Best Margin Brokers 2026

Margin brokers lend traders funds to increase their purchasing power. In return for a small outlay, known as the ‘margin’, traders can multiply potential profits (and losses). The best brokers for margin trading offer competitive fees, excellent tools and a secure environment.

List Of Best Margin Brokers

Our experts ran a comparison of firms across multiple categories, including the lowest margin rates, joining requirements, safety and resources that support clients trading on margin.

These are the top 5 margin brokers based on our findings:

- Vantage – Best Overall Margin Broker

- eToro – Best Margin Broker For Beginners

- AvaTrade – Best Margin Broker For Experienced Traders

- IC Markets – Best Margin Broker For Automated Trading

- FOREX.com – Best Margin Broker For US Traders

Comparison of Top 5 Margin Brokers

| Vantage | eToro | AvaTrade | IC Markets | Forex.com | |

|---|---|---|---|---|---|

| Margin Rate (Central Bank Rate + X%) | ∼ 3% | ∼1% | ∼2% | ∼2% | ∼2.5% |

| Maximum Leverage | 1:500 | 1:100 | 1:400 | 1:500 | 1:500 |

| Margin Requirement | 0.20% | 1.00% | 0.25% | 0.20% | 0.20% |

| Margin Call Level | 80% | 20% | 50% | 50% | 50% |

| Margin Calculator | Yes | No | Yes | No | Yes |

| Minimum Deposit | $50 | $50 | $100 | $200 | $100 |

Note, leverage and margin requirements may vary based on your location.

Vantage - Best Overall Margin Broker

Margin Call: 80%. Margin Rate: Base + Approx. 3%

We recommend Vantage because it offers an excellent all-round package with margin on 1000+ instruments spanning popular asset classes, from forex and stocks to commodity and crypto trades.

Add in a low minimum deposit plus near-instant payment methods, and you can start trading on margin quickly and securely.

The broker also stands out for its track record as a reliable brand, overseen by a tier-one regulator – the Australian Securities & Investments Commission (ASIC).

Below we explain what makes Vantage our best overall broker for margin trading.

Low-Cost, Fast And Accessible Payment Methods

Vantage offers an excellent selection of global funding methods with no deposit fees and immediate account funding. Fast processing times are especially important if you experience a margin call and need to quickly deposit more funds to cover potential losses.

The broker also offers more account currencies than the majority of margin brokers we evaluated, including support for USD, EUR, GBP, and AUD. This makes it easier to manage your margin account in your local currency.

Flexible Margin Opportunities

Traders can increase their purchasing power at Vantage through a straightforward process – simply contact the customer support team or head to the client portal.

It is just worth noting that proof of margin knowledge and strategy plans may need to be provided to access the best rates.

Caters To Beginners With A Low Minimum Deposit And Copy Trading

Our team has evaluated dozens of online brokers with margin trading and Vantage excels for its beginner-friendly offering.

As well as a starting deposit of just $50, the broker provides access to leading third-party social investing solutions, including ZuluTrade and DupliTrade, plus its own copy trading app. These are great options for beginners, who can place their confidence in more experienced margin traders.

Pro-Level Features And Tools

Vantage has some great features for beginners, but we also rate the offering for more experienced investors. The brokerage has raw ECN accounts with spreads from zero and $3 per lot commissions – pricing that is among the best of any margin broker we used.

Competitive fees, alongside access to a free Virtual Private Server (VPS) and no strategy restrictions, will serve active margin day traders.

