Best Brokers For Ethical Investing

Finding the best brokers for ethical investing is one of the most direct ways we can contribute to positive change in the world. Ethical investing is an umbrella term for all approaches to investing whereby trading can be both socially and environmentally responsible.

While fighting climate change and making changes to our lifestyle may seem a daunting task, technological advancements enable traders to support sustainability efforts. Using the best ethical investing brokers will help you invest your capital in green stocks, renewable energy, clean water and much more. In our review of the best brokers for ethical investing, we explain what it is, its pros and cons and the types of ethical investments you can make.

Best Brokers For Ethical Investing

These 6 firms offer the best selection of trading products for ethically-conscious investors:

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

TradeUp

TradeUp -

4

Zacks Trade

Zacks Trade -

5

XTB69-83% of accounts lose money when trading CFDs with this provider.

XTB69-83% of accounts lose money when trading CFDs with this provider. -

6

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money.

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- TradeUp - Established in 1986, TradeUp operates as a commission-free broker in the US offering trading for stocks, ETFs and options. Through its web platform and mobile app, clients can trade over 5,000 instruments with cash and margin options, while idle funds can earn interest.

- Zacks Trade - Zacks Trade is a FINRA-regulated US broker offering trading on stocks, ETFs, cryptocurrencies, bonds and more through a proprietary terminal. The broker is geared toward active traders and offers very affordable fees on most assets as well as an app and a vast amount of market data.

- XTB - Founded in 2002 in Poland, XTB now serves more than 1 million clients. The forex and CFD broker combines a heavily regulated trading environment with an extensive selection of assets and a commitment to trader satisfaction, featuring an intuitive in-house platform with superb tools to support aspiring day traders.

- Plus500 - Established in 2008 and headquartered in Israel, Plus500 is a prominent brokerage that boasts over 25 million registered traders in over 50 countries. Specializing in CFD trading, the company offers an intuitive, proprietary platform and mobile app. It maintains competitive spreads and does not charge commissions or deposit or withdrawal fees. Plus500 also continues to shine as one of the most trusted brokers with licenses from reputable regulators, including the FCA, ASIC and CySEC.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- Average fees may cut into the profit margins of day traders

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

TradeUp

"TradeUp is best suited to budget-conscious day traders looking to trade U.S. and global markets with zero commissions on a user-friendly mobile app. Its more than 250 Chinese American Depositary Receipts (ADRs), including Alibaba Group (BABA), also make it suitable for trading Chinese equities."

Christian Harris, Reviewer

TradeUp Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Bonds |

| Regulator | SEC, FINRA |

| Platforms | Desktop, Web, Mobile |

| Minimum Deposit | $0.01 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Pros

- TradeUp’s platforms work smoothly across multiple devices based on our tests, including mobile apps for iOS and Android, a desktop app for Windows and Mac, and a web-based platform. This allows active traders to switch between devices without losing continuity, whether you’re at home or on the go.

- TradeUp runs an integrated and intuitive financial calendar that helps you track earnings, dividends, and IPOs relevant to your watchlist, enabling you to stay ahead of market-moving events.

- TradeUp offers commission-free trading on US stocks and ETFs, and support for fractional shares lets you buy portions of a share for as little as $5.This makes it a cost-effective choice for active day traders who want to minimize trading expenses.

Cons

- The platform's technical indicators have limited customization options from our use. On both mobile and web versions, you can't layer multiple indicators on the same chart simultaneously, which restricts more sophisticated chart analysis.

- TradeUp's educational resources aren't kept updated, and were over 6 months old in our latest tests. While there are articles and tutorials aimed at newcomers, the content is somewhat limited and does not cover more advanced trading strategies or deeper topics.

- TradeUp does not support popular third-party platforms like TradingView or cTrader, so traders who rely on those for advanced charting, automation, or community features won't find that flexibility.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Cryptos, Options, Bonds |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Minimum Trade | $3 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Pros

- Demo account

- Customizable proprietary trading platform and mobile app

- Comprehensive research and data

Cons

- Withdrawal fees apply if removing funds more than once per month

- No forex, commodities or futures trading

- No MT4 or MT5 platform integration

XTB

"XTB stands out as a top choice for new day traders with the terrific xStation platform, low trading costs, no minimum deposit, and excellent educational tools, many of which are seamlessly integrated into the platform. "

Christian Harris, Reviewer

XTB Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on shares, Indices, ETFs, Raw Materials, Forex currencies, cryptocurrencies, Real shares, Real ETFs |

| Regulator | FCA, CySEC, KNF, DFSA, FSC |

| Platforms | xStation |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU) 1:500 (Global) |

| Account Currencies | USD, EUR, GBP |

Pros

- First-class 24/5 customer support is available, including a friendly live chat with response times of under two minutes during testing.

