Best Forex Day Trading Apps 2026

Forex trading apps allow you to speculate on the value of currencies from a mobile or tablet device. The best forex apps for day traders offer a terrific user experience with advanced charting tools, excellent pricing, reliable execution, value-add features, and access to a great range of major, minor and exotic currency pairs. We’ve identified the forex applications that excel in these areas.

Top 6 Forex Day Trading Apps

Our comprehensive analysis, hands-on tests and ratings from real traders show that these are the best iPhone and Android apps for trading forex:

-

1

Interactive BrokersiOS & Android

Interactive BrokersiOS & Android -

2

OANDA USiOS & AndroidCFDs are not available to residents in the United States.

OANDA USiOS & AndroidCFDs are not available to residents in the United States. -

3

FOREX.comiOS & Android

FOREX.comiOS & Android -

4

Optimus FuturesiOS & Android

Optimus FuturesiOS & Android -

5

InstaTradeiOS & Android

InstaTradeiOS & Android -

6

Focus MarketsiOS & Android

Focus MarketsiOS & Android

Here is a short overview of each broker's pros and cons

- Interactive Brokers - The IBKR Mobile app, available on both iOS and Android devices, makes your phone a powerful gateway to your IBKR accounts, offering you the freedom to keep an eye on portfolios, initiate trades, and dive into real-time quotes and charts, all while managing your account activities on the fly. This app stands out for its intuitive design, making it especially welcoming for those just starting their trading journey, providing a smoother and more accessible experience than the more complex TWS platform.

- OANDA US - OANDA's app stands out for its deeply customizable interface, ensuring you can tailor every aspect of the trading experience to your strategy, from setting custom notifications to adjusting chart sizes and overlays. This level of personalization, combined with the ability to quickly react to market changes, manage risk, and stay informed with alerts on significant market events, makes it a category leader.

- FOREX.com - Running alongside the MT4 and Web Trader platforms, the FOREX.com app offers full trading capabilities on a user-friendly, compact platform. Integrated news and analysis, plus real time trade alerts, are two mobile specific features that set this app above the crowd. Additionally, it beats out MT4 when it comes to mobile charting tools, with over 80 indicators and 11 chart types, not to mention a slicker design that we love.

- Optimus Futures - Optimus Futures Mobile gives futures traders fast, direct exchange access with low-latency execution and full depth-of-market (DOM) views. Order entry is quick and reliable, with support for advanced strategies such as brackets, OCO, and trailing stops alongside 150+ indicators for charting. It’s best suited for active day traders who need professional futures tools on the go.

- InstaTrade - InstaTrade offers its own app that’s been downloaded more than 2 million times and facilitates trading on its 300+ instruments from your palm. Fast, responsive and sporting a modern interface, it supports real-time quotes, an array of orders, and analytical tools. However, what stood out during testing was the ‘hot’ ideas and trading signals, helping investors find opportunities.

- Focus Markets - Focus Markets does not provide its own trading app, which is a downside for beginners. However, Apple and Android users can trade the broker's growing list of 1000+ CFDs on the MT5 mobile app with competitive trading conditions. This includes powerful charting with 21 timeframes, 4 execution types, and tight spreads from 0.0 pips in the Raw account.

Best Forex Day Trading Apps 2026 Comparison

| Broker | iOS Rating | Android Rating | Forex Assets | EUR/USD Spread | Minimum Deposit |

|---|---|---|---|---|---|

| Interactive Brokers | / 5 | / 5 | 100+ | 0.08-0.20 bps x trade value | $0 |

| OANDA US | / 5 | / 5 | 65+ | 1.6 | $0 |

| FOREX.com | / 5 | / 5 | 84 | 1.2 | $100 |

| Optimus Futures | / 5 | / 5 | 15 | Variable | $500 |

| InstaTrade | / 5 | / 5 | 65 | 0.0 | $1 |

| Focus Markets | / 5 | / 5 | 50+ | 0.0 | $100 |

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| GBPUSD Spread | 3.4 |

|---|---|

| EURUSD Spread | 1.6 |

| EURGBP Spread | 1.7 |

| Total Assets | 65+ |

| Leverage | 1:50 |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Minimum Deposit | $0 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- Day traders can enjoy fast and reliable order execution

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| GBPUSD Spread | 1.3 |

|---|---|

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:50 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Minimum Deposit | $100 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| GBPUSD Spread | Variable |

|---|---|

| EURUSD Spread | Variable |

| EURGBP Spread | Variable |

| Total Assets | 15 |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Minimum Deposit | $500 |

| Account Currencies | USD |

Pros

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

- Product and service upgrades, notably multi-bracket orders, an integrated trade journal, and a broader futures lineup, show Optimus Futures is making a clear effort to support active traders.

