Best Brokers Offering Sustainable Stocks 2026

The best brokers offering sustainable stocks allow traders to capitalize on the increasing prominence of social and environmental issues within the public consciousness.

Climate change, deforestation and other environmental factors threaten our world while society pushes for greater equality and inclusion, so many investors are looking to use their capital as a power for good by investing more ethically in stocks, indices and ETFs.

Best Brokers For Sustainable Stocks And ETFs

These 6 brokers offer the best suite of sustainable stocks and ETFs with low fees and user-friendly tools:

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

TradeUp

TradeUp -

4

Zacks Trade

Zacks Trade -

5

Plus50080% of retail CFD accounts lose money.

Plus50080% of retail CFD accounts lose money. -

6

City Index

City Index

Here is a short summary of why we think each broker belongs in this top list:

- Interactive Brokers - IBKR provides access to an unparalleled array of equity products originating from 24 diverse countries. Whether seeking capital appreciation, dividends, or voting rights, you can directly invest in stocks. Alternatively, you can engage in speculative trading on price movements through CFDs, futures and more than 13,000 ETFs. IBKR also enhanced its European equity derivatives offering in 2024 by adding trading on CBOE Europe Derivatives (CEDX).

- eToro USA - You can trade 3000+ popular US stocks and ETFs at eToro US, with zero commissions and fractional shares available. The broker remains an excellent choice for beginner stock traders, thanks to its comprehensive eToro Academy and user-friendly stock market research features.

- TradeUp - In our tests across mobile, web and desktop, TradeUP delivered a strong stock-trading experience with basic market/limit/stop/stop-limit orders, 22 core indicators and 30+ drawing tools, reliable quotes/fills, and clean confirmations. Beyond mainstream U.S. equities, access extends to selected OTC names and 250+ Chinese ADRs (e.g., BABA, BIDU, NIO).

- Zacks Trade - Zacks Trade offers a large selection of US and international stocks, including penny stocks, as well as ETFs and global indices. The broker also offers options as a way to speculate on stock price movements.

- Plus500 - Plus500 continues to offer an extensive range of shares across UK, US, and European markets via CFDs, with notable additions in 2025 spanning quantum computing and AI, such as IonQ, Rigetti, Duolingo, and Carvana. The ESG and cannabis sector opportunities are also enticing features not commonly found among other platforms. There also an impressive 30+ indices available with leverage up to 1:20.

- City Index - City Index offers 4,700+ shares from major stock exchanges via CFDs and spread bets, including big names like Tesla and Apple. Pre-market and after-hours trading is also available on 70+ US stocks, while it shines with indices that reflect growing consumer interests like AI, NFTs, ESG.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Stock Exchanges

Interactive Brokers offers trading on 18 stock exchanges:

- Abu Dhabi Securities Exchange

- Borsa Italiana

- CAC 40 Index France

- Chicago Mercantile Exchange

- Euronext

- IBEX 35

- Japan Exchange Group

- Korean Stock Exchange

- London Metal Exchange

- London Stock Exchange

- Nairobi Securities Exchange

- Nasdaq

- Nasdaq Nordic & Baltics

- New York Stock Exchange

- Russell 2000

- Shenzhen Stock Exchange

- Tadawul

- Toronto Stock Exchange

Pros

- IBKR continues to deliver unmatched access to global stocks with tens of thousands of equities available from 100+ market centres in 24 countries, most recently the Saudi Stock Exchange.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

eToro USA offers trading on 3 stock exchanges:

- Dow Jones

- New York Stock Exchange

- S&P 500

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- The proprietary terminal doesn't support trading bots and there are no additional stock market analysis tools

- Average fees may cut into the profit margins of day traders

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

TradeUp

"TradeUp is best suited to budget-conscious day traders looking to trade U.S. and global markets with zero commissions on a user-friendly mobile app. Its more than 250 Chinese American Depositary Receipts (ADRs), including Alibaba Group (BABA), also make it suitable for trading Chinese equities."

Christian Harris, Reviewer

TradeUp Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | SEC, FINRA |

| Platforms | Desktop, Web, Mobile |

| Minimum Deposit | $0.01 |

| Automation | No |

| Account Currencies | USD, EUR, GBP |

Stock Exchanges

TradeUp offers trading on 4 stock exchanges:

- Hong Kong Stock Exchange

- Nasdaq

- New York Stock Exchange

- S&P 500

Pros

- TradeUp runs an integrated and intuitive financial calendar that helps you track earnings, dividends, and IPOs relevant to your watchlist, enabling you to stay ahead of market-moving events.

