Best Day Trading Platforms and Brokers in Canada 2026

The best day trading brokers in Canada offer high-quality charting platforms, competitive pricing, margin trading and fast execution.

Many firms are regulated by the Canadian Investment Regulatory Organization (CIRO) and offer tailored conditions for Canadian day traders, including live accounts denominated in the Canadian Dollar (CAD). They also provide access to popular markets such as the Toronto Stock Exchange (TSX) and currency pairs like the USD/CAD.

Here you will find the best brokers for day trading in Canada. Each platform accepts Canadian investors and has been tested rigorously by our experts using demo or real-money accounts.

Best 6 Platforms For Day Trading In Canada

After evaluating hundreds of online platforms, these are the top 6 brokers for day trading in Canada:

-

1

FXCC

FXCC -

2

IC Markets

IC Markets -

3

Eightcap71% of retail traders lose money when trading CFDs

Eightcap71% of retail traders lose money when trading CFDs -

4

Fusion Markets

Fusion Markets -

5

Qtrade

Qtrade -

6

AvaTrade

AvaTrade

Here is a summary of why we recommend these brokers in January 2026:

- FXCC - FXCC is an established broker that’s been offering low-cost online trading since 2010. Registered in Nevis and regulated by the CySEC, it stands out for its ECN trading conditions, no minimum deposit and smooth account opening that takes less than 5 minutes.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Eightcap - Eightcap is a multi-regulated forex and CFD broker established in Australia in 2009. The broker has proven popular with active day traders, providing 800+ instruments with tight spreads and notable improvements in recent years, integrating the leading TradingView platform, alongside AI-powered financial calendars and algo trading tools with zero coding experience required.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- Qtrade - Qtrade is an award-winning Canadian financial services firm that offers a selection of investing accounts with $8.75 and $6.95 stocks, mutual fund trades and 100+ commission-free ETFs. This is a long-running brand that is well regarded in Canada, where many investors choose it to build their savings account or pension pot. QTrade is also highly trusted and authorized by the Canadian Investment Regulatory Organization (CIRO).

- AvaTrade - Established in 2006, AvaTrade is a leading forex and CFD broker trusted by over 400,000 traders. Operating under regulation in 9 jurisdictions, AvaTrade processes an impressive 2+ million trades each month. Through like MT4, MT5, and its proprietary WebTrader, the broker provides a growing selection of 1,250+ instruments. Whether it’s CFDs, AvaOptions, or the more recent AvaFutures, short-term traders at all levels will find opportunities. With terrific education and 24/5 multilingual customer support, AvaTrade delivers the complete trading experience.

Best Day Trading Platforms and Brokers in Canada 2026 Comparison

| Broker | CAD Account | CIRO Regulated | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|---|---|

| FXCC | - | - | $0 | CFDs, Forex, Indices, Commodities, Crypto | MT4, MT5 | 1:500 |

| IC Markets | ✔ | - | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Eightcap | ✔ | - | $100 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, TradingView | 1:500 |

| Fusion Markets | ✔ | - | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| Qtrade | ✔ | ✔ | $0 | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs | TradingCentral | - |

| AvaTrade | ✔ | ✔ | $300 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade | 1:30 (Retail) 1:400 (Pro) |

FXCC

"FXCC continues to prove itself an excellent option for forex day traders with an extensive range of 70+ currency pairs, ultra-tight spreads from 0.0 pips during testing, and high leverage up to 1:500 in the ECN XL account. "

Jemma Grist, Reviewer

FXCC Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Commodities, Crypto |

| Regulator | CySEC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP |

Pros

- FXCC is trusted and licensed by the CySEC, a top-tier European regulator offering high standards of safeguarding

- FXCC has added MT5, and in our hands-on tests, it matched MT4’s trading conditions with fast execution, enhanced charting, and depth of market tools.

