Best Brokers For Traders With No Time 2026

If you’re anything like me, then after work, family commitments, and personal time, you may have limited time left to pour into active trading. Yet time – to research markets, test strategies, catch up on new trends and set up trades – is a key ingredient for success in day trading.

Thankfully, many brokers now offer an array of useful time-saving tools that help traders concoct and carry out strategies without a large time investment. Dig into our list of the most important tools for time-starved traders and our selection of the best brokers that provide them.

Best Brokers For Traders With No Time In 2026

We've tested and listed the brokers with the best investing solutions for traders with less time:

-

1

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

2

xChief

xChief -

3

Optimus FuturesCopy trading services are available across some of the broker's extensive range of platforms.

Optimus FuturesCopy trading services are available across some of the broker's extensive range of platforms. -

4

InstaTrade

InstaTrade -

5

Pionex

Pionex -

6

Exness

Exness

Why Are These Brokers The Best For Time-Poor Traders?

Here’s a rundown of why we believe these providers stand out if you don't have the time to actively trade yourself:

- eToro USA is the best broker if you're a trader with no time in 2026 - You can mirror the positions and strategies of up to 100 other traders with the market-leading eToro US copy trading service. Unlike many competitors, eToro gives you more control over your portfolio, allowing you to stop or pause a copied trade at any time. Pricing is also fairly competitive, with only $1 required to copy a position. eToro copy trading is for crypto only.

- xChief - Clients can follow copy trading signals on the MetaTrader platform. Alternatively, signal providers can generate extra income by selling their positions. You can start copy trading in a few easy steps.

- Optimus Futures - Copy trading services are available across some of the broker's extensive range of platforms.

- InstaTrade - InstaTrade offers hands-off trading through its Fixed Income Structured Product, where clients automatically replicate the positions of active traders. What’s distinctive is InstaTrade’s offer to ensure clients make a 50% return by compensating any shortfall if other users are referred.

- Pionex - Pionex clients can find other successful investors and copy their trading bot setups. This allows users to buy and sell cryptos 24/7 from a user-friendly platform and app.

- Exness - Exness has introduced a unique copy trading feature on its web platform and mobile app. Its user-friendly based on our tests but the performance statistics for strategies could be more detailed to better guide investor decisions.

Compare The Hands-Off Trading Solutions At The Top Brokers

Compare the top providers based on the availability of trading features designed specifically for investors with limited time:

| Broker | Automated Trading | Trading Signals | Copy Trading | Managed Accounts | Robo Advisors |

|---|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✔ | ✔ | ✘ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✔ | ✘ |

| Optimus Futures | TradingView Pine Script, API Features | None | ✔ | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | - | ✔ | ✔ | ✘ |

| Pionex | Crypto bots | - | ✔ | ✘ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | - | ✔ | ✔ | ✘ |

How Safe Are These Brokers?

Here's how the top platforms protect your funds when you're not actively trading:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| eToro USA | ✘ | ✘ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Pionex | ✘ | ✘ | ✘ | |

| Exness | ✘ | ✔ | ✔ |

Detailed Ratings Of The Best Brokers For Passive Traders

See how the top hands-free trading platforms rate in core categories following our expert-assigned scores:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| eToro USA | |||||||||

| xChief | |||||||||

| Optimus Futures | |||||||||

| InstaTrade | |||||||||

| Pionex | |||||||||

| Exness |

How Popular Are These Hands-Off Brokers?

When you're not doing the heavy lifting trades yourself it's even more important to choose an established, well-used provider with lots of clients:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Pionex | |

| eToro USA | |

| Exness | |

| xChief |

Why Use eToro USA For Hands-Off Trading?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- eToro USA Securities is a trustworthy, SEC-regulated broker that is a member of FINRA and SIPC

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

Why Use xChief For Hands-Off Trading?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- The broker trails competitors when it comes to research tools and educational resources

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

Why Use Optimus Futures For Hands-Off Trading?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

Cons

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Why Use InstaTrade For Hands-Off Trading?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

Cons

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Why Use Pionex For Hands-Off Trading?

