How To Avoid Forex Trading Scams

Forex scams continue to prey on unsuspecting investors, promising quick wealth through deceptive schemes and fraudulent trading platforms.

Within this guide, discover prevalent forex trading scams, learn to identify their telltale signs, and find guidance if you’ve fallen victim. Additionally, explore our curated roster of trustworthy forex brokers for a secure trading experience.

Quick Introduction

- Forex trading involves volatility, and any claims of consistent, extraordinarily high returns without risk are likely deceptive.

- Unregulated forex brokers often serve as the facilitators of fraudulent activities. Ensure they’re registered with appropriate regulatory authorities.

- Forex scams often lack transparency about their operations, including unclear fee structures, hidden terms, or inconsistent information.

- Scammers often create a sense of urgency, pressuring you to invest hastily without proper research.

Trusted Forex Brokers

To help avoid forex trading scams, open an account with one of our 4 most trusted brokers. Our experts have evaluated each one and verified their regulatory credentials.

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

4

FOREX.com

FOREX.com

Understanding Forex Trading Scams

Forex trading scams are prevalent and prey on individuals enticed by the allure of quick profits. These scams manifest in various forms, often capitalizing on the complexity and volatility of the forex market.

One common scheme involves fraudulent brokers or traders promising guaranteed high returns with minimal risk, exploiting the lack of understanding among inexperienced traders.

They lure victims with enticing marketing tactics, boasting sophisticated trading strategies or insider knowledge, all aimed at soliciting investments.

One high-profile example that demonstrates the dangers of forex scams is shady broker, EverFX. Part of a global fraudulent trading network known as the Milton group, they defrauded unsuspecting investors out of over a billion dollars.

Operating through various brands, the scam involved aggressive phone calls, manipulation of vulnerable individuals, and redirection to unregulated entities, resulting in significant financial losses for victims who often fell prey to the elaborate scheme promoted through social media adverts.

This underscores the importance of due diligence. You must thoroughly research forex trading platforms, verify credentials, and be wary of unrealistic promises or high-pressure sales tactics.

Research, skepticism, and cautious decision-making are your best allies against forex scams. Never invest based solely on promises of unrealistic returns or high-pressure tactics.

What Are Common Forex Trading Scams?

Forex trading scams come in various guises. These are the most prevalent types of scams we see:

- Phantom Brokers Scams: Unregulated or unlicensed forex brokers entice you with promises of low spreads, high leverage, and guaranteed profits. However, they manipulate currency trades, increase spreads, refuse withdrawals, or vanish with your funds.

- Ponzi Scheme Scams: Fraudulent operators promise high returns by using funds from new forex traders to pay earlier investors. This creates a false impression of profitability until the scheme collapses, leaving most participants with losses.

- Signal-Seller Scams: Individuals or companies claim to offer insider information or trading signals that guarantee profits. Often, these signals are bogus, leading you to make losing trades or pay hefty fees for useless information.

- Robot/Expert Advisors (EAs) Scams: Scammers sell automated trading systems or robots that supposedly generate huge profits from the forex market without any effort from yourself. These systems often fail to deliver the promised results and typically wipe out trading accounts.

- Mirror Trading Scams: Mirror trading platforms claim to replicate the currency trades of successful traders automatically. However, some of these platforms may manipulate results, showcasing fictitious successful trades or using deceptive tactics to lure you into subscribing to their services.

- Education Scams: Some entities offer expensive forex training courses or seminars promising to teach foolproof trading strategies. However, these courses may lack substance, providing generic or outdated information without delivering the promised results.

- Fake Trading Platform Scams: Scammers create fraudulent trading platforms that mimic legitimate ones. Only after you’ve deposited funds into these platforms will you realize they have no actual access to the forex market, resulting in the complete loss of funds.

- Personal Data Scams: Dodgy forex brokers may use unauthorized or deceptive collection, misuse, or sale of your personal information for fraudulent purposes.

- Phishing & Malware: Scammers may use phishing emails, fake websites, or malware to gain access to your accounts or sensitive information. They might impersonate legitimate forex brokers or platforms to steal login credentials or personal data.

- Regulatory Impersonation: Fraudsters may pose as representatives of regulatory agencies, claiming to offer compensation or settlements for losses suffered in forex trading. They use this guise to extract sensitive information or fees.

How To Avoid Forex Trading Scams

To safeguard yourself against forex trading scams, it’s essential to adopt a vigilant and informed approach. Follow our 5 top tips:

- Verify the legitimacy of forex day trading platforms and brokers by checking their regulatory status with credible financial authorities. Reputable brokers are typically registered and adhere to regulatory standards, providing a layer of investor protection.

- Avoid falling for promises of extravagant returns with minimal risk. Be wary of high-pressure sales tactics or unsolicited offers that guarantee quick profits. If something sounds too good to be true, it often is.

- Scrutinize the background and track record of forex trading educators. Seek reviews from multiple credible sources to gauge their reputation and ensure they have a history of delivering on their promises. Legitimate educators focus on comprehensive education rather than promising effortless gains, offering valuable insights into forex trading without exaggerated claims.

