Best Day Trading Brokers In Ghana 2026

Want to start day trading in Ghana? We’ve listed and ranked the top day trading brokers in Ghana for active traders looking for trusted and reliable platforms.

Since the Securities and Exchange Commission of Ghana doesn’t actively regulate many day trading brokers, local traders often choose trusted international firms. If you do, you must adhere to the local regulations and tax laws in Ghana.

Top 6 Platforms For Day Trading In Ghana

After hands-on testing, these 6 brokers stand out as the best for short-term traders in Ghana:

-

1

Exness

Exness -

2

XM

XM -

3

RoboForex

RoboForex -

4

AvaTrade

AvaTrade -

5

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

6

Trade Nation

Trade Nation

Why Are These Brokers The Best For Day Traders In Ghana?

Here's a brief summary of why we believe these are the best day trading platforms for Ghanaians:

- Exness is the best day trading platform in Ghana for 2026 - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience. 100% deposit bonus + further offers up to 4500$

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

How Secure Are The Top Day Trading Platforms In Ghana?

When choosing a broker for day trading it's important to consider how they will protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Exness | ✘ | ✔ | ✔ | |

| XM | ✘ | ✔ | ✔ | |

| RoboForex | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Pepperstone | ✘ | ✔ | ✔ | |

| Trade Nation | ✘ | ✔ | ✔ |

Compare The Top Day Trading Apps In Ghana

Here's how the top day trading apps in Ghana perform based on our tests of the mobile trading experience:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Exness | iOS & Android | ✘ | ||

| XM | iOS, Android & Windows | ✘ | ||

| RoboForex | iOS & Android, R StocksTrader | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ | ||

| Trade Nation | iOS & Android | ✘ |

Are The Top Day Brokers In Ghana Good For Beginners?

Beginners need brokers that offer demo accounts, plus other key features for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| XM | ✔ | $5 | 0.01 Lots | ||

| RoboForex | ✔ | $10 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots | ||

| Trade Nation | ✔ | $0 | 0.1 Lots |

Are The Top Day Trading Brokers In Ghana Good For Advanced Traders?

Experienced traders need brokers with powerful tools to upgrade the day trading environment:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

| RoboForex | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ |

| Trade Nation | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 (entity dependent) | ✘ | ✘ |

Compare Detailed Ratings Of Top Day Trading Brokers In Ghana

Find out how the top day trading brokers scored in key areas following our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Exness | |||||||||

| XM | |||||||||

| RoboForex | |||||||||

| AvaTrade | |||||||||

| Pepperstone | |||||||||

| Trade Nation |

Compare Day Trading Fees

The cost of day trading can vary hugely between providers, so here's how our top platforms stack up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Exness | ✘ | $0 | |

| XM | ✘ | $5 | |

| RoboForex | ✘ | $0 | |

| AvaTrade | ✔ | $50 | |

| Pepperstone | ✔ | $0 | |

| Trade Nation | ✔ | $0 |

How Popular Are These Day Trading Platforms?

Many active traders in Ghana seek out the day trading platforms with the most clients as a sign of reliability:

| Broker | Popularity |

|---|---|

| XM | |

| Exness | |

| RoboForex | |

| Pepperstone | |

| AvaTrade |

Why Day Trade With Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

Why Day Trade With XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Why Day Trade With RoboForex?

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

Why Day Trade With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Why Day Trade With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Why Day Trade With Trade Nation?

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- Full range of investments via leveraged CFDs for long and short opportunities

- Multiple account currencies are accepted for global traders

- There is a low minimum deposit for beginners

Cons

- Fewer legal protections with offshore entity

Methodology

To assemble our list of the top day trading brokers in Ghana, we analyzed 140 brokers from our database, focusing only on those that accept Ghanaian clients. We then evaluated each platform using comprehensive first-hand tests and a broad spectrum of data points.

- We only chose brokers that accept Ghanaian day traders.

- We prioritized brokers with trusted regulatory licenses.

- We focused on brokers with a wide range of day trading markets.

- We favored brokers with competitive short-term trading fees.

- We preferred brokers with reliable charting and analysis tools.

- We checked that each broker offers clear leverage and margin requirements.

- We ensured that each broker delivers reliable trade execution.

How To Choose A Day Trading Broker In Ghana

We’ve spent years testing and evaluating day trading platforms and have found that these are the key factors to consider when choosing a broker in Ghana:

Trust

With trading scams remaining prevalent in the day trading market, it’s essential to choose a broker that you trust. That’s why we look for key safety markers when evaluating brokers, including:

- The broker’s licensing status

- The broker’s history in the industry

- The broker’s reputation and customer feedback

Ghana’s Securities and Exchange Commission is an ‘orange-tier’ regulator in our Regulation and Trust Rating, as it doesn’t provide robust regulatory oversight of day trading brokers.

This is why many clients choose reliable international brokers instead, though it’s important to adhere to your local tax rules if you go down this route.

