US Dollar Index

The US Dollar Index is a widely traded benchmark that gauges the strength or weakness of the planet’s number one currency.

This guide will explain what the Dollar Index is, discuss the factors that make it rise and fall, and unpack the different ways to speculate on short-term price fluctuations.

Quick Introduction

- The US Dollar Index compares the USD against the currencies of Britain (GBP), Japan (JPY), Canada (CAD), Sweden (SEK), Switzerland (CHF), and eurozone countries (EUR).

- The currency index can move sharply in response to economic and macroeconomic developments as well as technical factors.

- Short-term traders can choose from a variety of instruments – CFDs, futures, options and ETFs, providing the opportunity to make money whether the index increases or decreases.

- The US Dollar Index is also referred to by the symbols USDX and DXY.

Top 4 US Dollar Index Brokers

Based on our hands-on tests, we recommend these 4 brokers for trading the US Dollar Index:

-

1

Optimus FuturesCurrency index: USD

Optimus FuturesCurrency index: USD -

2

Focus MarketsCurrency index: USD

Focus MarketsCurrency index: USD -

3

ExnessCurrency index: USD

ExnessCurrency index: USD -

4

XMCurrency index: USD

XMCurrency index: USD

All brokers with US Dollar Index

What Is The US Dollar Index?

The US Dollar Index is used to gauge the value of the North American currency against a basket of other major foreign currencies.

Informally known as the “Dixie”, it measures the dollar’s value against the counters of six major economies or trading blocs:

