Best Day Trading Platforms and Brokers in Australia 2026

The best brokers in Australia offer low fees, a range of day trading tools and favorable execution. Importantly, many platforms deliver conditions that ensure secure and convenient day trading for Aussie clients, including oversight from the Australian Securities and Investments Commission (ASIC) and live accounts in AUD.

We also like to see platforms that offer excellent exposure to Australian markets, including the Australian Securities Exchange (ASX) and popular Aussie currency pairs like AUD/USD.

Our analysts have thoroughly tested hundreds of platforms and compiled a list of the best brokers for day trading in Australia. Many firms are ASIC-regulated and consistently top our rankings.

Top 6 Platforms For Day Trading In Australia

Our tests show that these are the 6 best day trading brokers in Australia:

-

1

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

2

Fusion Markets

Fusion Markets -

3

Trade Nation

Trade Nation -

4

AvaTrade

AvaTrade -

5

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

6

FBS

FBS

Here is a summary of why we recommend these brokers in March 2026:

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

Best Day Trading Platforms and Brokers in Australia 2026 Comparison

| Broker | ASIC Regulated | AUD Account | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | $0 | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist | 1:30 (Retail), 1:500 (Pro) |

| Fusion Markets | ✔ | ✔ | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| Trade Nation | ✔ | ✔ | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) |

| AvaTrade | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

| Eightcap | ✔ | ✔ | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 |

| FBS | ✔ | - | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support. Pepperstone's comprehensive package, operating under ASIC regulation, makes them an obvious pick for traders in Australia, where it scooped DayTrading.com's 'Best Aus Broker' annual award for 2025."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- The market analysis features, Market Buzz and Analyst Views, are great tools for discovering opportunities and conveniently integrated into the client dashboard.

- The range of charting platforms and social trading features is excellent, with MT4, MT5, cTrader and more recently TradingView, catering to a wide range of trader preferences.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

Cons

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- The trading firm offers tight spreads and a transparent pricing schedule

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

- Full range of investments via leveraged CFDs for long and short opportunities

Cons

- Fewer legal protections with offshore entity

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

Cons

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

Cons

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

- Investor protection is only available for clients within the EU, meaning global traders may not be protected if their account goes negative, significantly increasing the risk to your funds.

Choosing A Day Trading Broker In Australia

Leveraging the decades of industry experience across our expert team, we prioritize several conditions when choosing the best day trading platforms:

Regulation and Trust

Choose a reputable day trading platform that you can trust.

A trustworthy broker will be authorized by a reputable regulator and will be transparent about any measures it has in place to protect you from unfair trading practices and scams.

Unfortunately, some incidents have gained infamy in Australia in recent years, including the brutal ‘Pig Butchering’ scam, which made up 31% of reported scams in 2023.

In this highly manipulative scam, the fraudsters built trust with the victim over a prolonged period before pushing them into fake investment opportunities. This method of going for the ‘full hog’ is particularly malicious since it targets lonely or vulnerable people.

That’s why we always check whether the broker is regulated by a ‘green tier’ authority, such as the Australian Securities and Investments Commission (ASIC). Looking for this, combined with strong industry credentials and a long track record, are priorities during our routine tests.

The ASIC has strict measures in place to monitor day trading brokers operating in Australia, including enforcement proceedings and civil penalties.

To help protect consumers, it also runs the Moneysmart website which contains comprehensive advice on financial planning, online safety and scams.

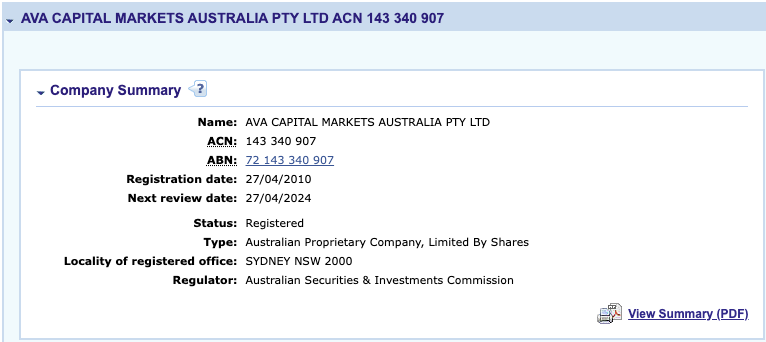

- AvaTrade maintains its position as one of the most heavily regulated platforms, with licenses from several top-tier authorities, including the ASIC. It also boasts a stellar industry reputation.

Day Trading Fees

Opt for a low-cost broker with competitive pricing.

If you’re an active day trader, keeping transaction costs low will be important to you.

We look out for brokerages that offer the full trading package at a low overall cost. This includes competitive trading fees, from low spreads and commissions to zero funding fees.

If certain parts of the service are paid for, then we also take into account the quality of the resources or tools provided. It can often be worth paying for top-quality charting tools, for example, if it saves you time and increases your potential for success.

