Best Day Trading Platforms and Brokers in Russia 2026

As the 11th largest global export economy with vast reserves of natural resources, such as oil and natural gas, Russia offers ample short-term trading opportunities.

If you’re interested in trading currency pairs containing the volatile Russian ruble (RUB), energy commodities, or stocks listed on the Moscow Exchange (MOEX), you need an online broker.

The Central Bank of the Russian Federation (CBR) regulates local brokers, but residents can also register with overseas firms as long as they adhere to Russian laws and tax requirements.

We’ve shortlisted the best day trading platforms in Russia. Every broker accepts Russian traders and many support popular payment methods in the country, such as WebMoney and Yandex Money.

Top 6 Platforms For Day Trading In Russia

Our hands-on tests indicate the following 6 platforms stand out from the crowd for Russian day traders:

Here is a summary of why we recommend these brokers in March 2026:

- VT Markets - Founded in 2015, VT Markets maintains its position as a top Australian multi-asset CFD broker. With 1000+ tradeable instruments and support for the MetaTrader 4 and MetaTrader 5 platforms, this broker delivers a wide range of day trading opportunities to over 400,000 clients worldwide. VT Markets is regulated by the ASIC, FSCA, and FSC.

- XM - XM is a globally recognized forex and CFD broker with 15+ million clients in 190+ countries. Since 2009, this trusted broker has been delivering low trading fees across its growing roster of 1000+ instruments. It’s also highly regulated, including by ASIC, CySEC and DFSA and SCA in the UAE, and offers a comprehensive MetaTrader experience.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

- Fusion Markets - Fusion Markets is an online broker established in 2017 and regulated by the ASIC, VFSC and FSA. It is best known for its low-cost forex and CFD trading, although its multiple account types and copy trading solutions cater to a range of traders. New clients can sign up and start trading in 3 easy steps.

- FBS - Founded in 2009, FBS is an award-winning CFD broker operating in over 150 countries with a client base exceeding 27 million traders. Traders are supported at every stage of their journey with 24/7 assistance, market analytics, trading calculators, and competitive pricing with zero commissions.

- BlackBull - BlackBull is a New Zealand-based CFD broker providing diverse trading opportunities on over 26,000 instruments. After undergoing a rebrand in 2023, it now sports a modern look and feel complete with professional-grade trading tools and ultra-fast execution speeds averaging 20ms.

Best Day Trading Platforms and Brokers in Russia 2026 Comparison

| Broker | Minimum Deposit | Markets | Platforms | Leverage |

|---|---|---|---|---|

| VT Markets | 50 - 500 USD | CFDs, Forex, Commodities, Stocks, Indices | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral | 1:500 |

| XM | $5 | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies | MT4, MT5, TradingCentral | 1:1000 |

| IC Markets | $200 | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Fusion Markets | $0 | CFDs, Forex, Stocks, Indices, Commodities, Crypto | MT4, MT5, cTrader, TradingView, DupliTrade | 1:500 |

| FBS | $5 | CFDs, Forex, Indices, Shares, Commodities | FBS App, MT4, MT5 | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| BlackBull | $0 | CFDs, Stocks, Indices, Commodities, Futures, Crypto | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist | 1:500 |

VT Markets

"VT Markets is a great choice for regular traders who are looking for very tight spreads and powerful charting software. The broker's share CFD offering is particularly strong, with hundreds of commission-free assets spanning multiple global markets."

Tobias Robinson, Reviewer

VT Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Commodities, Stocks, Indices |

| Regulator | ASIC, FSCA, FSC |

| Platforms | VT Markets App, Webtrader, Web Trader+, MT4, MT5, TradingCentral |

| Minimum Deposit | 50 - 500 USD |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- VT Markets offers free 90-day demo accounts allowing traders to thoroughly test their short-term strategies

- Market-leading MetaTrader 4 and MetaTrader 5 charting platforms are offered, with advanced technical capabilities and access to Expert Advisors (EAs)

- A proprietary copy trading service, VTrade, is available on two platforms, with access to 100+ providers

Cons

- Unlike similar brands like Fusion Markets, VT Markets does not offer crypto trading

- The broker’s bonus schemes have stringent terms and conditions, including restrictions on minimum deposits and payment methods used

XM

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM stands out for its commitment to trader education, with a wealth of well-presented resources, including webinars, tutorials, and even real-time trading sessions through XM Live.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

Cons

- Although trusted and generally well-regulated, the XM global entity is registered with weak regulators like FSC Belize and UK clients are no longer accepted, reducing its market reach.

