Natural Gas Brokers 2026

Trading natural gas is among the most popular types of commodities. In fact, only oil beats it when it comes to trading volumes, which means that traders and investors have a wealth of opportunity to make a profit.

This guide will explain what natural gas is and what dictates price movements, discuss the various financial instruments that can be used to trade the fossil fuel, and explore how traders can get started.

Best Natural Gas Trading Brokers

Based on our assessment, these 4 brokers are best for trading natural gas, with low fees, excellent tools and a secure investing environment:

-

1

Interactive Brokers

Interactive Brokers -

2

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

3

FOREX.com

FOREX.com -

4

xChief

xChief

| Broker | Minimum Deposit | Minimum Trade | Natural Gas | Platforms | Regulators |

|---|---|---|---|---|---|

| Interactive Brokers | $0 | $100 | ✔ | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Plus500US | $100 | Variable | ✔ | WebTrader, App | CFTC, NFA |

| FOREX.com | $100 | 0.01 Lots | ✔ | WebTrader, Mobile, MT4, MT5, TradingView | NFA, CFTC |

| xChief | $10 | 0.01 Lots | ✔ | MT4, MT5 | ASIC |

What Is Natural Gas?

Natural gas is a fossil fuel that is made up of a variety of different gases, predominantly methane. It is created over millions of years as layers of organic matter (namely plants and animals) are steadily subjected to extreme heat and pressure.

The commodity can be found in sedimentary rock formations both on land and under the sea, and is often drilled for alongside oil.

After it is drilled, raw natural gas is sent to a refinery where impurities such as water, oil and sulphur compounds are removed.

Natural gas liquids (or NGLs) are then separated to produce what is known as ‘dry’ or ‘consumer grade’ natural gas.

This final product can then be transported through pipelines to energy distributors or storage facilities. Alternatively, it may be cooled for conversion into a liquid state (known as liquified natural gas, or LNG), which can make the commodity easier to store and transport.

What Is Natural Gas Used For?

Natural gas is used to meet around 25% of the world’s energy needs. It is used for cooking and heating, as well as a feedstock (raw material) for a wide selection of products including fertiliser, paint, plastics and even medicines. It is also a popular fuel used by power stations to generate electricity.

Long-term demand for fossil fuels is likely to come under sustained pressure as the fight against climate change accelerates. Global demand for renewable energy, nuclear power and alternative fuels is steadily taking over as countries seek to hit their ‘net zero’ targets.

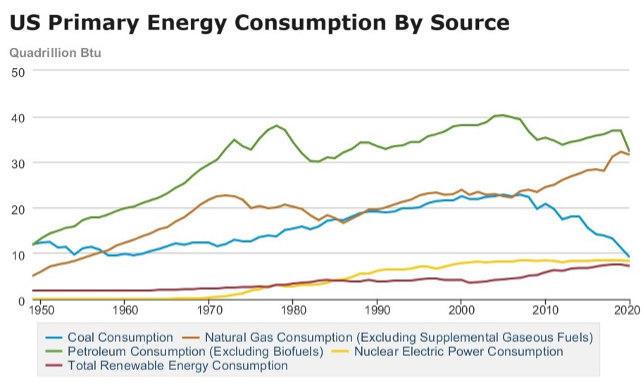

Methane is the chief ingredient of natural gas and is a potent greenhouse gas. However, the burning of this particular fossil fuel is far less harmful to the environment than using oil and coal. This is why, as the chart below shows, usage has grown over the past decade while consumption of other fossil fuels has declined.

Power generation from renewable sources is highly variable depending on weather conditions. So even as wind and solar farms grow in number, natural gas should still play a vital role going forward as a backup during calm and cloudy conditions.

This is thanks in part to how flexible gas-fired power plants can be rapidly switched on and off. When supply from other sources suddenly dips (or conversely when demand soars) natural gas can be used to fill any energy gaps.

That said, battery energy storage technology can also be used to guarantee a constant supply of activity. This is growing rapidly in popularity, and could take a big bite out of natural gas usage in the coming decades.

What Influences Natural Gas Prices?

Today, natural gas accounts for about a third of all energy used in the US. Therefore economic conditions in the world’s largest economy are closely watched for clues on future demand.