- The Euro

- The British Pound

- The Japanese Yen

- The Swiss Franc

- The Canadian Dollar

- The Swedish Krona

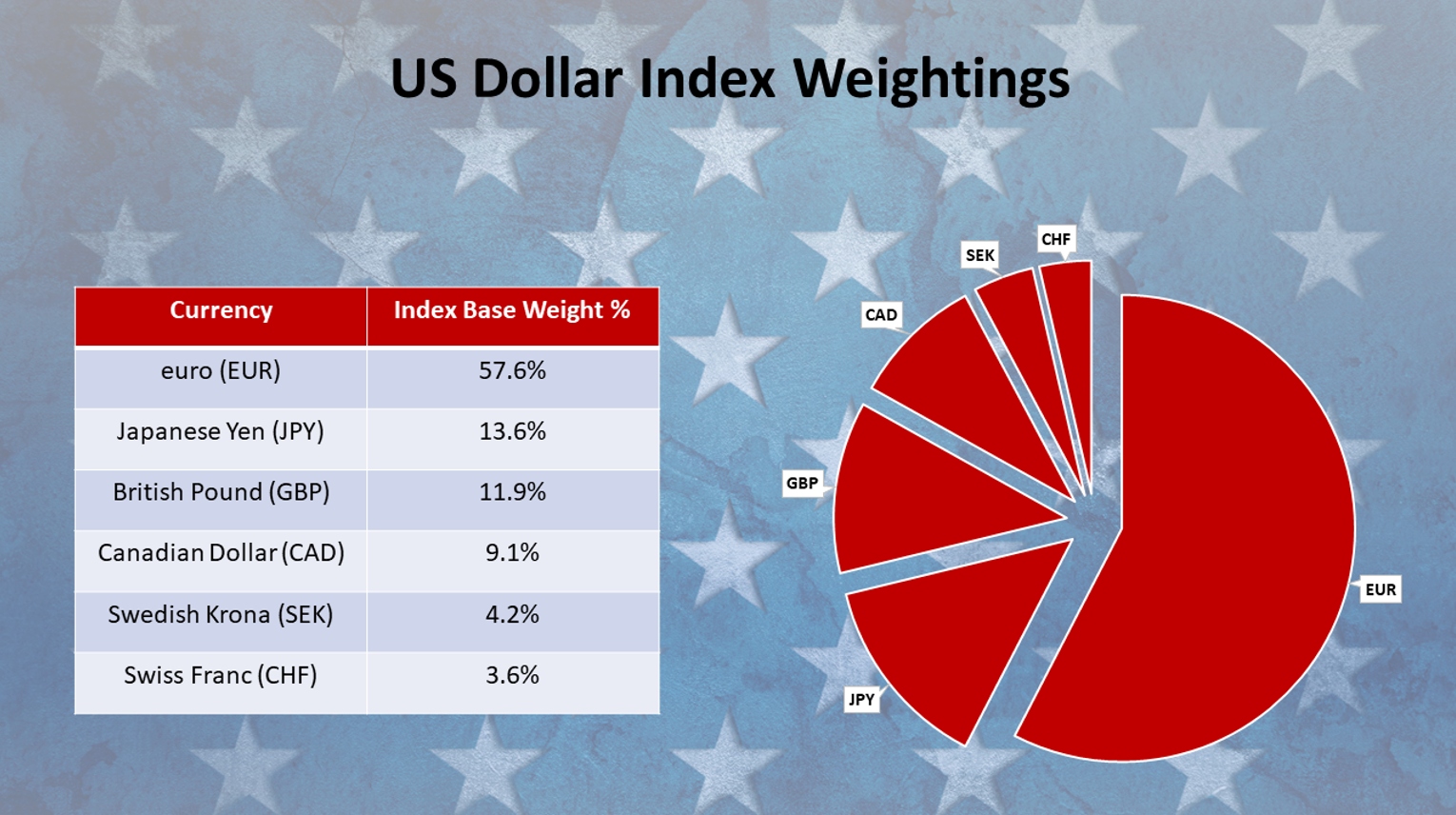

Currency weightings are calculated according to each monetary unit’s importance in US international trade.

The Euro is by far the largest component of the index, making up nearly 60% of its weight. This reflects the eurozone’s position as the United States’ largest trading partner.

The US Dollar Index was established in 1973 when major trading nations allowed their currencies to freely float against others. The Euro was introduced to the index in 1999 when it replaced several European currencies.

It has been 25 years since the index was last altered, and there are calls for it to reflect the changing international trading landscape.

Any future alterations could see the introduction of emerging market currencies like the Chinese Yuan, Mexican Peso and South Korean Won.

Chart

What Drives The Index’s Value?

When the US Dollar prints overall gains against those six currencies, the index generally follows suit. Conversely, the basket moves in the opposite direction when the US Dollar drops in value against those counters.

However, the different weightings mean that the index may not necessarily track broader movements in the US currency. The significant weighting of the Euro in particular can have a dramatic (and unpredictable) effect on the index.

Let’s say that the US Dollar has eked out modest gains against the Yen, Pound, Krona, Franc and Canadian Dollar. These increases could still be offset by a large upswing in the EUR/USD currency pairing that pulls the broader index southwards.

Importantly, a weaker Euro will usually lead to an increase in the price of the US Dollar Index, while a stronger Euro may result in a decline in value.

In addition, issues within a country that uses the Euro can lead to a loss of value in the currency, as seen in Greece. Conversely, the Euro can be bolstered by positive announcements from the European Central Bank (ECB).

On a historical note, the US Dollar Index reached peaks of 164.72 in February 1985 and hit a trough of 70.698 in March 2008.

A broad range of fundamental factors can influence the movement of component currencies and, by extension, the level of the US Dollar Index:

- Economic performance barometers including GDP statistics, retail sales numbers, employment surveys and housing market indices

- Geopolitical developments like election results, policy announcements and social unrest

- Natural and man-made disasters like wars and extreme weather events

- Interest rate changes and announcements on monetary policy

- Inflation reports

An interest or inflation rate above the market’s predicted value may increase the value of the USDX. The inverse is also true, with the US Dollar Index futures price potentially rising following a high interest rate or inflation announcement.

Technical factors also play a part. A move through key support or resistance levels, moving average crossovers, and the emergence of clear chart patterns can cause the benchmark to rise or fall sharply.

Short-term traders, therefore, need to keep a close eye on charts, too, to identify price and volume trends and other key indicators.

Due to its ability to track the performance of the US Dollar independently of a single currency pair, the USDX can also be used to hedge trades dependent on the value of the US Dollar.

How To Trade The US Dollar Index

Traders have a variety of ways to speculate on the movement of the currency index. These include:

Futures Contracts

Futures are financial derivatives that get their value from the price of an underlying asset. In this case, they obligate the owner to buy or sell the USDX at a specified level at a pre-determined date in the future.

When the contract expires, the profit or loss is settled in cash according to the difference between the contract price and the market price.

