Forex Index Trading

Forex index trading allows investors to speculate holistically on the value of a currency rather than trading a single currency pair. This guide will compare trading currency pairs vs forex indices, popular strategies, and how to find the best brokers for currency index trading.

Currency Index Brokers

These are the 6 best brokers for trading currency indices and the indices they offer:

-

1

Focus MarketsCurrency index: USD

Focus MarketsCurrency index: USD -

2

Optimus FuturesCurrency index: USD

Optimus FuturesCurrency index: USD -

3

XMCurrency index: USD

XMCurrency index: USD -

4

AvaTradeCurrency index: USD

AvaTradeCurrency index: USD -

5

ExnessCurrency index: USD

ExnessCurrency index: USD -

6

PepperstoneCurrency index: USD, EUR, JPY75-95% of retail investor accounts lose money when trading CFDs

PepperstoneCurrency index: USD, EUR, JPY75-95% of retail investor accounts lose money when trading CFDs

Here is a short summary of why we think each broker belongs in this top list:

- Focus Markets - Established in 2019, Focus Markets is an Australian-based MetaTrader broker offering access to over 1,000 tradable instruments, including forex, commodities, indices, stocks, and a particularly large selection of crypto derivatives.

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Currency Indices

Focus Markets only allows for trading on the USD currency index.

Pros

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

Cons

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Currency Indices

Optimus Futures only allows for trading on the USD currency index.

Pros

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- Optimus Futures stands out with ultra-low day trading margins on micro futures, starting at just $50 per contract and a $100 minimum balance, giving small accounts serious buying power.

- Optimus Futures has added event contracts from CME Group, allowing traders to express a daily market view with a simple yes-or-no position on major futures markets. Only offered by a handful of brokers, these fixed-risk products provide a straightforward way to speculate on a short-term basis.

Cons

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Currency Indices

XM only allows for trading on the USD currency index.

Pros

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Currency Indices

AvaTrade only allows for trading on the USD currency index.

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Currency Indices

Exness only allows for trading on the USD currency index.

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | Pepperstone Trading Platform, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

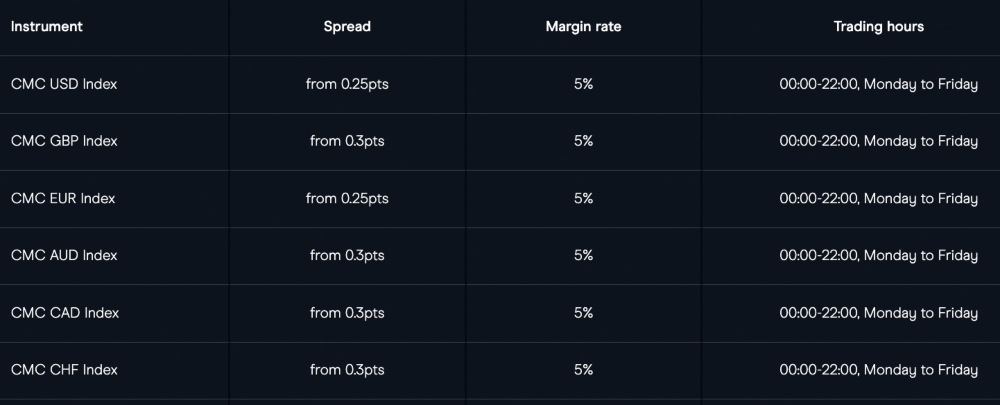

Currency Indices

Pepperstone offers trading on these 3 currency indices: USD, EUR, JPY

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Pepperstone boasts impressive execution speeds, averaging around 30ms, facilitating fast order processing and execution that’s ideal for day trading.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

Cons

- Pepperstone’s demo accounts are active for only 60 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

What Are Indices In Forex Trading?

In finance, an “index” is a collection of assets bundled together to represent a particular market sector. A forex index aims to track the value of a single currency in relation to a number of other significant currencies, all bundled up into one single figure.

The forex indices achieve this by tracking a basket of individual currency pairs, which are weighted to provide a theoretically balanced value for the main currency. This reduces exposure to a single currency pair and aims to provide a trading vehicle based on a single currency.