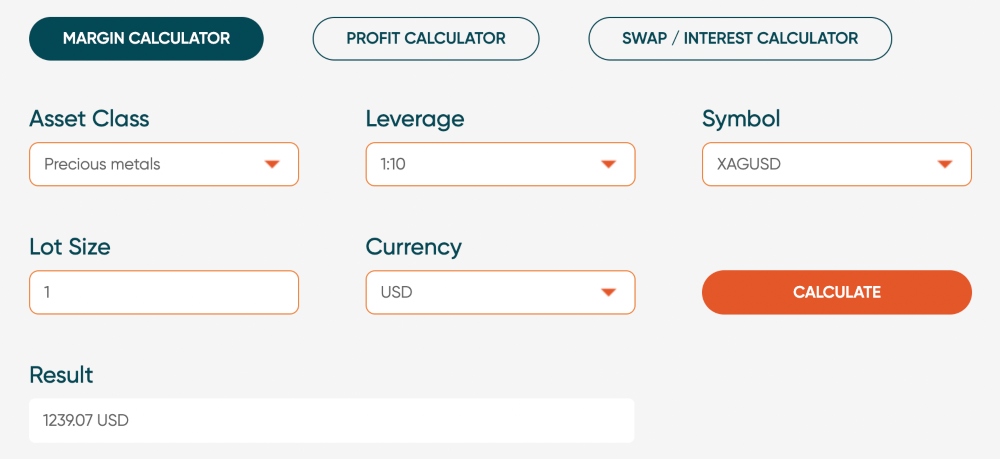

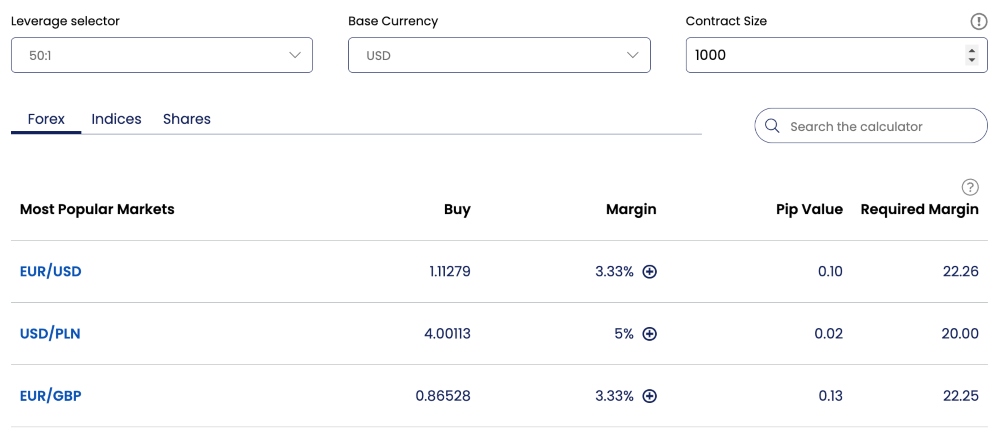

The free margin calculator is also useful for understanding requirements before making a trade:

Unlimited Demo Account To Practice Trading On Margin

Vantage offers an unlimited demo account where most of the margin brokers we assessed closed our practice account after 30 days.

We prefer demo accounts that do not expire – they allow beginners to practice on margin before risking real funds, while experienced traders can continue testing strategies alongside their live account.

Cons Of Margin Trading At Vantage

- Your location and the registered entity will impact margin terms – This is not so much a drawback of Vantage as something to be aware of – as a multi-regulated global broker, different branches will have different terms, including in relation to margin. Clients with Vantage Global Prime LLP, which is regulated by the UK’s Financial Conduct Authority (FCA), are restricted to a maximum multiplier of 1:30. This is mirrored by the Vantage Global Prime Pty Ltd, regulated by the Australian Securities and Investments Commission (ASIC). Clients registered with the other entities, overseen by the Vanuatu Financial Services Commission (VFSC) and the Cayman Islands Monetary Authority (CIMA), can access much higher purchasing power up to 1:500.

- Weak regulatory oversight offshore – The greater buying power provided by the broker’s offshore entities may appeal to day traders with a large risk appetite. However, users should be aware they may receive less legal and account protection. In particular, negative balance protection, which prevents your account from falling below zero while trading on margin, is not provided as default. And whilst many renowned brands have both regulated and offshore entities, it is worth keeping in mind that margin trading with these branches carries more risk. As such, take a sensible approach to risk management to avoid a margin call and forced stop-out.

Why Is Vantage Better Than The Competition?