- TradeUp’s platforms work smoothly across multiple devices based on our tests, including mobile apps for iOS and Android, a desktop app for Windows and Mac, and a web-based platform. This allows active traders to switch between devices without losing continuity, whether you’re at home or on the go.

- TradeUp offers commission-free trading on US stocks and ETFs, and support for fractional shares lets you buy portions of a share for as little as $5.This makes it a cost-effective choice for active day traders who want to minimize trading expenses.

Cons

- TradeUp's educational resources aren't kept updated, and were over 6 months old in our latest tests. While there are articles and tutorials aimed at newcomers, the content is somewhat limited and does not cover more advanced trading strategies or deeper topics.

- The platform's technical indicators have limited customization options from our use. On both mobile and web versions, you can't layer multiple indicators on the same chart simultaneously, which restricts more sophisticated chart analysis.

- TradeUp does not support popular third-party platforms like TradingView or cTrader, so traders who rely on those for advanced charting, automation, or community features won't find that flexibility.

Zacks Trade

"Zacks Trade will suit active day traders with experience using powerful platforms. Fees and margin rates are low while the market research is excellent."

Tobias Robinson, Reviewer

Zacks Trade Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | FINRA |

| Platforms | Own |

| Minimum Deposit | $2500 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, TRY, SEK, NOK, DKK, CHF, HKD, SGD, RUB, PLN, CZK, HUF |

Stock Exchanges

Zacks Trade offers trading on 4 stock exchanges:

- London Stock Exchange

- Nasdaq

- New York Stock Exchange

- S&P 500

Pros

- Comprehensive research and data

- Customizable proprietary trading platform and mobile app

- 20+ account denominations

Cons

- High minimum requirement of $2,500

- Withdrawal fees apply if removing funds more than once per month

- No forex, commodities or futures trading

Plus500

"Plus500 offers a super-clean experience for traders with a CFD trading platform that sports a modern design and dynamic charting. That said, the broker’s research tools are limited, fees trail the cheapest brokers, and there’s room for enhancement in its educational resources."

Christian Harris, Reviewer

Plus500 Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | FCA, ASIC, CySEC, DFSA, MAS, FSA, FSCA, FMA, DFSA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, CZK |

Stock Exchanges

Plus500 offers trading on 14 stock exchanges:

- Australian Securities Exchange (ASX)

- Borsa Italiana

- CAC 40 Index France

- DAX GER 40 Index

- Deutsche Boerse

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- IBEX 35

- London Stock Exchange

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Pros

- In 2025 Plus500 added new share CFDs in emerging sectors like quantum computing and AI, offering opportunities in stocks like IonQ, Rigetti, Duolingo, and Carvana.

- Plus500 has recently bolstered its suite of short-term trading products, including introducing VIX options with enhanced volatility and extended hours trading on 7 stock CFDs

- Plus500 provides a specialized WebTrader platform designed explicitly for CFD trading, offering a clean and uncluttered interface

Cons

- Algo trading and scalping are not supported, which may deter some day traders

- Educational resources are limited compared to best-in-class brokers like eToro, impacting the learning curve for beginners

- The absence of social trading means users can’t follow and replicate the trades of experienced traders

City Index

"City Index is a great match for active traders, with ultra-fast execution speeds averaging 20ms, a highly customizable web platform featuring 90+ technical indicators, and some of the best education we’ve seen."

Christian Harris, Reviewer

City Index Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | FCA, ASIC, CySEC, MAS |

| Platforms | Web Trader, MT4, TradingView, TradingCentral |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, AUD, PLN, CZK |

Stock Exchanges

City Index offers trading on 16 stock exchanges:

- Australian Securities Exchange (ASX)

- Borsa Italiana

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- London Stock Exchange

- Nasdaq

- New York Stock Exchange

- Russell 2000

- S&P 500

- SIX Swiss Exchange

Pros

- City Index has made strides to enhance the trading experience, notably through its Performance Analytics in 2024 for insights into trades and discipline, plus an upgraded mobile app featuring in-built market research and news at a swipe.

- City Index boasts 13,500+ markets spanning forex, indices, shares, commodities, bonds, ETFs, and interest rates, with the platform's inclusion of niche markets like interest rates offering unique trading avenues not always found elsewhere.