For example, the US Dollar Index is calculated by combining a basket of currencies from major global nations, including the UK, Canada and Switzerland. The weighting of the individual currency pairs is:

- 57.6% – Euro/US Dollar (EUR/USD)

- 13.6% – US Dollar/Japanese Yen (USD/JPY)

- 11.9% – British Pound/US Dollar (GBP/USD)

- 9.1% – US Dollar/Canadian Dollar (USD/CAD)

- 4.2% – US Dollar/Swedish Krona (USD/SEK)

- 3.6% – US Dollar/Swiss Franc (USD/CHF)

Major forex indices include the aforementioned US Dollar Index, the Euro Currency Index and the Swiss Franc Index. However, there are also forex currency indices available for minor and exotic currencies, such as the Swedish Krona Index and Norwegian Krone Index.

Forex Index Trading vs Forex Pair Trading

The main difference between trading forex pairs and indices is diversification. When trading forex pairs, investors are speculating on the price relationship between two currencies. This relationship is often more volatile than a forex index and the major assets such as USD/EUR are more liquid. On the other hand, forex index trading provides a more balanced value of a single currency.

Another difference is available assets. While there are hundreds of currency pairs, there are far fewer forex indices. Trading forex pairs vs indices, therefore, is a good way to speculate on minor or exotic currencies.

Markets & Instruments

When it comes to forex index trading, as outlined above, there are not as many markets to choose from as traditional indices or currency pairs. While non-major currencies such as the Swedish krona and Singapore dollar are available to trade, investors are limited to tens, rather than hundreds of markets.

However, there is no shortage of available trading instruments for forex indices. For example, the US Dollar Index can be traded through forex-style CFDs, futures, options, and spread betting.

Trading Fees

Fees are a key consideration for investors, as high charges and commissions can quickly eat into profits.

Investors will be pleased to know that for forex index trading, generally fees are competitive. In fact, for US Dollar Index trading and other major FX indices, many leading forex day trading platforms offer zero commission or low-spread CFD trading.

When looking to trade major forex indices through more traditional methods such as mutual funds or ETFs, costs are also low. This is because these instruments are passive tracker funds rather than actively managed funds that command higher commissions.

Pros Of Forex Index Trading

- Single Currency Trading – While forex pairs allow investors to pit two currencies against each other, forex index trading allows investors to speculate on a more balanced overall value of a single currency.

- Simple – When trading forex pairs, investors are very exposed to fluctuations in two currencies, rather than one. For example, a trader that believes the Euro will weaken can speculate on EUR/USD, but shall be vulnerable to USD changes as well. However, the balanced basket of currencies used in forex indices helps reduce exposure to base currency changes.

- Low Costs – Forex indices tend to have competitive spreads and commissions from forex day trading platforms, whether these are for forex-style CFD trades or other vehicles.

- Range Of Instruments – From CFDs to spread bets and futures, forex index trading is available through a range of vehicles, suiting various trading styles and strategies.

Cons Of Forex Index Trading

- Low Volatility – When trading leveraged derivatives such as options and CFDs, volatility can send profits spiralling. The more balanced values of forex indices can curtail this profit potential due to comparatively lower volatility.

- High Single Pair Exposure – The component forex pairs weightings are supposed to offer a diversified method of providing a value for a currency. However, this is not always achieved in practice. For example, due to the advent of the Euro and the consolidation of European currencies into one, the US Dollar Index has a 57.6% exposure in EUR/USD.

- Limited Markets – While hundreds of forex pairs offer investors the chance to speculate on minor and exotic currencies, comparatively few forex indices currently exist.

- Reduced Trading Hours – The forex markets benefit from 24/5 trading thanks to the use of several global trading hubs, including London and New York. Unfortunately, forex indices do not benefit from this system and have significantly reduced trading hours compared to forex currency pairs.

Forex Index Trading Strategies

There are different strategies for live forex index training. Ultimately, experienced traders will draw upon a combination of leading forex indicators and signals to predict trades.

Rumours & News

Seasoned forex investors will know the power of breaking news on the value of a currency. Traders can capitalize on this trading opportunity using forex indices, which filter out the effects of other currencies through their diversification.

One popular strategy is to “buy the rumour and sell the news”. This hinges on getting your position locked in before the market reacts to the upcoming news to maximize profits. However, this is a risky strategy as rumours can often be incorrect. Additionally, there is no guarantee that news will affect markets in the way that investors predict.

Breaking news to look out for includes inflation and interest rate announcements as well as high-profile currency interventions, such as in late 2022 when the Bank of England stepped in to purchase long-dated gilt bonds.