Vantage stands out as an excellent margin broker that caters to traders of all experience levels.

It offers the complete package, from transparent margin terms and flexible buying power to industry-leading platforms and accessible account conditions.

Our team also trust Vantage thanks to its long track record and oversight from tier-one regulators.

Who Should Choose Vantage?

Newer investors should consider Vantage. Beginners can learn about margin through social investing platforms, the unlimited demo account and high-quality educational materials. The broker also offers a lower minimum deposit than other margin brokers we reviewed.

Seasoned traders should also consider Vantage. Experienced traders benefit from low pricing in the raw-spread ECN account alongside access to industry-leading platforms, a VPS for 24/7 connectivity, plus no restrictions on margin strategies.

Who Should Avoid Vantage?

Users searching for significant buying power but not willing to sign up with an offshore entity that doesn’t provide negative balance protection should avoid Vantage.

The broker also offers fewer stocks than some alternatives, so we don’t recommend Vantage if you are interested in using margin on a wide selection of equities.

eToro - Best Margin Broker For Beginners

Margin Call: 20%. Margin Rate: Base + Approx. 1%

We recommend eToro because it offers a world-leading social investing platform and margin on over 3000 instruments. It is also heavily regulated, hugely respected, and well-designed to meet the needs of beginners.

Below we explain why we consider eToro a great broker for margin.

User-Friendly Platform With Transparent Margin Terms

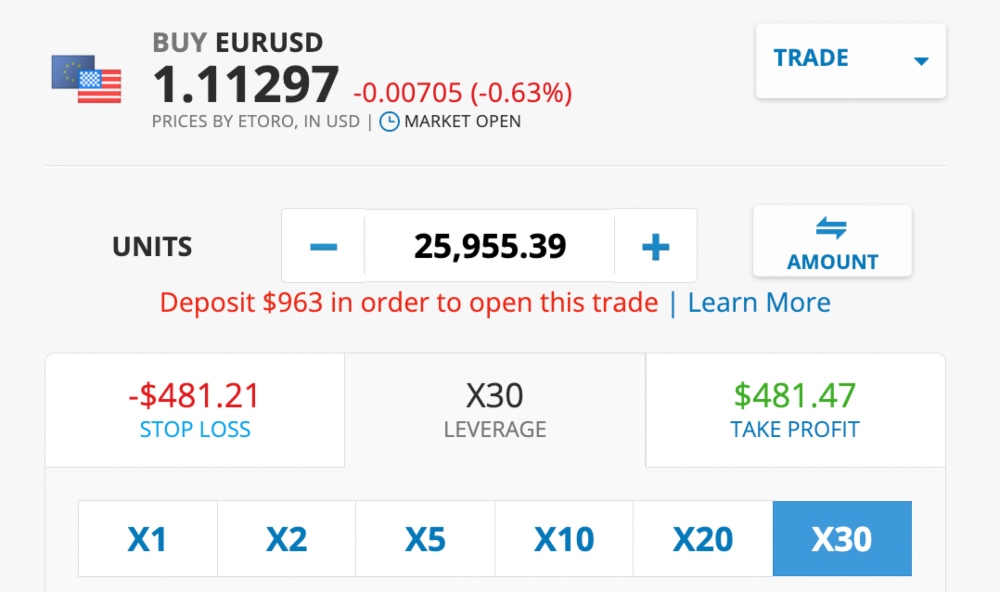

Out of all the margin brokers we tested – eToro’s bespoke platform was the easiest to navigate and apply margin to our positions.

We rate third-party platforms like MetaTrader 4, which are offered by many brokers with margin, but we also recognize that they take some getting used to. That isn’t the case with eToro’s web-based platform – new traders will find it straightforward to scan the markets and open trades in a few clicks.

Margin conditions are displayed clearly in the ‘new order’ screen. This includes the maximum buying power available, with an automatic error message displayed if you toggle margin levels beyond those permitted.

Best-In-Class Social Investing Community

eToro’s social investing network was the brand’s original unique selling point and we still consider it among the best available today.

