Australian Dollar Index

The Australian Dollar Index is a currency index that helps investors understand what the AUD is worth by comparing it to other currencies such as the USD. Several online brokers also offer a tradable Australian Dollar currency index.

This tutorial will cover how to start trading the Australian Dollar Index, from tips on developing a strategy to the key factors that influence its value. Our traders have also ranked the best AUD currency index brokers in 2026.

Australian Dollar Index Brokers

What Is The Australian Dollar Index?

An index is a way of monitoring the objective performance of a certain asset or group of assets, usually by comparing or compiling the performance of the whole group. Forex index trading is used to gauge the overall performance of a specific currency and the country or region it belongs to.

A currency index essentially measures the strength of a currency, such as the Australian Dollar, by comparing it to a basket of currencies from comparable countries, such as China and Japan.

The choice of currencies used in the index is up to the institution and broker that calculates it, but it is common to choose the country’s largest trading partners, with the weightings corresponding to trading volume. The Reserve Bank of Australia’s AUD trade-weighted index (TWI), for example, tracks the Australian Dollar’s performance against the country’s 17 biggest trade partners with proportional weightings updated periodically to reflect changing trade volumes:

- Chinese yuan

- Japanese yen

- Euro

- US dollar

- South Korean won

- Singapore dollar

- Indian rupee

- New Taiwan dollar

- Malaysian ringgit

- New Zealand dollar

- Thai baht

- UK pound sterling

- Vietnamese dong

- Indonesian rupiah

- Hong Kong dollar

- Swiss franc

- Philippine peso

Bear in mind that the TWI was created by Australia’s central bank as a way to gauge the AUD’s overall performance, and it isn’t necessarily the index that your broker will use for trading purposes.

Online brokers will often offer their own currency indexes with weightings of their choosing. For example, CMC Markets’ Australian Dollar Index has the following eight currencies with a floating weighting that changes daily:

- Chinese yuan

- Japanese yen

- US dollar

- Euro

- Singapore dollar

- British pound

- New Zealand dollar

- Swiss franc

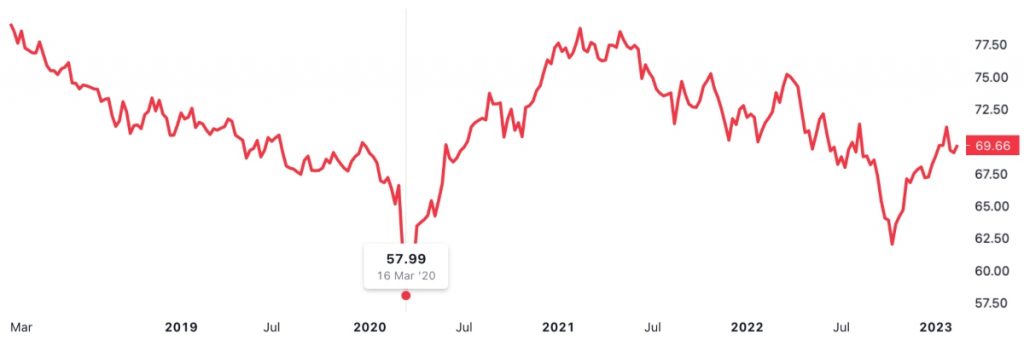

Price History

The Australian dollar (AUD) was introduced as a decimal currency on 14 February 1966, and was first pegged to the price of the British pound sterling, then to a variety of other currencies. The AUD was floated on 12 December 1983, transitioning to a free-floating exchange rate determined by market forces.

Today, the Australian dollar is consistently among the most traded currencies on the forex market with a daily average value in the hundreds of billions of dollars. The wealth of this resource-rich country has contributed to the AUD’s popularity, making it pairable with other global currencies.

The AUD’s price is to a large extent linked to commodities, and as one of the largest global exporters of gold, the precious metal has a huge influence on the Aussie dollar. Historically, AUD’s price against USD correlated approximately 80% with gold prices, though this changed with the high gold-price volatility experienced in 2025.

What Determines The Australian Dollar Index Price?

Because Australia has a floating exchange rate, the movements in the currency are dependent on the level of demand for it. Understanding how the Australian Dollar Index works means gaining insight into the factors that affect the supply and demand of the currency.

At the same time, traders must also keep in mind the factors affecting other currencies in the AUD index basket, since these will have an impact on the price – particularly the currencies with the highest weighting.

Here are some key factors that can influence the Australian Dollar Index price:

Australian Economy

The Australian Dollar Index is fundamentally a reflection of the strength of the country’s economy as a whole, so Australian economic performance will be one of its strongest determinants. Check for the latest data on inflation, interest rates, unemployment and economic growth. Generally, you’re looking for a few things:

- Interest Rate Differentials – Interest rate differentials measure the difference between the interest rate in Australia against the rate in other places. This is one of the most important long-term drivers in the value of the AUD. The key economies for comparison here are the US, Europe, and Japan.

- Terms of Trade – Terms of trade show a comparison between export and import prices. If the terms of trade rise, the AUD tends to rise. If it declines, the currency depreciates.

- International Trade – AUD can also be bought and sold for international trade. This means when goods are exported, the buyer must purchase AUD to buy the export. Therefore, demand for the AUD rises as well as the demand for Australian export. The value of the AUD then rises.