"Pionex is an excellent option for crypto traders with an interest in cutting-edge AI like ChatGPT and automated trading."

William Berg, Reviewer

Pionex Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | FinCEN |

| Platforms | Own |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 USDT |

Pros

- Supports crypto derivatives via futures trading

- Low trading fees compared with other major exchanges at 0.05% maker and taker

- 12 free integrated trading bots with no coding or programming requirements

Cons

- No demo account

- Limited contact options

- Withdrawal fees and limits may apply

Why Use Exness For Hands-Off Trading?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

How DayTrading.com Chose The Best Brokers For Hands-Off Traders

We started by identifying 10+ types of products built for traders with limited time, including automated trading, copy trading, robo-advisors, and managed portfolios.

Then we identified the top providers with these features from our database of 139 brokerages. Each provider was personally tested to assess usability, setup time, and how effectively they support hands-off strategies.

While we factored in automation features and platform experience, providers were ultimately ranked by overall ratings to reflect the best all-around options for time-strapped traders.

What Tools Can I Use To Trade If I Don’t Have Much Time?

As demand for fast and hands-off trading solutions has increased, we’ve seen a growing number of time-saving products offered by online brokers:

Managed Accounts

If you can’t dedicate several hours each week to managing your portfolio yourself, you might want to consider a managed trading account.

You’ll find three main types of managed accounts to choose from:

- Percentage Allocation Money Module Accounts (known as PAMM): Profits/losses are split by percentage among investors. These are simple and passive with no client control.

- Multi-Account Manager Accounts (known as MAM): More flexible, allowing custom trade sizes and risk per client.

- Lot Allocation Management Module Accounts (known as LAMM): Allocates fixed lot sizes per account. Less common and less flexible than MAM.

As the name suggests, these accounts are actively managed, typically by experienced professionals who monitor market movements and execute positions on your behalf.

Since account managers accrue fees, these accounts are more expensive than trading on your own time.

That’s why we look especially for brokers that have competitive pricing on trades and provide flexible pricing on managed accounts.

- IC Markets continues to impress as a destination for managed accounts, thanks to its ultra-tight spreads – from 0.1 pips on the EUR/USD pair – a first-class suite of features, including VPS and auto-trading tools, and cutting-edge managed account infrastructure that allows MAM clients to define their individual risk appetite.