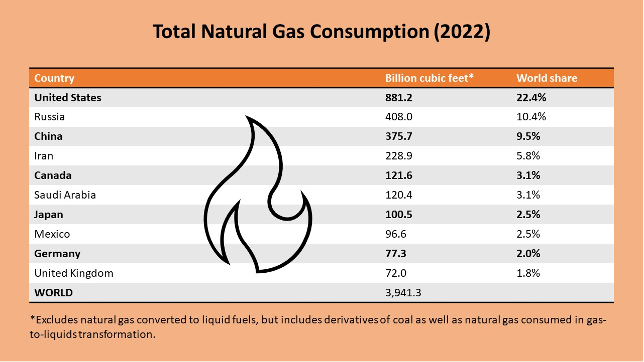

As the table above shows, other countries are also significant consumers of natural gas. So traders and investors will study economic news like manufacturing data, GDP statistics and inflationary numbers from across the globe to get an idea of future demand. When times are good natural gas usage by consumers and businesses tends to rise, and vice versa.

Demand for gas can also fluctuate wildly on seasonal factors. Deep and extreme winters can drive consumption higher as people turn the heating up, as can scorching summers as air conditioning usage spikes.

Like any commodity, prices of natural gas are also driven by supply-side developments, especially in the US. And as the world’s biggest producer of the fuel – thanks to the shale oil revolution, it accounts for 25% of all natural gas – supply developments in the US are closely watched.

News like the weekly rig count and inventory reports can have a substantial impact on natural gas trading prices. But signs of supply gluts or shortages in other markets like Russia, Iran, China and Australia can also cause volatility in energy markets.

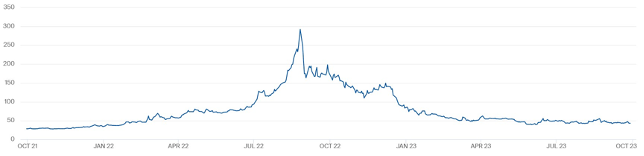

This was no more evident than in 2022 after Ukraine was invaded by Russia, the world’s biggest natural gas exporter. Prices hit repeated record highs in response to production disruptions and sanctions, as the below price chart for Dutch futures illustrates.

The availability and price of alternative fuels also sway the direction of the natural gas market. It is a good idea, then, to keep on top of the news for related commodities like crude oil, petroleum and biomethane.

Investors who take a long-term approach also need to watch for other notable developments. This can include the discovery of abundant new gas fields, the construction of extra LNG export terminals, political developments in and affecting key producing countries, and global trade agreements.

Again, traders will need to consider how these factors will affect the market balance alongside demand-related trends like the green energy shift.

Understanding Natural Gas Price Benchmarks

There is no one benchmark that is used to value natural gas. In fact, there are more than half a dozen that producers, consumers, traders, financial institutions and governments rely on to price the essential commodity. These benchmarks differ by location and the type and quality of natural gas.

The Henry Hub (HH) benchmark is the most widely used for natural gas trading. It is named after a major gas distribution hub in Erath, Louisiana, where several major pipelines connect.

Given the importance of the US as a producer and consumer, the significance of this benchmark is perhaps unsurprising.

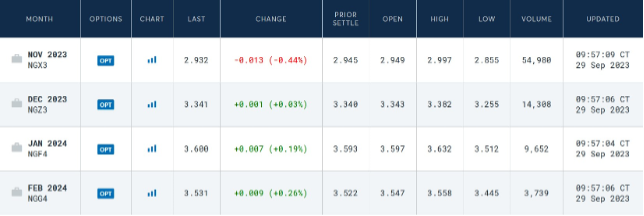

Henry Hub is popular with traders because of its price transparency and excellent liquidity. Natural gas futures that are traded on the New York Mercantile Exchange (NYMEX) are priced using the benchmark, and the hub is used as the standard delivery point for contracts.

Other popular global benchmarks include the Title Transfer Facility (TTF) based in the Netherlands, the National Balancing Point (NBP) in the UK, and the Japan/Korea Marker (JKM) that is used to price LNG.

Different Ways To Trade Natural Gas

Futures Contracts

Just like most other commodities, natural gas can be traded with futures contracts. These financial instruments involve a buyer and a seller agreeing to trade a specified amount of an asset for a certain price and on a particular date.