- XTB has boosted its interest rate on uninvested balances and added zero-fee ISAs (On ETFs and real shares, or 0.2% with transactions over €100k) for UK clients with a huge range of markets available.

- With a vast range of instruments across CFDs on shares, Indices, ETFs, Raw Materials, Forex, Crypto, Real shares, Real ETFs, share dealing and more recently Investment Plans, XTB caters to both short-term traders and longer-term investors.

Cons

- XTB does not offer a raw spread account, which is becoming increasingly common among competitors like Pepperstone, and may disappoint day traders looking for the tightest spreads.

- Trading fees are competitive with average spreads of around 1 pip on the EUR/USD but still trail the cheapest brokers like IC Markets, plus there's an inactivity fee after 12 months.

- The demo account expires after just four weeks, a serious limitation for traders who wish to thoroughly test the xStation platform and practice short-term strategies before committing real funds.

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, ETFs, Options, Crypto |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Pros

- Plus500 provides a specialized WebTrader platform designed explicitly for CFD trading, offering a clean and uncluttered interface

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- The broker offers low commission trading on a diverse range of markets, minimizing additional fees while appealing to established traders

Cons

- Algo trading and scalping are not supported, which may deter some day traders

- Compared to some competitors, especially IG, Plus500’s research and analysis tools are limited

- Plus500’s lack of support for MetaTrader or cTrader charting tools might be a deal breaker for advanced day traders looking for familiarity

What is Ethical Investing?

Before comparing the best brokers for ethical investing, let us first define the term. Ethical investing refers to the practice of aligning your moral compass and ethical values (environmental, social, political, religious, etc) to your selection of securities investing. The term encompasses all approaches to investing that consider ethical principles as well as profits.

Ethical investing is subjective, depending on a trader’s views – however, the UN has set out six principles for responsible investment that can act as a general guide for ethical investors. Other bodies that provide guidance include the International Organization of Securities Commissions (IOSCO), whose November 2025 report discussed ESG indices as benchmarks.

Ethical investing often aims to stop traders from profiting from activities that may be considered harmful to society and the environment. It encourages traders to invest in companies, projects, funds and other assets that are committed to sustainable operations and consider issues like climate change, gender equality, animal testing, firearms and gambling, for example.

Typically, the best brokers for ethical investing filter out harmful activities (negative screening) and seek out those investment options that are committed to making positive changes and impacts through their environmental, social and governance (ESG) practices (positive screening):

- Negative Screening – Finding ‘sin stocks’ that are involved or primarily deal with unethical or immoral activities, such as tobacco, gambling, weapons and adult entertainment, as well as issues like intensive farming, deforestation, genetic engineering and poor human rights.

- Positive Screening – Aiming to identify companies showing commitment to improving their environmental impact, corporate ethics and social justice.

Types Of Ethical Investing

This practice has lots of variations, even within just one of the best brokers for ethical investing, including green, socially responsible, impact and ESG investing. While most of these centre on the same idea and are often used interchangeably, we have explored them in more detail below:

Green Investing

Green investing specifically focuses on the environmental impacts of businesses and their commitment to the reduction of pollution and greenhouse gases, the conservation of natural resources and other environmentally friendly practices. Traders can buy green indices, ETFs, bonds and mutual funds or hold stocks in environmentally-conscious companies that support green initiatives. Pure-play green investments are those that generate all or most of their profits from green business activities.

Green business activities can be companies engaging in renewable energy research, developing eco-friendly alternatives to plastics or seeking to reduce pollution and the environmental impact from their operations.

This can be split into three categories, dark, medium and light green investing. Dark green investing is a strictly screened approach, avoiding any company or industry that does not meet the criteria, whereas light green investing seeks companies that are doing good rather than excluding companies that are considered to cause harm. Medium green approaches are a combination of the two.

