Best Forex Brokers And Trading Platforms In Australia 2026

The Australian Dollar (AUD) is one of the 10 most traded currencies globally and plays a significant role in the Asia Pacific. It represents around 6% of the entire foreign exchange market by volume, despite Australia only comprising approximately 1% of global gross domestic product (GDP).

With rising interest in forex trading, alongside strong regulatory oversight by the Australian Securities and Investments Commission (ASIC), Aussies now have hundreds of online brokers to choose from.

Discover our selection of the best forex trading platforms in Australia. Our recommended brokers cater specifically to Aussie traders with currency pairs containing the AUD and ASIC authorization.

Top 6 Forex Trading Platforms In Australia

Our latest tests show these brokers are the best for forex traders in Australia:

-

1

Pepperstone75-95% of retail investor accounts lose money when trading CFDs

Pepperstone75-95% of retail investor accounts lose money when trading CFDs -

2

Fusion Markets

Fusion Markets -

3

Vantage

Vantage -

4

AvaTrade

AvaTrade -

5

FOREX.com

FOREX.com -

6

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs

Here is a summary of why we recommend these brokers in January 2026:

- Pepperstone - Pepperstone offers ultra-competitive forex spreads averaging 0.12 pips on EUR/USD in the Razor account, accompanied by a diverse portfolio comprising 100+ currency pairs - an extensive selection surpassing most competitors. Additionally, Pepperstone distinguishes itself by offering three currency indices (USDX, EURX, JPYX), not commonly found among alternative platforms. Pepperstone has now won our annual 'Best Forex Broker' award twice.

- Fusion Markets - Fusion Markets offers an excellent selection of 90+ currency pairs, providing a range of short-term trading opportunities. It continues to excel for its ultra-tight spreads from 0.0 pips and exceptionally low commissions of $2.25 per side. You also get access to leading forex software in MetaTrader 4.

- Vantage - Vantage offers 55+ currency pairs - above the industry average, so experienced traders can explore plenty of opportunities. Vantage's deep liquidity pool provides forex spreads from 0.0 pips in the ECN account, lower than many alternatives. There are also no commissions, deposit fees or hidden charges.

- AvaTrade - AvaTrade delivers 50+ currency pairs with tight spreads from 0.9 pips and zero commissions. Trade majors, minrs, and exotics 24/5 on leading forex platforms, notably MT4, with sophisticated charting tools and forex education to sharpen your edge, including a dedicated guide to 'Currency Trading'.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- Eightcap - Eightcap offers 50+ currency pairs in line with the industry average but trailing category leaders like CMC Markets with its 300+ currency pairs. However, Eightcap stands out with institutional-level spreads from 0.0 pips on major pairs like the EUR/USD, alongside low $3.50/side commissions. The broker also offers rich forex data to inform trading decisions, including key fundamentals, bullish/bearish indicators and a calendar that tracks key events in the foreign exchange market.

Best Forex Brokers And Trading Platforms In Australia 2026 Comparison

| Broker | ASIC Regulated | AUD Account | Forex Assets | EUR/USD Spread | Forex App Rating | Minimum Deposit |

|---|---|---|---|---|---|---|

| Pepperstone | ✔ | ✔ | 100+ | 0.1 | / 5 | $0 |

| Fusion Markets | ✔ | ✔ | 90+ | 0.05 | / 5 | $0 |

| Vantage | ✔ | ✔ | 55+ | 0.0 | / 5 | $50 |

| AvaTrade | ✔ | ✔ | 50+ | 0.9 | / 5 | $100 |

| FOREX.com | ✔ | ✔ | 84 | 1.2 | / 5 | $100 |

| Eightcap | ✔ | ✔ | 50+ | 0.0 | / 5 | $100 |

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support. Pepperstone's comprehensive package, operating under ASIC regulation, makes them an obvious pick for traders in Australia, where it scooped DayTrading.com's 'Best Aus Broker' annual award for 2025."