Traders can also decide to keep their position open by rolling over their contract beyond expiry. This involves them closing out their current contract and opening a new agreement with a later expiration date.

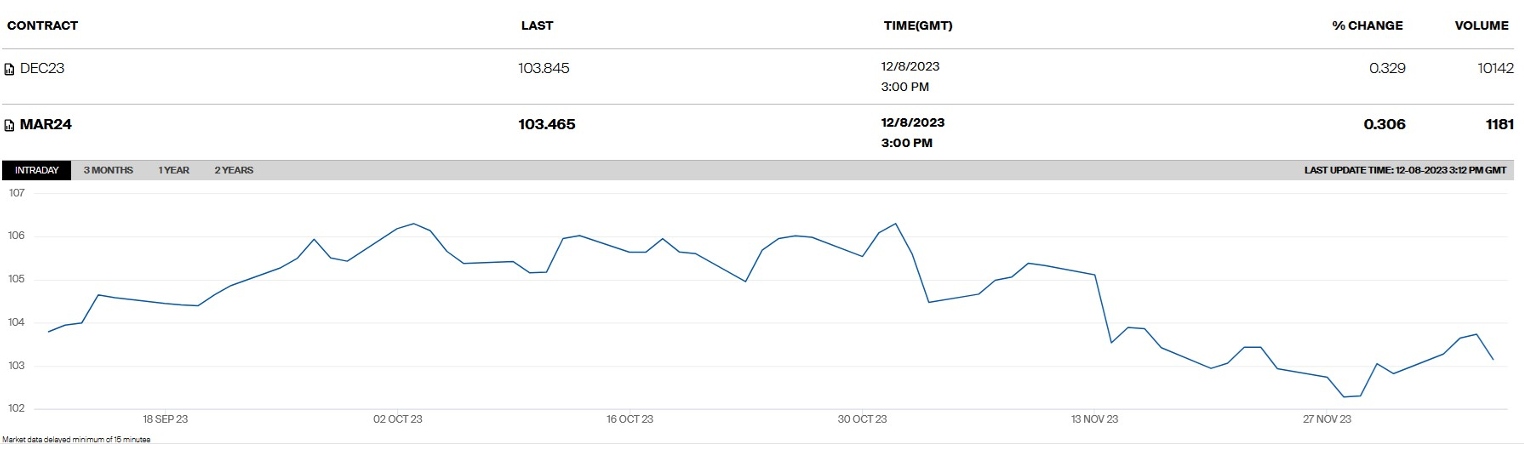

Here you can see US Dollar Index futures contract trading at the Intercontinental Exchange (ICE) using the trading symbol DX. The month in which each contract is settled (December 2023 and March 2024) is shown, alongside the latest prices and trading volumes.

Options Contracts

Speculators can also profit from DXY movements with options. Unlike futures, these derivative products give owners the right but not the obligation to purchase an underlying asset at a pre-set price and time.

In my opinion, options can be great if you require flexibility, although this advantage over futures contracts comes at a higher price.

A DXY Options Trade In Action

Let’s say I believe that the US Dollar Index will rise from current levels of 95. I think that the Federal Reserve will hike interest rates by a larger percentage than the market anticipates.

I decide to buy a call option, which gives me the right to buy the Dixie at a strike price of 97 (a put option, on the other hand, would allow me to sell the index at a lower pre-set price sometime in the future).

Now let’s fast forward to the expiration. I check in on the US Dollar Index and find that it is sitting at 98.50, meaning that I would be ‘in the money’. In other words, I would have made a profit from the trade.

What would have happened if the index had failed to reach or exceed the strike price at the expiration date? In this situation I would be ‘out of the money’; I would let my call option expire, and in the process incur a loss in the form of the premium I spent to acquire the contract.

Exchange-traded funds (ETFs)

Traders can also speculate on the US Dollar Index by purchasing an exchange-traded fund (ETF). Generally speaking, these financial products are designed to track a specific index.

Traders who wish to go long can purchase the Invesco DB US Dollar Index Bullish Fund. This ETF tracks the value of the USD relative to the EUR, YEN, GBP, CAD, SEK and CHF. It does this by following the price movements of USDX futures contracts.