- City Index provides versatile trading platforms for all skill levels. The intuitive Web Trader platform is ideal for beginners, while support for MetaTrader 4 (MT4) and TradingView adds robust analysis and automation features, ensuring a flexible experience for traders of all levels.

Cons

- While many brokers like eToro have expanded their crypto offerings, City Index only provides crypto CFDs, and the limited range may not satisfy traders looking for a broader selection of altcoins.

- City Index lacks an Islamic account with swap-free trading conditions, making the broker less appealing to Muslim traders compared to providers like Eightcap and Pepperstone.

- Unlike brokers such as AvaTrade and BlackBull, City Index does not provide passive investment opportunities like social copy trading, or real stock or ETF ownership, making it less appealing for hands-off trading.

How DayTrading.com Chose The Best Brokers For Trading Sustainable Stocks

To help active traders find the best platforms for accessing environmentally and socially responsible investments, DayTrading.com conducted an in-depth analysis.

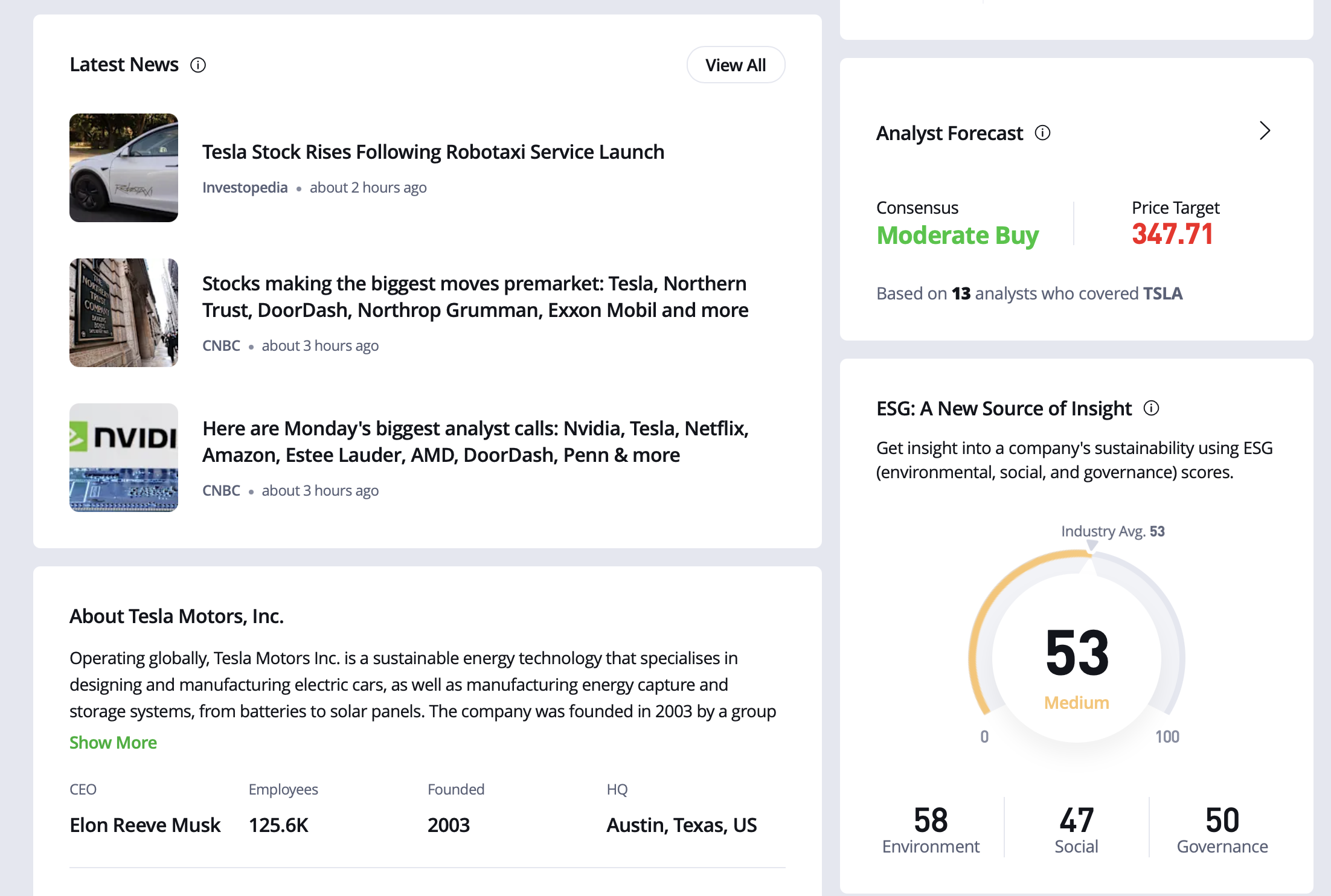

We began by identifying brokerage firms that provide access to stock trading, then filtered for those that go further – offering features specifically tailored to ESG (Environmental, Social, and Governance) trading. These include tools like ESG ratings, sustainability filters, green portfolios, and thematic stock lists focused on clean energy, ethical governance, and climate-positive companies.

From there, we ranked providers using our proprietary scoring system, drawing on over 200+ individual data points. We also incorporated findings from our hands-on platform tests to ensure each recommendation performs well in actual trading conditions – not just on paper.

What Are Sustainable Trading Instruments?

Broadly, sustainable investing involves a stock or group of stocks that prioritize the environmental, social and governmental challenges our world faces. These considerations are often abbreviated to ESG, and and tens of trillions of dollars are held within ESG assets globally.

Many of the best brokers we’ve tested offer sustainable stocks will use ESG measurements to inform their ratings.

Sustainable companies include those that tackle these issues head-on, who aim to combat issues such as the overuse of natural resources, rising levels of pollution or the effects of increasing urbanisation head-on.

A green energy company that invests in wind, solar and other alternatives to fossil fuel is an example of a sustainable stock, while an oil company that contributes to rising CO2 emissions is not.

Day traders who want to capitalize on sustainable investment trends have several options:

- Individual Stocks: Sustainable companies like US renewable energy firm Clearway Energy (CWEN).

- Sustainable ETFs: Exchange-traded funds comprising several sustainable company stocks, for example the VanEck Sustainable Future of Food UCITS ETF.

