Best Brokers For Third Party Trading Software

Finding the best brokers for third party trading software can be crucial whether you are new to trading or just looking to upgrade your methods. Brokers can be divided into those with integrated platforms and others that support third-party trading software. This article will explain the differences between the two and detail the advantages and disadvantages of third party trading software. Read on to discover significant factors and features that the best brokers for third party trading software offer.

Brokers With The Best Third-Party Trading Software

Our experts have ranked the 6 brokers with the best third-party tools based on usability, features and accessibility:

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

FOREX.com

FOREX.com -

3

xChief

xChief -

4

InstaTrade

InstaTrade -

5

Exness

Exness -

6

IC Markets

IC Markets

Here is a summary of why we recommend these brokers in February 2026:

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stock CFDs, Futures, Futures Options |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The broker trails competitors when it comes to research tools and educational resources

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

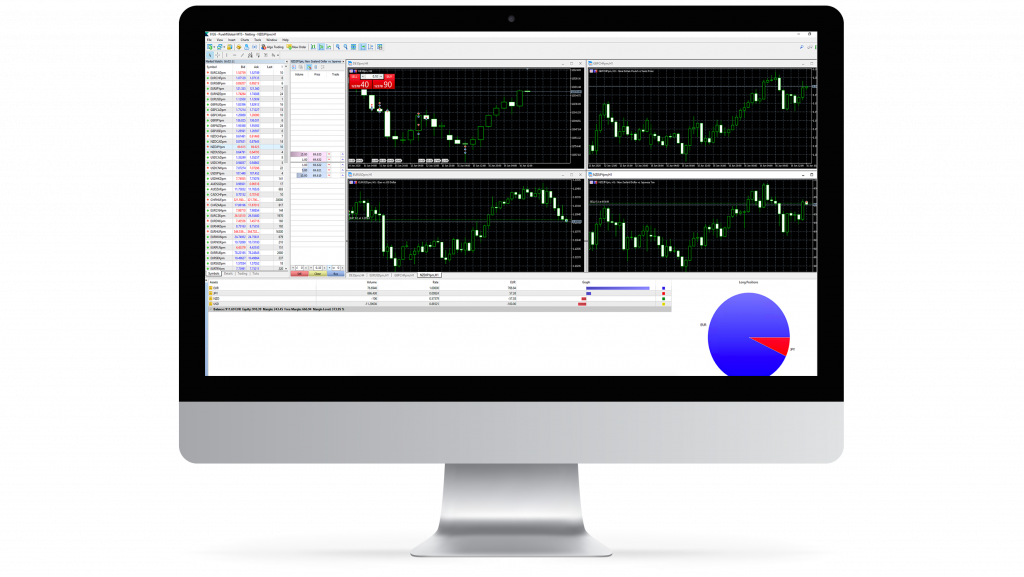

What Is Third-Party Trading Software?

To decide on the best brokers for third party trading software, it is useful to learn what this encompasses. When trading on forex, cryptocurrency and stock markets, a trading platform is an interface that allows interaction between users and the markets. In most cases, there will be a financial intermediary between a trader and the market, known as a broker. Brokers deal with financial transactions like buy and sell orders and options contracts on behalf of traders, either in exchange for fees or valuable data on trading patterns. To facilitate the communication of information like real-time asset prices, trading charts and order books with traders, brokers will employ trading platforms.

Many brokers create bespoke trading software for their platform, often designed to be uncomplicated and easy to use and aiming not to overwhelm or intimidate traders. Other brokers allow traders to choose their preferred trading software from a range of third party providers. Numerous brokers offer both options, allowing traders to progress from a simpler, in-house platform to trading with more advanced third-party software.

The upside of brokers with third party trading software support is that the external software often supports far more advanced options for tracking and trading on markets. Traders may be provided with a more complete picture of history and patterns and can compare these in real-time. Importantly for high-level traders, the best brokers for third party trading software can offer support for expert advisors, known as EAs, for automated trading.

Types Of Third Party Trading Software

When using the best brokers for third party trading software support, clients will look for different types of software to support their specific desires. Some third-party software will bundle these together but many traders opt for specific tools for each purpose.

Standalone Trading Platforms

The fundamental piece of third party trading software is the trading platform. The platform is responsible for displaying current market prices and charts and executing trades quickly and without issues. Advanced features such as backtesting trading strategies and comprehensive market scanning set these apart from the more basic integrated platforms.

Individual trading platforms will be designed for different assets or markets, with separate areas of trading often requiring unique features and data presentations. Specialised software is available for cryptocurrencies like Bitcoin and Ethereum, commodities like gold and oil and e-mini options trading. Platforms may only function in specific regions, such as the Indian or Canadian markets.