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:1000 (FSA) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

Cons

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

Fusion Markets

"Fusion Markets is a standout option for forex traders looking for excellent pricing with spreads near zero, industry-low commissions and recently TradingView integration. It’s a particularly good broker for Australian traders where the company is headquartered and regulated by the ASIC."

Jemma Grist, Reviewer

Fusion Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | ASIC, VFSC, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, DupliTrade |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- Fusion Markets continues to impress with its pricing that provides tight spreads with below-average commissions that will appeal to active day traders.

- Fusion Markets is set up to support algo traders with a sponsored VPS solution and a 25% discount if you opt for the NYC Servers VPS for MT4 or cTrader.

- Average execution speeds of around 37 milliseconds are noticeably faster than many rivals and can help day traders secure optimal prices in fast-moving markets.

Cons

- The demo account expires after 30 days, limiting its potential as a useful trading tool alongside a real-money account.

- While the selection of currency pairs trumps most rivals, the broker's alternative investment offering is average with no stock CFDs beyond the US.

- Fusion Market trails alternatives, notably IG, in the education department with limited guides and live video sessions to upskill new traders.

FBS

"FBS is an excellent choice for day traders at every level and budget, with just a $5 minimum deposit and intensive academy for aspiring traders alongside access to MT4, MT5 and highly leveraged trading opportunities up to 1:3000 for experienced traders."

Christian Harris, Reviewer

FBS Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Indices, Shares, Commodities |

| Regulator | ASIC, CySEC, FSC |

| Platforms | FBS App, MT4, MT5 |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (EU & Restricted Countries), 1:3000 (Global) |

| Account Currencies | USD, EUR |

Pros

- 24/7 customer support that performed excellently during testing is available, alongside a $5 minimum deposit, high leverage options, and a huge variety of 200+ funding options, making it ideal for traders with small accounts.

- The trading firm has picked up over 90 awards and amassed more than 27 million clients, making it one of the largest and most established brokers globally.

- FBS strikes the balance between robust features and ease of use, with a sign-up process taking <10 minutes, an intuitive app, advanced research through Market Analytics & more recently VIP Analytics, plus immersive education through the FBS Academy and Trader’s Blog.

Cons

- Although the FBS app offers a terrific mobile trading experience for aspiring traders and MT4/MT5 cater to advanced traders, the absence of cTrader and TradingView, which are increasingly offered by alternatives like Pepperstone, will deter day traders familiar with these platforms.

- There are only two base currencies available - EUR and USD - which isn't practical for minimizing currency conversion fees for many global traders, and is especially striking given the broker’s user base spans over 150 nations.

- Despite enhancing the selection of currency pairs, now providing over 70, FBS still trails industry leaders like BlackBull Markets in its market offering with a particularly narrow selection of commodities and indices.

BlackBull

"After improving its trading infrastructure with Equinix servers in New York, London, and Tokyo, reducing latency for traders, BlackBull is an obvious choice if you want to day trade stock CFDs with ECN pricing."

Christian Harris, Reviewer

BlackBull Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Stocks, Indices, Commodities, Futures, Crypto |

| Regulator | FMA, FSA |

| Platforms | BlackBull Invest, BlackBull CopyTrader, MT4, MT5, cTrader, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:500 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, SGD |

Pros

- After partnering with ZuluTrade and Myfxbook, alongside improvements to its own CopyTrader, and finally enabling cTrader Copy, BlackBull offers one of the most comprehensive copy trading experiences we've seen.

- BlackBulls’s research is superb, especially the daily ‘Trading Opportunities’ articles that break down complex market movements into easy-to-understand insights, making it simpler to capitalize on emerging trends.

- BlackBull is a much greater fit for aspiring traders following the overhaul of its ECN Prime account, now featuring improved spreads averaging 0.16 on EUR/USD and a more accessible minimum deposit of $0 compared to the old $2,000.

Cons

- Unlike most top brokers, BlackBull charges an irritating $5 withdrawal fee, which can detract from the overall cost-effectiveness, especially for active traders who frequently move funds.