Investors who expect the index to fall can instead go short with the Invesco DB US Dollar Index Bearish Fund. Price movements are also based on changes in the futures market, with traders making a profit when the USD falls against those other major currencies.

ETFs typically incur lower transaction fees than futures and options, which can make them a more cost-effective way to trade.

Contracts for Difference (CFDs) and Spread Bets

Short-term traders like day traders who wish to use high levels of leverage (borrowed funds) often prefer to use contracts for difference (CFDs) or spread bets to speculate on the Dollar Index.

These derivative products are financial contracts between a trader and a broker.

In most cases, CFDs and spread bets are quoted per point movement in the underlying asset, and traders choose how much to bet per point.

The levels of gearing available with these derivative instruments tend to be higher than with those other financial vehicles described above.

This can be a double-edged sword: allowing you to open larger positions can amplify gains when markets move in an expected direction. But they can also result in crushing losses when prices move in the ‘wrong’ direction.

The high-risk nature of CFD trading means that the practice is prohibited in some regions including the US.

Here is an example of a CFD trade on the US Dollar Index using Plus500. As you can see, I have an opportunity to use leverage of 1:5. This allows me to use $5 of borrowed money to trade with for every $1 I have deposited.

The amount of leverage you can use will differ from broker to broker and depend on local regulations.

Pros And Cons Of Trading The US Dollar Index

Pros

- Bulls and bears can profit – Traders can choose to go long or short with each of the financial instruments described above. As a consequence, they have a chance to make money whether the Dollar Index rises or falls.

- Leverage options – Those aforementioned financial products also allow traders to open larger positions with the use of borrowed funds. This can open the door for greater profits, though traders should be careful using this high-risk strategy.

- Flexible trading hours – Long hours are common on markets that allow speculators to bet on the index. This gives investors the opportunity to trade at their convenience. Dixie futures, for example, are traded for 21 hours a day.

- Dual purpose – The greenback-based index can be effectively used for different trading strategies. Speculators can use it to bet on upward and downward price movements. Traders can also use it to hedge other trades that are dependent on the performance of the US currency.

Cons

- Heavy EUR weighting – As the basket is significantly weighted towards Europe’s single currency, movements in the EUR/USD pair can have a substantial impact on the index, even if there are no changes in the dollar’s value against other currencies. This means the basket may not offer as much diversification as traders expect.