- Inflation – Exchange rate levels are connected to the price levels between economies. This means that an exchange rate adjusts so that the relative cost of goods across the world is the same. This means that if goods in Australia are more expensive than in other countries (relatively speaking), then the demand declines and the currency depreciates.

Counter-Cyclical Currency

The AUD is a rare example of a counter-cyclical currency, and it is also highly volatile. This means that the currency is less tied to other major economies and can often appreciate during times of trouble for other major currencies – the AUD is more closely tied to the price of commodities, which also makes it volatile.

Commodities

The AUD is known as a commodity currency, which means it depends hugely on the export of raw materials – it’s among the top exporters of gold, iron ore and coal, and these and other make a huge proportion of its international trade in goods. This means that the Australian dollar will usually perform strongly when there’s high demand for the commodities it exports, but it may be weaker when the market dries up.

Countries with commodity currencies struggled at the beginning of 2022 because of the geopolitical climate at the time, causing high volatility in the market.

China

China is by far Australia’s largest trading partner, and this is usually reflected by the weighting of the Chinese yuan in Australian Dollar Indexes. You can therefore expect to find a strong relationship between the AUD currency index and the Chinese currency.

East Asian Markets

While China has the biggest weighting in the AUD index basket, Australia has major trading partners around the region, with the Japanese yen, Singapore dollars, Thai baht, South Korean won and other nearby countries among the most influential. Knowledge of markets in east and southeast Asia will be useful for forecasting Australian Dollar Index price movements.

Importantly, countries such as China, India, and Japan have a huge demand for natural resources – the major export of Australia – and this can drive up the value of the AUD.

Economic News

All kinds of economic data can have an effect on the AUD, such as the release of major company earnings or key political events.

For real-time AUD exchange rates and the current TWI, consult the RBA’s official exchange rates page, updated daily.

How To Trade The Australian Dollar Index

Choose Your Instrument

The instrument you choose to trade has a fundamental impact on the kind of trading you will do, affecting everything from your strategy to the broker you use and the fees charged.

There is not a huge amount of choice out there, but CMC Markets is a popular and reliable broker that offers CFD trading on its own take on the Australian Dollar Index.

CFDs are widely used by retail traders who want to benefit from the derivative’s leverage and straightforward trading style that allows investors to go long or short on an asset.

Choose Your Broker & Create An Account

Ensure that the Australian Dollar Index broker you select offers the trading vehicle you want before you create your account.

Aside from instruments, it is important to pay attention to other factors that make for a good or bad trading experience, such as whether or not your broker is regulated, who regulates them, how their platform and payment methods work, their fee structure, and their customer support and education base.

Open & Close Trades

Once you have placed funds into your account, you will need to navigate to the appropriate place on your trading platform to open your first trade. On MetaTrader 4, you can search for the asset in the Market Watch widget. The popular ticker/symbol for the currency index is AXY.

Once your trade is open, monitor the Australian Dollar Index price until it is time to close the position. You can also set stop loss and take profit levels to limit risk and lock in profit.

AUD Trading Hours

Like other forex markets, the Australian Dollar Index is typically traded 24 hours a day for 5 days a week, from 00:00 UTC on Monday to 22:00 UTC on Friday night.

Importantly, the hours for the AUD currency index you trade will likely be set by your broker.

Final Word On Trading The Australian Dollar Index

The Australian Dollar Index helps investors track the value of the AUD relative to a basket of other currencies. This means that traders can use it to gauge the general economic performance of Australia and its currency. Additionally, traders can speculate on the price movements of the Australian Dollar Index itself, usually through CFDs or similar derivatives.

To start trading, sign up with one of the top-rated Aussie Dollar Index brokers.

FAQ

What Is The Australian Dollar Index?

The Australian Dollar Index is a currency index that allows traders to assess the value of the AUD by placing it in a currency basket with other liquid currencies. The composition of Australian Dollar indices may vary, but they are typically made up of key trading partners, such as China, Japan and South Korea.

Why Is The Australian Dollar Index Important?

The Australian Dollar Index matters because it provides a more objective view of Australia’s economic performance compared to a single currency pair, such as the AUD/USD. Its weighted composition essentially means it is less volatile and susceptible to a sharp rise or fall in the value of a single currency.

Which Currencies Are Used To Calculate The AUD Index?

Different forex indexes differ from one another, but generally, the basket of currencies used to calculate a currency index is made up of the country’s largest trading partners. In Australia’s case, this means that the Chinese yuan usually has the largest weighting in an AUD index, followed by the Japanese yen.

What Influences The Australian Dollar Index?

The Australian Dollar Index compares the AUD to other world currencies, so it will be influenced when an outside factor affects it or the other currencies it is being compared against.

The Australian Dollar is also a commodity currency and its value fluctuates depending on demand for its raw materials, particularly iron ore and gold.

Generally, any factor that influences Australian economic performance will also have an impact on the AUD index, including inflation and unemployment rates, plus its balance of imports and exports.

How Can I Trade The Australian Dollar Index?

One of the most popular ways for retail traders to speculate on the AUD currency index is through CFDs. CMC Markets, for instance, offers a minimum spread of 0.3 pips with a 0.01-lot minimum order size on the Australian Dollar Index. Shorting is also permitted.