Christian Harris, Reviewer

Pepperstone Quick Facts

| GBPUSD Spread | 0.4 |

|---|---|

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.4 |

| Total Assets | 100+ |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Pepperstone emerges as a low-cost broker, especially for serious day traders with spreads from 0.0 in the Razor account and rebates up to 30% (index and commodities) and $3/lot (forex) through the Active Trader program.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

Cons

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| GBPUSD Spread | 0.13 |

|---|---|

| EURUSD Spread | 0.05 |

| EURGBP Spread | 0.09 |

| Total Assets | 90+ |

| Leverage | 1:500 |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- There is no proprietary trading platform or app built with beginners in mind, a notable drawback compared to AvaTrade.

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

Vantage

"Vantage remains an excellent option for CFD traders seeking a tightly-regulated broker with access to the reliable MetaTrader platforms. The fast sign-up process and $50 minimum deposit make it very straightforward to start day trading quickly."

Jemma Grist, Reviewer

Vantage Quick Facts

| GBPUSD Spread | 0.5 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.5 |

| Total Assets | 55+ |

| Leverage | 1:30 |

| Platforms | ProTrader, MT4, MT5, TradingView, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, HKD, SGD, PLN |

Pros

- It’s quick and easy to open a live account – taking less than 5 minutes

- There are no short-term strategy restrictions with hedging and scalping permitted

- Vantage has bolstered its algorithmic trading tools for advanced traders with AutoFibo EA identifying reversal opportunities

Cons

- The average execution speeds of 100ms to 250ms are slower than alternatives based on tests

- It's a shame that some clients will need to register with the offshore entity, which offers less regulatory protection

- A steep $10,000 deposit is needed for the best trading conditions, which include the $1.50 commission per side

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| GBPUSD Spread | 1.5 |

|---|---|

| EURUSD Spread | 0.9 |

| EURGBP Spread | 1.5 |

| Total Assets | 50+ |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:400 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- Despite increasing its range of instruments, FOREX.com's product portfolio is still limited to forex and CFDs, so there are no options to invest in real stocks, real ETFs or real cryptocurrencies.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| GBPUSD Spread | 0.1 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.1 |

| Total Assets | 50+ |

| Leverage | 1:30 |

| Platforms | MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap stands out with a selection of powerful trading tools and resources, including MT4 and MT5, and more recently the 100-million strong social trading network TradingView.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

Cons

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- In spite of an increasing variety of tools, Eightcap doesn't offer industry favorites like Autochartist or Trading Central, which offer cutting-edge charting analytics, live news, and market insights for short-term traders.

Choosing A Forex Trading Platform In Australia

Years of hands-on tests and a research team comprised of active traders and industry experts give us a genuine voice on what makes a good forex broker. These are the key things we look for:

Trust

After observing various forex scams in recent years with increasing levels of sophistication, we prioritize choosing trustworthy brokers.

TradeFed, for example, was sued after using high-pressure sales tactics to entice Aussie forex traders to its platform before reportedly taking the opposing side of 95%+ of its clients’ positions, making money when investors’ trades went the wrong way, with some Aussies losing upwards of A$140,000.

That’s why all our recommended forex brokers are authorized by the Australian Securities and Investments Commission (ASIC), a ‘green-tier’ regulator in line with our Trust Rating, providing the highest level of investor protection.

We also balance firms’ regulatory credentials with their standing in the forex industry, though no brokerage can ever be totally ‘safe’.

ASIC-regulated forex trading platforms are required to provide several safeguards to retail investors, notably:

- Deposits are segregated from the business to ensure they can be returned in the event of liquidation. For example, when ASIC-regulated foreign exchange firm Halifax Investment Services went under in 2018, ASIC provided creditors with regular updates to ensure the segregated funds made their way back to clients.

- Forex traders should not be marketed financial products that are unsuitable for them. For instance, when I signed up with IC Markets I had to fill out a suitability questionnaire that asked about my risk appetite and source and scale of funds before I could trade currencies.

- Potential losses are capped by limiting leverage on forex to 1:30 for major currency pairs like the AUD/USD and 1:20 for minors like the AUD/JPY. These rules will be in place until at least 2027, following a 91% reduction in aggregate net losses by retail client accounts since the rules came into place in 2021.

- Negative balance protection should be in place, preventing Aussies from losing more than their deposit amount when trading currencies online.

- Although all our recommended forex trading platforms are ASIC-regulated, IG earns our vote as the most trusted. Authorization from 13 regulators, over 50 years of industry experience, a listing on the London Stock Exchange, and excellent reports from our active traders who’ve used the IG platform for real-money trading, help it stand out from the crowd.