This was to contain the mass sell-off that occurred after the government’s short-lived mini-budget, which affected the 30-year gilt yield by as much as 1% as well as the value of the pound against the dollar.

Fundamentals

Long-term investments in a forex index will often be driven by fundamental analysis. These are the economic and political factors that influence the value of a currency.

Examples of fundamentals include economic growth, as tracked by GDP and employment rates. Political stability is also a crucial fundamental, with markets notoriously sensitive to political changes. The balance of trade is also important, with high exports generally strengthening a currency.

Investors will often look at historical data to find trends in a currency’s fundamentals to make predictions as to its future value. However, if an investor believes that an upcoming event will change the pattern of fundamentals, a reversal trade is always a lucrative form of investing, especially when using options.

Technical Analysis

Thanks to the wide availability of retail analysis and platforms such as TradingView and MetaTrader 4, powerful technical analysis is more accessible to investors than ever.

Users may want to look at trend lines such as the relative strength index (RSI) in forex index trading or other leading indicators such as support and resistance lines and Fibonacci overlays.

Technical analysis can be done through various time frames, with short-term forex trading instruments such as binary options and CFDs able to analyse patterns on 1-minute or 5-minute charts.

How To Trade Forex Indices

Decide On Your Market & Instrument

While many brokers offer several currency indices, it is a good idea to decide on your favoured trading assets first. This is to ensure your chosen broker supports these assets before signing up and depositing funds.

It is also important to decide on your preferred trading vehicles, as most brokers support just one or two, for example, CFDs, ETFs, binary options or futures.

Choose A Broker

When it comes to trading forex indices, choosing a reputable and low-cost broker is key. Here are our top tips for finding the best forex index broker:

- Regulated by a reputable body, such as the FCA or CFTC

- Provides competitive trading and payment fee structures, such as a zero-commission account

- Supports your favoured payment methods, such as PayPal or wire transfer

- Supports reliable and user-friendly trading platforms such as MT4 or NinjaTrader

- Offers helpful and accessible customer support, available 24/5 via live chat or phone

Create An Account

Now, create an account. This is usually a simple process, but firms often require verification details for regulatory purposes, such as IDs, passports or bank statements.

Next up is to fund your forex index trading account. If you plan to trade a leveraged forex index market, ensure that you have sufficient capital to avoid a quick stop-out or margin call.

Find Your Market

Once your account is set up and funded, it is time to start trading forex indices. Download one of your broker’s supported trading platforms (some brokerages offer web-based platforms too) and navigate to your chosen product.

If your trading will centre around a small number of markets, most platforms allow traders to bookmark or favourite these asset pages for quick navigation in the future.

Make A Trade

Once you have conducted analysis of your forex index, it is time to make the trade.

As well as selecting your position, set stop-loss and take-profit levels, with advanced “trailing” tools available on some platforms. This will help keep a handle on your risk exposure.

Close Your Position

Monitor the market for the best opportunity to close your trade, taking your profit or closing out your losses.

With that said, some instruments like binary options may not offer an early cash-out opportunity. In these instances, hedging a trade to either lock in a profit or minimize losses may be possible.

Final Word On Trading Forex Indices

Forex index trading is a good choice for investors that wish to speculate on the value of a currency with less exposure to individual currency pairs. There are plenty of available forex index trading instruments, and these markets are largely low-cost. However, there is limited choice for exotic markets and trading hours are reduced compared to traditional currency pairs.

Use our list of the top forex index brokers to start trading.

FAQs

What Is An Index In Forex Trading?

A forex index is a basket of currency pairs with a common currency, such as the US Dollar. This provides a diversified measure of the value of this common currency.

Forex index trading essentially offers a means to speculate on the value of a single currency, such as the USD, EUR or GBP.

What Are The Best Currency Indices To Trade?

Forex indices such as the US Dollar Index, British Pound Index and Euro Index are highly liquid. However, a solid strategy can make any forex index a profitable trading market.

Head to our tutorial on forex index trading to find a suitable broker and get started.

What Is The Best Time To Trade Forex Indices?

The best forex index trading opportunities will occur around significant news, such as interest rate announcements, changes in government monetary policy and new global trade relationships.

Note that unlike trading standard forex pairs, FX indices may not be available 24/5.

Is Trading Forex Indices Better Than Forex Pairs?

Forex index trading allows investors to speculate on a single currency more reliably and stably than by using a single currency pair. However, currency pair trading can be more lucrative due to its comparative volatility, and investors have more options when it comes to available currencies.