Social trading on eToro isn’t just about copying the portfolios of experienced investors – though it is very easy to do this via the integrated league table. It also allows users to post their thoughts and ideas about margin strategies and instruments, complete with hashtags and keywords to make searching for relevant posts simple.

The real bonus for us is the ability to gain insights and run ideas past peers before setting up margin trades. This really sets eToro apart from many rivals and will serve beginners in particular.

Heavily Regulated And Widely Respected Brand

eToro is one of the best-known and most trustworthy margin brokers that our experts tested. It is one of the few brands that we evaluated to be regulated in Europe, the US, the UK, and Australia.

We generally recommend firms overseen by reputable regulators, such as the UK’s Financial Conduct Authority (FCA) and the Australian Securities & Investments Commission (ASIC).

Licenses from these tier-one regulators provide peace of mind while ensuring firms must abide by various rules designed to protect retail investors, including placing limits on margin levels to curb excessive losses.

Excellent Education Including Beginner-Friendly Guides To Margin

We have examined hundreds of online brokers and eToro’s educational academy is one of the best. In particular, we rate the clear examples of how leverage works and the risk implications of trading on margin.

There is also plenty of additional content that can be used alongside the academy resources, such as expert market analysis, videos, and live webinars – enough to turn a diligent student into a confident margin trader.

Cons Of Margin Trading At eToro

- Limited notice before forced stop out – eToro provides limited notice before closing out positions when your equity balance nears 20%. This does not offer much in terms of time to make account amendments or add funds. Typically brokers give a 20% to 30% buffer between margin calls and forced stop-outs to allow clients to rectify their accounts.

- A $5 withdrawal fee applies to live margin accounts – Whilst the firm charges a relatively small amount at $5, it is the only margin broker on our shortlist to levy a charge at the withdrawal stage. To prevent this fee from cutting into your profit margin, we recommend less frequent withdrawals.

- Less buying power than alternatives – Your purchasing power when trading on margin at eToro is in line with many competitors when it comes to heavily regulated jurisdictions like Australia (ASIC), the UK (FCA) and Europe (CySEC). However, the broker’s offshore entity, eToro Seychelles Ltd, offers less leverage (1:400) than some alternatives, such as Vantage (1:500). We don’t consider this a major drawback as we usually suggest sticking with entities with greater regulatory oversight. However, some global traders looking for the highest margin rate brokers may take this into account.

Why Is eToro Better Than The Competition?

eToro’s social investing network is the best out of the margin brokers we evaluated. We rarely come across competitors providing any similar service of such significant scale and quality.

The proprietary platform and app are also modern and sleek, allowing beginners to start trading on margin in a few clicks. The margin guides are also of high quality.

Who Should Choose eToro?

Beginners and casual investors should consider eToro.

The social investing features and educational academy are best in class and provide the support you need when getting started with margin. The intuitive platform with transparent margin conditions is another bonus for newer investors.

Who Should Avoid eToro?

High-volume day traders looking for the tightest spreads, fastest execution speeds and advanced software should avoid eToro.

The broker’s in-house platform also offers little in terms of algorithmic investing tools, such as Expert Advisors (EAs), so we don’t recommend it for automated strategies.

Other margin brokers in this list can better serve seasoned day traders with suitable tools and margin conditions.

AvaTrade - Best Margin Broker For Experienced Traders

Margin Call: 50%. Margin Rate: Base + Approx. 2%

AvaTrade is a leading global broker that offers margin on 1250+ instruments. UK clients have the benefit of being able to trade with margin on spread betting accounts too.

AvaTrade is one of our favorite margin brokers for several reasons. Firstly, we like that a tighter margin call is available for experienced traders, providing the flexibility to trade to the wire.

Additionally, the brand supports a superb suite of advanced platforms, from MetaTrader 4 and MetaTrader 5 to AvaOptions, AvaTradeGO, AvaSocial, DupliTrade, ZuluTrade, and Capitalise.ai.

