Best TradingView Brokers In 2026

As active traders, industry experts, and experienced users of the software, we’ve tested and ranked the top brokers with TradingView from its growing network of 80+ partners – helping you find the best fit for your needs.

Top 6 TradingView Brokers For 2026

Our updated March 2026 rankings reveal these are the top 6 TradingView brokers :

-

1

Interactive Brokers

Interactive Brokers -

2

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

3

FOREX.com

FOREX.com -

4

CEX.IO

CEX.IO -

5

Optimus Futures

Optimus Futures -

6

Coinbase

Coinbase

Why Are These Brokers The Best Brokers With TradingView?

Here’s a quick rundown of why we believe these brokers are the best for TradingView integration:

- Interactive Brokers is the best TradingView broker in 2026 - Interactive Brokers offers deep TradingView integration, enabling trading across global stocks, futures, forex, and options with competitive commissions from $0.005 per share. When we tested it, order execution was highly reliable and fast. Advanced analytics and algo tools empower professional traders with rich market insights.

- OANDA US - OANDA US supports TradingView charting and seamless order execution on 70+ forex pairs and CFDs, with spreads from 1.0 pip and no commissions. When we tried it, execution was precise. Advanced TradingView tools help refine strategies in real time.

- FOREX.com - FOREX.com provides TradingView users with access to 80+ forex pairs and CFDs, featuring tight spreads from 0.2 pips and commission-free standard accounts. During testing, execution speed was consistent and reliable for day traders. Advanced TradingView alerts and charting boost trade timing and strategy.

- CEX.IO - CEX.IO does not offer direct TradingView integration but supports charting tools and price alerts. In our hands-on testing of the platform, crypto trading execution was fast with competitive fees - starting around 0.25% per trade. With its sleek interface, entry is easy for casual and active crypto traders alike.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- Coinbase - Launched in 2012 as a platform enabling users to buy and sell Bitcoin via bank transfers, Coinbase has emerged as a crypto behemoth, expanding its services to include 240+ crypto assets, developing sophisticated trading platforms for retail investors, listing on the US Nasdaq, and securing licenses with multiple regulators. In May 2025, Coinbase also became the first crypto company to join the S&P 500, a milestone that enhances its credibility.

How Safe Are These Brokers That Support TradingView?

Explore the security measures at the top TradingView brokers:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| OANDA US | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| CEX.IO | ✘ | ✔ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| Coinbase | ✘ | ✘ | ✔ |

Compare Mobile TradingView Access

See how good the mobile TradingView experience is at our top brokers:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| OANDA US | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| CEX.IO | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| Coinbase | iOS & Android | ✘ |

Are The Top TradingView Brokers Good For Beginners?

Beginners should test TradingView in a demo account and look for other features that new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| CEX.IO | ✘ | $20 | $1 | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| Coinbase | ✘ | $0 | $2 |

Are The Top TradingView Brokers Good For Advanced Traders?

Seasoned traders should look for value-add features to take the TradingView environment to the next level:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| CEX.IO | API | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Optimus Futures | TradingView Pine Script, API Features | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| Coinbase | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

Compare The Ratings Of Top Brokers Supporting TradingView

Uncover how the top TradingView brokerages scored in core areas in our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| OANDA US | |||||||||

| FOREX.com | |||||||||

| CEX.IO | |||||||||

| Optimus Futures | |||||||||

| Coinbase |

Compare Trading Fees

The cost of trading on TradingView adds up over time - here's how the top providers stack up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| OANDA US | ✘ | $0 | |

| FOREX.com | ✘ | $15 | |

| CEX.IO | ✘ | - | |

| Optimus Futures | ✘ | $0 | |

| Coinbase | ✘ | $0 |

How Popular Are These Brokers With TradingView?

As the popularity of TradingView grows, traders look for established brokers, i.e. those with the most clients:

| Broker | Popularity |

|---|---|

| Coinbase | |

| CEX.IO | |

| Interactive Brokers | |

| FOREX.com |

Why Use TradingView With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Why Use TradingView With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

Why Use TradingView With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Use TradingView With CEX.IO?

"CEX.IO continues to serve a range of crypto investors looking to buy, sell, trade, hold and earn with low fees. The tiered pricing structure will appeal to active traders while rookie investors will enjoy the straightforward platform interface and excellent education."

Tobias Robinson, Reviewer

CEX.IO Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Regulator | GFSC |

| Platforms | TradingView |

| Minimum Deposit | $20 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Pros

- The $20 minimum deposit makes the broker accessible for beginners

- The range of 200+ cryptocurrencies is competitive and will serve more experienced traders

- Crypto leverage is available up to 1:3

Cons

- A maintenance fee applies after 12 months of no activity

- It's a shame that there's no demo account for traders looking to practice strategies

- The Exchange Plus platform delivers a cluttered interface compared to competitor platforms

Why Use TradingView With Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

Why Use TradingView With Coinbase?

"Coinbase is ideal for beginners looking for an intuitive platform to buy and sell a wide variety of cryptocurrencies, with robust security and regulatory compliance. However, its fees are higher compared to competitors in our tests, and it’s not as tailored for short-term traders."