Currency Pairs

All our top-rated forex platforms provide access to a range of currency pairs (at least 30), ensuring diverse trading opportunities.

Critically, they also provide trading on currency pairs containing the AUD, catering specifically to Aussie traders.

The Australian Dollar (AUD) is the national currency that replaced the Australian Pound in the 1960s. Because Australia is a major exporter of iron ore and coal, the price of these commodities can heavily influence AUD’s value, warranting the attention of active traders.

- Pepperstone’s selection of 100+ currency pairs remains almost unrivalled, with majors like the AUD/USD, six minors/crosses including AUD/SGD, AUD/JPY and AUD/GBP, plus exotics and commodity crosses not commonly found elsewhere, notably AUD/NOK and XAU/AUD. Its ultra-fast execution speeds of 30ms also help day traders lock in optimal prices in volatile FX markets.

Tools

Our hands-on tests show the best Australian forex brokers offer excellent tools for analyzing foreign exchange markets with insights into events that could influence the value of the AUD, amongst other currency pairs.

MetaTrader 4 (MT4) remains the most popular forex software, catering to experienced traders looking for strong charting features, with 30 indicators, 24 analytical objects and 9 time intervals from 1 minute (suitable for short-term trading). That said, I don’t like the dry workspace.

Fortunately, Aussie forex brokers are increasingly developing their own platforms to rival the MetaTrader suite, often with more intuitive interfaces for newer investors.

I recommend starting with a demo account, available from every one of our recommended Australian forex brokers. They provide a terrific way to learn platform features before risking funds.Equally, maintaining a trading journal can help you identify what works and what doesn’t and help you refine your forex trading strategy.