ESG Investing

ESG stands for Environmental, Social and Governance and is one of the most common forms offered by the best brokers for ethical investing. It is a form of ethical trading that considers an investment’s financial returns as well as its behaviours. Their impact on the world is measured using a score based on the following principles:

- Environmental – How a company impacts the environment can include its carbon footprint, biodiversity, climate change policies and goals, renewable energy usage and even employee benefit programs like cycle to work schemes.

- Social – Social factors are concerned with stakeholder relations. This could include a company’s commitment to racial and gender equality, diversity and inclusion programs, community development, charity work and ethical supply chain sourcing.

- Governance – Governance refers to a company’s board and management team. Issues range from reasonable executive compensation, protection of shareholder rights, the diversity of directors i.e., gender division, plus litigation history and relationships with regulatory bodies.

Socially Responsible Investing (SRI)

Socially responsible investing (SRI) does what it says on the tin: it is an investment that is considered socially responsible based on the nature of the business. SRI actively eliminates ‘sin stocks’ or selects investments according to specific ethical guidelines, like the ESG scoring system. The best brokers for ethical investing of this form blend positive and negative screening to capture the best of both worlds.

Socially responsible investments usually mimic the current social, economic and political climate. Therefore, the investments may suffer if something changes within that climate. Traders should be aware that just because an investment is socially responsible does not mean that it will provide investors with a good return.

An example of SRI is community investing, which goes towards companies that have a track record of helping the community but have also been unable to generate funds from other sources like financial institutions. By investing in these types of companies, they can continue to provide services to communities like affordable housing and loans, without depending on governmental assistance.

Impact Investing

Impact investing is a method that delivers measurable social and/or societal effects and benefits, alongside financial gains. The best brokers for ethical investing of this type focus on generating specific social or environmental outcomes whereby investments are put into market segments dedicated to solving certain issues.

A basic goal of impact investing is to help reduce the negative effects of business activities on the social environment and can often be considered an extension of philanthropy.

Using impact investing as a strategy involves considering a company’s commitment to corporate social responsibility (CSR). Impact investing is mostly done by institutional investors such as hedge funds, banks and pension funds. Traders may choose to invest their money into emerging or developed economies and an array of industries including agriculture, education, energy (particularly clean and renewable), and healthcare.

Ethical Company Stocks

The best brokers for ethical investing will allow you to invest in companies with strong environmental commitments, which is the simplest and most popular form of ethical investing. Many new start-ups are seeking to develop alternative energies and greener materials, while established companies are betting on a low-carbon future. It can be time-consuming to pick stocks and keep track of their performance and green credentials.

However, it results in a bespoke portfolio that matches your sense of what is ethical and important.