As mentioned above, contracts using the Henry Hub benchmark are traded on the NYMEX commodity futures exchange. Traders can also trade futures using other benchmarks on the Intercontinental Exchange (ICE) and Multi Commodity Exchange (MCX). These are based in the UK and India respectively.

Here you can see several Henry Hub futures contracts trading on NYMEX. The column on the left shows the expiry dates of the different contracts, while various pieces of price information (including the latest prices) can also be seen. Trade volumes are shown towards the right side of the table.

Futures allow individuals to trade without having to take physical delivery of the asset in question. Contracts usually have standardized expiration dates set by the exchange: natural gas futures, like most commodities, have monthly expiration dates, though quarterly and six-monthly contracts are also available.

Futures traders have the option to ‘roll over’ their contracts, allowing them to extend their position beyond the contract’s expiry date. During this process, the existing contract is closed and a new contract with a later expiration date is initiated.

Spot Contracts

Spot contracts, meanwhile, are transactions that require settlement (or delivery) of the asset to take place shortly after the trade is executed. Spot rates are important as they dictate the prices of futures contracts.

If spot rates are higher than futures rates, the market is known as being in a state of backwardation. Contango, on the other hand, refers to a situation where spot prices are lower than those for futures contracts. Traders use a variety of different trading strategies to make a profit in both scenarios.

Oil And Gas Stocks

When natural gas trading prices rise, so do the profits and share prices of companies that produce the commodity. Investor demand for oil and gas sector stocks rocketed in 2022 when war in Eastern Europe drove energy prices through the roof, as the share price chart for BP below shows.

Buying a natural gas producer can have advantages over purchasing futures in the commodity. A company will usually seek to share bumper profits by dishing out dividends. Traders can also receive better returns by investing in a producer with a strong operating performance.

Particular stocks can also allow a trader to spread their exposure across various energy types, which in turn reduces risk. Take Shell, for example. As well as being a major oil and gas supplier, the UK company also provides wind and solar energy, hydrogen and biofuels.

Exchange-Traded Funds

Natural gas can be traded in various ways via an exchange-traded fund, or ETF. These financial instruments are types of pooled investments that are transacted on stock exchanges.

The United States Natural Gas Fund, for example, is designed to reflect the price movements of natural gas futures contracts on NYMEX. Investors can buy this if they think the commodity price will rise. In this situation, an individual will be said to have taken a ‘long’ position.

Alternatively, the ProShares UltraShort Bloomberg Natural Gas ETF provides a way for investors to go ‘short,’ or bet that prices will fall. The fund moves in the opposite direction to the Bloomberg Natural Gas Subindex.

Traders can also seek to profit from natural gas by purchasing an ETF containing oil and gas stocks, or companies that provide products and services to fossil fuel companies.

Options

Traders use options contracts to buy the right (but not the obligation) to purchase or sell a pre-determined amount of natural gas within a specified timeframe. This can be on a certain date, as per a European options contract, or at any point before or on the expiry date (this is known as an American option).

Call options and put options are the most frequently used of these financial instruments. Calls are placed when a trader believes gas prices will rise, and they wish to purchase the commodity at a set price before the contract expires. Puts work in the opposite way.

Contracts For Difference (CFDs)

CFDs are financial derivatives, which means their value is based on the natural gas price. They are used by traders who wish to speculate on the direction of the underlying asset without actually owning the commodity itself.

They allow investors to speculate on the price of an asset with significant leverage, sometimes up to 1:500. However, due to their high leverage, this form of natural gas trading comes with increased risk compared to other instruments.

How To Trade Natural Gas

There is no such thing as having too much information when it comes to trading any asset. The beauty of living in the information age is that a treasure trove of books, tutorials, industry reports, online courses and other resources is readily available. So it is never been easier to get started.

Once you have become an expert on the natural gas market and the different ways to trade it, the next step is to come up with a trading strategy. There are many different approaches investors can take, all of which depend on an individual’s specific trading style and requirements.

After this, you will be ready to choose which natural gas broker to do business with. Some of the key things you will need to consider are how much they charge for their service, which products they allow you to trade (and whether leverage is available), and how user-friendly their platform is. Selecting a brokerage which offers a demo account is also a good idea for natural gas traders who are just starting off.

