Best Day Trading Brokers In Zambia 2026

Looking to day trade in Zambia? We’ve tested, rated and ranked the best day trading brokers in Zambia.

The Securities and Exchange Commission (SEC) oversees the financial markets in Zambia, but many local traders choose trusted international brokers. If you opt for this route, you must adhere to local regulations and Zambian tax rules.

Top 6 Platforms For Day Trading In Zambia

These 6 brokers scored the highest in our tests, making them the best for day traders in Zambia:

-

1

XM

XM -

2

Exness

Exness -

3

IC Markets

IC Markets -

4

RoboForex

RoboForex -

5

AvaTrade

AvaTrade -

6

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Why Are These Brokers The Best For Day Traders In Zambia?

Here's a quick rundown of why we believe these are the best day trading platforms for Zambians:

- XM is the best day trading platform in Zambia for 2026 - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

How Safe Are These Day Trading Platforms In Zambia?

When choosing a broker for day trading it's important to consider how they will protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| XM | ✘ | ✔ | ✔ | |

| Exness | ✘ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ | |

| RoboForex | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ | |

| Pepperstone | ✘ | ✔ | ✔ |

Compare The Top Day Trading Apps In Zambia

Here's how the top day trading apps in Zambia perform based on our tests of the mobile trading experience:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| XM | iOS, Android & Windows | ✘ | ||

| Exness | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ | ||

| RoboForex | iOS & Android, R StocksTrader | ✘ | ||

| AvaTrade | iOS & Android | ✘ | ||

| Pepperstone | iOS & Android | ✘ |

Are The Top Day Brokers In Zambia Good For Beginners?

Beginners need brokers that offer demo accounts, plus other key features for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| XM | ✔ | $5 | 0.01 Lots | ||

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots | ||

| RoboForex | ✔ | $10 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots | ||

| Pepperstone | ✔ | $0 | 0.01 Lots |

Are The Top Day Trading Brokers In Zambia Good For Advanced Traders?

Experienced traders need brokers with powerful tools to upgrade the day trading environment:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| XM | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:1000 | ✔ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✔ | ✘ | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ |

| RoboForex | Expert Advisors (EAs) on MetaTrader, Strategy Builder in R StocksTrader | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

| AvaTrade | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✔ | 1:30 (Retail) 1:400 (Pro) | ✔ | ✘ |

| Pepperstone | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:30 (Retail), 1:500 (Pro) | ✔ | ✘ |

Compare Detailed Ratings Of Top Day Trading Brokers In Zambia

Find out how the top day trading brokers scored in key areas following our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| XM | |||||||||

| Exness | |||||||||

| IC Markets | |||||||||

| RoboForex | |||||||||

| AvaTrade | |||||||||

| Pepperstone |

Compare Day Trading Fees

The cost of day trading can vary hugely between providers, so here's how our top platforms stack up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| XM | ✘ | $5 | |

| Exness | ✘ | $0 | |

| IC Markets | ✘ | $0 | |

| RoboForex | ✘ | $0 | |

| AvaTrade | ✔ | $50 | |

| Pepperstone | ✔ | $0 |

How Popular Are These Day Trading Platforms?

Many active traders in Zambia seek out the most day trading platforms with the most clients as a sign of reliability:

| Broker | Popularity |

|---|---|

| XM | |

| Exness | |

| RoboForex | |

| Pepperstone | |

| AvaTrade | |

| IC Markets |

Why Day Trade With XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

Why Day Trade With Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

Why Day Trade With IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

Why Day Trade With RoboForex?

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

Cons

- Despite offering a range of platforms, RoboForex still doesn't support the increasingly popular cTrader. This might deter traders who prefer this specific platform for their day trading activities and is available at firms like Fusion Markets.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

Why Day Trade With AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Why Day Trade With Pepperstone?

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Methodology

To identify the top day trading platforms in Zambia, we analyzed our database of 139 brokers, zeroing in on those that accept Zambian traders.

Our rankings are then based on detailed evaluations, combining our direct testing experiences with objective data.

- We ensured that each broker on our list accepts day traders from Zambia.

- We only included brokers with trusted regulatory credentials.

- We prioritized brokers offering a wide range of day trading markets.

- We favored brokers with competitive pricing.

- We chose brokers with dependable charting platforms.

- We examined each broker’s leverage and margin requirements.

- We assessed each broker’s quality and speed of order executions.

How to Choose a Day Trading Broker in Zambia

Based on our years testing and retesting day trading platforms, and our thorough understanding of the Zambian market, these are the key factors to consider when choosing a broker:

Trust

Choosing a trusted broker will help to shield you from potential trading scams.

Reputable brokers often demonstrate factors like a long history, positive reviews and listings on stock exchanges. Importantly, they are regulated by respected authorities as outlined in DayTrading.com’s Regulation and Trust Rating.

Due to its relatively limited oversight of online brokers, Zambia’s Securities and Exchange Commission (SEC) is classed as ‘orange tier’ in our Regulation & Trust Rating.

Some local traders turn to other international brokers. This isn’t prohibited, but it’s important to comply with local tax and trading regulations.

- AvaTrade maintains its high trust rating thanks to its nine regulatory licenses from authorities like CySEC (Cyprus) and ASIC (Australia), plus a 15+ year history. The broker’s clean track record and positive reviews from our testers make it a top choice for Zambian traders.