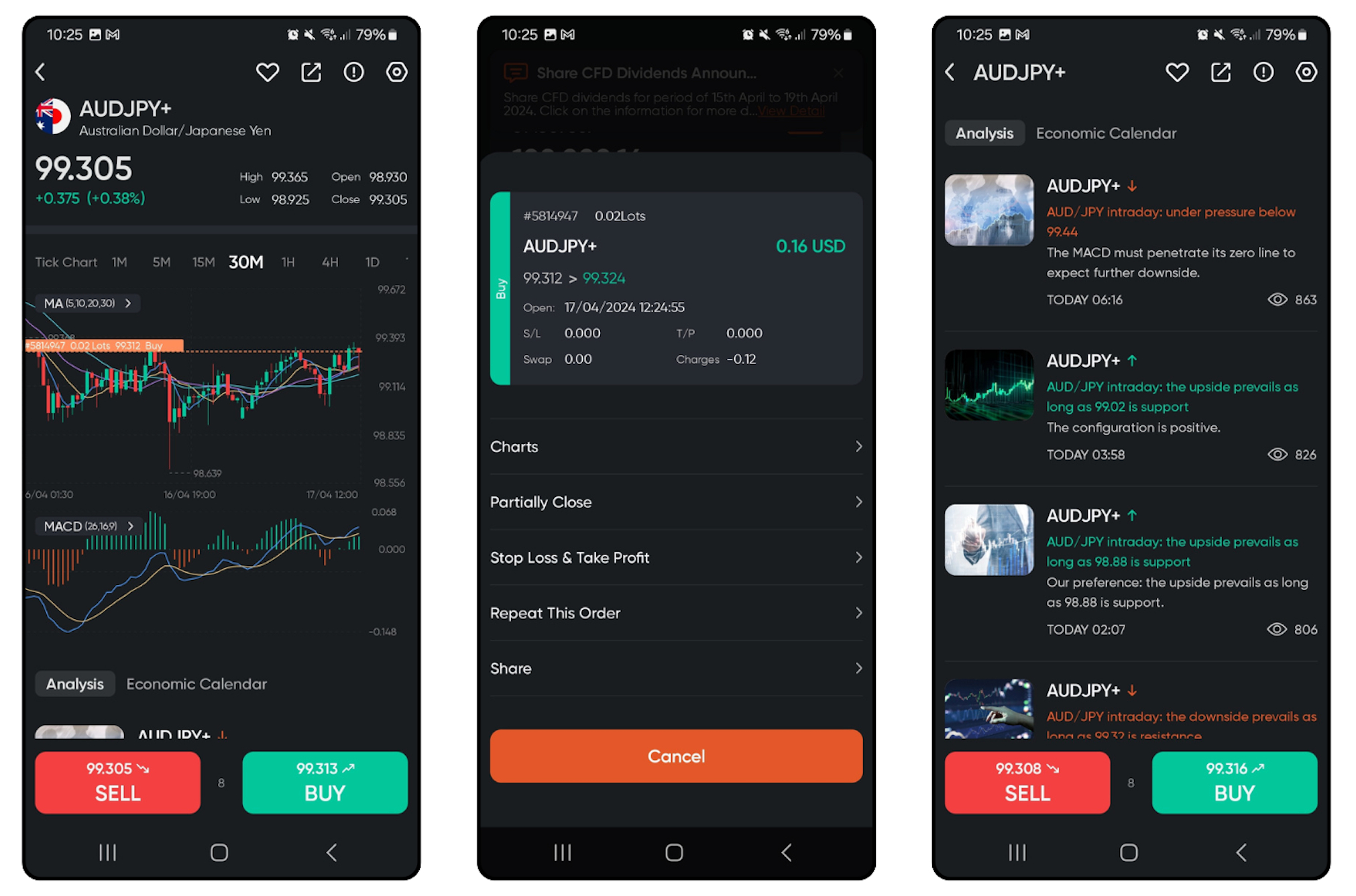

Forex day trading apps are also becoming ever-popular. The Vantage App is one of my favorites. The charting is detailed – you’re able to layer indicators, such as the RSI and MACD, and apply specific parameters. Charting switches from horizontal to vertical, viewing swiftly, with a pinch-to-zoom that I love. A wonderfully well-thought-through forex app in my book.

- Eightcap’s forex tools are also a cut above the rest. Alongside MT4 (built specifically for forex trading) and MT5 (more features for advanced traders), TradingView was made available in 2022 (superior interface for newer traders with a forex screener covering 13 AUD currency pairs). Eightcap also has an AI-powered calendar that I filtered by ‘Australia’ to get insights into inflation data and balance of trade statistics, which can influence the value of the AUD.

Pricing

Our top-rated Australian forex trading platforms offer competitive pricing, especially for day traders.

We make This assessment by analyzing spreads on popular currency pairs and factoring in any additional fees, such as commission (a fixed charge often applied in raw/low-spread accounts that are popular with active traders).

Importantly, as one of the most liquid currencies in the world, AUD currency pairs often have relatively tight spreads, especially when paired with other liquid currencies, such as USD and EUR.