- Competitive and transparent ECN spreads from 0.0 pips with zero commissions, making FXCC one of the cheapest forex brokers

Cons

- There is a threadbare selection of research tools like Trading Central and Autochartist, value-add features available at category leaders like IG

- FXCC’s MetaTrader-only offering is a drawback compared to many alternatives, notably AvaTrade which provides five platforms to suit different trader preferences

- While the range of currency pairs exceeds most alternatives, the selection of additional assets is narrow, and notably, there are no stocks

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- IC Markets secured DayTrading.com's 'Best MT4/MT5 Broker' in 2025 for its seamless, industry-leading MetaTrader integration, refined over years to maximize the platform experience.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

Eightcap

"Eightcap delivers in every area for day traders with a growing selection of charting platforms, education via Labs, and AI-powered tools. Now sporting 120+ crypto CFDs, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

Christian Harris, Reviewer

Eightcap Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, FCA, CySEC, SCB |

| Platforms | MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, SGD |

Pros

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Having excelled across all key areas for day traders, Eightcap outperformed every competitor to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title for 2025 and 'Best TradingView Broker' for 2025.

- After bolstering its roster in 2021, Eightcap offers one of the most extensive selections of cryptocurrency CFDs in the market, with crypto/fiat pairs, crypto/crypto pairs, plus crypto indices for broader exposure to the market.

Cons

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of 800+ instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

- Despite a useful library of educational guides and e-books in Labs, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

- Fusion Markets offers best-in-class support with very fast, friendly and helpful responses during tests and no frustrating automated chatbot to navigate.

Cons

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

- Traders outside of Australia must sign up with weakly regulated global entities with limited safeguards and no negative balance protection.

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

Qtrade

"Qtrade is a good match for Canadian traders who are looking for a reputable and regulated broker to make longer-term investments as well as leveraged trades."

William Berg, Reviewer

Qtrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, ETFs, Bonds, Mutual Funds, Options, GICs |

| Regulator | CIRO |

| Platforms | TradingCentral |

| Minimum Deposit | $0 |

| Minimum Trade | Variable |

| Account Currencies | USD, CAD |

Pros

- After years of testing, Qtrade has cemented its place as one of the best trading platforms in Canada, with easy-to-use software and a growing range of US and Canadian stocks as well as funds, ETFs and other assets.

- Qtrade’s new Options Lab, built with Trading Central provides trading ideas that match your goals, risk level, and experience - head to Investment Tools > Options Lab.

- Qtrade has teamed up with PersonaFin to launch “My News” - an AI-powered, personalized newsfeed built around your interests. Get timely insights from premium sources, discover trending topics fast, and explore smarter with AI-driven search.

Cons

- The transfer out fee is a nuisance and traders should be wary of the CAD to USD exchange charge.

- Commissions of $8.75 per equity can stack up for active stock traders, reducing its suitability for day traders.

- Qtrade doesn't offer trading opportunities on forex or crypto markets, potentially limiting its appeal if you're looking to build a diverse portfolio.

AvaTrade

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $300 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- Support at AvaTrade performed excellently during testing, with response times of 3 minutes and localized support in major trading jurisdictions, including the UK, Europe and the Middle East.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

Cons

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- The AvaSocial app is good but not great – the look and feel, plus the navigation between finding strategy providers and account management needs upgrading to rival category leaders like eToro.

How To Choose A Day Trading Broker In Canada

Based on our extensive experience in the industry, there are several factors to consider before registering with a day trading broker:

Choose A Regulated And Trusted Platform

Choosing a trusted brokerage will ensure you are protected from unfair trading practices and scams, some of which have been prevalent in Canada.

One example is the Alberta couple who operated a fake investment company and defrauded victims out of $1.3 million. Fernando Honorate de Silva Fagundes and his wife, Emilia Alas-As Elansin, used a phoney investment course to lure victims based in Alberta and British Columbia.

We therefore always check whether brokers are regulated by trusted authorities, such as the Canadian Investment Regulatory Organization (CIRO), which subject firms to strict monitoring and audit procedures.

