Forex Trading in Ghana

Forex trading in Ghana is gathering momentum, fuelled by the prospect of earning income in a country with improving internet access that’s grappling with high unemployment rates.

Trading in stronger currencies like the US Dollar and Euro could potentially protect Ghanaians’ wealth from the Cedi’s inflation and depreciation, with around 45 billion GHS in circulation.

Looking to start forex trading in Ghana? This guide for beginners covers all the basics, from the role of the GHS to the country’s regulatory and tax position on trading currencies.

Quick Introduction

- The Ghanaian Cedi (GHS) experiences significant volatility, with fluctuating exchange rates and inflationary pressures impacting its stability. While this may present opportunities, low liquidity and limited availability are barriers for active traders.

- The forex market is primarily regulated by the Bank of Ghana (BoG). The BoG is a ‘yellow tier’ body in line with DayTrading.com’s Regulation & Trust Rating. The Financial Intelligence Centre (FIC) also monitors financial transactions, including those related to forex trading.

- The London and New York session overlap (late afternoon or early evening local time) is the most favorable time to trade currencies for liquidity and volatility. Early mornings in Ghana also align with the opening of the Tokyo session, providing steadier market conditions.

Top 4 Forex Brokers in Ghana

We've conducted extensive tests, and these 4 platforms are superior for forex traders in Ghana:

How Does Forex Trading Work?

Forex trading involves converting one currency into another, for instance, Ghanaian Cedi (GHS) into US Dollar (USD).

Suppose you expect the GHS to strengthen against the USD because you anticipate positive economic data concerning Ghana’s GDP growth.

You decide to exchange USD for GHS at an exchange rate of 6.00. After the data is released, the exchange rate improves to 5.80, reflecting a stronger GHS. You exchange your GHS back into USD at this new rate, taking your profit (less any fees).

The Ghanaian Cedi may be traded against prominent currencies, such as US Dollar (USD), Euro (EUR) and Great British Pound (GBP).

This is because transactions between Ghana and other nations are often priced in USD, while the EUR and GBP reflect the country’s strong trade and investment ties with Europe and the UK. Ghana also receives foreign aid and loans from organizations that deal in currencies like USD, EUR, and GBP.

Is Forex Trading Legal In Ghana?

Forex trading is legal in Ghana. However, no regulatory body in Ghana specifically oversees trading currencies online.

The Bank of Ghana (BoG) regulates the broader financial sector, including foreign exchange transactions through authorized bureaus and banks. The BoG does not restrict online forex trading platforms.

As a result, many Ghanaian traders use international forex brokers regulated by authorities in other countries, like the FSCA in nearby South Africa and the ASIC in Australia.

The BoG governs foreign currency flows into and out of the country. It is more relevant to businesses and banks than individual traders but underscores the broader regulatory environment in which forex trading operates.

Is Forex Trading Taxed In Ghana?

Forex trading in Ghana is taxed, but tax treatment varies depending on your circumstances.

Profits from forex trading are generally treated as income and subject to Ghana’s income tax rates, which range from 0% to 35%.

If trading through a registered company, profits may be subject to corporate tax instead of personal income tax. The standard corporate tax rate in Ghana is 25%.

The Ghana Revenue Authority (GRA) requires all income to be declared, including earnings from forex trading. Keep detailed records of your trading activities, including trades, profits, losses, and related expenses, so you accurately calculate your taxable income and comply with tax laws.

You can deduct certain expenses related to trading currencies, like internet costs, trading software, or educational expenses. If you incur losses from trading, these may be offset against your other income or carried forward to offset future trading profits, depending on the latest tax rules.

I recommend consulting with a tax professional or accountant familiar with Ghanaian tax law to ensure full compliance and optimize your tax situation.

When Is The Best Time To Trade Forex In Ghana?

The overlap of forex market sessions determines the best times to trade currencies and provides the highest trading volume and liquidity.

- London Session (08:00 – 16:00 GMT): During this session, currency pairs like GBP/USD, EUR/USD, and USD/GHS experience significant price movements. Ghana’s time zone (GMT) is aligned with London’s, making this session particularly convenient for traders in Ghana.

- New York Session (13:00 – 21:00 GMT): The overlap between the London and New York sessions provides some of the highest trading volumes. Ghanaian traders can take advantage of major movements in USD-related pairs like USD/GHS and EUR/USD.

- Tokyo Session (00:00 – 08:00 GMT): This session offers a more stable environment for those who prefer a slower pace. The session overlap with London at the end (around 08:00 GMT) presents a window of opportunity for Ghanaian traders to trade pairs like USD/JPY before the London market fully opens.