Below we unpack what makes AvaTrade one of the best margin brokers in the industry.

Flexible Margin Requirements And Alerts

The AvaTrade margin call rate is more flexible than competitors like Vantage, with an alert activated if your account equity drops to 50%.

For experienced and non-EU traders, a tighter margin call is in place, activated if your equity level drops to 10% of your margin amount. This means users are given more lenience to trade closer to their minimum balance.

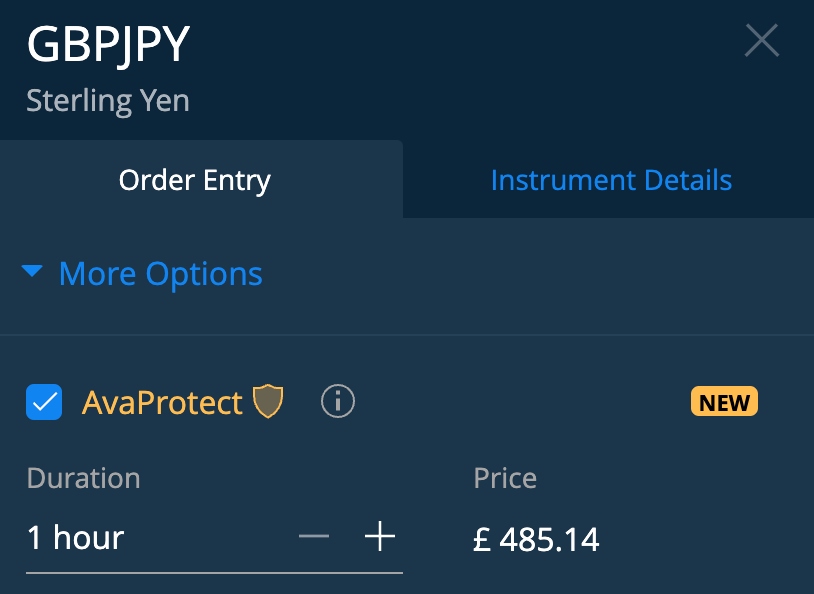

Bespoke Risk Management Tool That Can Be Applied To Margin Trades

Our team rated the AvaProtect risk management tool, which provides single trade protection against losses up to $1 million on forex, gold and silver. Essentially, the brand reimburses you for losing trades at the end of the ‘protected period’.

This is a helpful feature when trading with highly leveraged positions and can safeguard against extreme market movements.

A Choice Of Excellent Platforms And Tools

AvaTrade does not fall short when it comes to margin platforms. The ever-popular MetaTrader 4 and MetaTrader 5 are great options for serious traders with Expert Advisor (EA) functionality and rich technical analysis.

You can also trade on the broker’s proprietary AvaTradeGO, AvaOptions, and WebTrader solutions. However, the AvaTradeGO mobile app is the top choice for us, offering global market access, social trend feeds and a sophisticated dashboard.

Cons Of Margin Trading At AvaTrade

- Less buying power than some offshore alternatives – As is standard, the maximum buying power available from AvaTrade entities overseen by strict regulators is 1:30. This is not a disadvantage since any regulated broker in these jurisdictions faces the same limits – but AvaTrade’s offshore branch provides 1:400 leverage, which is lower than some alternatives.

- Slow customer service and no weekend support – We found AvaTrade customer support lacking. The broker promises 24/5 customer service, and on the upside, it does give international contact numbers. However, responses from the online enquiry form can take many hours. We also tested the chat function but struggled to get information relevant to our margin setup due to the automated chatbot. We found ourselves going around in circles trying to use keyword searches and using the category selection icons.

Why Is AvaTrade Better Than The Competition?

AvaTrade provides more choice when it comes to advanced software than nearly every other margin broker we evaluated. Other brands also do not provide the same level of risk management tools as the AvaProtect function.

Add in the strong regulatory oversight, multiple awards and more than 400,000 registered clients, and the margin broker is a serious contender.

Who Should Choose AvaTrade?