When you are up and running, you will need to keep a close eye on economic, financial, and market-specific news and announcements. Financial markets are fast moving and reacting quickly to developments is critical if you want to make a profit. It is also important to keep on top of the technical analysis side of things and keep a close watch on the price charts.

Pros and Cons Of Trading Natural Gas

- Wide product range – Individuals can use various instruments to profit from natural gas prices, meaning that different trading styles may be accommodated.

- High trading volumes – Certain financial products (like futures contracts and natural gas stocks) enjoy strong liquidity, meaning that traders can open and close positions quickly and easily.

- Extreme volatility – Natural gas prices can move sharply depending on supply and demand-related news, allowing traders plenty of opportunity to make money.

- Leverage opportunities – ETFs, CFDs and options all allow traders to use borrowed money which, if the market moves in the ‘right’ direction, can result in bigger earnings.

- Long business hours – Products like gas futures contracts trade 24 hours a day, six days a week, meaning traders can usually work at their own convenience.

- Second to oil – Natural gas trading volumes aren’t as high as those of WTI oil or Brent oil, meaning entering and exiting positions may not be as straightforward.

- Sudden price shocks – Volatility is a double-edged sword, and investors can suddenly book vast losses if prices unexpectedly move in an adverse direction.

- A dirty fuel – Prices of the commodity could fall over the coming decades as consumer demand switches to renewable energy and alternative fuels.

- Increasingly unfashionable – Climate considerations mean that, like coal, trading of this commodity could steadily decline as environmental, social and governance (ESG) concerns become more important to investors.

Bottom Line

Huge dealing volumes and frequent volatility make trading natural gas a great way for investors to generate large returns. What’s more, a wide spectrum of financial instruments – from futures contracts and company stocks to CFDs – means that many trading styles and risk tolerances are well-catered for.

Investors should remember, however, that the growth of the green economy creates huge uncertainty concerning natural gas prices over the long term. Having a thorough understanding of the fundamental and technical factors that drive energy values is essential.

Use our list of the best natural gas trading brokers to get started.

FAQ

How Can I Trade Natural Gas?

Several financial instruments are available to bet on natural gas prices, each with its own advantages and disadvantages. These include futures contracts, funds, options and company stocks.

What Drives Natural Gas Prices?

As with any commodity, natural gas values are influenced by market perceptions of the supply and demand landscape. So key data releases including Chinese industrial production, weekly US gas rig numbers, and even weather forecasts can significantly move prices.

What Is The Lot Size Of Natural Gas Futures?

This will vary from exchange to exchange. Henry Hub futures contracts traded on NYMEX, for example, trade in lot sizes of 10,000 mmBtus (million British thermal units).

What Is Natural Gas Trading At Today?

There are several prices related to natural gas, such as tracker ETF prices, spot values, futures contracts and company equity values. Interested parties can view most of these on a service such as TradingView or Yahoo Finance.

What Is The Best Natural Gas Trading Strategy?

The wide range of instruments available for natural gas trading means no shortage of strategies will work. However, our experts recommend starting with methods like trading news, or investing in long-term trends as a starting point.

Is Trading Natural Gas Profitable?

Many investors will want to know how to make money trading natural gas. The volatile market conditions present plenty of opportunities for profitable trading. However, ensure you do your due diligence before diving straight into the markets. Use our overview to trading natural gas to get started.

What Time Does Natural Gas Start Trading?

There are several international instruments to trade natural gas, all with unique market hours based on their local exchanges. However, as most natural gas trading instruments, such as the CME Natural Gas futures product, are US-based, US market hours will likely be the ones to follow.

Article Sources

- Henry Hub Natural Gas Benchmark

- Natural Gas: A Basic Handbook, James Speight

- Gas Trading Manual: A Comprehensive Guide to the Gas Markets, Elsevier Science

- US Energy Information Administration (EIA) - Natural Gas Data

- Energy Institute: 2023 Statistical Review of World Energy

- ICE - Natural Gas Price Chart

- London Stock Exchange - BP PLC Share Price

- AvaTrade - Natural Gas Trading Conditions

- CMC Markets - Natural Gas Trading Conditions

- FOREX.com - Natural Gas Trading Conditions

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com