Many trading platforms encompass some of the features of more specialised software, such as signals generators or EAs. While good for reducing cost, this may come at the price of accuracy or speed compared to individual software options. Two of the most popular external trading platforms are MetaTrader 4 and MetaTrader 5 and many of the best brokers for third party trading software will offer one or both of these.

Signals Software

This third party trading software aims to analyse data from the market and recognise patterns and trends to alert users to opportunities. These are called “signals” and project future price movements in assets. Particularly popular in forex trading for their simplicity, signals provide traders with suggestions as to buy and sell prices, as well as stop-losses to manage risk.

Signals range in accuracy and reliability depending on the software used to generate them. Often, the more expensive a signals generating software is, the more precise their predictions may be. Nonetheless, a lower or medium cost software could still yield significant profits for traders. The best brokers for third party trading software will provide integration support for good value signals products.

Arbitrage Software

When trading forex or cryptocurrency, it is possible to profit from the lack of a centralised exchange. Arbitrage involves exploiting discrepancies in the price of an asset between exchanges, allowing you to turn the difference into profit. Trading without software is a high-risk and inefficient strategy, as arbitrage trading opportunities tend to exist for a very short period.

To monitor and trade on as many markets and exchanges as possible, a trader requires reliable and powerful hardware to run this software. Arbitrage software needs to be fast to place these trades where seconds can mean the difference between profit and loss. The software will also need to run in conjunction with as many exchanges as possible to maximise potential profits. The best brokers for third party trading software in terms of arbitrage software may also provide a free virtual private server (VPS), from which the package can be run quickly and consistently.

Journalling Software

This form of third party software does not take part in any trading activity, instead comprehensively recording trades within a digital logbook. This tool is essential for full-time traders that need to keep accurate records of profit and loss to comply with local taxation rules. A journaling software that can distinguish between taxable and tax-exempt profits can save traders valuable time and ensure the accuracy of reported figures.

This type of third party trading software also serves another important purpose. Analysis of trading performance is a crucial element when looking to optimise a trading strategy. To this end, journaling software allows users to review past mistakes and successes, helping to understand the advantages and pitfalls of their approach.

Technical Analysis Software

Some of the best brokers for third party trading software provide additional analysis tools, which aim to provide traders with the relevant information and data required to make informed decisions. Where traders can be influenced by emotions such as excitement or anger, technical analysis takes away these factors, empowering data-based trading. This software is designed to provide greater breadth and depth to market monitoring compared to integrated platform solutions.

Technical analysis software help traders by quickly evaluating and flagging trading patterns before suggesting specific entry and exit points for a trade. Third-party technical analysis software can include dynamic watch lists that enable real-time, simultaneous monitoring of stocks and assets and customisable indicators that track fundamental data and social media for trading opportunities. Any trader needs capable and extensive technical analysis if looking for extended success in the market. Competent technical analysis software should be a priority for those considering the best brokers for third party trading software.

For many years, hedge funds and the world’s most prominent investment corporations have relied on automated trading to manage complicated investment strategies. Consumer trading robots have come a long way since their induction into the retail markets. More and more retail traders are trusting automation to generate profits that humans could not, taking advantage of the speed and scalability of automated trading.

One form of automated trading is copy trading, which follows the trades of a preset market leader. Copy trading is regularly marketed towards new traders as an opportunity to use anothers’ experience and insight to profit. However, you often have little to no agency over the trades themselves and are left vulnerable to potentially costly mistakes of another person. Many firms support integrated copy trading functionalities, though the best brokers for third party trading software will also allow the integration of external packages.

More experienced traders look to expert advisors and robots as an implementation strategy. They set parameters based on their approach to produce an algorithm without human input. These parameters will be as simple or complex as the code behind them, with entry and exit prices, stop-losses and trailing stops generated based on multiple factors set by the trader. These algorithms can enact many trades nearly simultaneously while working round the clock in markets that facilitate it.

Pros Of Third Party Trading Software

Here are some of the best reasons for favouring brokers suitable for third party trading software:

- Backtesting – A feature that proves the worth of using the best brokers for third party trading software is the capacity for backtesting. This allows traders to use historical market data to test the efficacy and accuracy of their trading instruments. Platforms that include a backtesting function can run simulations with their trading robots or see how receptive their signals are to past market changes. Using a backtesting facility, strategies can be perfected using real data and errors in software can be identified and rectified. Backtesting is valuable as it allows traders to sort out these issues before trading with real funds.

- Scalable Market Tracking & Trading – Another benefit of third party trading software is the ability to track more assets simultaneously. The most advanced market scanners can analyse data in real-time from tens of thousands of assets, alerting traders instantly to significant changes. Robots have a similar ability to place multiple trades within a fraction of a second, far out-scaling what even a team of humans might be capable of.