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| GBPUSD Spread | 0.2 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 2.8 |

| Total Assets | 65 |

| Leverage | 1:1000 |

| Platforms | InstaTrade Gear, MT4 |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Minimum Deposit | $1 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| GBPUSD Spread | 0.0 |

|---|---|

| EURUSD Spread | 0.0 |

| EURGBP Spread | 0.0 |

| Total Assets | 50+ |

| Leverage | 1:500 |

| Platforms | MT5 |

| Mobile Apps | iOS & Android |

| iOS App Rating | / 5 |

| Android App Rating | / 5 |

| Demo Account | Yes |

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Minimum Deposit | $100 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

Cons

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

In instances where forex brokers lack their own custom trading applications, opting instead to utilize external solutions such as MT4, MT5, or cTrader, we’ve provided these ratings from the relevant app stores. Additionally, please be aware that app store ratings are subject to change.

Comparing Forex Day Trading Apps

To find the top apps for trading currencies, we consider several criteria that collectively contribute to a superior mobile trading experience:

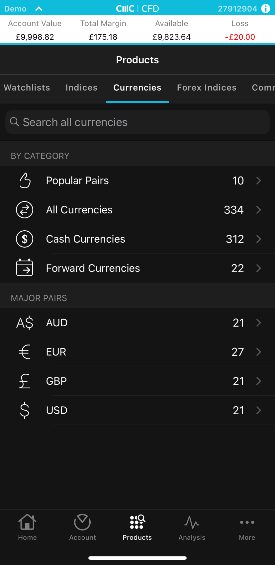

Forex Assets

Downloading an app that provides access to the currency pairs you want to speculate on is essential, as the range of currency pairs can vary significantly.

Our analysis of hundreds of forex apps shows that most top firms support at least 40 currency pairs, from majors like the EUR/USD to minors like the GBP/JPY and exotics like the CAD/SGD.

Choosing a forex app with a large suite of forex assets is important to ensure you have a good range of day trading opportunities and the ability to build a diverse portfolio.

Some brokers with forex apps, such as CMC Markets, also stand out by offering forex indices, providing an alternative way to speculate on the value of key currencies like the USD, EUR and GBP.

You can compare the selection of currency assets at our top forex apps below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Currency Pairs | 100+ | 50+ | 13 | 65+ | |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Trading Fees

Using a forex app that charges low fees is essential, as the frequent transactions involved in day trading strategies can accumulate, affecting net gains.

Our top-rated currency apps come with competitively low fees for short-term traders, a conclusion we reach through regular assessments of both trading and non-trading fees.

For example, we evaluate the spreads you will pay on three of the most popular currency pairs: EUR/USD, EUR/GBP and GBP/USD.

However, our extensive industry experience has underscored the need to balance cost with quality. Opting for the cheapest forex app without evaluating the range of currency pairs and charting tools can be a misstep, particularly for advanced traders requiring top-notch tools.

You can compare the spreads on popular currency assets at our top forex apps below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Fee Rating | |||||

| EUR/USD Spread | 0.08-0.20 bps x trade value | 1.3 | 0.75 | 1.6 | |

| EUR/GBP Spread | 0.08-0.20 bps x trade value | 1.6 | 1.7 | ||

| GBP/USD Spread | 0.08-0.20 bps x trade value | 1.6 | 3.4 | ||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Design & Usability

Choosing a forex app that provides a great user experience with an intuitive design is crucial; not only will it minimize the learning curve and enhance your ability to capitalize on market opportunities, but it also makes for an enjoyable trading experience.