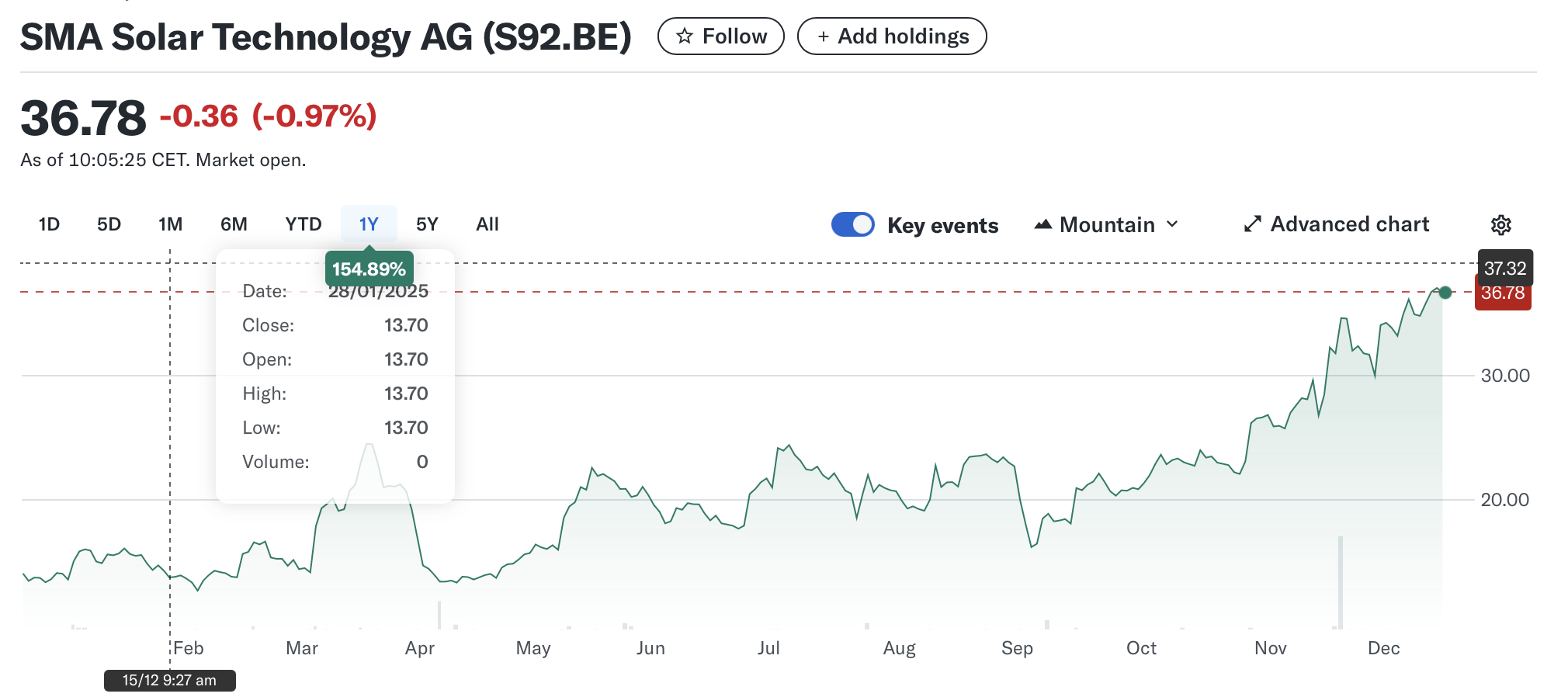

Top ethical stocks to invest in can include SMA Solar Technology, which has reached a high valuation while targeting environmentally conscious consumers. Salesforce also does well on ESG criteria as it has maintained net-zero greenhouse emissions since 2018 while also meeting renewable energy commitments. Other top investments include 3M (MMM), Colgate-Palmolive, and Kimberly-Clark.

These examples are based on commonly used ESG ratings and sustainability disclosures, but what counts as a ‘top’ ethical stock is inherently subjective and can change over time as new information and controversies emerge.”

Ethical Indices

Several indices seek to track environmentally favourable and sustainable businesses. Some organisations have created ethical indices that calculate benchmarks whose underlying is selected based on ESG criteria.

The starting point is a traditional index to which filters are applied (negative or positive criteria) to eliminate companies that do not satisfy social responsibility criteria. The investment spectrum will be filtered to a greater or lesser extent depending on the stringency of the SRI or ESG policies applied. Features like capitalisation, sector and geographical diversification are nearly always retained to give financial credibility to the index.

For example, the NASDAQ Clean Edge Green Energy Index and the MAC Global Solar Energy Index both target the renewable energy sector. The Dow Jones Sustainability Index (DJSI) was launched in 1999 and the FTSE4Good index was designed to measure the performance of companies that comply with recognised global sustainability standards.

These are two of the most well-known ethical investment indices for UK companies. The MSCI indices are global benchmarks that exclude companies operating in certain business segments that investors might prefer to avoid and includes companies with high ESG standards. The best brokers for ethical investing through indices will offer a wide range of such assets to allow clients to specialise or diversify their portfolios within the boundaries of their beliefs.

Ethical Funds

Recent industry surveys suggest that UK responsible and ethical funds now manage tens of billions of pounds, while global sustainable and impact strategies together run into the hundreds of billions of dollars, and in some classifications well above that figure.

Mutual funds, ETFs and index funds can provide wider exposure to ethical companies. Ethical funds that invest in renewable energy companies, for example, allow traders to support new technologies while perhaps tapping into any potential growth.

Ethical funds are provided by asset or investment management firms. They apply negative and/or positive value-based screening to help sift through socially responsible investments.

Ethical Cryptos

There has been a lot of attention on Bitcoin’s environmental impact recently, so some of the best brokers for ethical investing have been looking for ways that crypto traders can find the best of both worlds.

Bitcoin relies on the proof of work verification system for its blockchain, involving huge numbers of calculations and amounts of processing power to produce a single coin. While efforts are being made to reduce the digital currency’s carbon footprint, traders have started looking for greener options. Cryptocurrencies that use a proof of stake system, for example, use far less energy.

