Brokers With The Best Customer Support In 2026

Having a broker that can provide fast and reliable support is essential, especially for active traders. Yet with the rise of automated chatbots, we know many traders are growing frustrated with the assistance provided.

Fortunately, we’ve done the hard work – contacting and evaluating the level of support provided by over 450 brokers and counting. Dig into our pick of the trading brokers with the best customer service.

Top 6 Brokers For Customer Support

Based on our direct tests, these 6 brokers offer the best customer support for traders:

-

1

FOREX.com

FOREX.com -

2

Nexo

Nexo -

3

NinjaTrader

NinjaTrader -

4

InstaTrade

InstaTrade -

5

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

6

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

Why Are These Brokers The Best For Customer Support?

Here's a quick summary of why we believe these are the best brokers for customer service and support:

- FOREX.com is the broker with the best customer support in 2026 - When we tested FOREX.com, support agents impressed with their market knowledge and clear, confident answers across live chat, phone, and email. Response times were quick, even during peak hours. Multilingual support is available, and follow-ups were well-handled—ideal for active traders needing clarity fast, especially when managing positions in volatile markets.

- Nexo - During our testing, Nexo’s live chat support was very responsive, with initial replies in under a minute. Agents handled crypto-related questions especially confidently and sometimes struggled with more technical or account-specific queries. Email follow-ups were slower, as you'd expect, often taking over 24 hours.

- NinjaTrader - During our hands-on tests, NinjaTrader’s email support was detailed and handled by knowledgeable staff, even if live chat and phone availability were more limited compared to others. Response times varied and were notably faster during U.S. hours. While there’s no 24/7 support, follow-ups were thorough, which gave us confidence.

- InstaTrade - While using InstaTrade, live chat responses were fast, and agents provided clear guidance on account setup and platform use. Email follow-ups were generally timely, though complex queries occasionally required extra clarification. Multilingual support is available, offering accessible assistance for global traders who need dependable, hands-on service.

- Plus500US - When we tested Plus500 US, support was primarily via email and live chat for account and platform queries. Responses were generally clear and professional, especially on basics like market offerings, though more complex questions required longer follow-up times. The customer support is ultimately excellent for casual traders.

- eToro USA - eToro USA’s live chat for logged-in users was responsive and helpful in our recent tests, covering account setup and platform navigation clearly. Email follow-ups were consistent but not always immediate. Customer service remains user-friendly and dependable for retail traders in the U.S. market.

How Secure Are The Top Support Brokers?

Fund protection is key when you're actively trading. Here’s how these brokers protect your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| FOREX.com | ✘ | ✔ | ✔ | |

| Nexo | ✘ | ✘ | ✘ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Plus500US | ✘ | ✘ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ |

Are These Brokers Good For Beginners?

Good support matters even more for new traders. Here’s how else these brokers help beginners:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| Nexo | ✘ | $10 | $30 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| Plus500US | ✔ | $100 | Variable | ||

| eToro USA | ✔ | $100 | $10 |

Do These Brokers Support Advanced Traders?

Experienced traders also need quick answers, especially during volatile market sessions. Here's how these brokerages support serious traders:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Nexo | - | ✘ | ✘ | ✘ | - | ✘ | ✘ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Plus500US | - | ✘ | ✘ | ✘ | Variable | ✔ | ✘ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

Compare Detailed Ratings Of Top Brokers For Customer Support

We tested and scored each broker’s support performance, alongside other key areas, so you can see how they stack up:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| FOREX.com | |||||||||

| Nexo | |||||||||

| NinjaTrader | |||||||||

| InstaTrade | |||||||||

| Plus500US | |||||||||

| eToro USA |

How Well Used Are These Customer Support Leading Brokers?

We also considered broker popularity when evaluating the best platforms for customer support:

| Broker | Popularity |

|---|---|

| Plus500US | |

| InstaTrade | |

| Nexo | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Choose FOREX.com For Reliable Customer Support?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Why Choose Nexo For Reliable Customer Support?

"Nexo gives crypto traders the capability to trade, invest, lend and borrow digital assets in one place, and it’s especially good for its credit functions that pay out very high yields to lenders. However, its fees are relatively high and many day traders will prefer a more tightly regulated crypto broker."

Michael MacKenzie, Reviewer

Nexo Quick Facts

| Demo Account | No |

|---|---|

| Instruments | Cryptos |

| Platforms | Nexo Pro |

| Minimum Deposit | $10 |

| Minimum Trade | $30 |

| Account Currencies | USD, EUR, GBP |

Pros

- Reputable crypto exchange that has been in business since 2018 and has taken some steps toward regulation

- Value-add tools integrated into the trading platform including social media analysis and newsfeeds by asset

- Traders can access perpetual futures to open long or short positions on crypto assets, increasing strategic opportunities

Cons

- Very few educational resources are available, reducing its appeal to beginners who can find more helpful resources at category leaders like eToro

- High maker/taker fees mean day traders will pay more to trade derivatives than they would at some rival exchanges

- Although Nexo has registered with some reputable watchdogs, it is riskier to trade with than established crypto brokers like AvaTrade and Vantage

Why Choose NinjaTrader For Reliable Customer Support?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- You can get thousands of add-ons and applications from developers in 150+ countries

Cons

- The premium platform tools come with an extra charge

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

Why Choose InstaTrade For Reliable Customer Support?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

Cons

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

Why Choose Plus500US For Reliable Customer Support?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

- The straightforward account structure, pricing model and web platform offer an easier route into futures trading than rivals like NinjaTrader

Cons

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

Why Choose eToro USA For Reliable Customer Support?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- A free demo account means new users and prospective day traders can try the broker risk-free

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

Cons

- Average fees may cut into the profit margins of day traders

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

How DayTrading.com Chose The Best Brokers For Customer Support

Our team conducted hands-on testing of the customer support at each shortlisted broker using multiple channels, including live chat and email.