- Advanced Technical Tools – While integrated software platforms will offer basic indicators and some drawing tools for traders to use, those who wish to create bespoke indicators and access unlimited technical tools may need to turn to other trading software. Integrated packages may have a limited news section but external options will often feature live updates on stocks and tools, drawing from data sets that include social media. For traders that engage in options contracts, the value of both top-notch technical tools and rapid sentiment updates cannot be understated.

- A Choice Of Platform – Relying on brokers’ integrated platforms when trading is restrictive, trapping you within software that some users may find unintuitive or lacking features. Using the best brokers for third party software tools allows a choice of platforms for traders to use, so most traders should find a few that suit their needs. Furthermore, using a third-party package removes a variable when deciding which broker to trade with, allowing greater scope for focus on important considerations such as fees and asset range.

- Try Before You Buy – Many providers of third party trading software allow traders to trial their platforms and products before committing to a purchase. These free trials allow potential customers to familiarise themselves with the software and learn whether it can meet their needs. By trading with demo funds in such an account, traders can gain valuable experience in their chosen market with no risk.

- Unique Trading Opportunities – Because of the near-instantaneous trading capabilities of robots, third party trading software creates favourable conditions for methods like arbitrage and scalping. These strategies can be difficult to implement successfully when trading manually due to the fast-moving nature of markets and exchanges. A delay of just a few seconds can lead to large losses when caught between trades. Automation helps solve this issue, making both of these strategies viable for sustained profit.

Cons Of Third Party Trading Software

Despite the abundance of features and options provided by the best brokers for third party trading software, there are some notable disadvantages to consider:

- Creating False Trends – Third-party trading software can be subject to incorrect reading and predicting of patterns. While no forecasts can ever be guaranteed, a malfunction in trading software can lead to more than just a few missed trades. This was demonstrated in 2012 by Knight Capital Group, which lost over $440 million in minutes when their trading software glitched and misplaced trades on their behalf. While a mistake of this size is extremely rare, a smaller-scale glitch can still damage trading profits for anyone.

- Software & Hardware Costs – This is perhaps the most substantial disadvantage of favouring the best brokers for third party trading software. Advanced software can set traders back hundreds of dollars a month. Hardware capable of computing advanced algorithms can also be a very costly investment. Traders can bypass this upfront cost by hosting their software on remote servers but this rental cost will soon add up.

- Automation Drawbacks – Some traders may imagine that automating their trades using robots will mean that they can take a hands-off approach to trading. However, this is not the case. Robot software should be monitored regularly to catch faults such as connection issues, software problems and market anomalies that can impact your trading strategies. Furthermore, the removal of the ultimate decision making by humans has drawbacks. Automated trades can take place independently of greater market events that can drastically impact profits. As long as the prerequisites are met, the robot will trade with no greater perspective than it has been programmed to consider.

- Confusing & Complex Software – When compared with integrated trading software offerings, the added features and complex layouts can be confusing. There can be a steep learning curve when adapting to advanced trading software, with multitudes of data and charts to choose from. For those new to trading or only wishing to make a few, simple trades, third party trading software may be overwhelming or overkill for what they need from a trading platform.

- Accessibility And Reliability – Due to the advanced nature of some third-party software options, systems that can run advanced and complex trading setups will usually be immobile, making trading on the go impractical. While traders can leave their software running unsupervised, this may not be wise. Compared with the cloud-based integrated platforms that can run on laptops or mobile apps, many third party trading apps suffer from a lack of accessibility. While all types of trading software are subject to reliability issues, as third party trading software usually relies on an individual’s hardware to process trades and contracts, it can be less reliable.

Next Steps

Now that you are familiar with the details of third party trading software, you may be looking to get started. There are two main elements to this decision: selecting a, or multiple, suitable packages for your needs and finding the best brokers for third party trading software to trade with.

How To Choose Trading Software

When deciding on which third party trading to use, it is a good idea to demo a particular tool before committing to a purchase. Here are some attributes that you can use to refine your trial list:

- Availability Of Markets & Assets – As mentioned earlier, different software will be compatible with or optimised for individual markets and trading methods. The first step when deciding on which third party trading software to utilise is making sure that it operates on the markets or strategies you require. For example, a particular arbitrage software may be perfect for forex but not work on cryptocurrency exchanges, while other software may be compatible with US markets but not work on Indian and Chinese markets, or vice versa.

- Reliability & Reputation – To trade effectively, traders should use dependable third-party trading software. Software prone to crashing or freezing can seriously hamper trading, even more so when using a method reliant on fast transactions. It is worth researching the reputation of a specific third party trading software and gauging user sentiment, checking for any red flags around transaction speed or overall software stability. Also important is the level of support offered through regular updates.