We also look out for a long track record, a strong reputation and positive client reviews, especially in cases where a CIRO license isn’t present.

- Interactive Brokers continues to lead as one of the most heavily regulated firms that accept Canadian day traders. The broker has a long 40+ year history and is licensed by the CIRO, among other Green Tier authorities.

Choose A Broker With Competitive Day Trading Fees

It’s important to choose a broker with low trading and non-trading fees. Active day traders, in particular, are likely to accrue more transaction costs which can eat into profits.

We ensure that brokers offer competitive pricing for traders, including low spreads on popular assets like USD/CAD as well as non-trading fees like deposit and withdrawal charges.

In cases where higher costs are incurred, we consider the overall quality of the broker’s services along with the day trading tools provided to justify such expenses.

- Forex.com is one of the lowest-cost brokers based on our extensive testing, with forex spreads as low as 2.2 pips on USD/CAD, plus zero commissions and no deposit or withdrawal fees.

Choose A Broker With High-Quality Charting Platforms

Trading on a stable and reliable charting platform is key for day traders who typically require a range of technical tools for uncovering short-term market opportunities.

During our hands-on tests, we look out for high-quality and varied analysis tools suitable for all trading styles and experience levels. A selection of basic technical indicators such as moving averages, as well as more sophisticated solutions such as Ichimoku Cloud, will serve both beginners and seasoned analysts.

- Forex.com maintains its position as a top day trading broker, thanks to the availability of feature-rich charting platforms, MT4 and TradingView, plus additional tools for varied requirements, including Trading Central and SMART Signals.

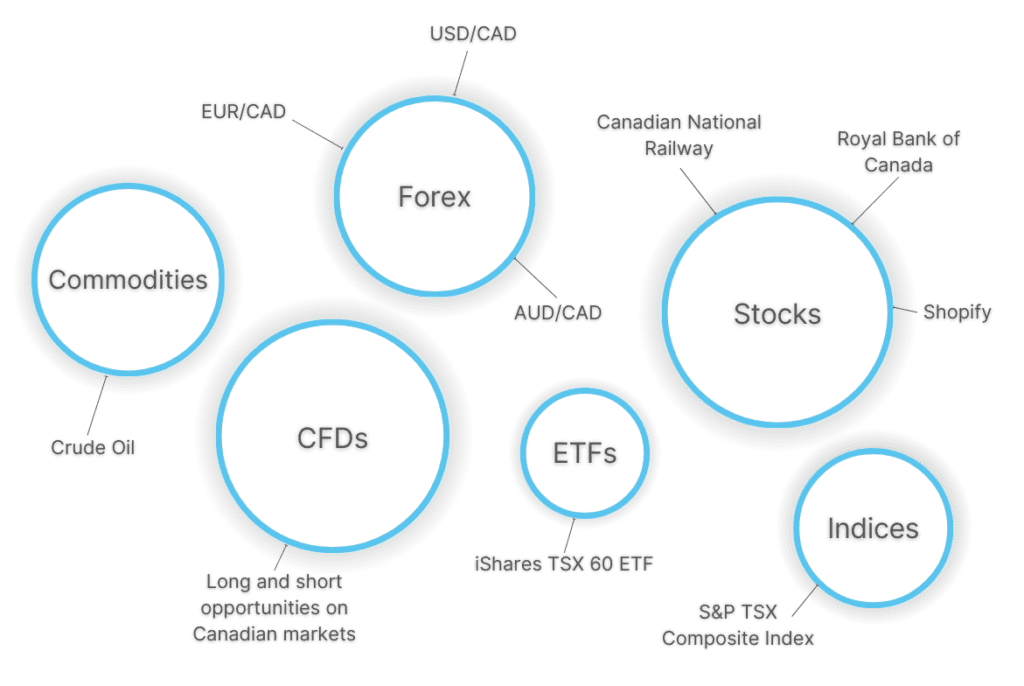

Choose A Broker With Diverse Market Coverage

The best online brokers in Canada offer access to a generous range of markets, including popular assets like USD/CAD, EUR/CAD or the Toronto Stock Exchange (TSX).

