you access it via the API? This will allow you to test your code and strategies with low risk and ensure that a paid account will be a good fit for your needs.

- Coding Language & Data Formatting: Ensure the API works with a language that you are comfortable with and that the format of the outputted data can be well understood by your program. JSON is a well-known data format that can be read by different coding languages.

- Documentation: A well-explained API is a must, especially for beginners. Choose a broker that offers complete documentation with examples and code snippets to make the learning curve easier.

- Support: The broker’s customer support should also cover their API, so they can help with more technical questions or issues.

- Quotas & Fees: If a broker has a limit on API trading, ensure your trading needs are well within this limit or that you are happy to pay the corresponding fees.

- API Type: Do you prefer REST, WebSocket or SOAP APIs? They each have specific characteristics, though the differences may not be huge if you are just getting started.

- Open An Account & Register For The API: Open an account with your selected broker, ideally a demo account, and register for API access. You will then get a key that you can use to log in.

- Set Up The API & Test Your Strategy: Check that you can access the API with no trouble, try out the code examples provided and connect your strategy to the API. Also, link your API to any third-party software you would like to use. When you are comfortable, test your strategy. It is recommended you do so for a few weeks to fully de-bug any technical issues that come up and tweak your strategy if needed.

- Use The Trading API With A Live Account: Once you are happy with your broker and their API and your strategy has been tested, you are ready to go live. Always ensure you monitor your strategy and the API and do not hesitate to contact the broker’s help desk or trading community if you have any issues.

Bottom Line

Brokers with APIs and their use are becoming increasingly ubiquitous. They allow users to create custom terminals and implement advanced trading strategies through automation.

Having a good grasp of coding languages such a Python, Java and C++ will give you the edge when trading using brokers with APIs. However, there are numerous free online tutorials about coding and APIs and many good brokers that we’ve tested provide comprehensive documentation to help get you started.

FAQ

What Should I Compare When Looking For Brokers With APIs?

When starting with APIs, make sure you can test your code on a free demo account. Find out which coding language and format are used by the broker and ensure you are comfortable with them. Make sure the broker has comprehensive API documentation, as well as reasonable fees and limitations.

Do Brokers Charge To Use APIs?

Alongside regular brokerage fees, some firms we’ve tested place limitations on the information you can receive using their API. For example, you may only be able to update your live data once every 5 minutes. Brokers may also charge additional fees if you wish to increase the amount of information you can receive.

Should I Start Using My Broker’s API?

Trading using a broker’s API can have advantages for active traders that specialize in algorithmic trading and want to develop more complex strategies.

However, make sure you are aware that you will need to have at least basic to intermediate programming knowledge to start trading via an API.