Best Day Trading Platforms and Brokers in Sweden 2026

To place short-term trades on local and global financial markets, such as currency pairs containing the Swedish krona (SEK) or stocks listed on the Nasdaq Stockholm, you’ll need an online broker.

The Financial Supervisory Authority of Sweden, Finansinspektionen (FI), regulates the financial markets, and by extension trading providers. But other EU brokers can onboard Swedes through the region’s passporting scheme.

Discover DayTrading.com’s pick of the best day trading brokers in Sweden. Every platform accepts Swedes, while some excel with local securities, SEK accounts, and convenient deposit options like Sweden’s Klarna.

Top 6 Platforms For Day Trading In Sweden

After our extensive tests, these 6 brokers have proven to be the top choices for short-term traders in Sweden:

-

1

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

2

Skilling65% of retail investor accounts lose money when trading CFDs with this provider.

Skilling65% of retail investor accounts lose money when trading CFDs with this provider. -

3

XM

XM -

4

AvaTrade

AvaTrade -

5

Trade Nation

Trade Nation -

6

IC Trading

IC Trading

This is why we think these brokers are the best in this category in 2026:

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- Skilling - Skilling is a multi-asset broker founded in 2016 and based in Cyprus. The brand offers hundreds of day trading instruments with competitive spreads from 0.1 pips and beginner-friendly platforms. Skilling are also regulated in Europe and beyond with a transparent pricing structure. You can sign up and start trading in three easy steps.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

- Trade Nation - Trade Nation is a top FX and CFD broker regulated in multiple jurisdictions including the UK and Australia. The firm offers low-cost fixed and variable spreads on 1000+ assets with robust trading platforms and training materials. The Signal Centre can also be used for trade ideas.

- IC Trading - IC Trading is part of the established IC Markets group. Built for serious traders, it boasts some of the most competitive spreads, reliable order execution, and advanced trading tools. The catch is that it’s registered in the offshore financial centre of Mauritius, enabling it to offer high leverage but in a weakly regulated trading setting.

Best Day Trading Platforms and Brokers in Sweden 2026 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage | Regulator |

|---|---|---|---|---|---|

| Eightcap | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:30 | ASIC, FCA, CySEC, SCB |

| Skilling | 1000 SEK | Forex, CFDs, Stocks, Indices, Commodities and Cryptos | Skilling Trader, MT4, cTrader, TradingView | 1:30 (Retail) | CySEC |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:30 | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| AvaTrade | $100 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Trade Nation | $0 | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) | TN Trader, MT4 | 1:500 (entity dependent) | FCA, ASIC, FSCA, SCB, FSA |

| IC Trading | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures | MT4, MT5, cTrader, AutoChartist, TradingCentral | 1:500 | FSC |

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- Eightcap added TradeLocker in 2026, marking it out as the best regulated TradeLocker broker, while still delivering Eightcap's ultra-fast execution and low fees for active traders on the charting software.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

Cons

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

Skilling

"Skilling maintains its position as a top pick for beginners looking for a competitive zero commission account with direct access to a copy trading feature. It will also serve experienced strategy providers looking to earn commissions, or anyone looking to trade forex during extended hours."

William Berg, Reviewer

Skilling Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Stocks, Indices, Commodities and Cryptos |

| Regulator | CySEC |

| Platforms | Skilling Trader, MT4, cTrader, TradingView |

| Minimum Deposit | 1000 SEK |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) |

| Account Currencies | USD, EUR, GBP, SEK, NOK |

Pros

- The €100 deposit and zero commissions in the Standard account are accessible for beginners

- The broker offers smooth account funding with a good range of payment methods with zero deposit fees

- Excellent third-party charting platforms are available for serious day traders, with dozens of technical indicators and advanced order types

Cons

- You can only access shares in the Skilling Trader platform and fewer instruments are available overall in the MT4 accounts

- Skilling trails alternatives like IG when it comes to research tools that can help day traders make informed decisions

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s customer support has delivered over years of testing, with 24/5 assistance in 25 languages, response times of under 2 minutes and a growing Telegram channel.

Cons

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

Cons

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

Trade Nation

"Trade Nation is a good choice for newer traders looking for a wide range of financial markets on a user-friendly platform. There is no minimum deposit, free funding options and strong education."