Christian Harris, Reviewer

Coinbase Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Crypto |

| Regulator | FinCEN, FCA, CBoI, MAS, OAM, DNB, BdE |

| Platforms | Coinbase, Advanced Trade, Wallet, NFT, TradingView |

| Minimum Deposit | $0 |

| Minimum Trade | $2 |

| Account Currencies | USD, EUR |

Pros

- As a Nasdaq-listed company, Coinbase follows strict financial regulations, with licensing across the US, UK, and Europe. Security includes FDIC insurance for USD balances (up to $250,000) and two-factor authentication (2FA).

- Coinbase Advanced has added TradingView integration, a feature rarely offered by crypto exchanges, allowing users to trade spot and futures markets directly from real-time charts with powerful technical analysis tools.

- Coinbase supports 240+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and more recently listed altcoins like $Trump, giving early access to emerging tokens.

Cons

- High crypto fees based on tests, especially compared to competitors like Kraken and BitMEX, and notably on the standard dealing platform.

- There are woeful research tools; Advanced Trade has TradingView charts but lacks features like news feeds, economic calendars, and AI market insights.

- Frustrating customer support during testing, with most help options hidden behind login, making it tough for locked-out users or non-account holders to get assistance.

How DayTrading.com Chose The Best Brokers For TradingView

To compile a list of the best brokers that support TradingView, we:

- Took our evolving database that currently stands at 139 online brokers;

- Pinpointed those that support trading through the TradingView platform;

- Sorted those providers by their overall rating, combining 200+ data points with our first-hand findings.

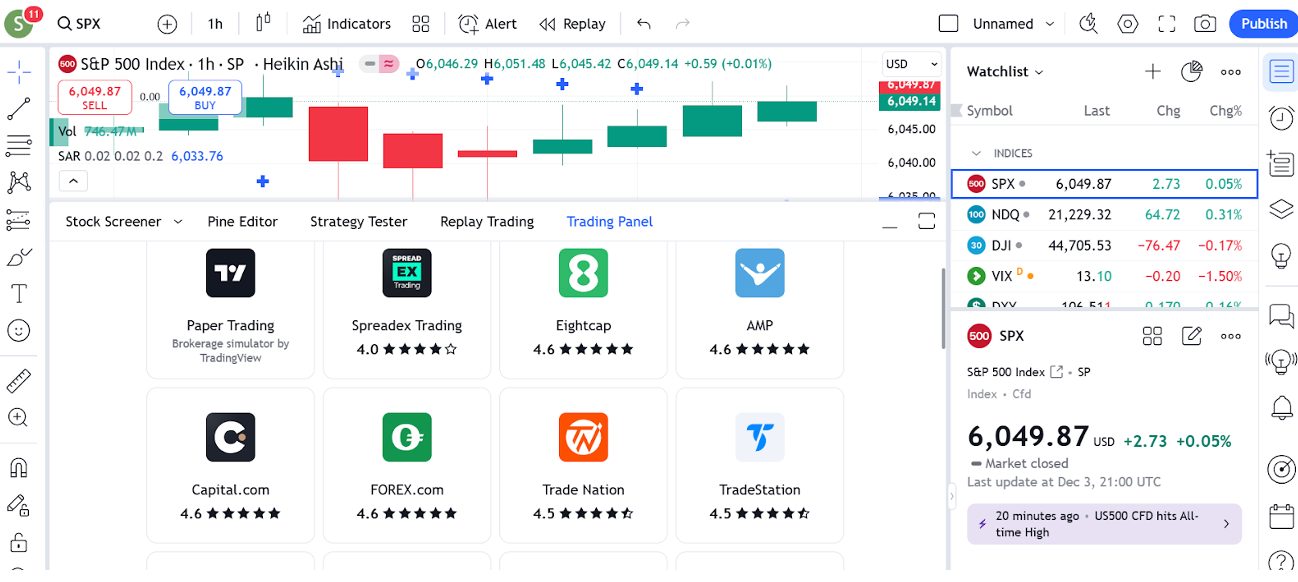

How To Connect TradingView To A Broker

By connecting your broker, you can seamlessly execute trades, manage your portfolio, and monitor performance, all in one place.

Here’s how to link the TradingView software with a broker:

- Open the Trading Panel (click the arrow at the bottom of the platform).

- Choose your brokerage from the list of supported providers.

- Log in using your broker’s credentials.

- Follow any additional verification steps your broker requires.

I’ve watched brokers rush to integrate TradingView over the years, with big names like IG and Fusion Markets, joining in 2024.Established partners like Eightcap have also expanded their offerings, now including a TradingView Plus subscription for UK users.

I expect the majority of forex and CFD brokers will integrate the TradingView software in the coming years.

Bottom Line

TradingView isn’t just another charting platform – it’s a dynamic ecosystem designed to empower active traders of all levels, which is why we’re seeing brokers increasingly support this modern software.

Whether you’re analyzing markets, collaborating with others, or executing trades, TradingView provides everything you need in one place. That’s why some of our team have subscriptions with TradingView for their personal investments.

To get started, find the right TradingView broker for your needs.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com