Brokers With US Dollar Index

Brokers with the US Dollar Index (USDX) allow traders to speculate on the strength of the USD against a basket of foreign currencies. Managed by the Intercontinental Exchange (ICE), the USDX can be traded via various instruments depending on the trading platform, notably futures, options, and CFDs.

Discover the best brokers with the US Dollar Index, all personally tested by our experts.

Best Brokers For US Dollar Index

Following our first-hand evaluations, these are the top 6 trading platforms that offer the USDX:

-

1

Optimus FuturesCurrency index: USD

Optimus FuturesCurrency index: USD -

2

Focus MarketsCurrency index: USD

Focus MarketsCurrency index: USD -

3

ExnessCurrency index: USD

ExnessCurrency index: USD -

4

XMCurrency index: USD

XMCurrency index: USD -

5

AvaTradeCurrency index: USD

AvaTradeCurrency index: USD -

6

PepperstoneCurrency index: USD, EUR, JPY75-95% of retail investor accounts lose money when trading CFDs

PepperstoneCurrency index: USD, EUR, JPY75-95% of retail investor accounts lose money when trading CFDs

This is why we think these brokers are the best in this category in 2026:

- Optimus Futures - Established in 2004, Optimus Futures specializes in low-cost, customizable futures trading. It provides access to a growing suite of around 70 futures markets spanning micro E-minis, energies, metals, grains, and cryptos. With commission tiers starting at $0.25 per side for micros and the option to choose your own clearing firm (e.g. Ironbeam, StoneX, Phillip Capital), the brokerage offers flexibility. Optimus Futures has also introduced excellent features like multi-bracket orders and journaling, giving active traders more control.

- Focus Markets - Established in 2019, Focus Markets is an Australian-based MetaTrader broker offering access to over 1,000 tradable instruments, including forex, commodities, indices, stocks, and a particularly large selection of crypto derivatives.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Pepperstone - Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Brokers With US Dollar Index Comparison

| Broker | Currency Indices | Minimum Deposit | Platforms | Regulator |

|---|---|---|---|---|

| Optimus Futures | USD | $500 | Optimus Flow, Optimus Web, MT5, TradingView | NFA, CFTC |

| Focus Markets | USD | $100 | MT5 | ASIC, SVGFSA |

| Exness | USD | Varies based on the payment system | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| XM | USD | $5 | MT4, MT5, TradingCentral | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| AvaTrade | USD | $100 | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Pepperstone | USD, EUR, JPY | $0 | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

Optimus Futures

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Currency Indices

Optimus Futures only allows for trading on the USD currency index.

Pros

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

Focus Markets

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Currency Indices

Focus Markets only allows for trading on the USD currency index.

Pros

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- Focus Markets’ MT5 platform delivered fast, seamless trade execution during testing with advanced charting, multiple timeframes, and useful tools like Depth of Market (DOM). Its clean interface made navigation easy, while clear risk/reward ratios ensures precise trading.

Cons

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- A significant drawback of Focus Markets is the lack of platform variety. It only support MT5, excluding popular platforms like MT4, cTrader, and TradingView, plus it hasn't developed its own software that could better meet the needs of beginners.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Currency Indices

Exness only allows for trading on the USD currency index.

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Currency Indices

XM only allows for trading on the USD currency index.

Pros

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Currency Indices

AvaTrade only allows for trading on the USD currency index.

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

Pepperstone

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

Christian Harris, Reviewer

Pepperstone Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting |

| Regulator | FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB |

| Platforms | MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail), 1:500 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Currency Indices

Pepperstone offers trading on these 3 currency indices: USD, EUR, JPY

Pros

- Pepperstone has scooped multiple DayTrading.com annual awards over the years, most recently 'Best Overall Broker' in 2025 and 'Best Forex Broker' runner up in 2025.

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- Pepperstone has greatly improved the deposit and withdrawal experience in recent years, adding Apple Pay and Google Pay in 2025, as well as PIX and SPEI for clients in Brazil and Mexico in 2024.

Cons

- Pepperstone’s demo accounts are active for only 30 days, which may not be not long enough to familiarize yourself with the different platforms and test trading strategies.

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets, though it has introduced an intuitive copy trading app.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers who focus on this area, with no option to invest in real coins.