- Sustainable Indices: These will track the performance of a number of sustainable companies tied together by industry or by their ESG rating. The Vanguard FTSE Social Index Fund is one example.

How To Choose A Broker For Sustainable Stock Trading

Availability

Choose a broker with a wide range of sustainable stocks to trade, or you’ll be stuck trading a handful of instruments while missing out on prime opportunities elsewhere.

Day trading sustainable stocks is a niche interest, so it can be difficult to find a broker that caters specifically to this.

That’s why we especially value brokers that are up-front and detailed about the sustainability of the assets on offer, for example by providing an ESG rating or allowing users to easily search for sustainable stocks, ETFs and funds.

- Our experts consistently rate eToro for its range of sustainable stocks, with individual companies’ ESG ratings prominently displayed on the stock front page, as well as detailed financial information and in-built news and sentiment analysis.

Flexibility

Since sustainable indices and mutual funds can often only be bought and sold at the end of each trading day, often with significant delays to prices, stocks and ETFs are the clear choice for you if you’re a day trader seeking intraday profits.

Also consider brokers that offer fractional shares or CFDs on these sustainable assets, as these reduce the capital outlay needed to enter markets.

Instead of buying and selling full shares, these allow you to purchase smaller fractions of them or to speculate on price movements using derivative contracts.

- Interactive Brokers remains one of the most flexible brokers around for sustainable day trading, with access to a massive number of global stocks across 90+ different stock markets, including fractional shares and the option to trade CFDs and other derivatives.

Diversification

Sustainable stocks and other trading instruments might not always provide the volatility and/or liquidity you need for day trading, so you should look for a broker with a good range of alternative assets.

As a sustainable day trader you will want to steer clear of fossil fuels and environmentally unfriendly companies, so we recommend looking for a large variety of stocks as a starting point.

Remember that some assets like cryptocurrencies have a high carbon footprint, and index tracker funds will include environmentally unfriendly companies, potentially making these poor choices for sustainable day traders.When I’m looking for ethical options, I find it easiest to search for stocks with good ESG ratings.

- If you want access to diverse tradable assets, IG beats out rivals year after year for its massive range, including 17,000 CFDs plus access to exchange-traded securities in some countries.

Fees

Choose a broker with low fees to make sure you are not overpaying when you trade sustainable stocks and ETFs.

Unlike longer-term ethical investing, where the greatest expense tends to come from account or fund management fees, day traders’ most important considerations should be the spread and any commission fees.