We evaluated response times, availability, professionalism, and the depth of knowledge in each interaction. Each broker’s support team was tested with real questions from our experts, who then assigned each one a rating.

Based on these customer support ratings, we ranked the top brokers for their trading assistance.

What To Look For In A Broker’s Customer Service Offering

Based on our hands-on testing and years operating trading accounts in our personal time, here are the most critical features to prioritize in a broker’s customer service:

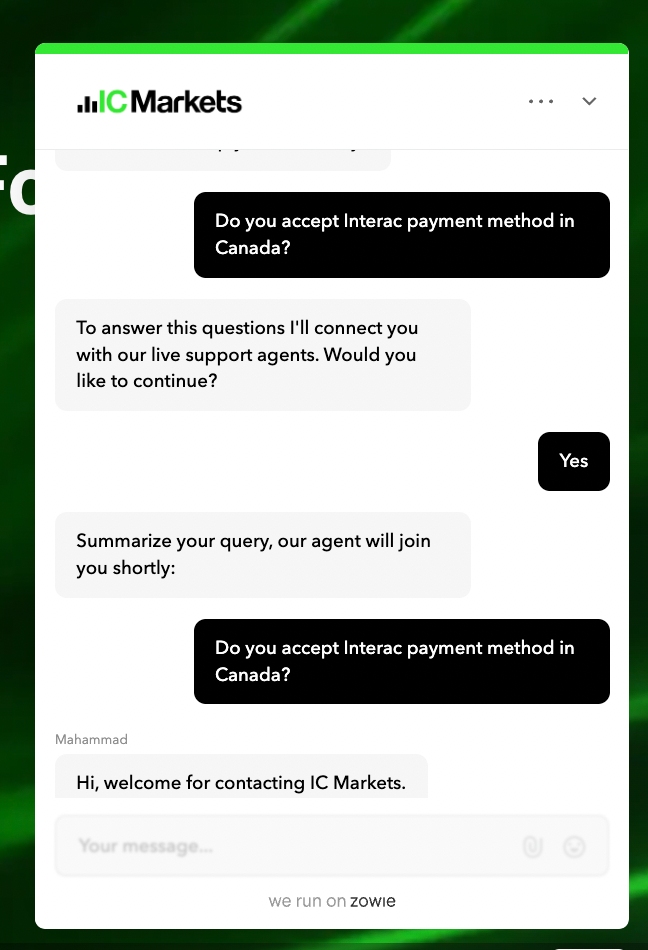

- Live Human Support – Fast. Avoid brokers relying primarily on bots or email-only support. Look for 24/5 or 24/7 live chat staffed by humans. FOREX.com, IC Markets, and XM consistently responded in under a minute during testing.

Support That Knows the Market. Trading is complicated. Your broker’s agents should understand trading platforms, order types, slippage, leverage, and more. IG, Pepperstone, and Dukascopy delivered unscripted, confident responses to complex questions during our tests. - Weekend & After-Hours Coverage. For crypto or global market traders, support should be available when you need it (not just 9–5 Monday–Friday). This is key when we’re seeing a growing number of brokers introduce extended hours trading. Videforex and RaceOption provide round-the-clock live chat, though depth of knowledge may vary from our experience.

- Multilingual Assistance. Global access matters. Top brokers offer support in multiple languages – not just English. XM, CMC Markets, and Fusion Markets excelled in international accessibility when we used them.

- Prompt, Professional Follow-Ups. A good broker doesn’t just answer – they follow up to resolve the issue fully. Trade Nation, IG, and Fusion Markets impressed during our investigations, with timely, clear email follow-through.

Why Great Customer Support Matters For Active Traders

In high-speed day trading, timing is everything. A delay of even a few minutes can lead to missed opportunities or significant losses.

Unfortunately, many brokers we use now are steering traders to automated chatbots that are slow, unhelpful, and often incapable of handling complex issues – leading to a poor, frustrating and time-wasting user experience.

Here are some realistic, high-stakes scenarios that highlight why choosing a broker with exceptional customer service is non-negotiable for serious traders:

Locked Out Before A Volatile Market Move

- You’ve left positions open before the weekend, planning to manage them on Saturday as news breaks.

- Suddenly, you’re locked out of your account, and the password reset email never arrives.

- The broker uses a chatbot-only system – no live agents on weekends. Multiple tickets go unanswered until Monday.

- By then, the market’s moved. You miss the ideal exit window and suffer major losses.

- With a broker like IC Markets or Dukascopy, you get 24/7 live human support, with agents able to troubleshoot account access issues in real time – even on weekends.

Funds Missing, Chatbot Loop Begins

- You initiate a withdrawal on Wednesday. By Monday, the funds still haven’t arrived.

- You try contacting support, only to be looped through generic bot prompts asking the same irrelevant questions.

- When a human finally steps in, they request unclear documentation and offer no timeline.

- Your capital is tied up, stopping you from entering promising trades.

- Pepperstone or CMC Markets have knowledgeable agents available fast who give clear timelines and don’t bury you in red tape.

Bottom Line

If you’re an active trader, such as a day trader, poor customer support is more than an inconvenience – it’s a liability. Choose a broker that equips you with real, knowledgeable human support when it matters most.

To get started, see our pick of the brokers with the best customer support for traders.