Smaller cryptos have a lower energy footprint as they involve fewer daily transactions, while some are just generally more energy efficient. Below we have listed some more sustainable cryptocurrencies:

- Cardano (ADA) – developed by the co-founder of Ethereum, ADA uses proof of stake and is, therefore, more energy-efficient

- BitGreen (BITG) – founded in response to the environmental impact of BTC. Users can earn BITG by carpooling and buying sustainable coffee.

- SolarCoin (SLR) – this platform aims to incentivise real-world environmental activity: verifiably produced solar energy

Pros

There are many obvious advantages of using the best brokers for ethical investing:

- Grow Savings Responsibly – ethical investing means that you can maintain your values while trading. Investors can feel happy when an ethical investment performs well when that investment reflects their moral values.

- Portfolio Quality – the additional analysis of companies involved in ethical investing means that you can improve the quality of your portfolio with better-managed companies and/or assets. Also, taking into account societal shifts like climate change concerns will give traders exposure to growing industries and technologies.

- Avoid Volatile Assets – by excluding some types of investment, your profits may be less exposed to volatility. For example, if your portfolio excludes oil and the price of oil falls dramatically, you will be less likely to be affected.

- Encourages Further Sustainability – as ethical investing gains more importance and social prominence, it will encourage other businesses to improve their ethical practices.

Cons

Despite making a positive impact, even the best brokers for ethical investing has some drawbacks:

- Potential For Less Growth – choosing an investment based on ethical preferences is not indicative of the investment’s overall performance. Excluding sectors for their harmful practices could increase the likelihood that you will miss out on growth and opportunities.

- Labour Intensive – ethical investing is not a passive strategy and requires a lot of research, especially without the assistance of a financial advisor or investment fund. Picking and choosing which ethical investments to make can be very time-consuming.

- More Expensive – constantly changing your investments in line with ethical standards can damage your overall profit when you consider transaction costs. Financial advisors and investment funds could also charge high fees.

- More Risk – sometimes, choosing ethical companies or funds means investing in those that are in their earlier stages of development with lower revenues.

Final Word

Ethical investing is a growing phenomenon among traders as it balances earning profits with making positive environmental, ecological, political and social changes in the world. From an investor’s point of view, buying stocks in companies that fit into ESG criteria is a simple way to make a difference but doing the research can often be time-consuming. Using an ethical investment fund or a broker for ethical investing is a simpler way but is an expensive option.

FAQs

How Can I Invest Ethically?

Before getting involved with the best brokers for ethical investing, some research is required. Firstly, consider what you are passionate about. Choose an issue (or several) that you care about as this will help narrow your search for investments. Next, choose an approach: do you want to exclude certain sectors completely, invest in problematic companies to improve their operations or invest your money into finding solutions. Following that, you need to pick a fund, asset or company by checking their mission statement to see if your values are aligned (or not) with theirs.

Is Islamic Trading A Type Of Ethical Investing?

Yes, Islamic trading accounts are a popular example of a religious-based approach, offered by many of the best brokers for ethical investing. The main attraction of brokers offering Islamic accounts is that it allows those who follow Sharia Law to trade on the markets without breaking with their faith. It also allows traders to stay true to their morals and ethics, avoiding investments involving alcohol, pork, gambling and other forbidden items.

How Do Ethical Investing Returns Compare?

No investment method or strategy is guaranteed to generate more or fewer profits than another. The performance of ethical funds is similar to that of traditional funds, if not somewhat better, and the greater depth of research and analysis of companies may mean that you invest in better ones. However, excluding certain industries may also limit your growth prospects and diversification opportunities.

What Is The Difference Between ESG Vs SRI Vs Impact Investing?

ESG investing has set criteria, looking at a company’s environmental, social and governance practices while also using more traditional financial measures to enhance analysis. Socially responsible investing involves negatively screening companies or excluding certain investments based on personal ethical criteria. Impact investing is focused on generating specific social or environmental outcomes and investments are put into market segments dedicated to solving certain issues.

Who Are The Best Brokers For Ethical Investing?

Interactive Brokers have ESG scores via dedicated tools on its platforms and you can receive alerts where ESG news may affect the scores of the companies you are investing in. With OpenInvest, you can declare what you care about most, whether that is climate change or social equality, and they will handle your investments accordingly. Ellevest is a platform built “for women by women” that considers the reality of women’s lives, including the gender pay gap. With its impact portfolio, traders can invest in women in leadership, sustainable practices and community development.