Experienced margin traders looking for a respected global broker with an almost unrivalled choice of tools should consider AvaTrade.

Active traders will also appreciate the support for automated strategies through EAs and a VPS, plus flexible margin conditions.

Who Should Avoid AvaTrade?

AvaTrade doesn’t serve new margin traders as well as other brokers in our opinion, especially eToro.

The copy investing services and educational resources aren’t as comprehensive as competitors and the customer support is less responsive.

IC Markets - Best Margin Broker For Automated Trading

Margin Call: 50%. Margin Rate: Base + Approx. 2%

We recommend IC Markets because it offers competitive margin opportunities to retail investors from around the world. Over 2250 instruments are available spanning forex, commodities, stocks, indices, bonds, futures, and cryptos.

The brokerage is also trusted by over 180,000 clients and is regulated by leading financial bodies, including the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

Excellent Automated Trading Tools And Support

IC Markets is best in class for automated traders.

Both MetaTrader, through Expert Advisors (EAs), and cTrader, through cAlgo, cater to algorithmic strategies. The firm also supports Virtual Private Servers (VPS), some of the tightest spreads we have seen, plus ultra-fast execution speeds of <40 ms.

Together, this provides an excellent environment to deploy fast-paced day trading strategies using margin.

Reliable And Responsive Customer Support

We rated IC Markets’ outstanding customer service, which is among the best of the 100+ margin brokers we have reviewed.

IC Markets is a rare broker that offers 24/7 assistance, which will appeal to online traders, especially given the brand’s heavily leveraged cryptocurrency offerings.

In our tests, IC Markets responded to our margin queries in less than one minute.

Extremely Competitive Pricing Averaging 0.1 Pips On The EUR/USD

IC Markets offered some of the lowest fees of all the margin brokers we examined. This includes raw spread accounts with competitive commissions from $3.

The brokerage partners with 25+ liquidity sources to offer leading pricing. For example, the EUR/USD currency pair has an average spread of just 0.1 pips.

Cons Of Margin Trading At IC Markets

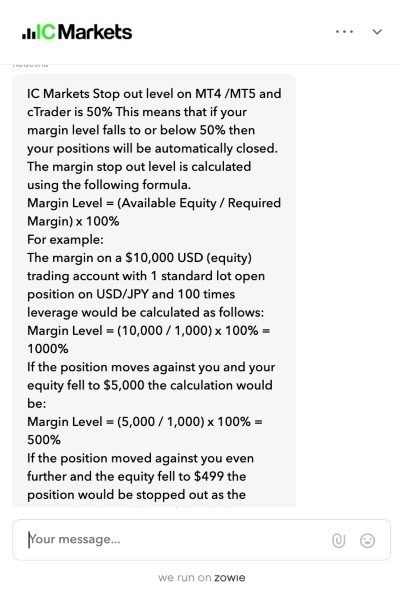

- Higher margin call than many competitors – Unlike other brokers in this guide, our experts found the IC Markets’ margin call level is set at 100%. This means that an alert will be activated when your equity balance is 100% of the margin needed on your open positions. This is quite limiting and may lead to frequent alerts.

- Significantly higher stakes with the offshore entity – IC Markets offers leverage up to 1:500 on all account types under the entity registered with the Seychelles Financial Services Authority (FSA), which is in line with Vantage. These amounts are available for the least volatile instruments, which include major forex pairs and a few commodities. It is usual for brokers to downgrade the amount of leverage available on more volatile products, and this is the case with IC Markets. However, the difference here is that even these downgraded rates are considerably higher than competitors’. While this won’t be a downside for some traders with a large risk appetite, it does magnify your exposure and can lead to substantial losses.

Why Is IC Markets Better Than The Competition?

IC Markets offers some of the lowest fees and most competitive environments for automated traders. The 24/7 customer support is also great to see and stands out against alternatives with no weekend assistance.

Add in low margin rates and a strong reputation and IC Markets offers a good all-round package.

Who Should Choose IC Markets?

IC Markets is a great option for automated traders with excellent pricing, fast execution, and powerful software.