William Berg, Reviewer

Trade Nation Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, Indices, Shares, Commodities, Futures, Bonds, Spread Betting, Cryptos (Bahamas Entity Only) |

| Regulator | FCA, ASIC, FSCA, SCB, FSA |

| Platforms | TN Trader, MT4 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.1 Lots |

| Leverage | 1:500 (entity dependent) |

| Account Currencies | USD, EUR, GBP, AUD, ZAR, SEK, NOK, DKK |

Pros

- There is a low minimum deposit for beginners

- The trading firm offers tight spreads and a transparent pricing schedule

- A choice of trading platforms and apps, including MT4, make the brand a good fit for savvy traders

Cons

- Fewer legal protections with offshore entity

IC Trading

"With superior execution speeds averaging 40 milliseconds, deep liquidity, and powerful charting software, IC Trading delivers an optimal trading environment tailored for scalpers, day traders, and algorithmic traders. "

Christian Harris, Reviewer

IC Trading Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Cryptos, Futures |

| Regulator | FSC |

| Platforms | MT4, MT5, cTrader, AutoChartist, TradingCentral |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Trading offers unusual flexibility in its accounts, enabling traders to open up to 10 live and 20 demo accounts, meaning you can run separate profiles for different activities, such as manual trading and algo trading.

- The simplified and digital account opening process saves time and effort, allowing traders to start trading sooner without extensive paperwork, taking just minutes during testing.

- IC Trading provides industry-leading spreads, including 0.0-pip spreads on major currency pairs such as EUR/USD, making it ideal for day traders.

Cons

- Unlike IC Markets, IC Trading does not support social trading through the group’s IC Social app or the third-party copy trading platform ZuluTrade.

- The educational resources are greatly in need of improvement, unless you navigate to the IC Markets website, posing a limitation for beginners in search of a comprehensive learning journey, especially compared to category leaders like eToro.

- Despite being part of the trusted IC Markets group, IC Trading is authorized by a weak regulator - the FSC of Mauritius, with limited financial transparency and regulatory safeguards.

Methodology

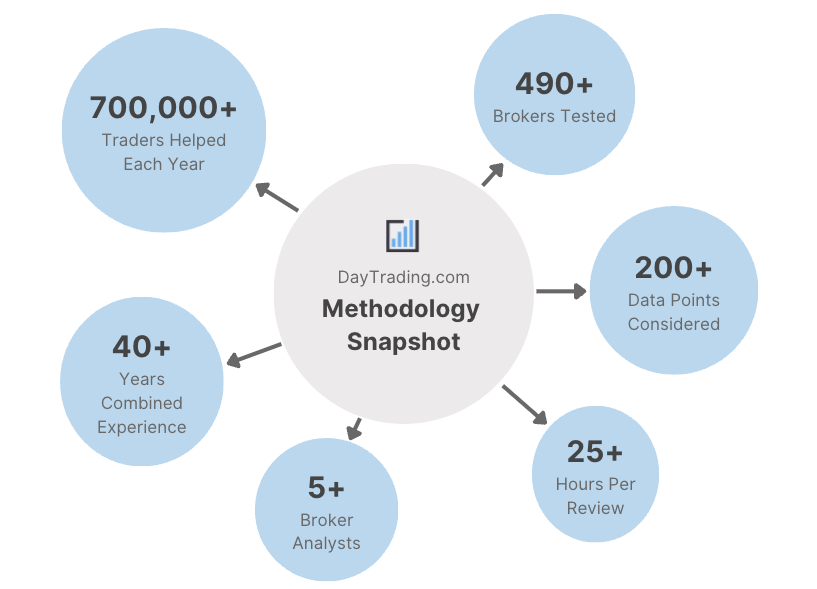

To find the best day trading platforms in Sweden, we scoured our database spanning hundreds of online brokers and removed any that don’t accept Swedish traders.

We then ranked the remaining brokers by their overall rating, which combines 200+ data points with our findings from hands-on tests.

- We verified that each broker accepts Swedish day traders.

- We recommended brokers we trust after evaluating their regulatory credentials.

- We favored brokers with a range of financial markets such as Swedish stocks.

- We prioritized brokers with competitive day trading fees.

- We ensured that each broker offers excellent charting platforms.

- We preferred brokers with transparent leverage and margin requirements.

- We investigated each broker’s execution speed and quality.

- We confirmed account funding was convenient for Swedish traders.

How To Choose A Day Trading Broker In Sweden

Our many years evaluating trading platforms of all stripes have helped us pinpoint the key factors to consider:

Trust

Choose a well-regulated broker to help protect you from trading scams. This is especially important given the rise in clone investment websites across Scandinavia in recent years, as reported by Finance Feeds.

We recommend brokers we trust, and preferably with authorization from a respected authority in line with DayTrading.com’s Regulation & Trust Rating. Additionally, we look for long-standing providers with large, active client bases and transparent trading practices.