- Sydney Session (21:00 – 05:00 GMT): This session is ideal for Ghanaians who want to position themselves for upcoming volatility during the Tokyo or London sessions. AUD/USD or other pairs that are less liquid but more predictable can be traded during this quieter period.

USD/GHS Trade

To illustrate how forex trading in Ghana works in practice, let’s explore an example. The line chart below illustrates the significant rise of USD versus GHS in recent years.

Due to the strength of the US dollar and the relative weakness of African currencies, it’s challenging to envisage this situation altering over the coming years unless the US Fed reduces the key interest rate over the short term.

Background

I always scope the fundamentals regarding a potential FX trade, combined with the technical feedback I get from the charts on specific timeframes. Some of the critical fundamentals for Ghana include inflation running at over 23% and poverty rates of 32%.

Ghana is in debt distress, and its public debt is unsustainable. The country needs to renegotiate the loans with external creditors and the IMF’s extended credit facility of over $3b. However, its debt vs. GDP hovers around 65%, and its estimated GDP for the year at the time of writing was 2.8%.

The World Bank paints an optimistic picture of sustainable recovery over the coming years.

Technical Set Up

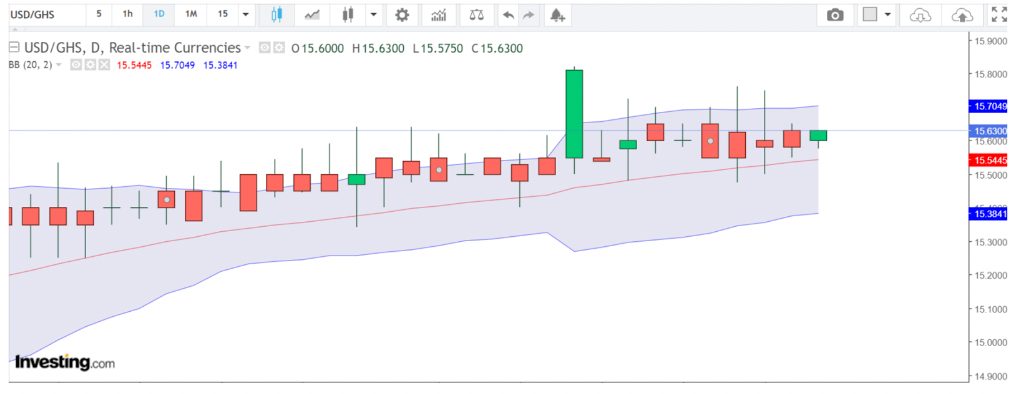

I looked at the chart for signals to establish the credibility of my theory that USD will continue to rise vs. GHS. Although I prefer naked candlestick charts to search for setups and price action, I often scan the library of proven and tested indicators to reaffirm my decisions.

Bollinger Bands are a trading tool used to determine entry and exit points for trade and trends. They’re also used to determine overbought and oversold conditions.

I’m looking for evidence that the current daily trend will continue here. The bands tend to narrow and contract naturally according to price action.

The bands widened as a bullish trend developed earlier in the month, narrowed as momentum faded, and widened again as the underlying bullish trend continued.

Active forex traders like me know day trading exotic and minor currencies has inherent dangers, most notably the spreads, liquidity, price gaps, and poor fills away from the quoted price.

Therefore, I am willing to trade such FX pairs with a swing or position mindset; I’m okay holding over for several days when a pair is ranging. I never enter a trade without an exit strategy using profit limit orders and always use a stop loss order.

I’m predicting the yearly high will be breached. With this in mind, my TP is 16.00, my stop loss is 15.50, and my market order fill is 15.7. I’ll also place a time limit on this trade. If the trade stalls, I’ll exit even at a slight loss.

I’ll monitor my economic calendar for news concerning forward guidance from the Fed and Ghana’s fiscal and monetary management.

Bottom line

Forex trading in Ghana presents an enticing opportunity for those who are well-prepared, educated, and cautious.

However, the forex market’s high-risk nature and limited regulatory oversight in Ghana require traders to approach it with diligence and a clear understanding of the risks involved. You could lose any Cedis you invest.

Ghanaian traders should potentially focus on global currency pairs like EUR/USD, GBP/USD, and USD/JPY, but also keep an eye on USD/GHS, especially during times of significant economic news from Ghana.

To get going, check out DayTrading.com’s pick of the best forex trading platforms in Ghana.

Recommended Reading

Article Sources

- Cash in Circulation in Ghana - Statista

- Bank of Ghana (BoG)

- The Financial Intelligence Centre (FIC) in Ghana

- Ghana Revenue Authority (GRA)

- Ghana Economy Expected to Recover - World Bank

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com