The significant buying power available on cryptocurrencies and other assets also makes this broker a good destination for traders with a high-risk appetite, willing to sign up with the offshore entity in return for fewer legal protections.

Who Should Avoid IC Markets?

IC Markets isn’t the best pick for beginners. We prefer eToro’s user-friendly platform, social investing service, and educational materials.

We also don’t recommend IC Markets’ offshore branch if you are looking for financial safeguarding, especially with the lack of negative balance protection in place.

Forex.com - Best Margin Broker For US Traders

Margin Call: 50%. Margin Rate: Base + Approx. 2.5%

We recommend Forex.com for US traders because it offers a secure and competitive margin trading environment in line with local regulatory requirements.

The broker is also transparent, with specific margin rates by instrument published within the proprietary software, making it easier to plan trades. The 80+ currency pairs also trumps most brokers.

Our team explain why Forex.com takes the spot as the best margin broker for US traders below.

Transparent Margin Terms

Out of the margin brokers we reviewed, Forex.com had one of the clearest pricing structures and margin conditions. We found the easiest way to view this information is via the Forex.com platform, selecting the arrow icon next to the instrument name and then selecting ‘Market 360’. Margin requirements are displayed at the top.

The margin and buying power available from Forex.com is dependent on the branch you trade with. The US entity offers leverage up to 1:50, in line with regulatory requirements.

Competitive Margin Call And Stop-Out Level

Similar to AvaTrade, Forex.com initiates a margin call if your account balance nears 50% of your margin requirement, with stop outs implemented if your account balance drops below this. This should give clients enough space to trade confidently with borrowed funds, with the flexibility to run closer to stop out.

We also liked that Forex.com offers a free margin calculator, meaning you can review the finance needed for the trade you want to set up.

A Top-Rated And Trustworthy Brand Overseen By The US NFA And CFTC

Forex.com is one of the most regulated margin lending brokers out of the hundreds our team has reviewed. The brand is overseen by some of the most reputable financial bodies in the industry, including the National Futures Association (NFA) and the Commodities Futures Trading Commission (CFTC) in the US.

This adds a layer of credibility and will provide peace of mind to traders.

Cons Of Margin Trading At Forex.com

- No negative balance protection – Forex.com does not provide negative balance protection. So although the firm’s margin conditions and stop-out levels can help curb losses, you can lose more than your balance, particularly during volatile periods. Whilst this is fairly common amongst US brokers, it does mean a careful approach to risk management is required.

- Decreasing buying power may disappoint high-volume traders – Forex.com increases requirements for some large volume sizes. This is executed based on step levels, increasing the minimum margin requirements at specific quantity ‘steps’. For example, Forex.com US offers 2% or 1:50 for trade volumes up to 24,000,000, then 3% (1:33) up to 61,000,000 and 20% (1:5) on all volumes after that. We recognize that this will not affect many traders, but it is worth noting if you plan to trade in very high volumes.

Why Is Forex.com Better Than The Competition?

Forex.com offers a secure margin environment for US clients. With an excellent reputation, oversight from the NFA and CFTC, plus a wider selection of currency assets than most competitors, the broker has a lot to offer.

We also appreciated the transparency offered by the brand when it comes to margin rates, plus access to free margin calculators and total portfolio views.

Who Should Choose Forex.com?

US residents looking to trade on margin will be well served by Forex.com.

Experienced traders, in particular, will appreciate that there’s a DMA account, VPS hosting and 1:50 leverage. With 80+ forex pairs, the brand also lives up to its name as an excellent destination for forex traders.

Who Should Avoid Forex.com?

Forex.com is not the best margin broker for non-US traders. Other brands reviewed in this article offer more complete packages and margin requirements.

Forex.com is also not the best option if you want the account security that negative balance protection provides.

What To Look For In Margin Brokers

To find, compare and rank the best margin brokers, our team looked at several factors:

Trust & Reliability

When we compare margin brokerage accounts, the reliability and track record of a brand are key considerations.

