Best Brokers With LAMM Accounts

Lot Allocation Management Module (LAMM) brokers allow you to give part of your capital to fund managers who will invest on your behalf.

They differ from other popular managed trading accounts like PAMM accounts and MAM accounts in their method of allocation. Capital is denominated in lots, hence lot allocation.

LAMM accounts will suit hands-off forex traders who want a degree of control over risk – you can decide the number of lots to invest.

Best LAMM Account Brokers In 2026

Following our tests, we gave these 2 brokers the highest overall ratings. They all offer some form of lot allocation through their managed account solutions.

Here is a summary of why we recommend these brokers in January 2026:

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- IronFX - IronFX is a multi-regulated forex and CFD broker founded in 2010. This award-winning firm offers 500+ markets to over 1.5 million clients across 180 countries. Traders can access various account types with competitive pricing on the MT4 platform, as well as 24/5 customer support in 30 languages.

Best Brokers With LAMM Accounts Comparison

| Broker | LAMM Account | Minimum Deposit | Platforms | Regulators |

|---|---|---|---|---|

| RoboForex | ✔ | $10 | R StocksTrader, MT4, MT5, TradingView | IFSC |

| IronFX | ✔ | $100 | MT4, AutoChartist, TradingCentral | CySEC, FCA, FSCA, BMA / Bermuda |

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- RoboForex secured the 'Best Forex Broker 2025' title in DayTrading.com's Awards after broadening their FX offering, cutting spreads and opening up services in various countries.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

IronFX

"IronFX remains a good choice for experienced forex traders looking to trade with fixed or floating spreads. The range of 80+ currencies is more than many competitors and there are some excellent forex market research tools on offer."

Tobias Robinson, Reviewer

IronFX Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Indices, Shares, Futures, Commodities, Metals (all CFDs) |

| Regulator | CySEC, FCA, FSCA, BMA / Bermuda |

| Platforms | MT4, AutoChartist, TradingCentral |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (FCA), 1:30 (CySEC), 1:500 (FSCA), 1:1000 (BM) |

| Account Currencies | USD, EUR, GBP, AUD, JPY, PLN, CZK |

Pros

- Alongside MT4, the broker continues to offer several additional services, including copy trading, a VPS solution, and PAMM/MAM accounts

- The IronFX Academy delivers some excellent educational tools for beginners through to advanced traders

- Traders get access to the popular Trading Central research tool, which offers automated AI analytics and 24/7 support

Cons

- Commissions start from $13.50 per lot in the zero-spread accounts, nearly double the industry average

- Compared to the leading brokers, IronFX offers a relatively small selection of share CFDs

- It’s a shame that the broker doesn’t offer any additional software such as MT5 or TradingView to give experienced traders more choice

How Did DayTrading.com Choose The Best LAMM Account Brokers?

To compile a list of the best LAMM accounts, we looked at several key factors:

- We checked brokers offer a form of LAMM account. They are no longer supported by many brokers, who increasingly offer copy trading, PAMM accounts and MAM accounts instead.

- We prioritized brokers we trust. Safety and security are key when you are trading, but even more so if you’re trusting someone else to manage your funds. IronFX stands out as one of the few heavily regulated brokers to offer LAMM accounts.

- We investigated the fund manager reports available. This is important because the top firms provide access to skilled fund managers with reports that detail past performance, approach to risk and other key metrics, helping you decide who to invest your capital with.

- We selected brokers with a low minimum investment, that makes LAMM accounts accessible to beginners. Grand Capital offers one of the lowest account minimums among LAMM brokers, starting from $10.

- We evaluated the fees you will pay to invest using a LAMM account, as they partly determine your chances of making a profit and limit the amount you can make. RoboForex offers a form of lot allocation with competitive spreads and a 25% management fee that is charged on profitable positions.

- We chose brokers with customer service you can rely on following our tests that considered the coverage, speed and professionalism of support in dealing with our questions about LAMM account conditions.