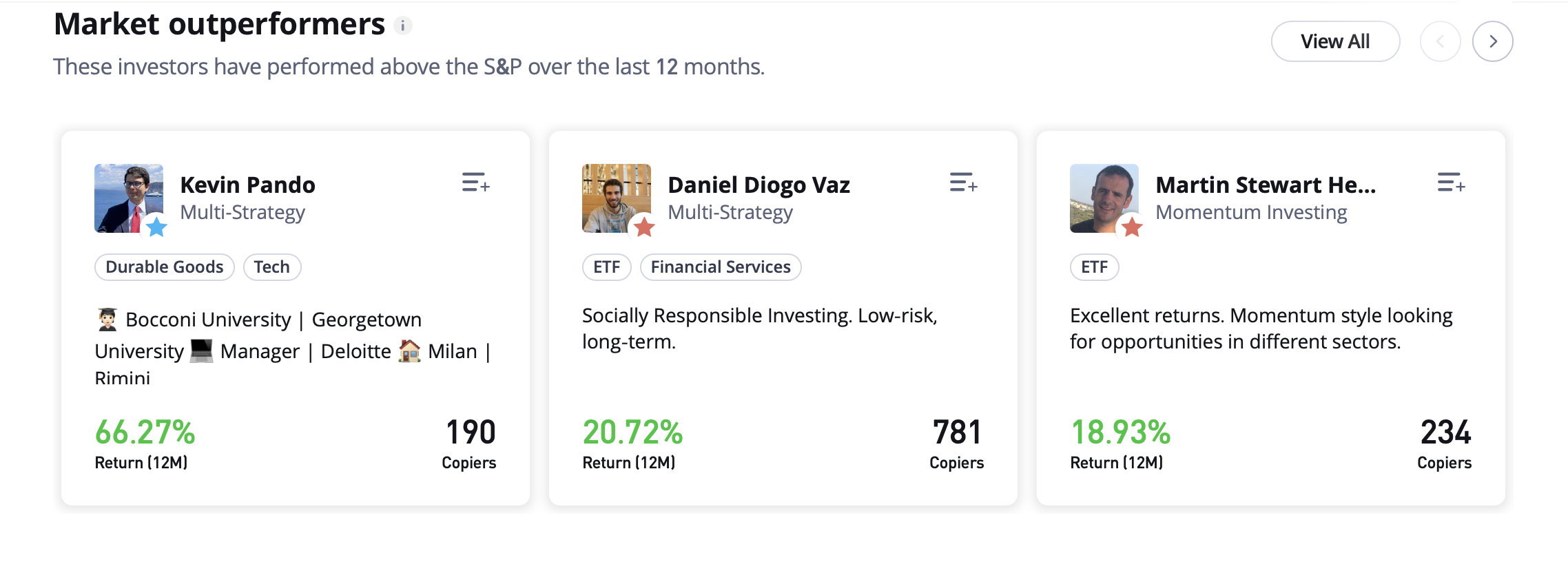

Copy Trading

Similar to using a managed account, a broker with copy trading allows you to reduce your time studying markets by automatically replicating the positions of an experienced trader.

Most copy trading brokers we’ve tested allow users to browse copy providers via a platform that displays data including their expertise, current portfolio and past performance.

Once you’ve chosen your provider, you can usually decide how much you want to invest and start copying their trades with a couple of clicks.

Doing so will replicate their positions proportionally according to how much you’ve invested and will open and close trades when the copy trader does.

While testing copy trading firms, I’ve found that the best brokers provide deep information on their providers, such as their risk profile and personal bio.Ideally, there should also be a social trading function that allows providers to discuss their ideas and explain decisions.

- eToro was a pioneer for copy trading and it’s still our top pick in this class, thanks to its quick and intuitive platform that allows traders to seamlessly research and choose providers via powerful search and filter options.

Automated Trading

You can save a lot of time by using automated trading tools to execute positions on your behalf according to the parameters you choose and set.

Today, the majority of shares traded on U.S. exchanges follow automated trading orders, and many of the top brokers for traders with no time offer such features.

The tools used in automated trading are often called ‘trading robots’ or, on the MetaTrader platforms, ‘Expert Advisors.’ While some coding knowledge is useful for setting these up, we’ve found a rising number of brokers provide tools to build trading robots without using any code.

You can get a lot of use from these tools when you’re short of time (and even if you’re not) for several reasons:

- They let you conduct your trading activity before markets open, adding a huge amount of flexibility to your workflow.

- They monitor market movements and open and close positions automatically, saving you time as you don’t need to do so yourself.

- You can download trading robots that have been programmed by other users, reducing the time you need to spend setting them up yourself.

- They take the emotion out of trades, which is especially helpful when you have little time and need to make snap decisions.

So, some of our favorite brokers for time-poor traders are set up with automated trading in mind; for example, they may provide access to third-party auto-trading tools like Capitalise.ai, or to free VPS access allowing your robots to access markets 24/7.

- Pepperstone‘s automated trading options consistently impress our reviewers, with Expert Advisors and other automated options supported by a range of additional features and plug-ins, including VPS hosting and the impressive Capitalise.ai.

Signals

If you prefer to take a hands-on approach to trading, you might want to use trading signals instead of trading robots.

These detailed trade recommendations may come via email, as text messages to your phone, or through app notifications.

They can be generated by algorithms or based on in-person analysis by seasoned traders, and they often include information on entry prices, stop-loss and take-profit levels, making them an ideal time-saver for traders who want to execute trades themselves.

- NinjaTrader‘s advanced charting software and suite of signals, auto-trading tools and third-party plug-ins continue to draw traders year after year.