- Features & Capacity – There is a wide range of third party trading software available, each designed with the needs of diverse traders in mind. Some capabilities that users will find attractive are backtesting and real-time market scanning. As well as this, a specific trading software will have a different capacity for processing trades or tracking assets simultaneously.

- Cost Efficiency – Finding a balance between features and cost is one of the most important considerations when choosing third-party trading software. Those considering third party trading software should strive to avoid overpaying for features and trading capacity they do not need. While having room to expand your trading and tracking capacity may seem attractive to traders, more isn’t always better here. The price of the most capable software can be extremely high. Traders should instead aim for software that provides them with features they are comfortable using and only the capacity for tracking and trading that they will use.

How To Find The Best Brokers For Third Party Trading Software

There are many brokers with third party trading software support, so traders will be spoilt for choice when it comes to selecting one. However, here are some attributes that best brokers for third party trading software will excel in:

- Trusted & Reliable – The most important qualities in a broker are honesty and dependability. When selecting a broker to use for third party trading software, you want their transaction process to be fast and secure, as well as to store your funds safely. Many brokers are regulated by independent financial authorities that ensure they fulfil their obligations to traders. Look for reviews from trusted sites to gauge whether you should consider trading with a specific broker.

- Compatible With Preferred Software – Another fundamental to consider is whether a broker supports the third party trading software that you favour. The best brokers for third party trading software will support a wide range of additional technical instruments and programs. However, if your preferred tool is not supported, then you should consider finding another firm rather than compromising on necessary software features.

- Low Fees – For many traders, fees are a primary element of whether to trade with a particular broker or look elsewhere. Fees can be levied on deposits and withdrawals, as well as trading transactions. Watch out for brokers that attempt to hide fees with confusing fee structures. For low margin trading such as scalping and arbitrage, keeping fees down can be vital to turning a profit. Options and longer-term trading are not immune to the effects of fees either. When making greater volumes of trades, fees will add up quickly, so it is imperative to find a broker with low fees to generate the most potential profit.

- Availability Of Assets, Markets & Trading Variants – There is no point in having software capable of trading on thousands of assets and complex options if these are not supported by the broker making your transactions. It is worth making sure your chosen broker facilitates the types of trading you wish to carry out on the assets and markets you require.

- Open APIs For Custom Software – For traders who wish to create custom software and robots, a platform’s Application Programming Interface, or API, may be restrictive. When looking to combine additional software with a broker’s platform, this is crucial to consider. If a particular feature is crucial for you then you need to make sure to choose a platform with an API that offers that function.

Final Word

Finding the best brokers for third party trading software depends entirely on the requirements of the trader, while some may be completely fine with the integrated options offered. However, external software can open up opportunities for new profits, strategies and markets, while enhancing capacity to predict trends and make orders. When it comes to the best brokers for third party trading software, there are several elements to consider. Traders should prioritise finding a trusted and reliable broker, also taking into account variables like fees and availability of a range of assets and markets. Following this guide, you should be able to find trading software well suited to your needs and identify the best brokers for integrating third party trading software.

FAQs

Should I Use One Of The Best Brokers For Third Party Trading Software?

While using purely integrated broker trading software is often adequate for beginner traders and those who trade sporadically, more experienced traders should consider third-party trading software. Access to advanced features and the ability to create unique indicators are valuable assets to serious traders. Automated trading also increases efficiency and can result in enhanced profits for traders.

Can I Trade Cryptocurrency With The Best Brokers For Third Party Trading Software?

Third-party trading software can be used to trade across many markets, including worldwide major stocks and shares markets, forex, cryptocurrency, penny stocks, e-minis and commodities. Different tools will often be optimised for different markets and assets, so no matter what you wish to trade, there will likely be a third party software solution for you.

Are Many Brokers Compatible With Third-Party Trading Software?

The best brokers for third party trading software will often support a range of tools and packages, though some firms may limit their availability. If you wish to build or commission custom trading software, it is important to make sure your chosen platform supports an open API.

Can I Create My Own Custom Trading Software?

The wide range of customisability opportunities in third party trading programs is suitable for many traders but some may want to create bespoke software for their own specific needs. If you cannot code it yourself, bespoke software will often be expensive to commission. Custom software will likely have more bugs than thoroughly tested commercially available software. However, the complete control over the features included as well as the ability to create a personally intuitive layout will appeal to some traders.

Should I Automate My Trading With Third-Party Trading Software?

There are lots of advantages to automating your trading with some of the best brokers for third party trading software. Perhaps the greatest is the speed of trading, with external trading software able to seize momentary opportunities by completing trades in fractions of a second. The capacity to complete multiple trades at any one time also cannot be understated, alongside the reassurance of backtesting your automated trading strategy.

However, some traders could be reluctant to hand over complete control of their funds to an algorithm. Robots are not immune to errors in perception or execution and, left unchecked, a malfunction could prove costly to a trader.