What Is A LAMM Account?

A LAMM, or Lot Allocation Management Module, allows you to partition capital for a fund manager to execute your orders.

This allocation is done by a set lot size, so the manager cannot access your whole account.

Profits or losses are calculated in line with the lot size you select.

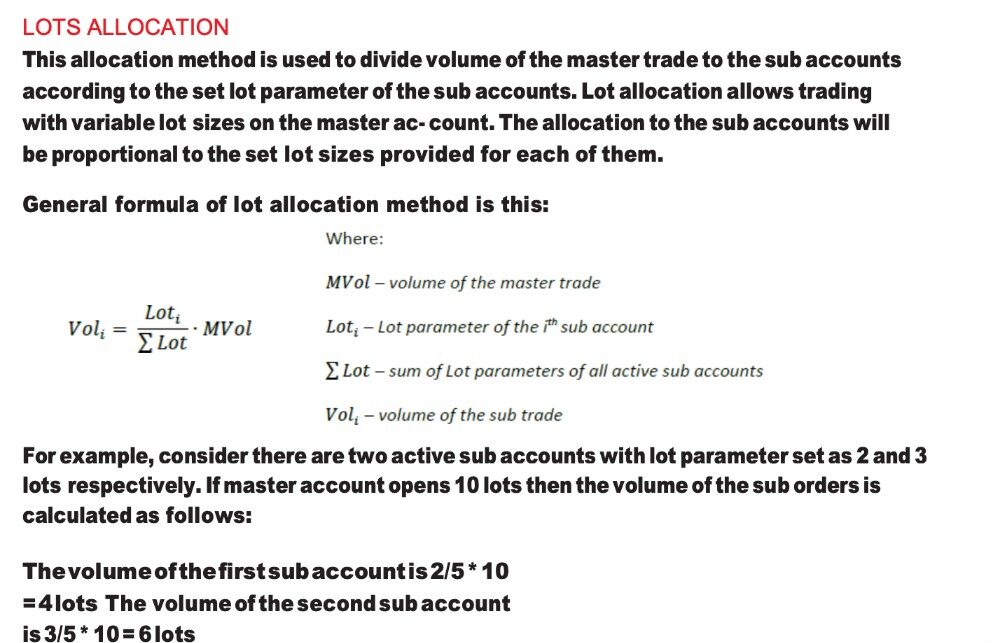

You can see exactly how it works in IronFX’s solution below.

How Are LAMM Accounts Different To Other Managed Accounts?

Other popular managed trading accounts include Percentage Allocation Management Module (PAMM) and Multi-Account Manager (MAM).

LAMM is very similar to PAMM trading, the difference being that in a LAMM account, you specify the number of lots to allocate, whereas in PAMM accounts you specify a percentage of your capital.

In MAM trading, a single master trader executes trades that are mirrored by all the MAM account holders, though these investors also have the option to set their own parameters and have some control over the account.

Bottom Line

LAMM brokers offer a form of managed account that allows you to provide a set number of lots for a fund manager to carry out trades on your behalf.

LAMM accounts take much of the work and required knowledge out of trading, as you can simply select a manager and let them do the work.

However, there is no guarantee that you will make money and finding a trusted broker with a strong pool of fund managers can be challenging.

That’s why we recommend using one of our highest-rated brokers with LAMM accounts that have been reviewed by our testing team.

FAQ

What Are The Advantages Of LAMM Accounts?

The main benefits of LAMM accounts are that you can spend less time trading and you can leverage the experience of seasoned forex traders, for example.

You also retain a degree of control because you can normally choose how many lots to invest and you can use multiple fund managers to spread risk.

What Are The Risks Of LAMM Accounts?

There is no guarantee you will make money using a LAMM account. This will depend on the skill of the fund manager you entrust your capital with, and the fees you pay.

Also, LAMM accounts are less popular than PAMM and MAM solutions, which are provided more frequently by regulated brokers.