Most day traders aim to build a diversified trading portfolio, so we look for traditional short-term assets, alongside emerging investments that are popular in Canada, such as Cannabis stocks.

We also assess the availability of specific short-term trading vehicles, including contracts for difference (CFDs) which allow you to speculate on rising and falling prices without owning the underlying security.

- Interactive Brokers continues to offer an unmatched range of assets, with thousands of instruments from over 100 global market centers, including the Canadian Securities Exchange (CSE).

Choose A Broker With High-Quality Order Execution

Registering with a broker that delivers fast execution is vital for day trading strategies. Intraday traders require optimum conditions to secure the best chances of success, which means no latency or slippage.

The best brokers in Canada will ideally meet our execution speed benchmark of <100 milliseconds and deliver a high rate of order fulfilment.

Bear in mind that other factors can also affect execution quality, including the order size and the type of asset being traded.

For example, a large order may take more time to fill. Conversely, more liquid assets are typically easier to execute at favorable prices.

Choose A Broker That Supports Leverage And Margin Trading

Leverage trading allows you to boost your earnings with only a small initial outlay. Choosing a broker that offers sensible and flexible leverage is important for experienced day traders looking to increase their purchasing power.

For example, a broker may offer you 1:50 leverage (or 2% margin requirement) on the USD/CAD forex pair, which means if you deposit an initial sum of $1000, you have $50,000 to trade with.

However, it’s important to remember that your risk of losses also increases, so a solid risk management strategy is key. It’s also worth checking your broker’s individual margin rules.

- AvaTrade is a leading day trading platform offering transparent margin requirements. For example, the USD/CAD pair is offered with a 1.5% margin.

Choose A Broker With An Accessible Minimum Deposit

Choosing a broker with an accessible minimum deposit will ensure that you can start trading in line with your budget and financial situation. This is particularly vital for beginners with limited trading capital.

Most Canadian brokers require an initial deposit of <$500, though many of the brokers that we’ve personally tested go even lower.

- AvaTrade is a great option for Canadians since it offers a CAD account with an accessible starting deposit of 300 CAD.

Methodology

To find the best day trading platforms in Canada, we used both quantitative data and qualitative insights from our rigorous broker reviews, focusing on several factors:

- We confirmed that the broker accepts Canadian day traders.

- We checked whether the brokerage is regulated by a trusted authority, such as the CIRO.

- We prioritized brokers with competitive day trading fees.

- We favored brokers that deliver high-quality charting tools for short-term strategies.

- We checked for a wide range of assets and prioritized those with access to Canadian markets.

- We paid attention to the broker’s execution quality, including speeds and pricing.

- We focused on brokers with transparent margin and leverage requirements.

- We ensured all day trading platforms offer an accessible minimum deposit.

FAQ

Which Day Trading Brokers Accept Clients From Canada?

You can refer to our list of the best day trading brokers in Canada, many of which hold several top-tier licenses, including from the CIRO, and offer a range of assets popular in Canada.

How Much Capital Do I Need To Start Day Trading In Canada?

Most platforms that accept Canadian clients require a first deposit between $0 and $500.

We recommend that beginners opt for a low minimum deposit broker and trade only in small amounts to start with.

Who Regulates Day Trading Brokers In Canada?

The Canadian Investment Regulatory Organization (CIRO) is the authority responsible for licensing investment firms in Canada.

The CIRO works closely with Canada’s provincial umbrella organization, the Canadian Securities Administrators (CSA), which oversees the regulation of capital markets in the 10 provinces and 3 territories of Canada.

You can check your broker’s details on both the CSA and the CIRO registers.

Recommended Reading

Article Sources

- Canadian Investment Regulatory Organization (CIRO)

- Canadian Securities Administrators (CSA)

- Canadian Securities Exchange (CSE)

- Toronto Stock Exchange (TSX)

- Canadian Trading Scam

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com