In Sweden, the Financial Supervisory Authority (FI) oversees the financial markets and trading providers.However, you can also sign up with other brokers regulated in the European Economic Area (EEA) through the region’s passporting initiative.

- AvaTrade remains one of our most trusted brokers with a 4.8/5 trust score, EU licensing from CySEC (Cyprus) and CBI (Ireland), and a long history since 2006. Clients also benefit from robust safety measures including negative balance protection and the broker’s own risk management tool, AvaProtect.

Financial Markets

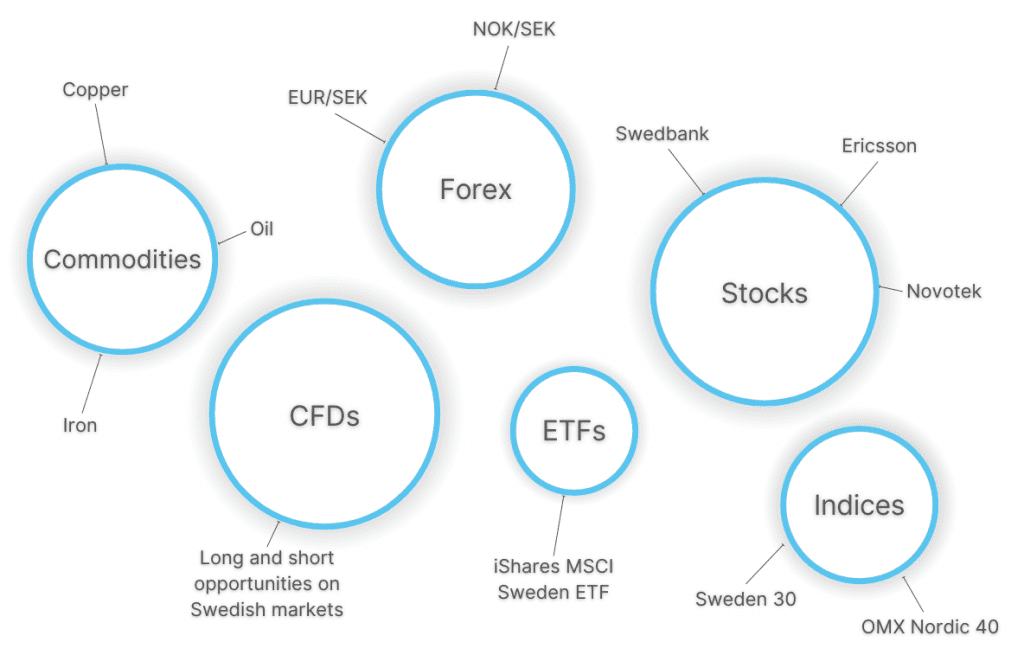

Choose a broker that provides access to the asset classes that you’re interested in, enabling you to spread your risk and capitalize on diverse trading opportunities.

For Swedish traders, this may include currency pairs involving the Swedish krona (SEK) such as EUR/SEK, as well as stocks listed on the Nasdaq Stockholm, such as Swedbank and Novotek.

Swedes may also be interested in the country’s chief export commodities like oil and iron ore.

- Pepperstone’s range of markets outshines most competitors and includes minor currency pairs like CHF/SEK and NOK/SEK, popular ETFs like the iShares MSCI Sweden ETF, various Nasdaq Stockholm-listed stocks, plus notable commodities like oil and copper.

Trading Fees

Choose a broker with competitive, transparent costs, which can quickly accumulate for active traders.

The most common costs you’ll incur are spreads and commissions, though we also evaluate non-trading fees such as inactivity charges or costs for depositing in Swedish krona if your trading account is based in say euro. Brokers with SEK trading accounts help Swedish traders minimize or eliminate conversion fees.

Also consider whether any additional tools justify higher fees. For example, analyst insights into the Nordic stock market or fiscal updates from the Riksbank, which could impact the value of the krona, could be valuable for aspiring traders.

- IC Trading continues to offer among the lowest fees we’ve seen, with spreads from 0.3 on EUR/SEK, 2.0 on NOK/SEK and 0.380 on the Sweden 30 index. Commissions are competitive, starting from $3 per side. Also, you get an economic calendar where you can filter for Swedish events, plus trading data via its blog.