- AvaTrade is licensed in 9 jurisdictions and boasts a long 15+ year history, making it one of the most dependable brokers that we’ve evaluated. The broker has maintained a strong reputation among customers, thanks to its fund safety measures and transparency.

Market Access

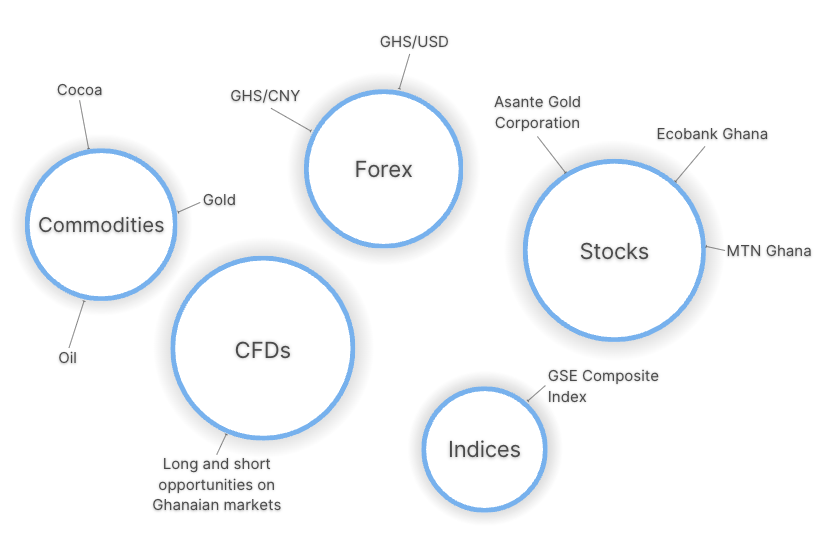

The best brokers will offer a diverse range of markets for short-term trading.

Ghanaians may look for currency pairs involving the cedi, like USD/GHS, or local stocks listed on the Ghana Stock Exchange, such as Asante Gold Corporation.

That said, these are rare from our research, so it might be worth looking at more popular global markets like major currency pairs, or notable commodities like gold and cocoa.

- RoboForex offers over 12,000 instruments, offering more short-term trading opportunities than many competitors. Asset classes include major, minor and exotic currency pairs, a vast selection of global equities, and commodities like oil and cocoa.

Day Trading Costs

Trading short-term markets can lead to rapidly mounting costs, so we assess notable fees like spreads and commissions on popular markets like EUR/USD and gold.

Active traders will also need to keep an eye on any deposit/withdrawal fees or currency conversion charges if funding your account in Ghanaian cedi, for example.

- Pepperstone continues to score well in the pricing category, with competitive spreads from 0.0 pips in the Razor account and around 1.0 pips in the zero-commission Standard account. With no funding fees, Pepperstone is a cost-effective option for Ghanian traders.

Charting Platforms

Day traders require dependable charting tools to effectively analyze short-term markets, with popular options including MetaTrader 4, MetaTrader 5, and TradingView.

These platforms provide a variety of technical analysis resources, along with market research features that allow you to stay abreast of local and regional news.

- Exness offers a superb range of platforms, including both MetaTrader iterations and an in-house app powered by TradingView. Trading Central is also available – a superior analysis tool offering a suite of features, including an economic calendar and market sentiment data.

Leverage & Margin

Using leverage allows you to gain wider access to an asset with a minimal initial investment (margin).

While some brokers in Ghana might provide uncapped leverage of 1:1000 and beyond, day trading with such exposure can lead to heavy losses. Remember to implement risk management and never risk more than you can afford to lose.

- XM offers leverage up to 1:1000 for global traders, though we don’t recommend this for beginners. There’s also a useful all-in-one calculator which tells you how much margin you need before opening a trade.

Execution Quality

Quick and reliable trade execution is crucial when navigating volatile markets in Ghana. During our evaluations, we look out for brokers that deliver execution speeds of less than 100 milliseconds.

Top brokers will also provide minimal slippage (the gap between the requested price and the price at which the trade is executed) and low latency (the delay encountered when placing a trade).

- IC Markets executes trades in around 35 milliseconds thanks to its superior connection to the NY4 data center in New York. The broker also offers a VPS service for experienced traders using Expert Advisors.

Account Funding

Ghanaian traders may be looking for cost-effective funding options, particularly when making regular transactions.

Many brokers offer local bank transfers, credit cards, or mobile payment systems, with reasonable minimum deposits from 0 USD.

- Deriv offers a wide range of payment methods for Ghanaians, including local bank transfers, credit cards, and e-wallets. New traders can also start with just 10 USD on their first deposit.

FAQ

Who Regulates Day Trading Brokers In Ghana?

The Securities and Exchange Commission supervises the financial markets in Ghana, but since it doesn’t actively license many brokers, traders often choose trusted international firms.

This is permitted, though it’s important to adhere to local tax laws and regulations in Ghana.

Which Broker Is The Best For Ghanaian Day Traders?

The best broker for you depends on your requirements. See DayTrading.com’s updated list of the best day trading brokers in Ghana to find the right fit.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com