The safest thing is to register with a broker that is overseen by a reputable financial authority. A regulated margin broker, authorized by the likes of the FCA, CySEC, ASIC, or the SEC, is obliged to comply with rules designed to protect retail investors.

Important protection measures when trading on margin are negative balance protection, to prevent you from losing more than your account balance, plus reasonable limits on the amount of buying power your margin, or cash outlay, provides. In the EU, UK and Australia, for instance, this is 1:30.

Some traders choose offshore or unregulated firms to access greater purchasing power. And while attractive, our experts highlight that this can seriously increase the risk of trading on margin.

Bear in mind that if the margin broker you trade with goes bankrupt or if you have a dispute, you may have little or no legal recourse with an unregulated firm, and weakly regulated firms may be unable to force a brand to reimburse client funds in the event of misconduct.

Low Fees

Brokers with the lowest margin rates offer competitive fees, otherwise known as interest charges, on the buying power your margin provides you. This rate is often shown as a percentage that includes the central bank underlying rate plus a markup from the broker.

Margin rates can vary depending on the pricing structure and formula adopted by the broker, the amount of borrowed funds, and the instrument you want to trade.

Importantly, brokers will often provide more attractive margin rates if you trade in higher volumes, and for active day traders in particular, this can make a noticeable difference to your bottom line.

In our experience, low-cost margin brokers keep their markup to around 0.5% to 3.5% (prior to the central bank rate). AvaTrade, for example, has a competitive 2% margin rate.

But whilst the margin rate is a cost – it is not the only fee to consider. We also take into account the spreads and/or commissions, plus additional charges like inactivity fees and funding costs.

Accessibility

When testing brokers with margin, we also consider how straightforward it is to get started and use the firm’s tools.

This ranges from the minimum deposit requirement – we consider anything below $500 suitable for newer traders. We also look at the range and accessibility of deposits and withdrawals. The top firms offer near-instant account funding with no interest charges via wire transfer, bank cards and popular e-wallets like PayPal. eToro, for instance, we marked down for its $5 withdrawal fee.

We also consider the quality of the customer support available, which is especially important for those new to margin. Although we favor firms with 24/7 access such as IC Markets, sometimes brands with 24/5 assistance offer more reliable communication channels and faster response times during the heaviest market hours.

Tools & Resources

The breadth and quality of tools are key considerations, alongside the best margin rates for traders.

Beginners can benefit from rich educational materials and services like copy trading, available at leading online margin brokers like eToro. Our team assess and test the quality of tools and services to opine on their viability for newer margin traders.

Equally, we know experienced traders may favor advanced software, plus useful features like access to Virtual Private Servers (VPS). Again we compare how these tools stack up to competitors and whether they enhance the margin trading experience.

FAQs

How Does Margin From Online Brokers Work?

Margin refers to the amount of capital you need to put down to borrow funds from a broker. It is usually displayed as a percentage of the borrowed amount, for example, 10%. Traders can then use the capital from the brokerage to open larger positions than their balance would otherwise allow, increasing potential returns and losses.

How Do Brokers Make Money On Margin?

Most brokers charge a fee for margin trading. This is essentially an interest loan rate and is typically an admin charge in addition to the central bank’s underlying rate. Margin rates charged by brokers typically vary depending on the instrument traded, the borrowed amount and market conditions.

Why Do Brokers Offer Trading On Margin?

Trading on margin provides a revenue stream for brokers, who can charge a fee to investors for borrowing funds. Of course, there are also benefits to traders, who can purchase more securities than they would otherwise be able to.

Which Broker Gives More Margin?

Offshore brokers that operate with little to no regulatory oversight tend to offer the highest margin trading opportunities. However, traders should be aware that they may not receive the same legal or account protections. This includes negative balance protection to stop your account falling below zero and access to compensation schemes should the broker become insolvent.

Article Sources

- eToro - What are leverage and margin?

- AvaTrade - Guide to leverage and margin trading

- IC Markets - Forex margin definitions

- Forex.com - Margin Requirements

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com