- Despite a growing selection of 26,000+ assets, including additions to its Asia Pacific indices, they are mainly stocks with an average selection of currency pairs and indices.

- Although the Education Hub now features improvements like webinars and tutorials, the courses we’ve explored need more focus on explaining the wider economic factors influencing prices.

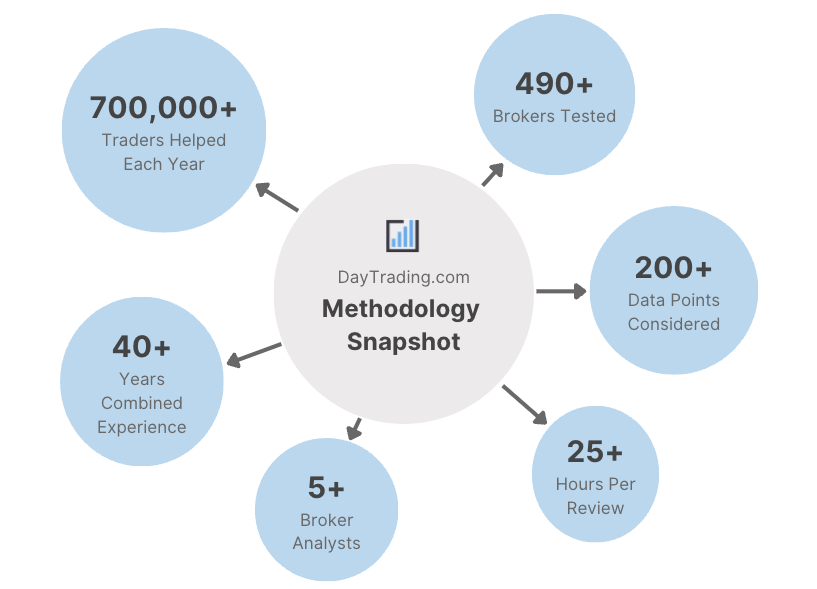

Methodology

To identify the best day trading platforms in Russia, we sifted through our library of 139 online brokers and honed in on all those that accept Russian traders.

We then ranked the remaining platforms by their overall rating, combining 100+ data points and insights from our hands-on tests.

- We only selected brokers that accept Russian day traders.

- We assigned each broker a trust score.

- We prioritized brokers with a wide range of markets.

- We favored brokers with competitive day trading fees.

- We checked for reliable, user-friendly charting platforms.

- We focused on brokers with clear leverage and margin.

- We investigated each broker’s order execution.

- We examined each broker’s account funding.

How To Choose A Day Trading Broker In Russia

Based on our research, there are several key factors to consider when choosing a broker for day trading:

Trust

Choosing a trustworthy broker with a clean track record should help give you peace of mind when depositing Russian rubles.

Importantly, it can help to protect you from trading scams, such as the notorious forex market fraud reported by The Moscow Times, whereby over 1000 victims lost more than 1 billion rubles.

The Central Bank of the Russian Federation (CBR) regulates online trading, although the CBR doesn’t actively license many online brokers, especially compared to regulators in other major financial centers.

- XM maintains its position as a highly trusted day trading platform, with multiple licenses including two ‘green tier’ authorizations with the ASIC (Australia) and CySEC (Cyprus). It also boasts a long history since 2009.

Market Coverage

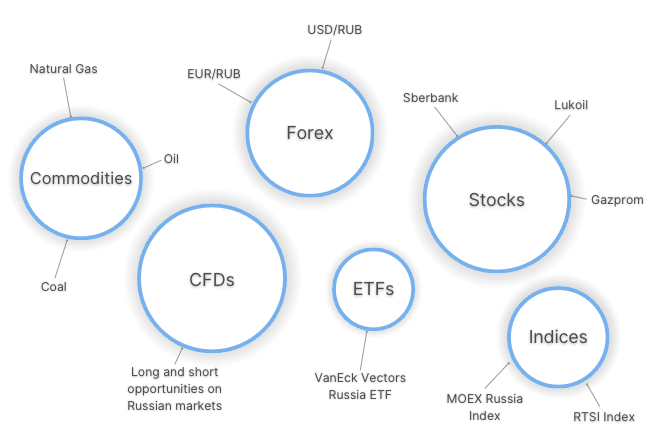

The best day trading brokers offer a range of financial markets so that you can explore diverse opportunities.