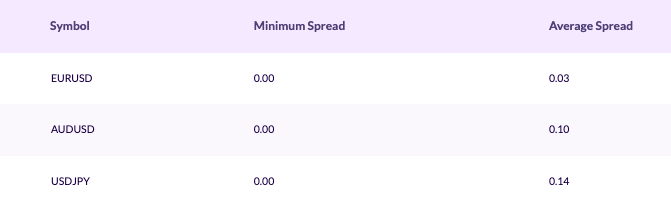

- Fusion Markets remains one of the lowest-cost brokers that we’ve evaluated, especially for Aussie day traders. Alongside a $0 minimum deposit, you can expect forex commissions as low as $2.25 per side, plus spreads from 0.0 pips on AUD/USD.

Charting Platforms and Apps

Choose a user-friendly platform with a range of short-term trading tools.

To ensure an optimum day trading environment, pick a broker that delivers comprehensive charting tools for technical analysis.

In particular, we prioritize brokers that offer a good selection of indicators and drawing tools. Familiarizing yourself with a range of volatility tools, moving averages and technical studies, for example, can help you uncover short-term market opportunities.

- Pepperstone is an excellent choice here, with a leading range of charting platforms and third-party analysis tools, including MetaTrader 4 (MT4), cTrader, and Autochartist. Whether you trade on the go or execute complex algo strategies, there’s something for everyone at this broker.

Tradable Assets

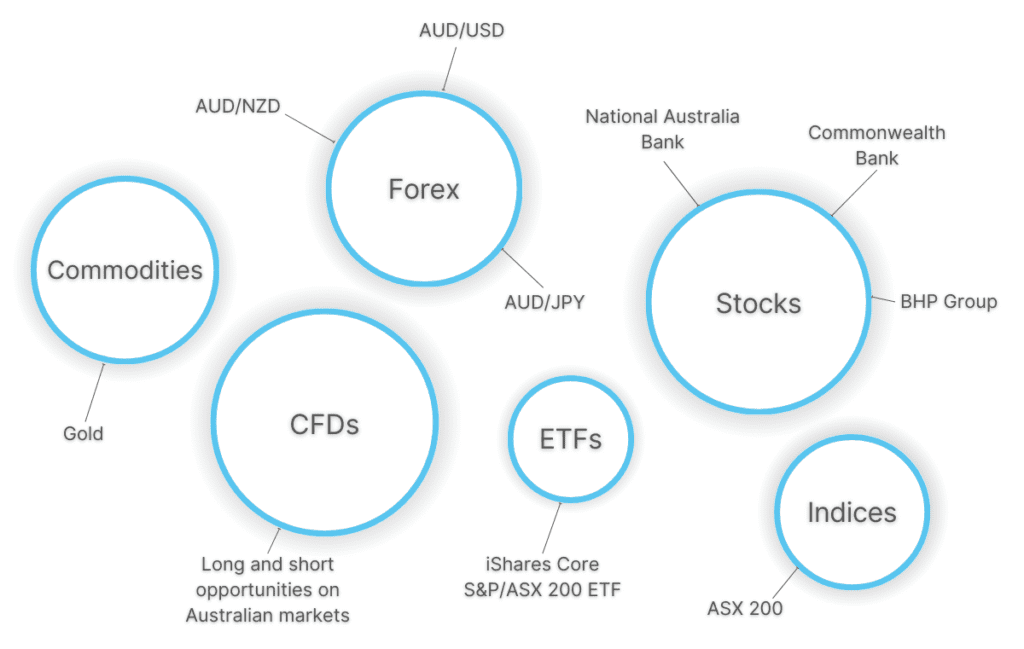

Pick a broker that offers a diverse range of day trading markets.

Having access to a wide range of assets will allow you to build a diversified portfolio, hedge against risks and gain confidence trading the financial markets.

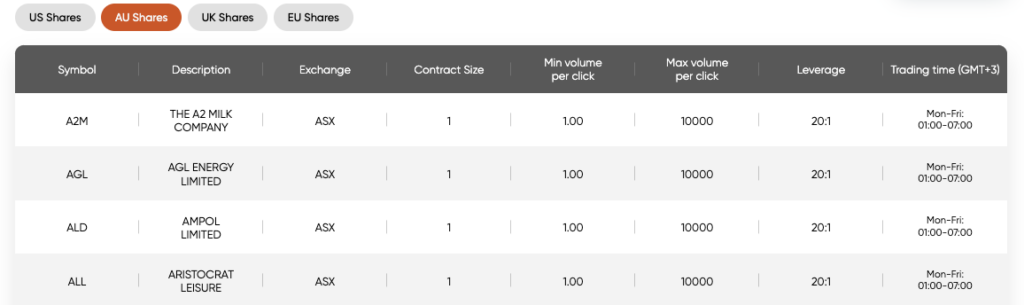

For Australian traders, we look out for popular currency pairs like AUD/USD and GBP/AUD, as well as stock markets like the Australian Securities Exchange (ASX).

Most top brokers typically offer trading via contracts for difference (CFDs). These are short-term derivative products that allow you to speculate on price movements without taking ownership of the asset.

- Vantage continues to offer a strong range of 1000+ assets for Australian day traders, including popular currencies and commodities like gold and silver against the AUD, plus dozens of ASX-listed share CFDs.