- Never share sensitive personal or financial information in response to unsolicited communication. Be cautious of phishing attempts or fraudulent forex brokers seeking your details. Stick to reputable, secure communication channels and avoid engaging with suspicious entities.

- Use forex demo accounts extensively to practice and refine your trading strategies before venturing into real trading. This helps build confidence and familiarizes you with market dynamics without risking your capital.

What To Do If You’ve Been Scammed

The fundamental principle to prevent forex trading scams is to avoid involvement initially, leaving little recourse afterwards. However, attempt to engage with the broker or individual to negotiate a withdrawal of your funds, outlining steps you’ll take if they refuse to comply.

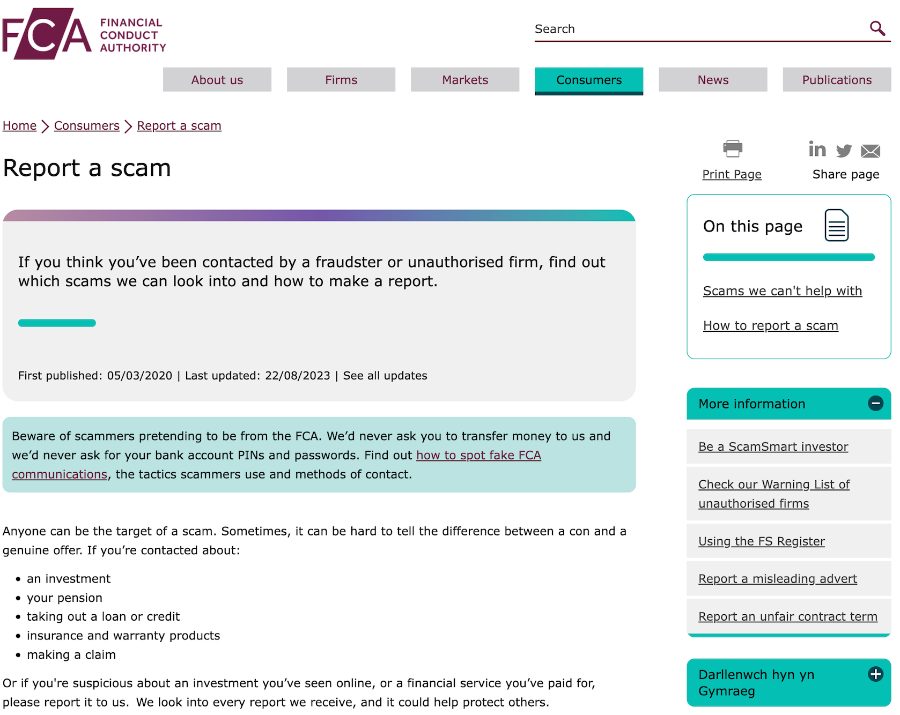

If your broker won’t comply, or you’ve fallen victim to another type of scam, it’s important to report the incident to the relevant authority. For individuals in the UK, for example, you can file a report to the FCA.

Additionally, sharing your experience with the forex community serves as a proactive step to prevent others from encountering the same fraudulent scheme. You can leave a comment on any broker review published on our website, for example.

By narrating your story, you contribute to raising awareness and safeguarding fellow day traders against potential forex scams.

Bottom Line

You can take various steps to shield yourself from forex trading scams. Begin cautiously by utilizing demo accounts and gradually increase investments only when confident in your broker’s reliability. Prioritize thorough research upfront as options become limited once capital is invested.

While the industry is making strides in combating fraudsters, the responsibility still rests on you to educate yourself on avoiding forex trading scams. It’s also largely up to you to find a trusted forex broker.

Remain vigilant against emerging forex scams as the enticing promise of substantial profits continuously attracts newer and more advanced scammers to this market.

If you are looking to invest hard-earned income that you can’t afford to lose, avoid trading in foreign exchange altogether.

FAQ

Can I Get My Money Back From A Forex Scam?

Recovering money from a forex scam can be challenging and depends on various factors like the scam’s nature, jurisdiction, and the resources available to pursue legal action.

Initiating a chargeback through your payment method, reporting the scam to relevant financial authorities, seeking legal counsel, and cooperating with investigative agencies might increase the chances of recovering some funds.

However, success in retrieving money from a forex scam isn’t guaranteed and often requires swift and thorough action, along with a bit of luck.

Are Forex Signals A Scam?

Forex signals themselves aren’t inherently scams, as they’re essentially trade ideas or recommendations shared by traders or automated systems.

However, the forex signal industry is susceptible to scams due to the presence of fraudulent providers offering inaccurate or manipulated signals for profit.

Scrutinize signal providers, verify their track records, and exercise caution before blindly following any signal, as relying solely on forex day trading signals without understanding market dynamics can lead to losses.

Is Forex Trading Like A Pyramid Scheme?

Forex trading operates within the financial markets and involves buying, selling, and exchanging currencies. It’s a legitimate market governed by global financial regulations.

Unlike a pyramid scheme, where profits primarily come from recruiting others into the scheme, forex trading relies on market movements and strategies for profit generation.

While forex scams do exist, legitimate trading involves analyzing market trends and making informed decisions rather than relying on recruitment for earnings.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com