Russian traders, in particular, may be interested in currency pairs containing the Russian ruble (RUB) such as USD/RUB, or equities listed on the Moscow Exchange (MOEX), like Sberbank and Lukoil. That said, our tests show these aren’t widely available at online brokers.

As one of the largest export economies in the world, key commodities like crude oil, gasoline and coal may also be attractive investments.

- eToro offers more tradable Russian assets than most alternatives we’ve evaluated, including the USD/RUB currency pair, the VanEck Vectors Russia ETF and a selection of Russian stocks including Sberbank and Lukoil, among thousands of other global markets.

Day Trading Fees

Securing competitive trading fees will help you protect profit margins when making frequent daily transactions.

During our evaluations, we examine key costs like spreads and commissions, as well as fees on payments, for example transferring Russiam rubles to an account denominated in another currency.

We then assess these against other aspects of the broker’s service, such as analysis tools or education resources. For example, Russian traders may value access to daily forex market analysis on the USD/RUB, or live economic updates from the CBR.

- IC Markets continues to deliver superior pricing, including spreads from 4 on the USD/RUB pair and from 0.020 on crude oil. It’s also got a superb economic calendar that I really rate, allowing you to filter by Russian market events.

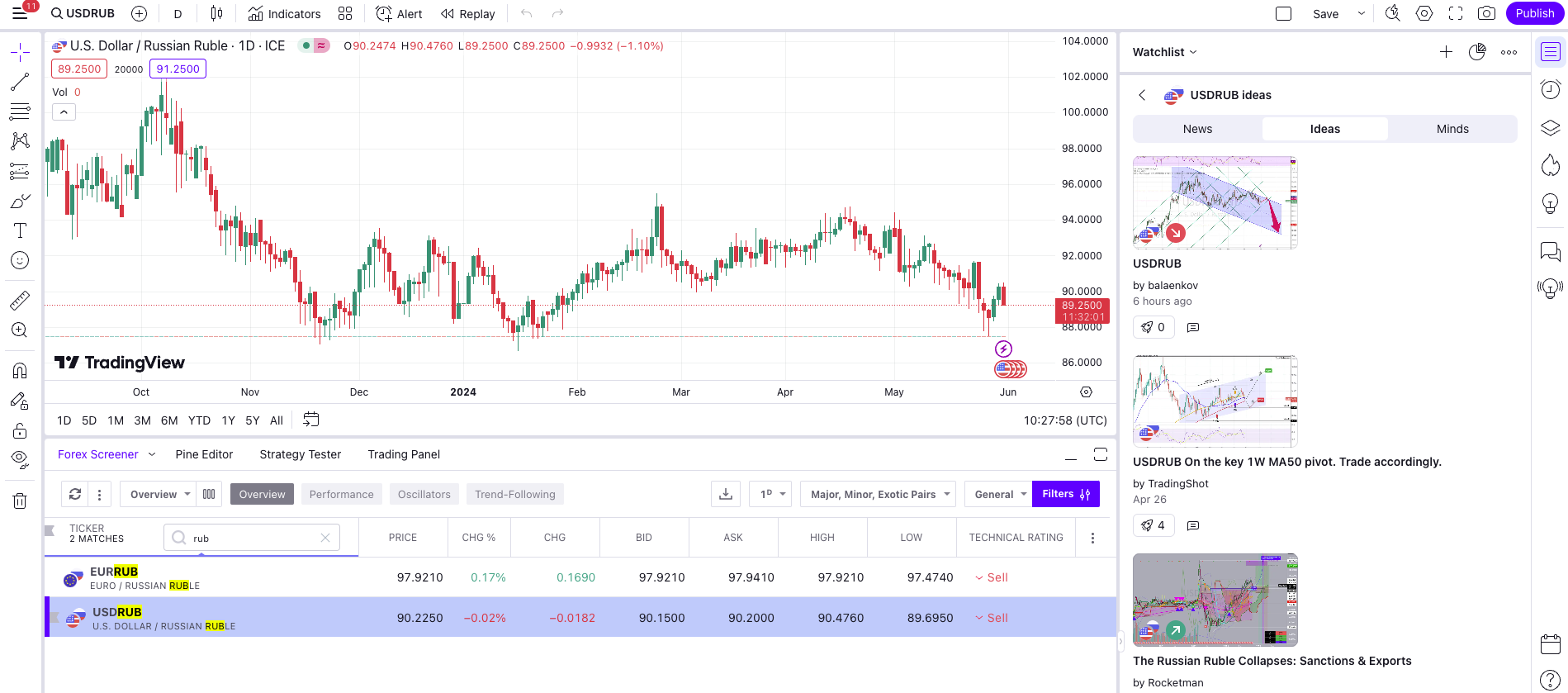

Charting Platforms

The best brokers offer powerful charting tools for technical analysis.

Day traders typically use industry favorites, MetaTrader 4 and MetaTrader 5, though many have become accustomed to using more attractive options like TradingView in recent years.

TradingView offers the full package for me. The cleverly integrated workspace allows me to identify and analyze short-term trading opportunities seamlessly.There’s also a useful forex screener where I could search for RUB pairs, as well as a built-in news feed, market events, trade ideas, and technical summaries.

- Blackbull Markets offers a charting platform for everyone, including MT4, MT5, cTrader and TradingView. There’s also a superb range of additional features, notably social and copy trading via Myfxbook and ZuluTrade which may appeal to up-and-coming traders.

Leverage & Margin

It’s important to choose a broker with clear margin requirements so that you understand the potential gains and losses of your leveraged positions upfront.

Leverage allows you to maximize the value of your trades by only putting down a deposit that’s within your budget. This means you can boost your potential profits, but it can also dramatically increase losses.

Let’s say I want to speculate on Lukoil shares using leverage of 1:5 and an initial margin of 5000 RUB. This means the value of my position would be magnified to 25,000 RUB (5 x 5000 RUB).