Execution Speed and Quality

Consider the broker’s execution policy and whether it will optimize your day trading strategies.

This will include the likelihood, quality and speed of execution which, when performing optimally, will ensure the best possible conditions for short-term strategies.

The good news is that many leading brokerages with fast execution operate in Australia, and we favor those with speeds of less than 100 milliseconds.

- IC Markets continually excels in this category, with orders executed in around 35 milliseconds. Experienced short-term traders can also access a VPS subscription which delivers ultra-low latency and reduced slippage.

Leverage and Margin Requirements

Make sure the broker has transparent leverage and margin requirements.

Trading with leverage appeals to many day traders looking to maximize their potential returns with a small initial deposit.

That said, leverage trading is inherently risky, so it’s important to register with a broker that is transparent about their margin requirements.

- OANDA is an excellent choice for Australian traders looking for a trustworthy ASIC-regulated broker that provides margin rates up-front. The broker also offers guaranteed stop-loss orders (GSLO) plus additional margin relief for pro traders.

Minimum Account Deposit

Choose a broker with an affordable minimum deposit requirement that suits your budget.

Anything below $500 is reasonable, though most leading Australian day trading platforms offer a minimum deposit of less than $200. This is ideal for beginners who may be on a smaller budget.

It’s also worth looking out for brokers who offer accounts denominated in AUD, which will save you exchange fees when it comes to funding.

- Pepperstone is a great beginner-friendly option, offering a competitive AUD account with no minimum deposit requirement.

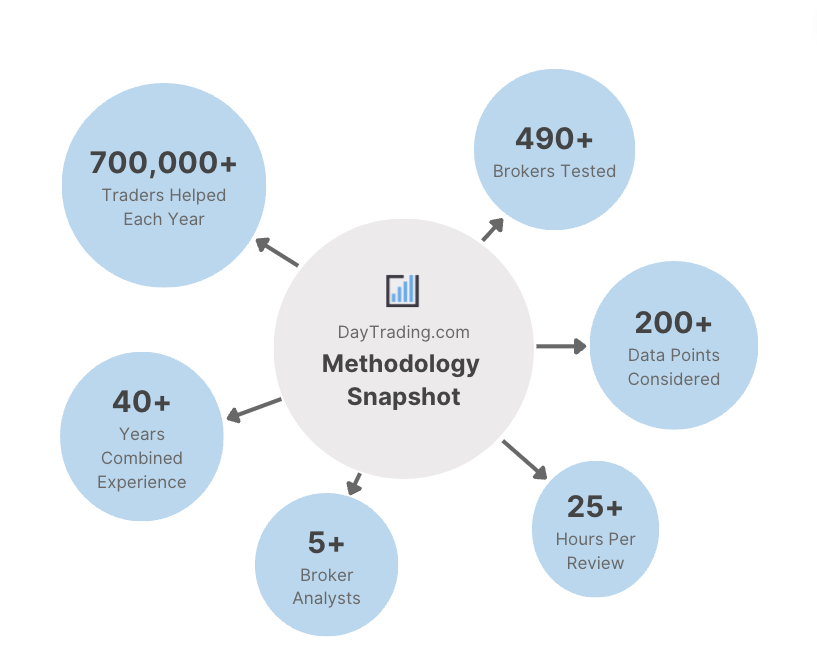

Methodology

Our approach to finding the best day trading platforms in Australia involved comprehensive qualitative and quantitative assessments of each broker. In particular:

- We ensured that the platform accepts Australian day traders.

- We checked for a trustworthy license from a reputable agency, such as the ASIC.

- We focused on brokers with low day trading fees.

- We prioritized charting platforms that cater to short-term strategies.

- We checked the broker’s execution speeds and pricing.

- We favored platforms with reasonable margin and leverage requirements.

- We picked brokers that offer an affordable minimum deposit.

Bottom Line

We’ve tested and evaluated dozens of platforms to find you the best day trading brokers in Australia.

Before signing up, check that your chosen broker is listed on the respective regulator’s website. We also recommend trying out the platform in a demo account to determine if the platform is stable, easy to use, and offers the instruments you want to trade.

FAQ

How Much Money Do I Need To Start Day Trading In Australia?

Most brokers offer live trading accounts with an initial deposit of $500 or less, with some even requiring no minimum deposit. Pepperstone, for example, is a great choice for beginners on a budget with zero minimum.

Who Regulates Day Trading Platforms In Australia?

The Australian Securities and Investments Commission (ASIC) is the primary regulatory authority that oversees financial markets in Australia.

We consider the ASIC a ‘green tier’ agency, which means it offers the highest standards of financial safeguarding for Australian clients.

That said, it’s important to understand the inherent risks of day trading and always ensure you have a solid risk management strategy in place.

Which Are The Best Brokers That Accept Day Traders From Australia?

Check our list of the best day trading brokers in Australia to find the right option for you. Many of these firms offer services tailored to Australian clients, including an AUD account, ASIC regulation, and a range of tradable assets popular in Australia.