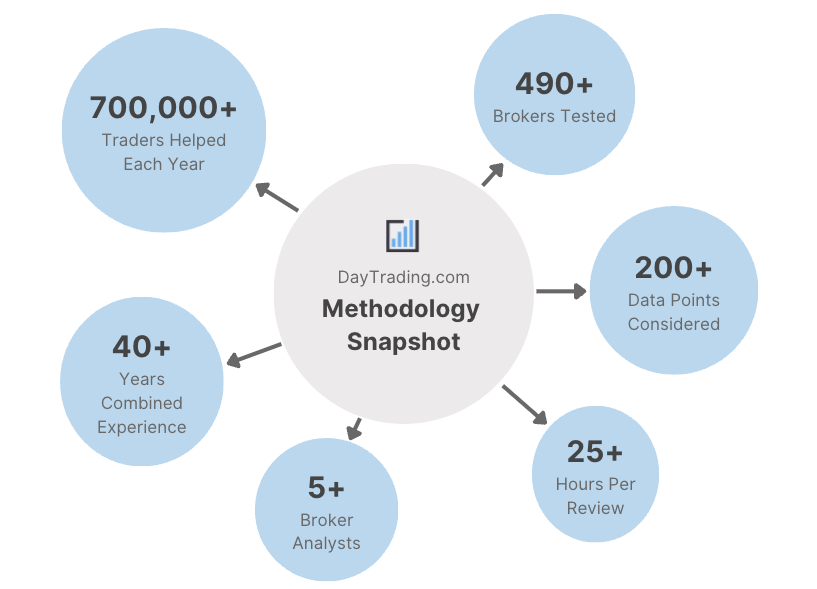

Methodology

To identify the best trading platforms with USDX, we examined our database of 140 online brokers and pinpointed all those that facilitate trading on the US Dollar Index.

We then ranked them by their overall rating, blending over 100 data entries with our direct observations during testing. This revealed the trading platforms that go the extra mile for traders interested in the US Dollar index.

- We only recommended brokers that have earned our trust.

- We prioritized brokers with competitive trading fees.

- We checked each broker has correlating markets to the USDX.

- We ensured each broker offers excellent charting platforms.

- We examined each broker’s leverage and margin requirements.

How To Choose A Broker With The US Dollar Index

There are several factors we, and you, should consider when choosing a broker for US Dollar Index trading:

Choose A Trustworthy Broker

An established, regulated broker will help protect you from trading scams.

This is important given that the Commodity Futures Trading Commission (CFTC) has warned against the increase in foreign currency fraud in recent years, publishing tips on identifying potential signs of a scam. For example, fraudsters may use persuasion techniques to convince traders of ‘guaranteed’ gains and create a false sense of urgency to invest.

This is why we always verify the regulatory credentials of each broker that we test and assign each broker a score from 1 to 5 for ‘Regulation & Trust’, helping to keep your funds secure when trading the USDX and other financial markets.

- AvaTrade is highly trusted, with an excellent record spanning 15+ years and licenses from multiple ‘green tier’ authorities. It also offers robust safeguards, including negative balance protection, segregated accounts and a bespoke risk management tool, AvaProtect with up to $1M in insurance against trading losses.

Choose A Broker With Competitive Fees

Brokers with low trading fees on the USDX will help you maximize returns, especially for active traders.

That’s why we evaluate spreads, commissions and other charges when examining brokers, including recording fees on correlating markets, such as the EUR/USD.

We then assess non-trading fees, such as deposit/withdrawal charges, and weigh these against the overall service provided.

- Pepperstone continues to lead in this category, with spreads averaging 6.00 pips on the US Dollar Index and 0.10 pips on EUR/USD, plus access to a fantastic economic calendar for tracking financial announcements.

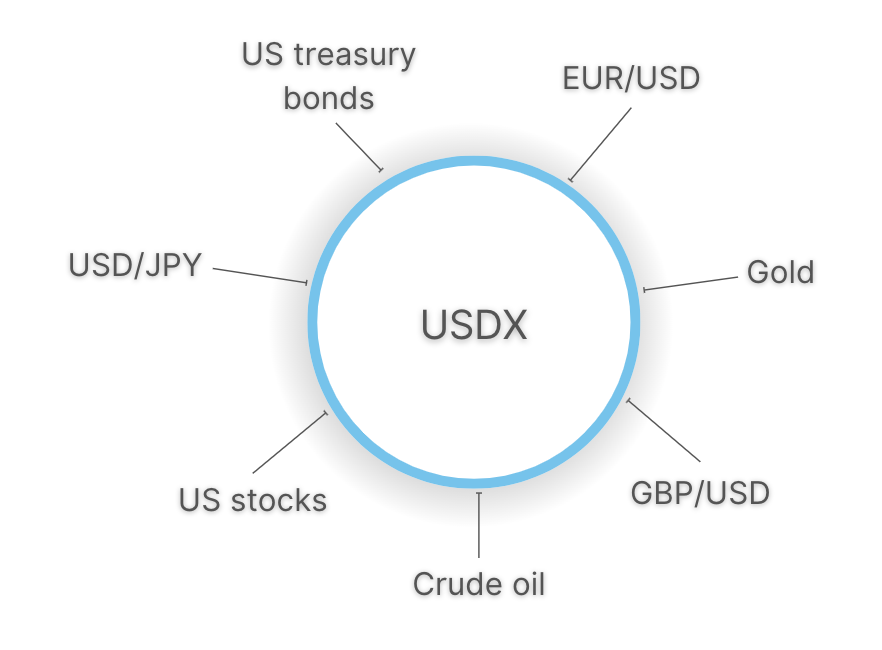

Choose A Broker With Correlating Markets

Traders may also be interested in a broker that provides access to other currencies within the USDX basket, providing alternative trading opportunities.