You should also look out for hidden fees in the form of charges to fund and empty your account, inactivity fees or charges to access tools and data.

- Zack’s Trade has long been a top performer among US stockbrokers, and it it still one of the best options for traders who favor sustainable stocks, with a low $0.01 fee per stock or ETF (minimum $1).

Charting Platforms

As with other types of day trading, you’ll need a powerful and flexible charting platform to get the most out of your sustainable intra-day trades.

The classic MetaTrader 4 and MetaTrader 5 platforms are the most widely available, in our experience, but you might prefer the sophisticated cTrader for its algorithmic and copy trading features or TradingView for its slick, comprehensive interface with charting, social trading and research functions.

- City Index remains one of our top choices for its charting prowess, with a proprietary Web Trader plus MT4 and TradingView allowing users to plan and execute their sustainable day trades with speed and precision.

Extra Tools

Today, day traders have access to a huge range of extremely useful tools, so you should take advantage by signing up with a broker that includes a good range of these at a low or no extra cost.

These might include integrated tools that can turn your platform into a high-performance charting machine, dedicated news sections with updates relevant to sustainable investing, or tools to create and run algorithmic trading robots.

- Swissquote continues to provide a superb suite of additional tools and features, from access to third-party analysis tools like Autochartist and Trading Central to onboard research tools including a daily news feed – more than enough to research and monitor sustainable stocks while preparing your trades.

Pros Of Trading Sustainable Stocks

- Supporting Positive Change – Investing in alignment with personal values is often gratifying, with traders knowing that their capital is supporting the growth of companies with sustainable business models, whether this is through renewable energy, climate change solutions, health, safety or community development.

- Performance – A common misconception of sustainable investing is that potential returns are sacrificed compared to non-sustainable investments. However, sustainable indices have historically shown that they are no gimmick. For example, the MSCI KLD 400, an index where an extremely high ESG score is required for inclusion, outperformed the US market over 30+ years.

- Growing Market – Sustainable stocks, indices and ETFs are in high demand from investors, particularly socially conscious millennials, and the increased demand for sustainable investment has led to an increase in options for investors. The number of available sustainable investing funds has grown exponentially in recent decades, with top brokers offering investors more choice than ever when looking to invest in sustainable stocks, indices and ETFs.

Cons Of Trading Sustainable Stocks

- Less Availability – Despite the rise in ESG investments, sustainable stocks are still a relatively niche asset type so you won’t have as much choice as you would trading regular instruments. That goes both for the stocks that are available to trade, and the brokers that provide them.

- Unspecific Definitions Of Sustainability – Almost all brokers and indices have accepted the ESG criteria as a method of defining sustainability. However, the term was shrouded in controversy after the SEC issued a risk alert to investors warning of poor definitions of ESG. Even more worryingly, there have been allegations of financial firms misreporting the ESG compliance of their funds.

- Opportunity Loss – Trading sustainable stocks can be profitable (and high-risk), but so can many other instruments that aren’t considered ethical. Sustainable day traders might miss out on price swings in volatile instruments like cryptocurrencies and oil, for example.

Bottom Line

For socially and environmentally conscious investors and traders, finding the best brokers offering sustainable stocks can be key.

However, it can also be a good idea for many others, as stocks, indices and ETFs that incorporate ESG considerations have been competitive over the last few decades.

The best brokers offering sustainable stocks and funds will provide low pricing and high-quality tools, as well as detailed breakdowns of assets and in-depth analyses of the companies, allowing clients to rest easy with their ethical investing.

FAQ

What Are Sustainable Stocks, Indices And ETFs?

To be classed as sustainable, a stock, index or ETF must score highly in ESG factors, which incorporate environmental, social and governance considerations.

These can be companies that address these issues directly or those that incorporate ESG compliant business principles into the running of their corporation.

How Does Performance Compare For Sustainable Stocks?

Sustainable investing is a viable option for both short and long term trading. ESG index funds and ETFs regularly keep pace with and sometimes even overperform the general market, with anecdotal evidence showing that optimising for ESG factors boosts the productivity and therefore performance of a particular company.

Can I Day Trade Sustainable Stocks And ETFs?

Sustainable stocks and ETFs can be traded throughout the day on their local markets, often with margin or options contracts. However, some funds differ in that they can only be bought and sold at the end of the trading day, making them less-suited for day trading.