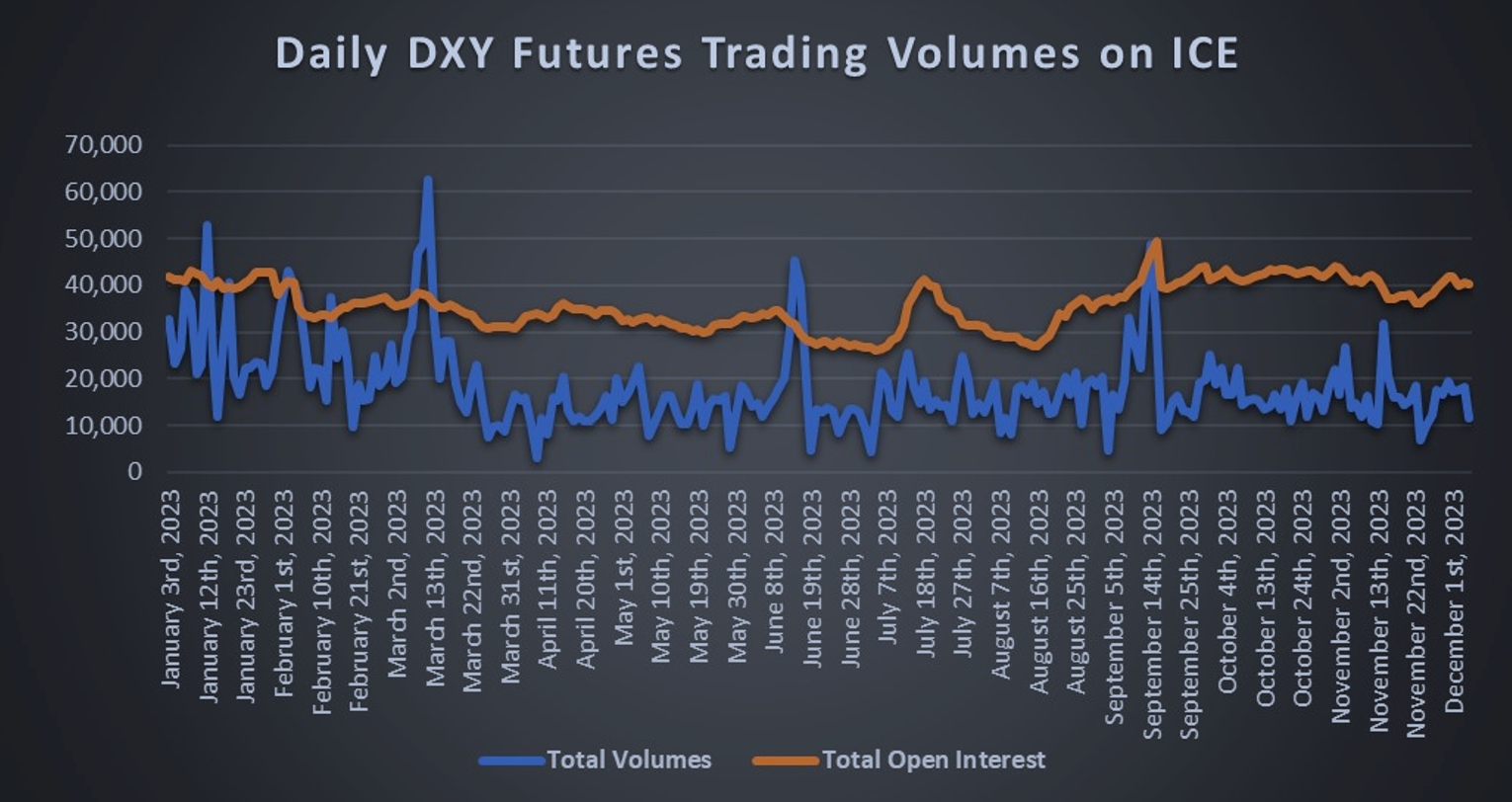

- Volatile volumes – Trading volumes can fluctuate wildly and drop sharply when economic releases are thin on the ground. This can lead to price volatility that can cause huge losses, while bid-ask spreads tend to widen and eat into trader profits when volumes are thin. Below you can see how volatile Dixie futures volumes were on ICE during 2023.

Bottom Line

The availability of leverage and a wide range of financial instruments makes the US Dollar Index a popular asset with short-term traders. The benchmark can be extremely volatile, which in turn creates opportunities for traders to turn a profit.

However, individuals need to closely monitor fundamental factors and undertake technical analysis to make money with the Dixie.

Starting with a demo account is my go-to advice for beginner traders, offering a risk-free space to practice trading the US Dollar Index before investing real money.

FAQ

Is The US Dollar Index Important?

The US Dollar Index is historically significant as it represents the end of the relationship between the US Dollar and gold. Now, it is a valuable barometer for evaluating the strength of the US Dollar vs foreign monies such as the Euro, Pound and Canadian Dollar.

What Does The US Dollar Index Represent?

The USDX is a US Dollar strength index – a high value means that the Dollar is strong compared to a basket of major global currencies, while a low price signifies a reduced value compared to these assets.

What Moves The US Dollar Index?

The Dollar Index moves based on the strength of the USD compared to other major currencies, with lots of exposure to the Euro. Therefore, inflation, interest rates, stock market performance and regional economic data can all impact the strength of the US Dollar Index.

How Can I Speculate On The US Dollar Index?

CFDs are popular with short-term traders, offering the opportunity to speculate on rising and falling prices with leverage available to amplify returns (and losses). Futures, options and ETFs can also be used to trade the US Dollar Index.

When Can You Trade The US Dollar Index?

The US Dollar Index trades on extended hours from 8 pm to 5 pm ET from Monday to Friday. There is also a 30-minute pre-market session from 7:30 pm.

Recommended Reading

Article Sources

- Daily Volumes for DX-US DOLLAR INDEX FUTURES – Intercontinental Exchange

- Top Trading Partners (October 2023) – United States Census Bureau

- U.S. Dollar Index Contracts FAQ – Intercontinental Exchange

- List of Exchange-Traded Funds - Invesco

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com