Mobile Trading

Mobile trading offers ultimate flexibility: trade on the go, from almost anywhere via your mobile. Such has been the popularity of mobile trading, that in recent years this has become a standard offering.

From my personal experience, mobile trading is absolutely essential when you’re short of time for several reasons:

- It’s the quickest and most convenient way for me to access markets as I can open my app at any time without needing to log into my personal computer.

- It lets me squeeze research and trading time into free moments, such as coffee breaks or time on public transport.

- It gives me the flexibility to access trading opportunities at times I would ordinarily be busy or away from the keyboard – for example, accessing Australian Securities Exchange stocks during UK time.

Mobile trading apps are generally compatible with both Android and iOS devices. Most tend to be free of charge and are available to download from either the App Store or Google Play.

Note that some brokers’ proprietary apps only allow you to access limited features – such as monitoring your positions and depositing funds – so I always check that I can open and close trades and access charts with a good range of indicators and research tools.

- XTB’s slick mobile app remains one of our favorite tools for trading on the move because it provides access to the broker’s most important features from a user-friendly interface that includes rare – and incredibly useful – smartwatch functionality.

Third-Party Tools

Some of my favorite time-saving tools for trading are the ones that make it more efficient for me to analyze markets myself and sharpen my skills.

Sustained success in training comes from analysis of market movements and successful and unsuccessful trades to develop your strategy, before further time must be spent testing and refining it.

There’s simply no way around the fact that this takes time, but I’ve found that many brokers now offer access to or otherwise support third-party tools that cut a lot of the legwork.

Analysis tools can take the pain out of reading charts and determining entry points – Autochartist and Trading Central are two such tools that some brokers provide their clients free of charge, for example.

Automated trading journals are another valuable tool because they provide a fast, efficient way to conduct deep analysis on your past trades.

Keeping a trading journal is one of the most significant steps I’ve taken to up my game, but it can be hard to consistently make time for it. That’s why I use a journal app that plugs into my platform and automatically records my trades.

- FOREX.com‘s superb range of proprietary and third-party tools keeps this broker at the top of its class for research and analysis, with traders enjoying perks including access to Trading Central for analysis, a Reuters news feed, and onboard performance analytics.

What Are The Risks Of Trading If You Don’t Have The Time?

Even if you choose a broker offering hands-off tools, there are still important risks to consider:

- You’re Still Exposed to Market Risk – Copy trading doesn’t eliminate losses. If the trader or strategy you follow hits a drawdown, so will your account. Automation can help with execution, but it can’t protect against poor market conditions or strategy flaws.

- You May Rely Too Heavily on Others – With hands-off tools, you’re outsourcing decisions. But even top traders make mistakes, change strategies, or go quiet altogether. If you’re not actively monitoring, you may not catch those shifts in time.

- Higher Fees or Performance Costs – Managed portfolios and social trading platforms often come with extra costs — such as performance fees, management charges, or markups on spreads. Over time, these can eat into your returns, especially in flat or down markets.

- Limited Customization and Control – Some hands-off systems we’ve evaluated aren’t tailored to your specific risk tolerance or goals. You may end up overexposed to markets or strategies that don’t match your profile simply because they looked good historically.

- Complacency and Lack of Learning – Automating trades can be efficient, but it can also lead to a disconnect from understanding what’s actually happening. Without learning the basics, it’s hard to judge if a strategy is still working – or when it’s time to pivot.

Bottom Line

Not everyone has the time – or desire – to actively day trade, and that’s fine.

The good news is there’s now a growing range of platforms offering hands-off tools like copy trading, managed portfolios, and automation to help you stay in the market without being glued to a screen.

We’ve listed our top picks based on real testing and overall ratings. But while these tools can save time, not all are created equal. Some come with high fees, poor transparency, or limited control, so it pays to choose carefully.

If you’re short on time but still want to trade smart, start with one of our trusted brokers for time-poor traders and stay engaged enough to ensure the strategy works for you.