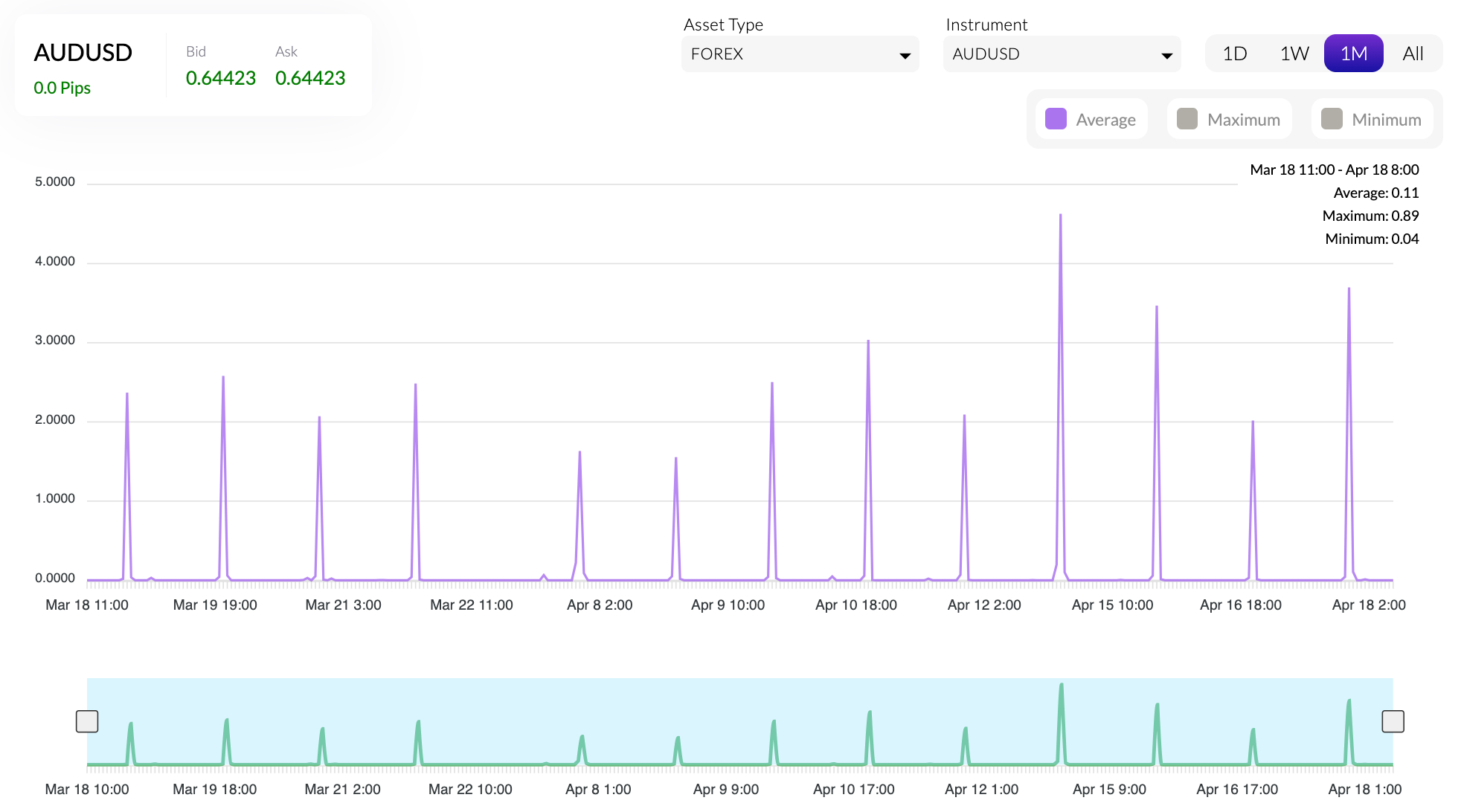

- Fusion Markets, according to both the firm’s marketing claims and our own assessment, is one of the cheapest forex brokers in Australia. It charges low spreads with a $2.25 per side commission. We particularly appreciate the transparency around spreads. They host a ‘Live and Historical Spread’ tool that displays the average, minimum and maximum spreads over three timeframes. For example, I found that over the past month (at the time of writing), the AUD/USD had an average spread of 0.11 pips, while the lowest was 0.04 pips.

Account Funding

We know from first-hand experience that convenient account funding can make for a smooth forex trading experience. That’s why we evaluate the selection of payment methods available, paying attention to popular local solutions, such as those in Australia.

Whilst credit cards, debit cards and wire transfers are still king in Australia, PayID is increasingly popular as it allows Aussie traders to easily check who they’re transferring to before hitting send, helping to prevent scams.

- City Index impresses with a growing list of deposit and withdrawal solutions, notably PayID, bank cards and wire transfers, plus no minimum deposit, making it a stand-out option for beginner forex traders in Australia.

FAQ

Which Is The Best Forex Trading Platform In Australia?

Use our list of the best forex trading platforms in Australia to find the broker that best meets your needs.

They all cater to Australian forex traders, but the choice is ultimately personal, depending on individual needs and preferences.

Who Regulates Australian Forex Brokers And Trading Platforms In Australia?

The Australian Securities and Investments Commission (ASIC) regulates forex brokers and trading platforms serving Australian traders.

The ASIC is a first-rate, highly active regulator that’s cracked down on the industry in recent years, shutting down unregistered firms and taking action against platforms that fail to disclose the risks of trading currencies online sufficiently.

Ultimately, Aussies will be best protected by signing up with an ASIC-regulated forex broker, though trading remains inherently risky, so only invest what you can afford to lose.

What Is The Minimum Amount I Need To Start Trading Forex In Australia?

This varies depending on the broker, but our findings show you’ll normally need between 0 and 400 AUD.

That said, we’re seeing a growing trend towards forex platforms having no minimum deposit alongside excellent educational tools, catering to beginner traders. The highest-rated following our assessment are Pepperstone and ThinkMarkets.