For example, the EUR/USD, which is available at all of our recommended brokers, is typically inversely related to the US Dollar Index.

Additionally, currency pairs where USD is the base or quote currency can also indicate a correlation with the USDX, such as USD/JPY or GBP/USD.

Other markets may also be of interest to USDX traders, such as commodities like gold (gold is quoted in dollars) as well as bonds (which are impacted by yield rates against the USD).

- IG is our top pick if you’re looking to trade the USDX alongside other relevant markets, including US bonds, gold, and USD currency pairs. I also love that you can follow announcements from the Federal Reserve Meeting in almost real-time through IG’s live market coverage.

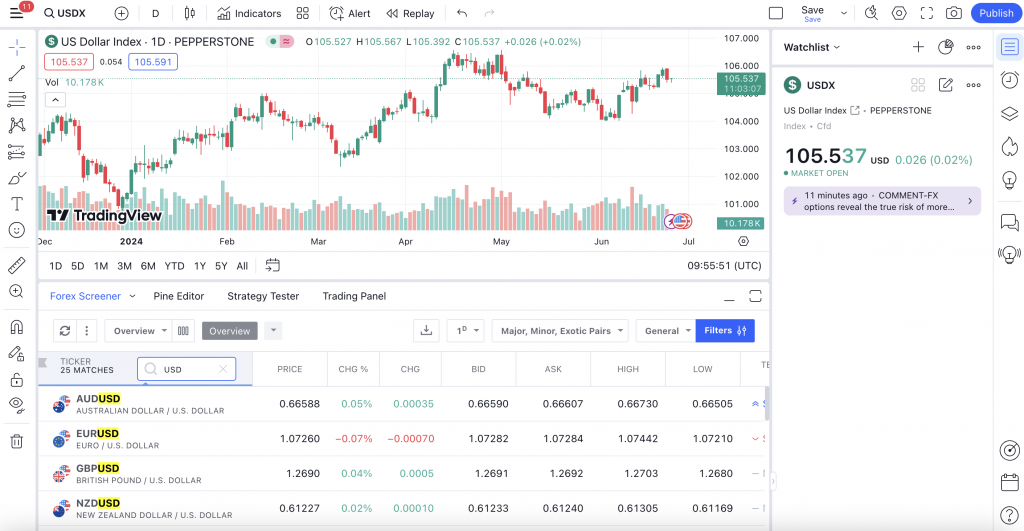

Choose A Broker With Excellent Platforms

Day traders speculating on the US Dollar Index will require a broker that offers a powerful charting platform to perform technical analysis.

Most brokers we test offer the MetaTrader 4 and MetaTrader 5 platforms. That said, I find the seamless navigation and integrated tools in TradingView far more appealing for active traders.

For example, you can use the integrated forex screener to analyze relevant currency pairs alongside your USDX chart, as you can see below.

Since the USDX is a popular macro indicator for the strength of the US Dollar, having access to excellent market research services like Trading Central can also be a value-add.

You may want a broker that provides interest rate updates from the Federal Reserve, as well as other relevant Central Banks, notably the European Central Bank as the EUR forms the largest weighting in the US Dollar Index.

- XM offers a superb selection of charting platforms for USDX traders, including MT4 and MT5. However, where it shines is its fantastic research tools, with trade ideas, technical summaries and news where you can search specifically for the US Dollar Index.

Choose A Broker With Clear Margin Requirements

Day traders, in particular, often trade the US Dollar Index with leverage, allowing them to maximize their potential gains using a small outlay.

This makes it important to choose a broker with clear margin requirements so you know what’s needed and what it costs, to borrow funds.

Crucially, brokers regulated by ‘green tier’ authorities like the FCA and CySEC cap leverage for retail investors at 1:30.

This means that if I were to put down $100 for a USDX CFD, the value of my position would be $3,000 (30 x $100).This means both my profits and losses will be multiplied by 30. As such, I recommend using risk management tools like stop-loss orders to close positions before large losses can accumulate.

- eToro offers leverage up to 1:10 on the US Dollar Index, with transparent margin requirements clearly displayed in the platform. You can also quickly and easily set stop loss and take profit parameters, while its social trading platform is world-leading and used for real-money trading by our team.

FAQ

Which Is The Best Broker With The US Dollar Index?

See our list of the best brokers with the USDX to find a suitable option based on your trading needs.

For example, Pepperstone offers some of the lowest fees on the USDX, while XM offers hourly technical summaries and sentiment data on the world’s most prominent currency index.

Article Sources

- USDX - Intercontinental Exchange (ICE)

- The US Dollar Index - Forbes

- Forex Trading Scam Warning - CFTC

- Federal Reserve Board

- European Central Bank (ECB)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com