That’s why these elements are at the core of our evaluation process, derived from the personal observations of our hands-on testers, and reinforced by ratings from other forex traders on Apple and Android devices, which we’ve collated from the relevant app store.

Below you can see how the ratings from our in-house experts stack up against those from the Apple App Store and Google Play Store across our top forex apps.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Our Rating | |||||

| iOS Rating | |||||

| Android Rating | |||||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

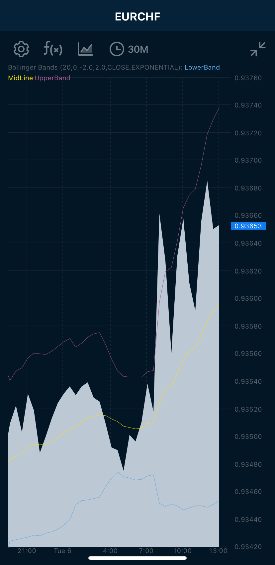

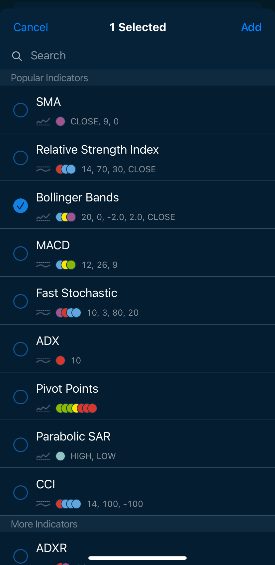

Charting Tools

Picking a forex app with excellent charting tools is crucial, especially for day traders who often use technical analysis to identify entry and exit points in fast-paced currency markets.

We know from first-hand experience that you often sacrifice charting functionality when you move from a desktop platform to a mobile or tablet device, particularly in the number of indicators, drawing tools and customization options.

That’s why we look for apps that offer a robust charting package for mobile traders of all levels, including indicators that are particularly popular with forex day traders, such as Moving Average Convergence Divergence, Bollinger Bands, and Average Directional Index.

We also check for access to popular third-party apps like MetaTrader 4 (MT4), which was built specifically for forex trading and remains the most popular trading platform despite increasing competition from proprietary solutions developed by online brokers and third-party alternatives like cTrader and TradingView.

You can compare the charting tools available at our top forex apps below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Charting Rating | |||||

| Charting Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | NinjaTrader Desktop, Web & Mobile, eSignal | eToro Trading Platform & CopyTrader | WebTrader, App | OANDA Trade, MT4, TradingView, AutoChartist |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Order Execution

Opting for a forex app with fast execution speeds is critical, especially for day traders speculating on exotic currency pairs where high volatility can lead to rapid price changes.

We’ve also seen that mobile forex traders, in particular, can face challenges here, with reduced execution speeds stemming from mobile network delays and issues related to the stability of applications.

That’s why we recommend mobile applications with fast and dependable order execution, an assessment we make by reviewing their execution policies and available data on execution times.

You can see whether our top recommended forex apps met our execution benchmarks below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Reliable Order Execution | Yes | Yes | Yes | Yes | Yes |

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Value-Add Features

Downloading an app that provides additional forex tools aimed at your experience level, strategy requirements or personal preferences can help create an optimal trading environment.

For example, some apps offer education that covers the essentials of forex trading for beginners. eToro excels here, with superb courses on the forex market, strategy guides and risk management.

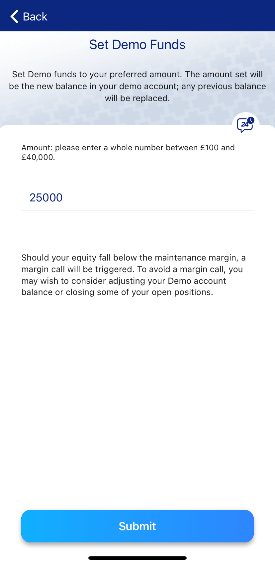

Alternatively, Plus500 is one of the few forex day trading platforms with a mobile app to offer an unlimited demo mode, allowing you to continuously test strategies even after opening a live account.