Charting Platforms

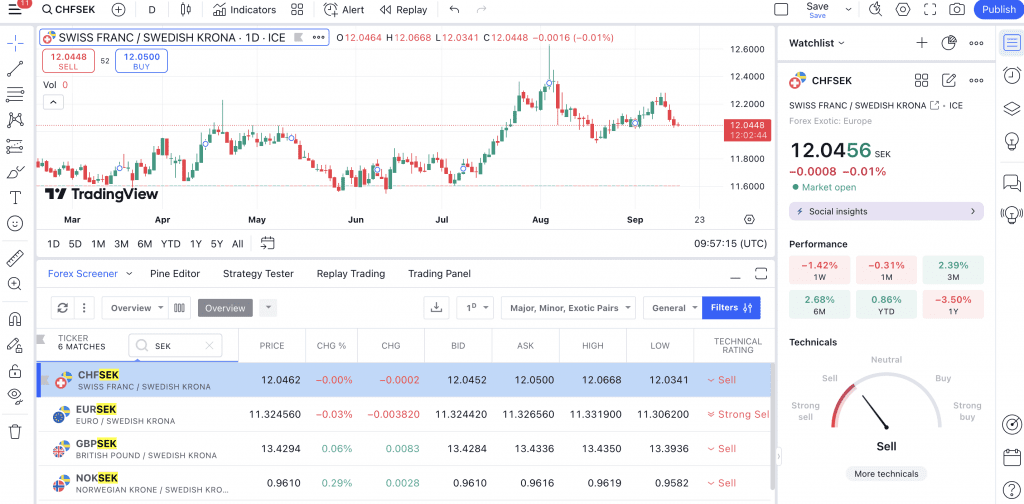

Choose a broker with a reliable and powerful charting platform for technical analysis – a popular way active traders identify short-term trading opportunities.

Terminals like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader and TradingView are preferred by many day traders for their comprehensive range of charting features, including technical indicators and timeframes. At least one of these is available at most reputable brokers.

However, we’ve found proprietary platforms available at some firms, often with scaled-down features and streamlined interfaces, offer a smoother entry point for beginners.

- Eightcap delivers a superior range of charting platforms catering to day traders at every level, including TradingView, MT4 and MT5, available via desktop and web. The broker also stands out with its intuitive Capitalise.ai automated trading tool and comprehensive FlashTrader risk management software.

Leverage Requirements

Choose a broker that is upfront about the risks and requirements of trading with leverage, an approach adopted by many day traders.

Leverage gives you exposure to larger positions whilst only requiring a small cash outlay (known as margin).

Let’s say I want to trade EUR/SEK with leverage of 1:20 and a down payment of €250.This would mean the value of my position would magnify by 20, to €5,000.

Whilst this can magnify gains by a factor, in this case 20x, it can also contribute to heavy losses. Therefore, solid risk management and a sound understanding of your broker’s margin requirements are essential.

- Deriv’s leverage requirements are clearly displayed within its platform, available up to 1:30 for Swedes. It’s also one of the few brokers to offer multipliers, which offers a straightforward way to speculate on markets.

Execution Quality

Choose a broker that executes trades swiftly and efficiently. Day traders rely on precise execution more than longer-term traders, who aren’t typically as impacted by narrow margins.

We assess this by examining execution speeds whenever data is available. We also take into account latency and slippage, which measure the time delay and price difference between when a trade is placed and executed.

- FOREX.com offers ultra-fast execution speeds averaging 30 milliseconds, making the broker ideal for active traders. Execution stats are also impressive, with 99.99% of limit orders filled at the requested price or better.

Account Funding

Choose a broker that makes deposits and withdrawals to your trading account a breeze.

Most brokers that we evaluate allow you to open an account with €250 or less (approximately SEK 2800), though some have no minimum deposit, making them ideal for beginners.

Also consider whether the broker that offers convenient funding solutions, which could help you save on transaction costs. According to Pay.com, Klarna remains one of the top five payment methods in Sweden.

FAQ

Who Regulates Day Trading Platforms In Sweden?

The Finansinspektionen (FI) is responsible for overseeing the financial markets in Sweden, and by extension, online trading providers.

That said, other brokers in the EEA can also onboard Swedish traders through the region’s passporting initiative. If you go down this route, it’s important to continue following FI regulations and Sweden’s tax rules.

Which Is The Best Broker That Accepts Day Traders From Sweden?

Use DayTrading.com’s pick of the best day trading brokers in Sweden to find the right provider for you.

Pepperstone, for example, offers a terrific range of Swedish markets, from SEK FX pairs to local securities, whilst eToro offers accessible funding for Swedes with SEK deposits and payment options like Trustly and PayPal.

Recommended Reading

Article Sources

- Finansinspektionen (FI)

- Nasdaq European Stock Data

- Scandinavian Capital Markets Warns of Fake Clone Website - Finance Feeds

- Riksbank

- Swedbank - Nasdaq Nordic

- Novotek - Nasdaq Nordic

- Payment Methods in Sweden - Pay.com

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com