- Deriv is a top pick for experienced day traders seeking high leverage up to 1:1000. Alternatively, aspiring traders can explore the broker’s multipliers which offer a less risky way to maximize your day trades, available up to x30.

Execution Quality

Fast-paced day trading strategies require optimum execution conditions, especially if you’re trading volatile markets like crude oil.

We investigate key execution criteria during our tests, including speeds (ideally less than 100 milliseconds) and the rate at which trades are filled.

We also consider latency (whether there is any time delay between trade receipt and execution) and slippage (whether there is any difference between the requested price and filled price).

- FxPro remains one of the fastest brokers we’ve tested, with most orders being filled in under 13 milliseconds. We also love the broker’s proprietary trading app, complete with an integrated calendar and push notifications on market volatility – perfect for trading volatile Russian markets.

Account Funding

Choose a day trading platform with an appropriate first deposit requirement for your budget. Our research shows you will typically need up to 250 USD (approximately 2,2605 RUB) though many brokers go much lower.

It’s also worth opting for a broker that offers locally supported payment methods or RUB accounts, if available, which can help you avoid conversion fees and keep processing times down.

Research by Global Finance shows that WebMoney is one of the most popular e-wallets in Russia, whilst card payments via UnionPay have become prominent in recent years.

- Vantage only requires $50 to get started, making it accessible for budget traders. It also offers a range of free deposit methods, including UnionPay, offering convenient account funding for active Russian traders.

FAQ

Who Regulates Day Trading Platforms In Russia?

The Central Bank of the Russian Federation (CBR) regulates online trading in Russia, though day traders can also register with international firms.

If you do opt for an overseas trading platform, make sure you adhere to CBR regulations and tax rules from the Federal Tax Service of Russia.

Which Is The Best Broker That Accepts Day Traders In Russia?

Refer to our list of the best day trading platforms in Russia to find an option that works for you.

For example, eToro is a great option if you’re looking for Russian markets, while Vantage is accessible for beginners and offers convenient funding via UnionPay.

Recommended Reading

Article Sources

- Economy of Russia - Wikipedia

- Moscow Exchange (MOEX)

- The Central Bank of the Russian Federation (CBR)

- Russia Forex Trading Scam - The Moscow Times

- Russia Exports & Trade - OEC

- Popular E-Wallets In Russia - Global Finance Magazine

- The Federal Tax Service of Russia (FTS)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com