Brokers With Trailing Stop Loss Orders

Brokers with trailing stop loss orders enable traders to set a stop at a certain percentage or number of points below a security’s market price. As the name suggests, the stop loss then trails behind the asset when the price shifts in an advantageous direction. The free risk management tool is commonly used when trading volatile assets, such as commodities and exotic forex pairs.

This guide explains how to set up a trailing stop loss using examples. We also list and review the best brokers with trailing stop losses in 2026. Read on to find out whether the popular risk management tool is good or bad.

Brokers With Trailing Stop Loss

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

FOREX.com

FOREX.com -

3

xChief

xChief -

4

InstaTrade

InstaTrade -

5

RoboForex

RoboForex -

6

XM

XM

Here is a short overview of each broker's pros and cons

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- RoboForex - RoboForex is an online broker, established in 2009 and registered with the IFSC in Belize. Traders can choose from five accounts (Prime, ECN, R StocksTrader, ProCent, Pro) catering to different needs with trades from 0.01 lots and spreads from 0 pips. RoboForex has also enhanced its offering over the years, adding CFD instruments and launching its stock trading platform, plus the CopyFX system.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The proprietary OANDA web platform continues to deliver a highly competitive charting environment, including 65+ technical indicators powered by TradingView

- Beginners can get started easily with $0 minimum initial deposit

- The broker offers a transparent pricing structure with no hidden charges

Cons

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

- The broker trails competitors when it comes to research tools and educational resources

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

RoboForex

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- RoboForex offers over 12,000 instruments, providing more short-term trading opportunities than the vast majority of online brokers, with forex, stocks, indices, ETFs, commodities, and futures.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

Cons

- RoboForex now restricts base currency options to USD and EUR. This limitation may inconvenience day traders preferring to manage their accounts in other currencies, while potentially leading to conversion fees.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM’s Zero account is ideal for day trading with spreads from 0.0 pips, 99.35% of orders executed in <1 second, and no requotes or rejections.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

How Does A Trailing Stop Loss Work?

The definition and purpose of a trailing stop loss is to limit losses or lock in returns by pulling out of the market before the value of an asset moves too far in an unfavorable direction. The investor essentially defines a percentage by which the price of a security would need to fall to automatically close out the position. The stop loss will remain active until either the trader cancels the order or the position is liquidated.

- If a trader is going long, the trailing stop should be placed below the current price

- If a trader is going short, the trailing stop should be placed above the current quote

The trailing stop should not be confused with a standard stop loss which is similar but set at a fixed amount/price rather than a percentage/number of points that moves in tandem with the position. Some day traders manually move a standard stop loss to replicate the benefits of trailing stop loss alerts and notifications, but this is time-consuming and unnecessary.

The trailing stop is particularly useful when there is market growth in your favour but then pulls back, because your trailing stop will move with the positive price trend but it won’t head in the other direction.

Note, a trailing stop loss will close the trade at the next available price which means there is a chance of slippage. To avoid this, a trader can set a guaranteed stop loss.

Example

To help understand how brokers with trailing stop loss orders work, let’s look at an example…

A swing trader buys one ounce of gold at $1,750. But instead of using a classic stop loss to sell their holdings if the price falls below $1,487.50, the investor places a trailing stop loss order at 15% below the current price.

Now if the price of gold falls to $1,487.50, the broker would automatically exit the position. But if the value of gold climbs, the trailing stop-loss would follow suit, staying 15% below the market value.

This means if the price of gold climbs to $2,500, the trailing stop loss would increase to $2,125. If the value of gold did then subsequently fall to $2,125, the position would be closed and the trader would take home a profit of $375 ($2,125 – $1,750). Note, this doesn’t take into account any broker fees.

Setting Up Tips

Consider the tips below when setting up a trailing stop loss:

- Try not to set trailing stops at a threshold that will trigger unnecessarily. A sensible amount is beyond 1.5 times the lowest price drop in the asset’s current range.

