Best Day Trading Journals

A trading journal can be an invaluable tool used by active traders to record and analyze trades. It can be a physical notebook, a spreadsheet, or increasingly a specialized software application that you pay for. Learn what information to record to get the most out of your journal with our example entries.

We built a trading journal template which you can download for free to track your trades, results, emotions, and monitor your overall portfolio.

Do I Need A Free Or Paid Trading Journal?

Creating a trading journal is easy (I know I’ve done it), and there are plenty of free and very accessible programs that you can use to construct a database, or calendar, of your trading history.

All you need is the ability to build tables to input data, to write some text describing your feelings towards a trade, and, if you want to, the ability to insert screenshots of charts that could help your analysis.

If you want a free trading journal, you can make use of the following well-known programs, some of which are available as zero-cost downloads:

- Google Docs

- Google Sheets

- Microsoft Word

- Microsoft Excel

- Apple Numbers

Download a free copy of DayTrading.com’s trading journal template spreadsheet.

Some are also now available in app form, making them easy to access when day trading on the go – great for the growing class of mobile traders.

However, despite the range of free journal options, there are a growing number of paid-for software that plugs straight into your trading platform and automatically creates an interactive journal.

These tools also sometimes have intuitive charts, AI-powered insights, real-time feedback and expert tips to help you improve.

What Does A Trading Journal Do?

1. Tracks Performance

- Records trade details: This includes the date, time, asset traded, entry and exit prices, position size, and profit/loss.

- Monitors progress: Tracking your trades allows you to see how your short-term trading strategy is performing over time and identify areas for improvement.

- Measures key metrics: You can calculate important performance indicators like win rate, average profit/loss, risk/reward ratio, and Sharpe ratio to evaluate your overall trading success.

2. Improves Decision-Making

- Write down your criteria: Whenever we make a decision there’s something going on in our brains that causes us to do what we do. What are the criteria? The quality of your decisions ultimately determines your success in trading, so it helps to write down exactly how you’re making those decisions. This also brings a host of other benefits, such as being able to stress-test what you think to make sure it’s actually good.

- Identifies patterns: Reviewing your trading history enables you to spot recurring patterns in your behavior, both good and bad. This helps you understand your strengths and weaknesses as a trader.

- Analyzes mistakes: A journal allows you to dissect losing trades to understand why they went wrong. Were your entry/exit points poorly chosen? Did you ignore your risk management rules?

- Refines strategy: You can identify what’s working and what’s not in your trading strategy by analyzing your trades. This allows you to make adjustments and better optimize your approach.

3. Improves Discipline And Emotional Control

- Promotes accountability: Keeping a journal forces you to be accountable for your trading decisions. This can help you avoid impulsive trades and stick to your plan.

- Manages emotions: Trading can be emotional. A journal provides a space to record your thoughts and feelings during and after trades, helping you understand how emotions impact your decisions.

- Reduces biases: Objectively reviewing your trades enables you to identify and address cognitive biases that may be affecting your trading.

4. Facilitates Continuous Learning

- Captures observations: You can use your journal to record observations about the market, specific assets, or your own trading psychology.

- Tracks learning progress: Your journal helps you track your progress as you learn new techniques or adapt your strategy and see the impact of those changes on your trading.

What Should I Include In My Trading Journal?

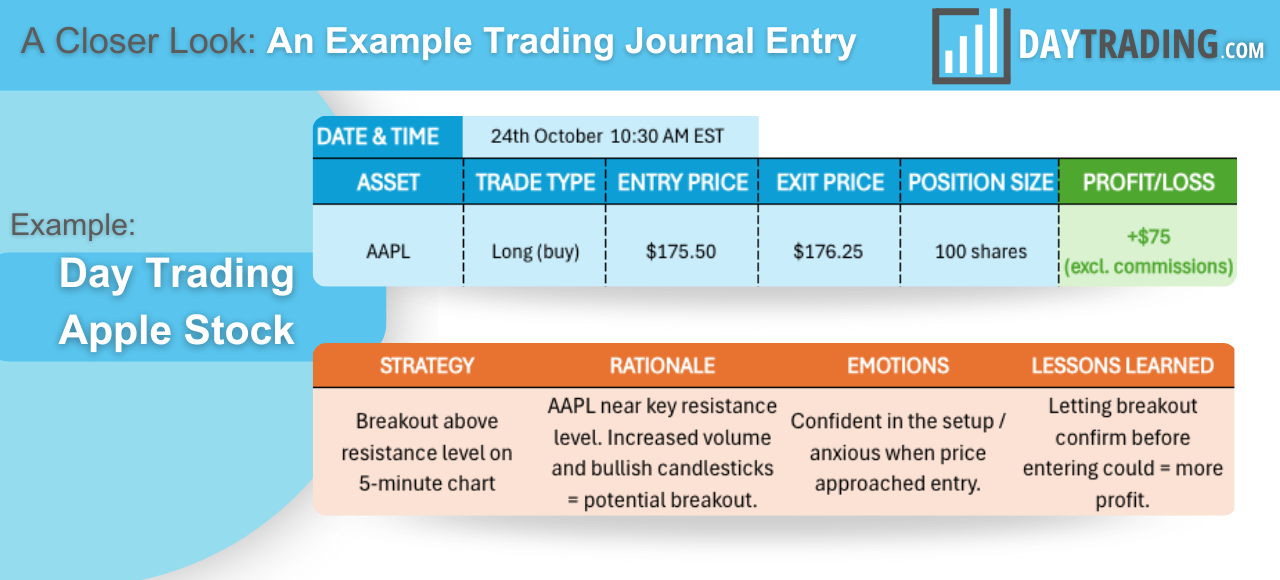

Let’s give a hypothetical example.

We’ll structure this by date and time, asset, trade type, entry/exit price, position size, profit/loss, strategy, rationale, emotions, and lessons learned.

When used correctly, a good trading journal should leave you with a broad database of information to analyze and help you pinpoint areas for improvement in future trading activities.

Bottom Line

A trading journal can be useful for self-improvement and achieving more consistency in short-term trading. It may help you move from impulsive, emotion-driven decisions to a more disciplined and analytical approach.

FAQ

Do I Have To Use A Trading Journal?

No – you don’t have to use a trading journal.

However, if you are a beginner or advanced trader serious about improving then it’s worth considering.

What Is The Best Platform For Making A Trading Journal?

Many programs can be used to create a trading journal, from classic spreadsheet software like Excel and Microsoft to sophisticated paid applications.

Some brokers also offer an inbuilt journal template, and this will save you time by automatically recording the data needed. Pepperstone is one such example – I’ve experimented with the journal integrated into its web platform – it’s basic but does the job if you don’t want any frills.

Will A Trading Journal Make Me More Money?

Not on its own.

While a trading journal is a good way to make your trading activity more organized and efficient, there is no guarantee that it will make your trading more profitable.

It’s more about how you use the journal and act on its insights to develop an effective strategy and approach to risk management.

Do I Need A Journal For Day Trading?

A trading journal is useful to any short-term trader, no matter what timeframe they are trading in, be it day trading stocks and forex or swing trading commodities and cryptos.

However, for very active trading over short periods, you may want to streamline the amount of data you record for each trade. This is where journals that are integrated with your brokerage are especially useful – taking away a lot of the manual data gathering.