Market Access

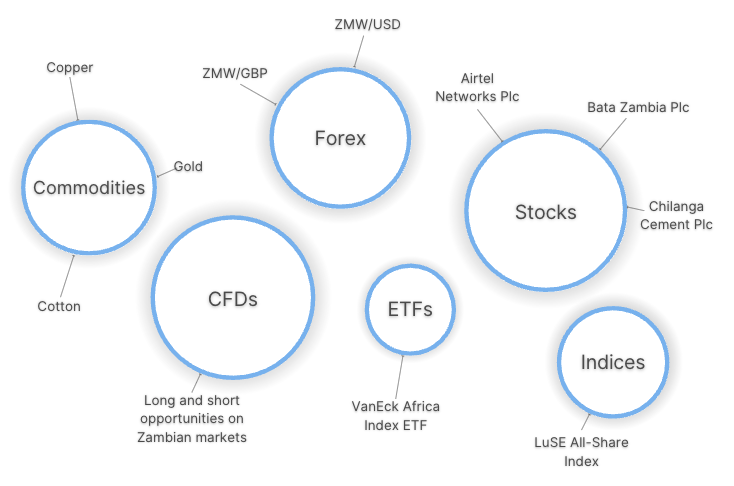

To build a diversified portfolio of assets, your chosen broker should offer a wide range of markets.

Zambian traders may look for currency pairs involving the Zambian kwacha (ZMW), such as ZMW/USD, or stocks listed on the Lusaka Securities Exchange, like Airtel Networks Plc.

That said, these markets are not widely available at online brokers in our investigations, so you may need to consider other instruments, such as the country’s major export commodities like copper, and popular currency pairs like EUR/USD, which offer the liquidity needed to quickly enter and exit positions.

- Pepperstone offers a superb range of 1300+ day trading markets for those looking for diversity, including exotic and NDF currency pairs, emerging markets ETF products, and notable hard and soft commodities, including copper and coffee.

Day Trading Fees

High trading costs can easily mount up for active traders, so we assess key day trading fees including spreads, commissions and any applicable conversion fees when transferring in ZMW.

Fees can be particularly steep for volatile markets, including Zambian assets, while liquid markets such as major forex pairs may be best if you’re starting out.

We also evaluate any account maintenance fees, such as deposit and withdrawal charges (though most leading brokers we’ve used don’t charge for deposits) and inactivity fees.

- RoboForex continues to offer low fees for active traders, including spreads from 0.0 pips on major assets like EUR/USD and the option to trade with zero commissions in its STP account. For those opting for ECN accounts, traders can also get rebates on commissions which will suit active traders looking to keep costs down.

Charting Platforms

Day traders need reliable charting tools to analyze short-term market trends.

Leading platforms like MetaTrader 4, MetaTrader 5 and TradingView are widely available at most brokers we’ve evaluated and offer a wide range of technical indicators to inform day trading strategies.

We also look out for integrated research and analysis features, such as news feeds and economic calendars. These may provide insights into interest rate decision from Zambia’s central bank or updates on supplies of the country’s exports like copper.

- XM‘s selection of charting platforms makes it a great choice for beginners and experienced traders alike, including MT4, MT5 and a proprietary app. There’s also a superb suite of additional research tools, including a Reuters news feed and Trading Central analysis.

Leverage Trading

Leverage gives you broader exposure to a trade while only using a small deposit (known as margin).

This can increase both your potential profits and losses, so it’s important to understand the broker’s margin requirements and to implement a risk management strategy before entering any trade.

While there are no restrictions on leverage in Zambia, which means you could trade with up to 1:1000+ at some brokers, we don’t recommend this for beginners.

- Deriv offers high leverage up to 1:1000 for Zambian traders, as well as multipliers up to x30 with capped losses – a more accessible option for beginners. There’s also a useful trading calculator so you can view your required outlay for each trade.

Execution Quality

Fast order execution speeds are essential when trading fast-paced markets, especially if they’re volatile Zambian assets.

The best brokers we’ve evaluated will execute trades in less than 100 milliseconds, ensuring minimal slippage and low latency for the optimal entries and exits.

- IC Markets is one of the fastest brokers that we’ve tested, with execution speeds of around 35 milliseconds and low latency thanks to their Equinix NY4 data center server location. Active traders can also access a VPS solution, which reduces speeds even further.

Account Funding

Choose a broker that supports convenient deposit and withdrawal methods. Most brokers require a minimum deposit of up to $250, though some let you start with $0.

It’s also worth looking out for local bank transfers, credit card and mobile payments accepted in Zambia which might make funding easier.

- Exness makes it easy to fund accounts, with a vast range of payment methods including local bank transfers, credit cards and mobile payments. Additionally, the 10 USD minimum deposit requirement makes the broker an accessible choice for beginners.

FAQ

Who Regulates Day Trading Platforms In Zambia?

The Securities and Exchange Commission (SEC) oversees the financial markets in the country, but it doesn’t regulate many online brokers compared to financial bodies in other regions.

Zambian traders can use brokers that are registered by other reputable authorities, but you must still follow local laws.

Which Is The Best Broker For Day Traders From Zambia?

The best broker depends on your requirements. Refer to DayTrading.com’s list of the top day trading platforms in Zambia to find your perfect match.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com