- Trailing stops should reflect a market’s current volatility, so if there is little movement in the value of an asset then the trailing stop will likely be closer to the current price.

- When using trailing stops on stocks that are experiencing significant price swings, moving averages are helpful to overlay. This can help to prevent a trailing stop from triggering unnecessarily due to a low swing in price.

- Don’t be overly reliant on trailing stops. Keep an eye on momentum as it could be worth adjusting the trailing stop if the asset is reaching an all-time high, for example.

- Trailing stop losses can also be used in premarket and after hours trading sessions. Just check your futures broker, for example, supports extended hours.

Other Risk Management Tools Explained

Interactive brokers with trailing stop loss orders also tend to offer other useful risk management tools. One popular solution is a take profit order which sets the price to sell an asset to safeguard any profits which have been made on a trade. The trader can continue to benefit from the price moving in a favourable direction but if the market was to swing in a way that could jeopardise profits, then the trailing stop can be used for damage control.

Another popular form of risk management is hedging. This is essentially the practice of taking out opposing positions on similar assets to cover any losses on original trades. Used correctly, a hedge can be an effective way to minimize risk exposure.

One strategy that can also be used in collaboration with the tools and strategies above is the 1% rule. This is where you do not risk more than 1% of your total portfolio on any single trade. You could invest slightly more than that, however, the key is to be disciplined and not to risk a small amount of your overall capital or deposit. This will mean that several bad trades won’t erode all your trading funds.

Bottom Line

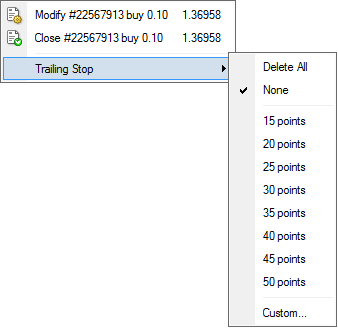

Brokers with trailing stop loss orders provide an effective risk prevention tool. Trailing stops are available on most popular trading platforms and algorithms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Some brands also offer trailing stop options on their own in-house trading terminals. Trailing stops are available at several popular brokers, including Webull.

To prevent trailing stops from being triggered unnecessarily, research assets using moving averages and previous trends. This will help you choose thresholds which protect you from crashes, rather than cashing out during a dip that could be recovered from.

Use our list of top brokers with trailing stop loss orders to start trading today.

FAQ

What Is The Meaning Of A Trailing Stop Loss?

A trailing stop loss is a percentage-based threshold that can be set by the trader. If the value of an asset drops below this amount then it will be liquidated before its value can drop further. Importantly, the trailing stop will move in tandem with the original position if the market moves in the trader’s favour.

Is A Trailing Stop Loss A Good Idea?

Used correctly, brokers with trailing stop loss orders can help reduce risk exposure. Just make sure you have your trailing stop set beyond a level that could be triggered by ordinary market trends. This will help to avoid preemptive losses that could be easily recovered.

What Can I Do About Trailing Stop Losses Not Working?

If your trailing stop loss did not work, the best thing to do is to head to a demo account to refine your approach. You can also consider other risk management strategies.

Are Trailing Stop Losses A Suitable Form Of Risk Management For Beginners?

As long as you learn how to use them effectively, trailing stop losses can be a useful tool for all levels of traders. If you are new to trading, practice using brokers with trailing stop loss orders in a demo account first. You can then upgrade to a real-money account when you feel confident.

Which Is Better Stop Loss Or Trailing Stop Loss?

This will ultimately come down to trader preference. A standard stop loss is arguably easier to understand, but trailing stops provide greater flexibility – they will move with the market when it shifts in your favour but limit losses if it turns the other way.

How Long Does A Trailing Stop Loss Last?

Traders can decide how long they want a trailing stop loss to run on their platform. With that said, a trailing stop loss will usually run until the investor cancels the order or the position is liquidated.