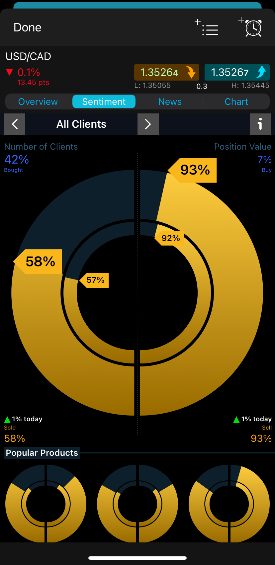

The CMC Markets app is also noteworthy for its well-presented data on client sentiment that displays interest in different currency assets, including in which direction, helping traders discover opportunities.

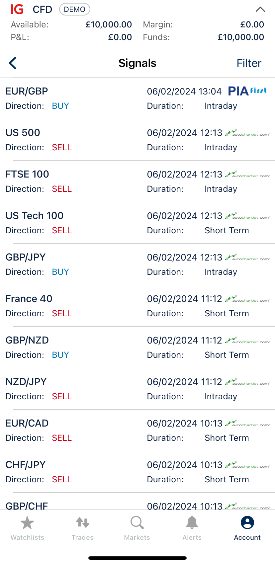

Finally, some apps, such as those from IG, provide live forex signals with trade suggestions. For example, buy the EUR/USD at X price and place a stop limit at Y. Forex signals can be provided free of charge or users may have to pay a small fee, though we’ve seen a lot of scams in this space so be wary when selecting a firm.

You can compare the value-add features at our top forex apps below.

| Interactive Brokers | NinjaTrader | eToro USA | Plus500US | OANDA US | |

|---|---|---|---|---|---|

| Forex Education | Yes | Yes | Yes | Yes | Yes |

| Demo Mode | Yes | Yes | Yes | Yes | Yes |

| Forex VPS | No | No | No | No | No |

| Forex Signals | Yes | No | |||

| Visit | Visit | Visit | Visit eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation |

Visit Trading in futures and options involves the risk of loss and is not suitable for everyone. |

Visit CFDs are not available to residents in the United States. |

| Review | Review | Review | Review | Review | Review |

Methodology

We identified the best forex day trading apps by leveraging our years of industry experience and extensive testing to identify the hallmarks of an excellent app for day trading currencies, outlined below.

Our testing methodology stands out by considering millions of ratings from traders on the Apple App Store and Google Play Store, offering a comprehensive evaluation of forex trading apps that combines the insights of our experts with those of fellow traders.

FAQ

How Do Forex Day Trading Apps Work?

Forex trading apps allow you to speculate on currency pairs from your mobile or tablet device. They are specially designed to optimize the mobile trading experience, often integrating touch controls and with split-screen modes to let you observe two or more FX markets simultaneously.

The latest forex apps are also powered by the cloud, which helps you to access market data, analysis tools and price alerts wherever you are.

Can I Open A Forex Account From An App?

Yes, most forex trading apps allow you to open a live or demo account directly from within the application.

We’ve personally tested dozens of forex apps and most take less than 5 minutes to get started with by following the on-screen instructions.

Are Forex Day Trading Apps Free To Download?

Most forex trading apps can be downloaded free of charge, either through in-house applications from brokers or via supported third-party options like MetaTrader 4, MetaTrader 5, and TradingView.

Forex trading costs, however, whether via spreads or commissions, will be the same on mobile apps as they are on full online trading platforms.

What App Do Most Forex Day Traders Use?

There is no single app that every forex trader prefers. The choice will normally come down to a range of factors, such as costs, speed and reliability.

However, we’ve scoured the Apple App Store and Google Play Store to find the most popular forex apps based on downloads and several stand out: MetaTrader 4 (10+ million), MetaTrader 5 (10+ million), Plus500 (10+ million), Trading212 (10+ million).

What Are The Advantages Of Day Trading Forex From My Mobile?

Forex trading apps offer the convenience of managing trades, analyzing data, and accessing your account from anywhere, eliminating the need for a fixed office setup.

What Are The Risks Of Day Trading Forex From My Mobile?

Trading forex from your mobile has several drawbacks, notably the limited screen size can restrict your ability to monitor multiple charts and positions simultaneously, while distractions from notifications and social media can lead to errors.

We’ve also found that you may have to contend with slower execution speeds due to mobile network latency and app stability issues.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com